分析

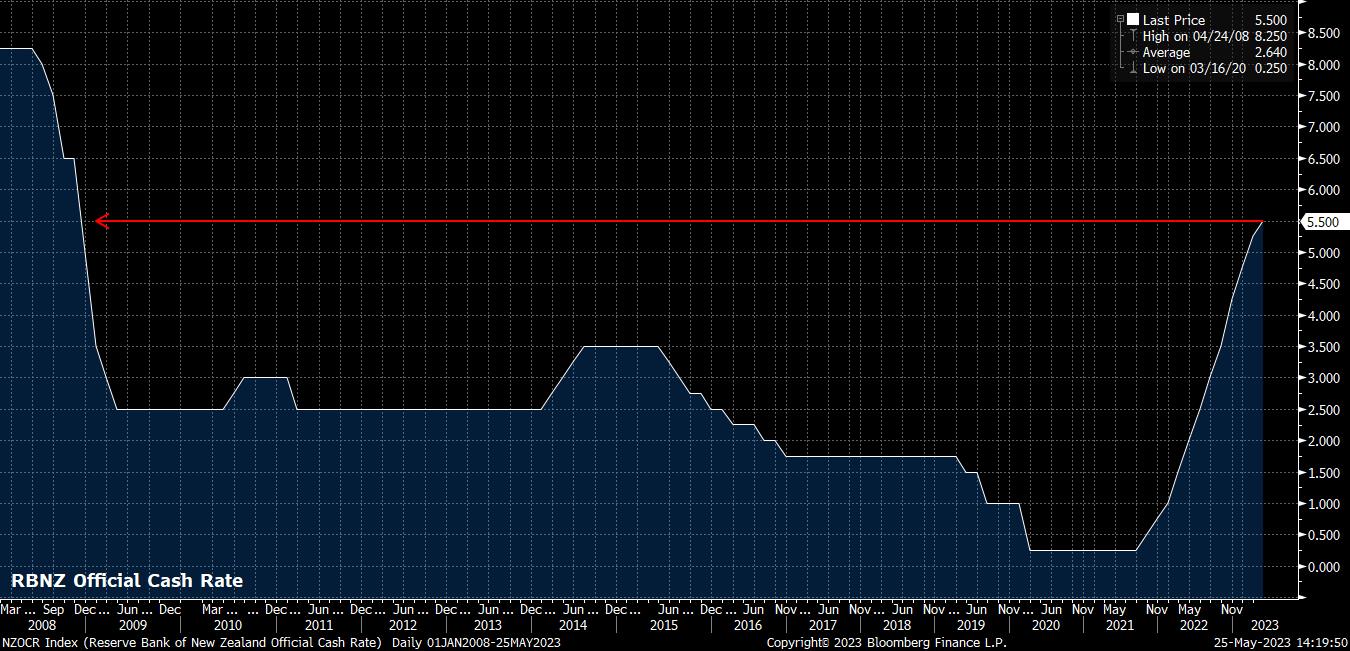

As expected, and as priced by money markets, the RBNZ raised the Official Cash Rate (OCR) by 25bps this week, taking the OCR to its highest level since 2008 at 5.5%. However, this was the only part of the decision that was in line with prior expectations.

Firstly, the vote split had a dovish bent, with 2 of the 7 member MPC dissenting in favour of leaving rates unchanged, a break from the unity seen thus far in the tightening cycle. Of more importance, the RBNZ effectively declared the hiking cycle to be over, believing that enough tightening has now been delivered to tame price pressures, and return inflation to target. Furthermore, the RBNZ’s own economic forecasts pencilled in rate cuts as soon as the second half of 2024, despite also indicating that a mild recession will likely be experienced in mid-2023.

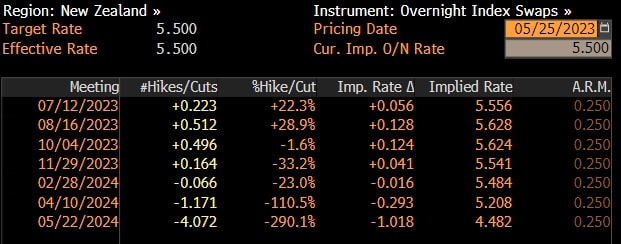

This was substantially more dovish than markets had been expecting, with the OIS curve pricing at least one additional hike (beyond that delivered this week), before expecting rates to remain on hold. Unsurprisingly, the curve has undergone a significant dovish repricing since, with traders marking their bets to the RBNZ’s own projections, albeit expecting a slightly more aggressive pace of loosening than the central bank itself.

This dovish shock, and subsequent repricing, had a predictably violent impact on the NZD. NZD/USD notched its biggest one-day decline since the early days of the pandemic on Wednesday, while also breaking a number of key technical levels – tumbling below all of the 50-, 100-, and 200-day moving averages, in addition to cracking under the 0.61 handle which has represented the bottom of the range traded since early-March.

Given that the RBNZ have somewhat demolished the bull case for the Kiwi with their surprisingly dovish decision, and with the aforementioned technical levels breaking, playing from the short side is likely to become increasingly popular. The bears are likely to now be eyeing the 0.60 figure, both due to its psychological importance, and this being the 50% retracement of the rally from Oct 22 to Feb 23.

Against its antipodean peer, the NZD has also come under pressure, seeing AUD/NZD reclaim its 50-day moving average for the first time since late-April.

_M_2023-05-25_14-23-26.jpg)

Once again, we see policy divergence at work here, with the RBA having abandoned their pause at the May meeting, reinstating a tightening bias, and markets pricing a roughly 50/50 chance that the RBA deliver at least one more rate hike. AUDNZD bulls are likely now to be targeting the 100-day moving average at 1.0810, a break of which would add further momentum to the move.

Related articles

此处提供的材料并未按照旨在促进投资研究独立性的法律要求进行准备,因此被视为营销沟通。虽然它并不受到在投资研究传播之前进行交易的任何禁令,但我们不会在向客户提供信息之前谋求任何优势。

Pepperstone并不保证此处提供的材料准确、及时或完整,因此不应依赖于此。无论是来自第三方还是其他来源的信息,都不应被视为建议;或者购买或出售的要约;或是购买或出售任何证券、金融产品或工具的征求;或是参与任何特定交易策略。它并未考虑读者的财务状况或投资目标。我们建议此内容的读者寻求自己的建议。未经Pepperstone批准,不得复制或重新分发此信息。