Playbook For The September BoE Decision

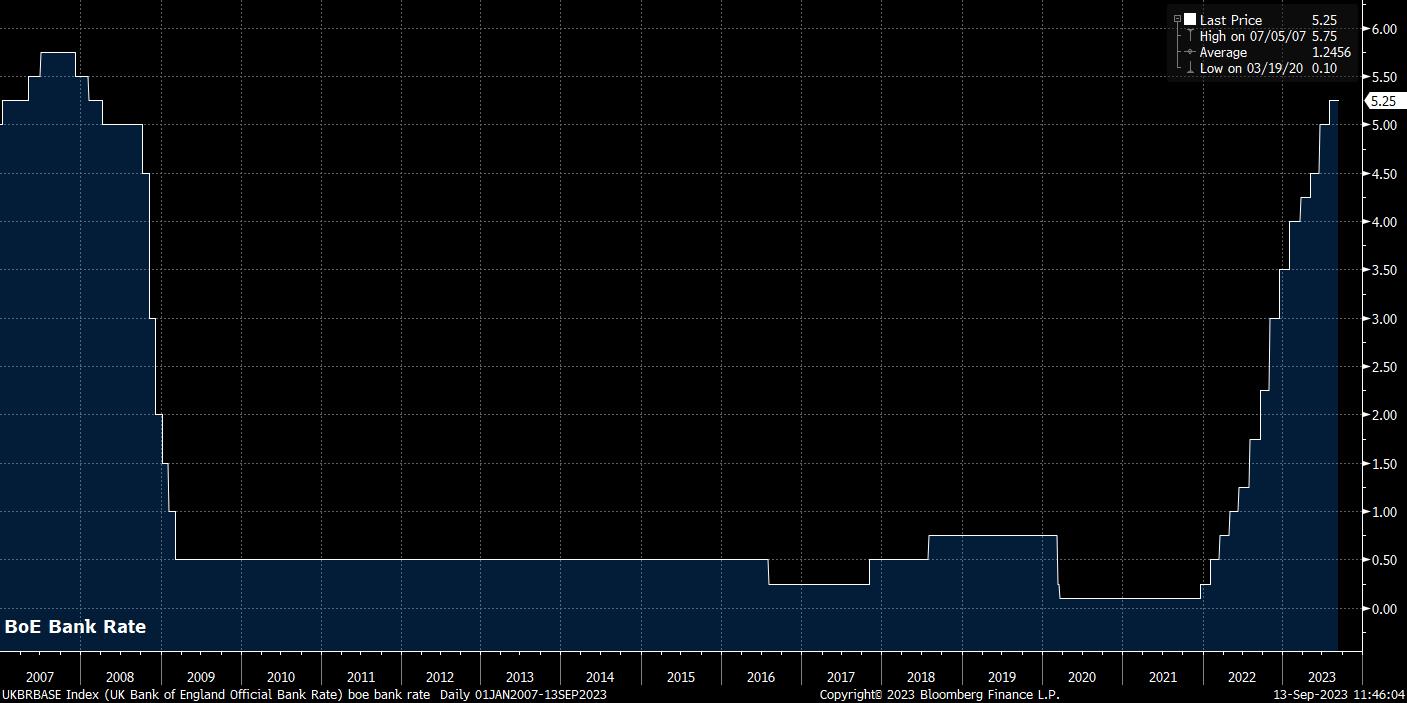

As noted, the MPC are set for another 25bp hike at the September meeting, an outcome to which money markets assign a roughly 80% probability (with a 20% chance of no move).

However, the decision to raise rates is, once again, unlikely to be unanimous. Perma-dovish external MPC member Dhingra is likely to dissent in favour of maintaining Bank Rate at its present level, having noted in a recent Treasury Select Committee (TSC) hearing that policy is already restrictive, and that further tightening poses a ‘serious risk’ to economic growth.

Consequently, the MPC’s vote in favour of a 25bp hike is likely to be 8-1 in favour of such a move, significantly less divided than that seen at the August meeting where, while 8 members voted for a hike, two preferred a larger 50bp move. Such hawkish dissent appears unlikely this time around, given how economic data has softened, and taking into account the growing downside risks facing the economy. Nevertheless, there is a slim chance that the MPC’s most hawkish member, Mann, does plump for a larger move once again.

Whatever the vote split, a hike is all-but-assured, though said hike is increasingly likely to be the final one of the cycle. Recent commentary from influential BoE policymakers has tilted towards a more cautious bias – Governor Bailey has noted that the UK is ‘near the top of the cycle’ on rates; Chief Economist Pill has stated his preference for a lower terminal rate, but to spend more time at said level; while Deputy Governor Broadbent has also reiterated this ‘higher for longer’ approach, while also alluding to the two-way risks facing policy going into the remainder of the year. Consequently, market pricing pinning the terminal rate just shy of 5.6% still seems a little over-the-top.

