Playbook For The September FOMC Decision

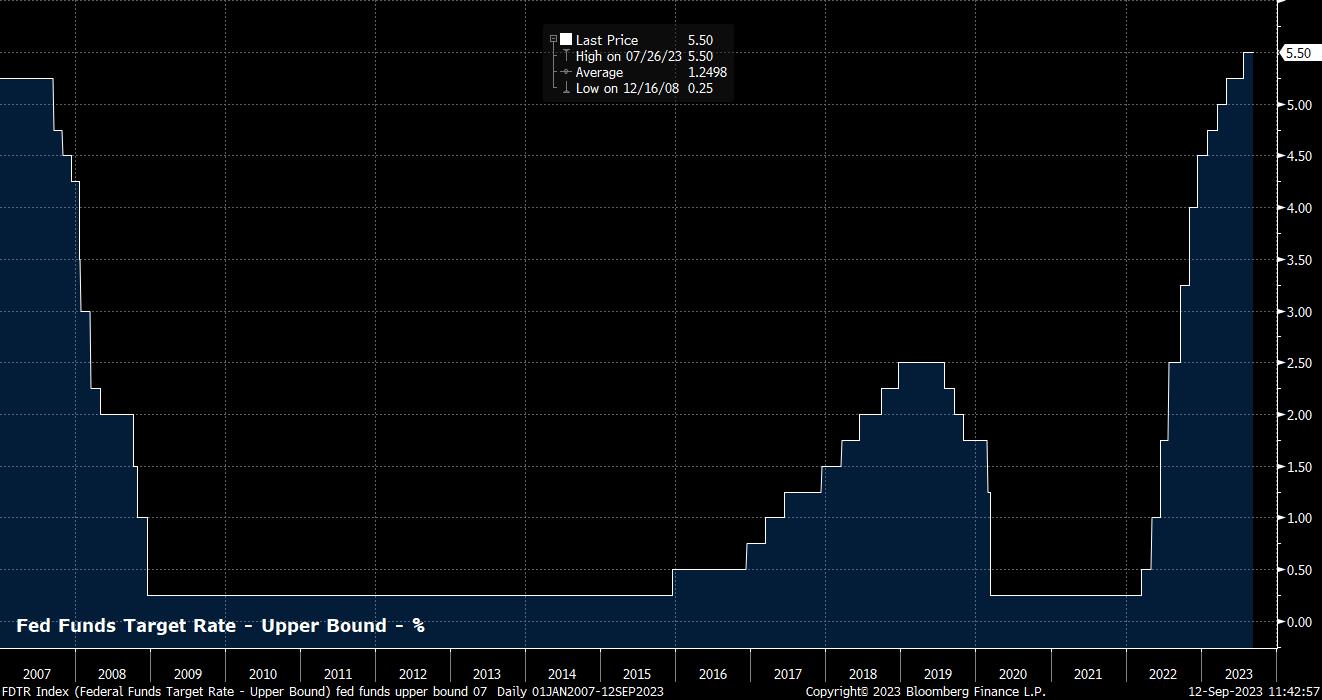

As mentioned, the FOMC are set to maintain the target range for the fed funds rate at 5.25% - 5.50% at the September meeting. OIS implies a roughly 95% probability of such an outcome, while recent remarks from influential Fed Board members Waller and Williams indicate a broad consensus that policy is in a ‘good place’, and that further tightening is not immediately required. Thus, the decision to keep rates unchanged should be unanimous in nature.

The guidance surrounding such a decision is likely to be relatively unchanged from that seen at the July meeting, with the Committee highly unlikely to commit to any pause in the tightening cycle being the final hike. Consequently, the policy statement is likely to repeat the FOMC’s data-dependent tightening bias, with the pledge to adjust policy 'as appropriate’ to achieve the dual mandate retained. Furthermore, detail around the FOMC’s reaction function is unlikely to differ from that outlined previously, in that further hikes will be dependent on the effect of the cumulative tightening already delivered, the lagged effects of policy on economic activity, as well as economic and financial developments. In short, a very long-winded way to say that further tightening will be delivered, if inflation remains above target, or growth remains substantially above trend.