In any case, the official guidance given as part of the MPC’s updated policy statement is unlikely to be significantly different from that issued last month. As such, the Bank are likely to repeat that policy is now seen as restrictive, and that further tightening could be delivered, if signs of persistent inflationary pressures were to develop. On the whole, this largely mirrors the stance of most other G10 central banks, being a data-dependent hiking bias, keeping a watchful eye on inflation, but being reluctant to pre-commit to further hikes in the face of a rapidly weakening economy.

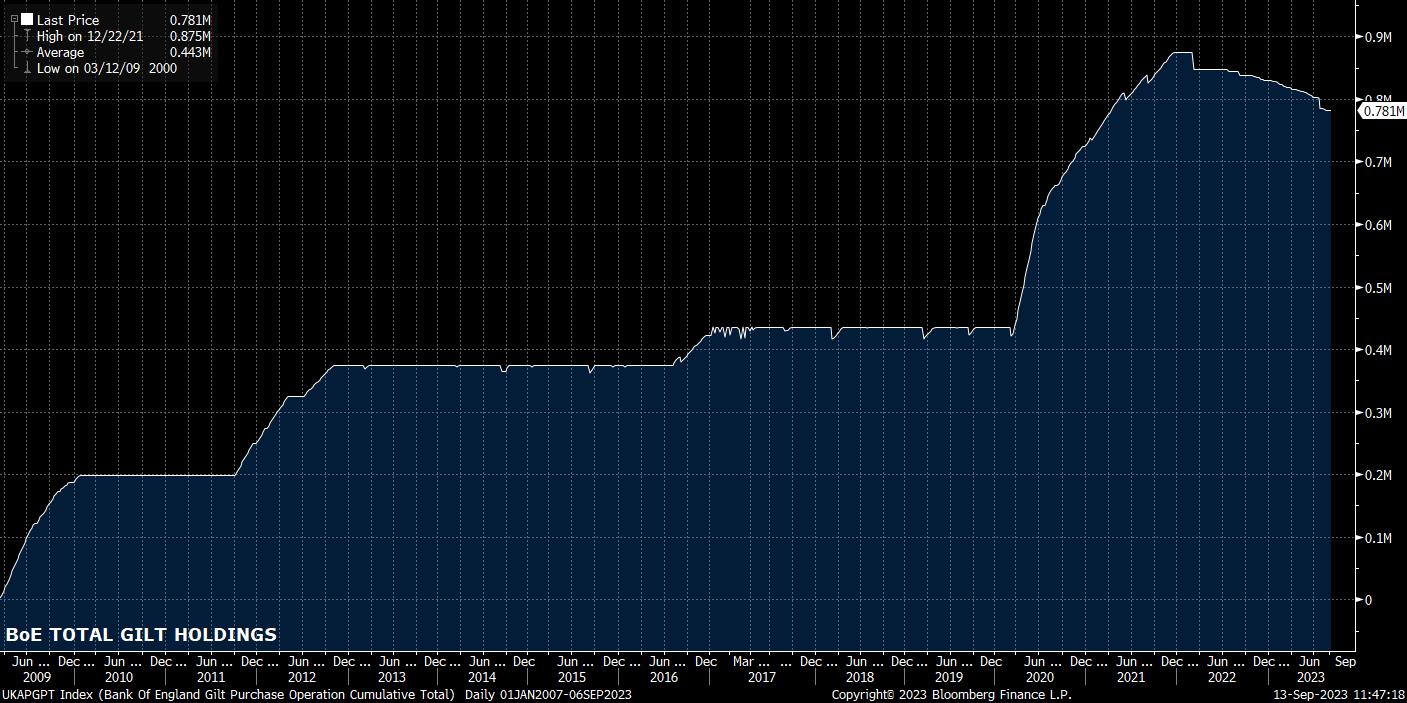

While the rate decision appears rather straightforward, it is not the only matter up for debate at the September meeting. This month also heralds the MPC’s annual review of its quantitative tightening programme, which has thus far been progressing smoothly, with the balance sheet reducing at a pace of £80bln worth of gilts per annum, via a mix of both outright sales, and the reinvestment of maturing securities having been halted.

Given the smooth progress of QT thus far, and the MPC’s desire to reduce the size of the balance sheet as rapidly as possible – presumably to give headroom for policy easing in the future – a quickening of the current pace seems likely. A decision to raise the pace to around £100bln per annum shouldn’t be especially surprising, nor should it cause too significant a reaction in gilts; it will, however, result in the BoE continuing to crystallise significant losses on their asset portfolio, given the surge in rates since said securities were purchased.

As for the economic outlook, we will have to wait until the next MPC decision in November for the publication of the BoE’s latest economic forecasts.

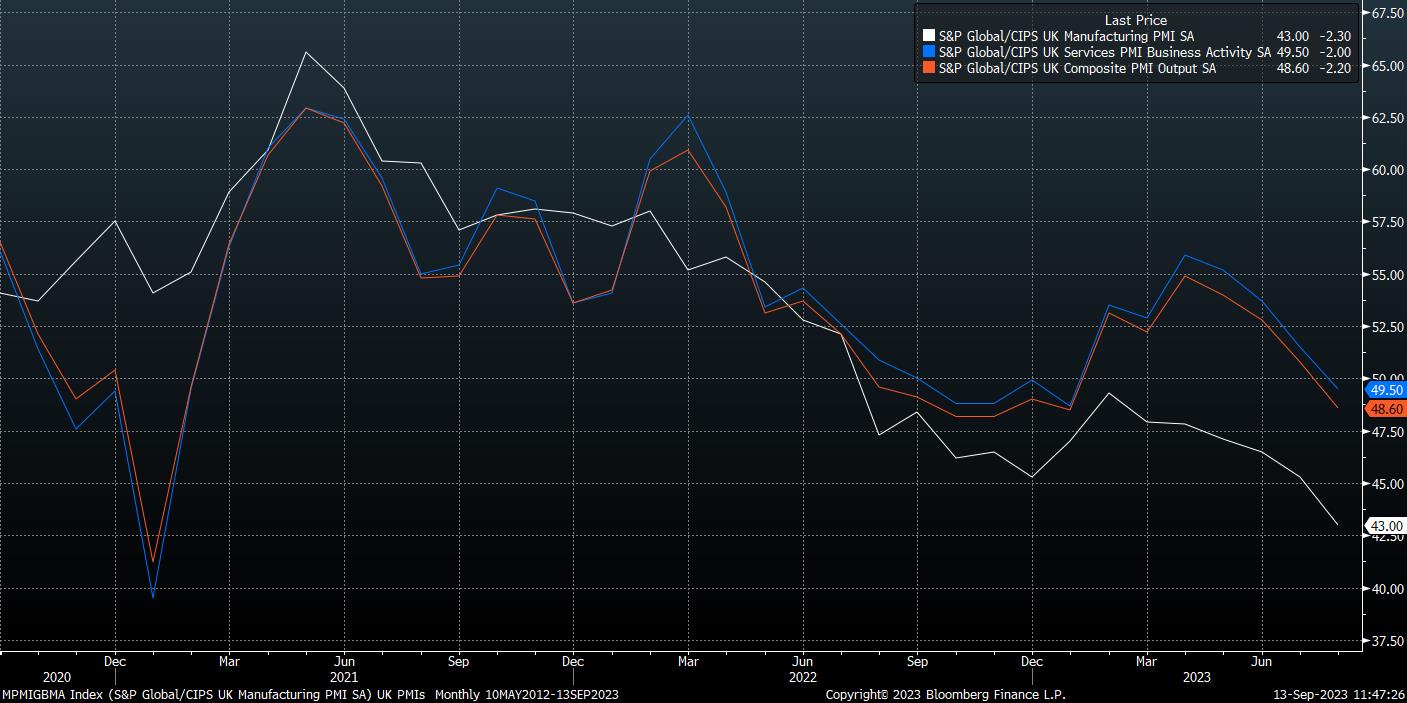

Nevertheless, the Committee’s economic commentary is likely to take on a more cautious tone, with the growth outlook having continued to deteriorate since the publication of the August Monetary Policy Report, as consumer spending remained weak over the summer, seeing the services PMI join the manufacturing index below the 50 mark (implying contraction) in August). Risks to the growth outlook likely now point to the downside, though the MPC may wait until November to state so explicitly, given both the well-documented sluggish performance of the Chinese economy, and the impending wave of remortgaging that will further squeeze the UK consumer.