The FOMC’s latest ‘dot plot’, released as part of the quarterly Summary of Economic Projections (SEP), is likely to echo this message, reflecting individual policymakers’ expectations of the appropriate level for rates in each year of the forecast horizon. The 2023 median dot is likely to remain unchanged at the present 5.625% level, implying a further hike is possible later this year, though there is a chance the median is revised a touch lower to the present midpoint of the target range for the fed funds rate, at 5.375%.

Looking further ahead, the median dots for both 2024 and 2025 are also likely to remain unchanged, at 4.625% and 3.375% respectively. Despite this, these dots are likely to generate some interest. Firstly, the dispersion of the dots – i.e. the difference between the highest and lowest forecasts – is set to become significantly tighter, most likely via some of the hawks reducing their rate expectations, reflecting a much grater degree of confidence among FOMC members on both the future rate trajectory, and (on the part of the hawks) that the battle against inflation is indeed being won.

The second point of interest is that the dots indicate around 100bp of easing is likely during 2024, with further cuts to come in 2025. This is not only a reflection of the Committee’s view that the economy is likely to slow as the full impacts of the 525bp of tightening delivered this cycle are felt, but is also a reflection of the ‘higher for longer’ stance that has been drummed into investors for almost two years now.

While it may seem counter-intuitive for steadily lower nominal rates to imply a prolonged period of tight policy, this view makes more sense when one considers real (inflation adjusted rates). Given the expectation that inflation is likely to fade back to 2% over the forecast horizon, the FOMC will need to lower the fed funds rate in line with the decline in price metrics, in order for real rates to remain at the same level. Were the fed funds rate to remain unchanged for the remainder of the forecast horizon, this would actually result in a mechanical tightening of both monetary policy, and financial conditions, as lower inflation would force the real policy rate substantially higher over this time period.