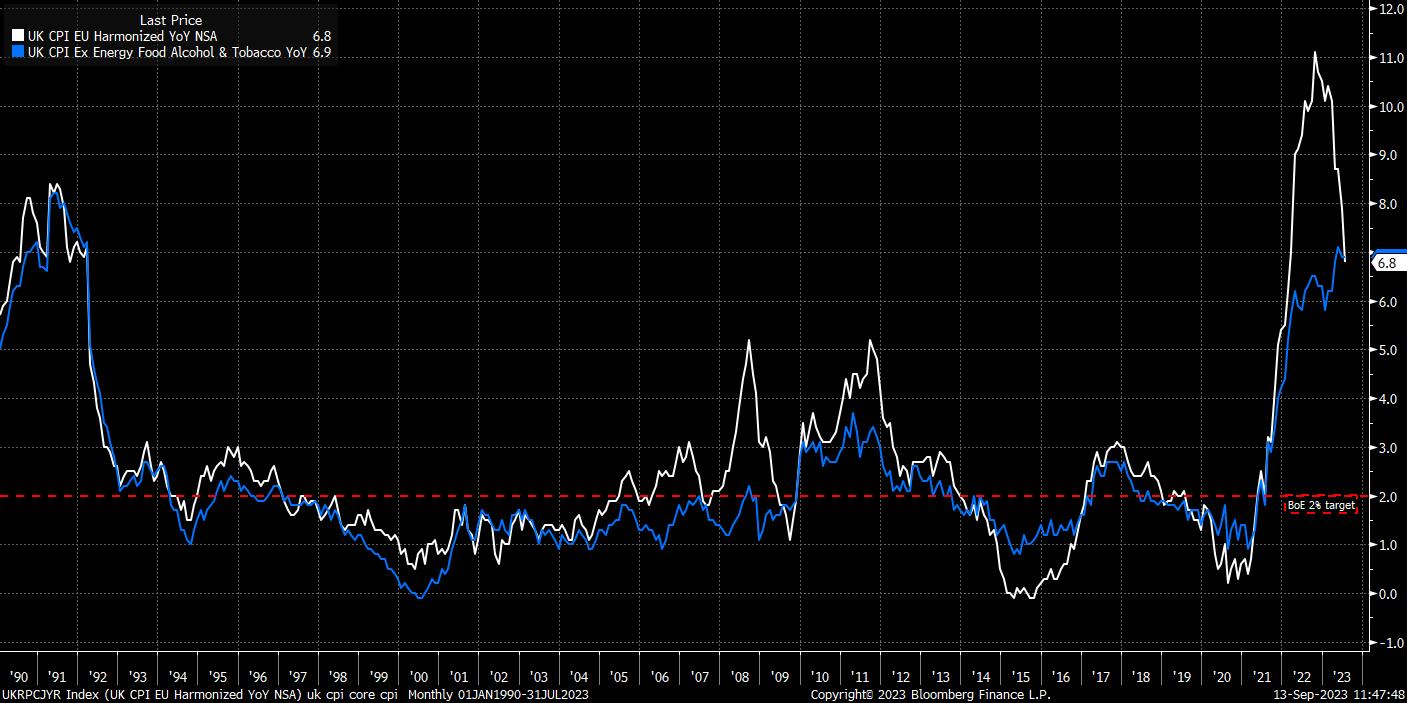

On the inflation front, it’s important to note that the latest (August) CPI report is due for release the day before the BoE’s policy announcement, and on the day of the MPC’s policy vote. Headline prices are likely to have ticked higher in August from the 6.8% YoY pace seen in July, largely as a result of rising fuel prices, and the increase in alcohol duty that came into place at the start of the month.

The MPC will likely look through these one-off factors, with Governor Bailey having said as much in the recent TSC hearing, with the broader disinflationary trend set to remain intact for the remainder of the year. Despite this, the MPC should once again judge that risks to the inflation outlook remain skewed to the upside, particularly in light of core inflation remaining sticky just shy of 7% YoY, and after two months of record total earnings growth.

This pace of earnings growth, 8.5% YoY in the three months to July, is somewhat deceiving. The figure has been skewed higher in both June and July by numerous temporary factors, namely one-off cost of living payments made to civil service and NHS employees. That said, regular pay in the private sector continues to increase at a pace above 8% YoY, likely sparking some concern among policymakers.