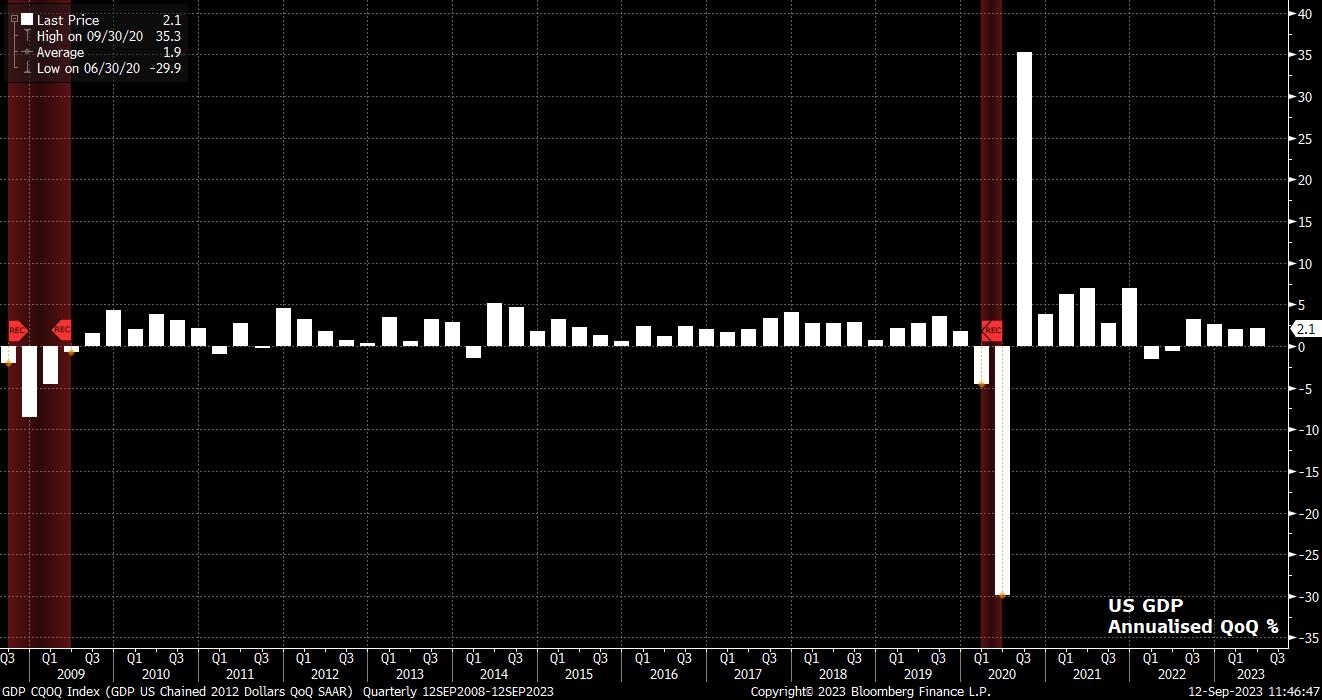

Other areas of the latest SEP are, meanwhile, likely to paint a more optimistic picture of the US economy, which has remained remarkably resilient since the last FOMC meeting, with expectations for a ‘soft landing’ growing.

The impressive economic resilience seen over the summer, with GDP having grown by over 2% on an annualised basis in the second quarter, and PMIs pointing to a continued solid pace of growth – especially in the services sector – is likely to result in a substantial upgrade to this year’s GDP forecast of 1.00%, with a doubling of this projection not entirely out of the question. However, the 2024 and 2025 calls are set to be nudged marginally lower, both as a result of lagged policy effects, and in reflection of the likelihood of economic slowdown having been delayed, rather than averted.