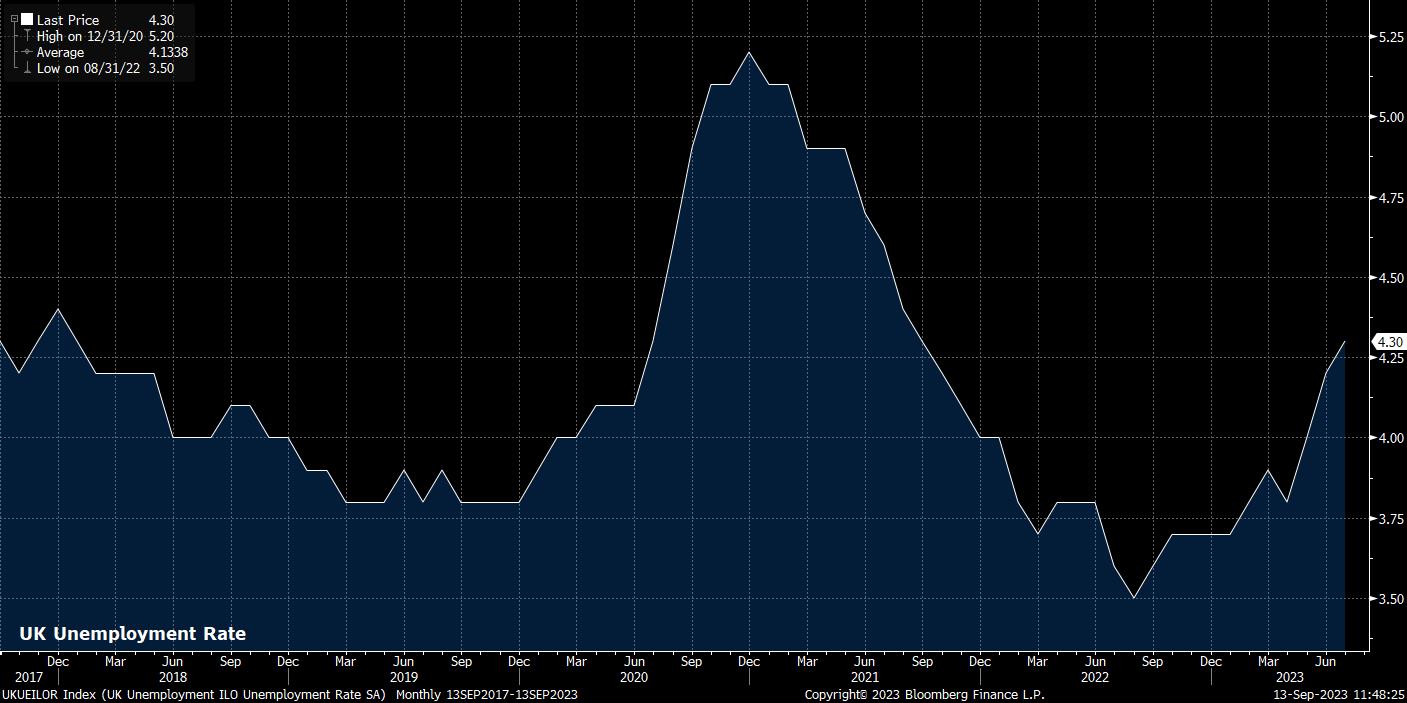

Despite this, the labour market is clearly beginning to soften, and is deteriorating more rapidly than the MPC outlined in their latest forecasts. Unemployment rose to 4.3% in July, the third straight monthly rise, hitting a level that the MPC had not projected to be seen until Q3 24. Furthermore, the number of vacancies dipped below a million for the first time in two years, signifying corporate reluctance to commit to further hiring.

This reinforces the idea that the risks to the UK economic outlook are tilted to the downside, consequently pointing to a greater chance of an increasingly dovish stance from the ‘Old Lady’. In this light, risks to the pound appear tilted to the downside, with a break below the 200-day moving average at 1.2430 likely opening the door to further downside towards the 1.23 handle; 1.25 stands out as strong upside resistance, meanwhile.

_2023-09-13_11-48-35.jpg)

In terms of equities, the FTSE 100 remains largely a currency play, continuing to demonstrate a strong inverse correlation with the GBP, as shown by its recent relative resilience, despite shaky risk appetite more broadly.

Upside has, thus far, been capped by the 100-day moving average, a closing break above which could see the bulls look to target the 200dma, just north of 7,600. To the downside, 7,450 stands out as key support, being both the August to date uptrend, and longstanding horizontal support; below, there is little until the recent 7,225 double-bottom.

Related articles

此处提供的材料并未按照旨在促进投资研究独立性的法律要求进行准备,因此被视为营销沟通。虽然它并不受到在投资研究传播之前进行交易的任何禁令,但我们不会在向客户提供信息之前谋求任何优势。

Pepperstone并不保证此处提供的材料准确、及时或完整,因此不应依赖于此。无论是来自第三方还是其他来源的信息,都不应被视为建议;或者购买或出售的要约;或是购买或出售任何证券、金融产品或工具的征求;或是参与任何特定交易策略。它并未考虑读者的财务状况或投资目标。我们建议此内容的读者寻求自己的建议。未经Pepperstone批准,不得复制或重新分发此信息。