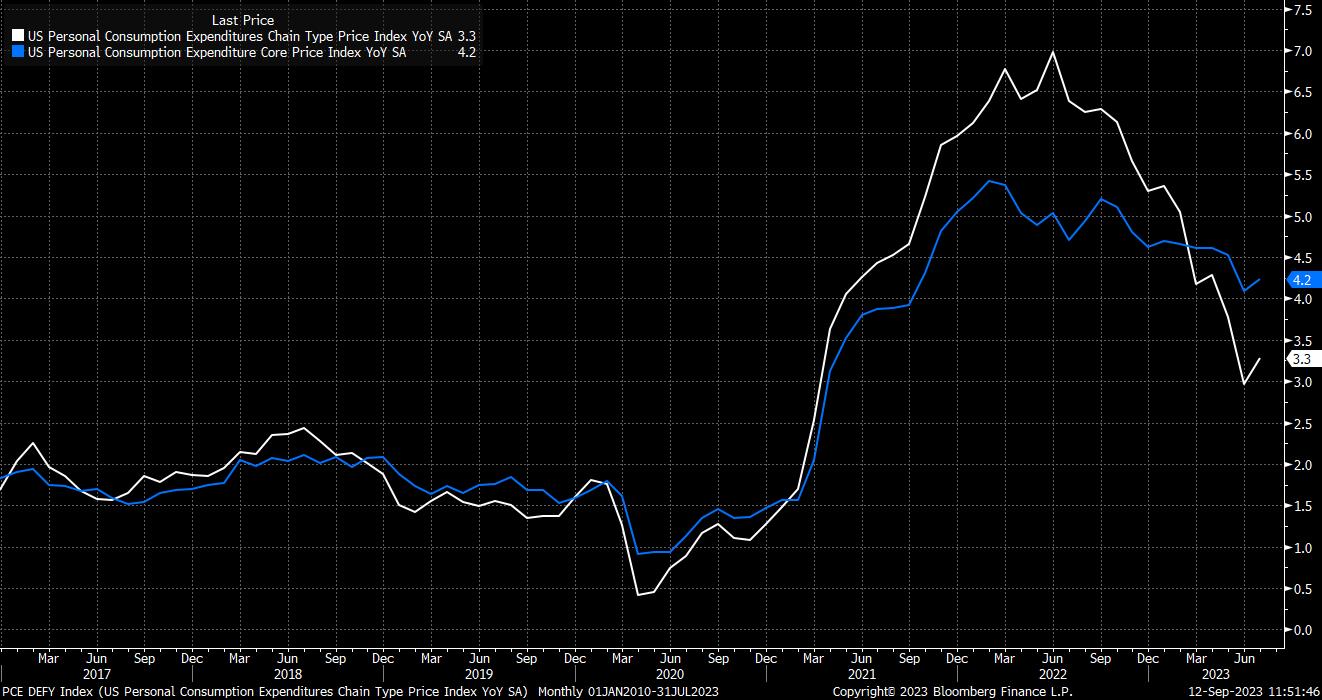

On the inflation front, there are unlikely to be significant changes. Forecasts for both the headline and core PCE metrics are likely to be nudged around 0.2pp lower for the end of this year, while the longer-term expectations may also tick down a touch. While small, these revisions would be notable, marking the first time since 2020 that the FOMC have downwardly revised their core inflation expectations.

Rounding out the SEP, the Committee are also likely to nudge their unemployment expectations a touch lower, with a rise to 4.1% by year-end, and to 4.5% at the end of 2024, seemingly out-of-step with the strong performance of the labour market thus far, even if the pace of jobs growth is clearly slowing.

Overall, these forecast revisions and the largely unchanged statement should see Chair Powell ‘stick to the script’ at the post-meeting press conference. At Jackson Hole, when we last heard from the Fed Chair, Powell noted that further rate hikes will be delivered ‘if appropriate’, and that further tightening may be warranted were growth to remain persistently above-trend, as is currently being seen. The prospect of rate cuts in the near future, while not explicitly ruled out in Wyoming, is likely to be so at the presser, while a desire to proceed ‘carefully’ on future policy moves is likely to be conveyed.

As for the market reaction, the balance of risks appears to tilt towards the hawkish side, with OIS pricing just 12bp of further tightening before the end of the year, while also fully pricing at least one rate cut in the first half of 2024. Consequently, risks point towards further USD upside, as well as downside for both stocks and Treasuries.

For the greenback, which has notched 8 straight weeks of gains against a basket of peers, the 104.50 level stands out as key support for the DXY, which has thus far proved well-respected.

_D_2023-09-12_11-51-57.jpg)

Above, the bulls are likely to target both the longstanding 105.50 region, before potentially eyeing a move towards the YTD highs seen in Q1 at 105.90. Dip buying is likely to remain the preferred strategy for most, with downside likely contained by the 200-day moving average, which comes in at the psychologically key 103 figure.

In the equity space, the S&P 500 has faced headwinds of late, with the bulls having failed to make a decisive break back above the 4,500 handle, or the 50-day moving average.

Were the aforementioned levels to be broken, the YTD high at 4,630 – which could also be said to mark a double-top – will likely come into view relatively rapidly. To the downside, initial support comes at 4,400, before the 100-day moving average, around the prior 4,350 lows.

Related articles

此处提供的材料并未按照旨在促进投资研究独立性的法律要求进行准备,因此被视为营销沟通。虽然它并不受到在投资研究传播之前进行交易的任何禁令,但我们不会在向客户提供信息之前谋求任何优势。

Pepperstone并不保证此处提供的材料准确、及时或完整,因此不应依赖于此。无论是来自第三方还是其他来源的信息,都不应被视为建议;或者购买或出售的要约;或是购买或出售任何证券、金融产品或工具的征求;或是参与任何特定交易策略。它并未考虑读者的财务状况或投资目标。我们建议此内容的读者寻求自己的建议。未经Pepperstone批准,不得复制或重新分发此信息。