As widely expected, and as markets had fully discounted, the FOMC voted unanimously to hold the target range for the fed funds rate steady at 5.25% - 5.50% at the culmination of the May policy meeting, marking the 7th meeting in a row at which the FOMC have kept rates unchanged. Of course, this now brings us into our 10th month since the fed funds rate reached its terminal level, after the final hike in July 2023, somewhat longer than the median 8 month duration between the final hike, and the first cut, seen over the last four decades.

With rates unchanged, focus naturally fell on the FOMC’s guidance in terms of the policy outlook, particularly with the May meeting coming after a disappointing run of recent inflation figures, including three consecutive headline CPI figures above consensus expectations.

However, on this front, there were again few surprises, with the policy statement largely being a ‘cut and paste’ of that issued after the May meeting. Hence, the Committee once more flagged how the economy is expanding at a “solid pace”; that job gains remain “strong”. The narrative on inflation did shift, however, with the statement noting a “lack of further progress” towards the 2% target, however this largely mirrored language used by Chair Powell, and other FOMC members, in recent remarks.

In terms of the outlook, policymakers continue to seek “greater confidence” that inflation is moving “sustainably towards” the 2% target, before delivering the first cut. Confidence which, of course, remains somewhat elusive at present though, note, the continued inclusion of “towards”, implying that the price target need not be hit before the easing cycle commences, just that policymakers need to be sufficiently sure it will be achieved in order to begin to normalise policy. In any case, the Committee again stressed a preparedness to “adjust the stance of monetary policy as appropriate”, were risks to achieving the dual mandate to emerge.

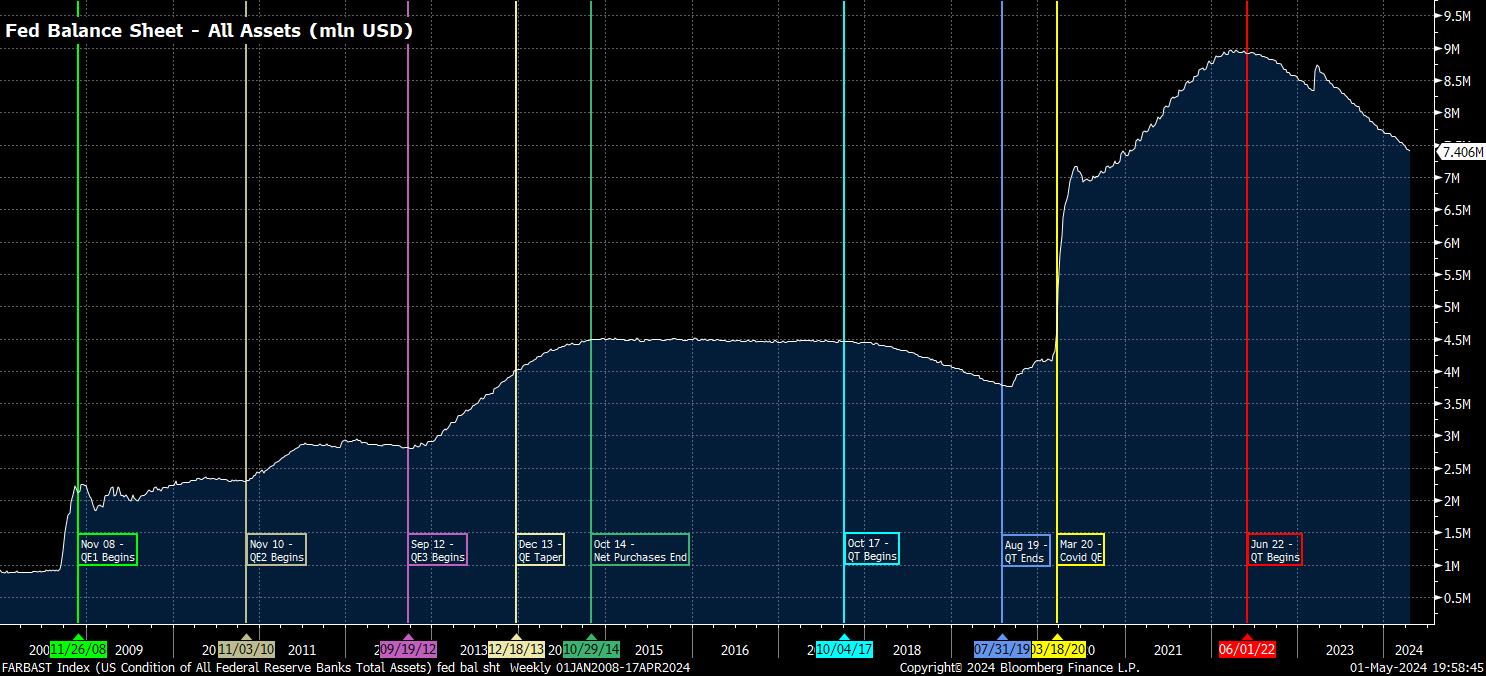

The most significant change to the policy statement came in terms of the balance sheet.

Having flagged, in March, that it would be appropriate to slow the pace of asset runoff “fairly soon”, the FOMC duly delivered the taper to quantitative tightening that many had been expecting. Consequently, from the start of June, the cap on maturing Treasury securities rolling off the balance sheet will be lowered from $60bln per month, to $25bln per month, while the cap for mortgage-backed securities (MBS) will remain unchanged at $35bln per month.

This is an important policy tweak, for a couple of reasons, though, importantly, the FOMC continue to try and separate their balance sheet and interest rate policies during this cycle. Thus, any read-across from a QT taper

Firstly, it is clear that policymakers are attempting to head-off any potential funding squeezes, or other financial plumbing issues, which may occur as a result of the liquidity drain caused by QT. This is a particularly prescient concern, with the overnight reverse repo facility balance set to fall close to zero by the end of June, at which point QT will then begin to pull funds from bank reserves, potentially bringing said reserves below their “ample” level. Secondly, by slowing the pace of runoff, the Fed are likely to be able to proceed with QT for a longer period of time, thereby resulting in a smaller overall balance sheet, comprised primarily of Treasuries, achieving the FOMC’s long-standing aim, while attempting to minimise the risk of significant financial market stress.

Besides the balance sheet, Chair Powell’s press conference was the other main focus for market participants.

At the presser, remarks broadly mirrored those delivered in March, and more recently in Powell’s appearance at the IMF a couple of weeks ago. Perhaps of most significance was Powell’s assertion that it is “unlikely” the next move in the fed funds rate will be a hike, with the FOMC focused on how long rates will need to remain at their current level, in order to ensure a sufficiently restrictive stance to return inflation to the 2% target.

While Powell didn’t repeat his belief that rates have likely peaked for this cycle, instead noting that this hinges on incoming data, the Chair wisely didn’t rise to the bait laid by attending journalists asking about potential further hikes, instead shutting down said debate in noting that it is “unlikely the next move will be a hike”.

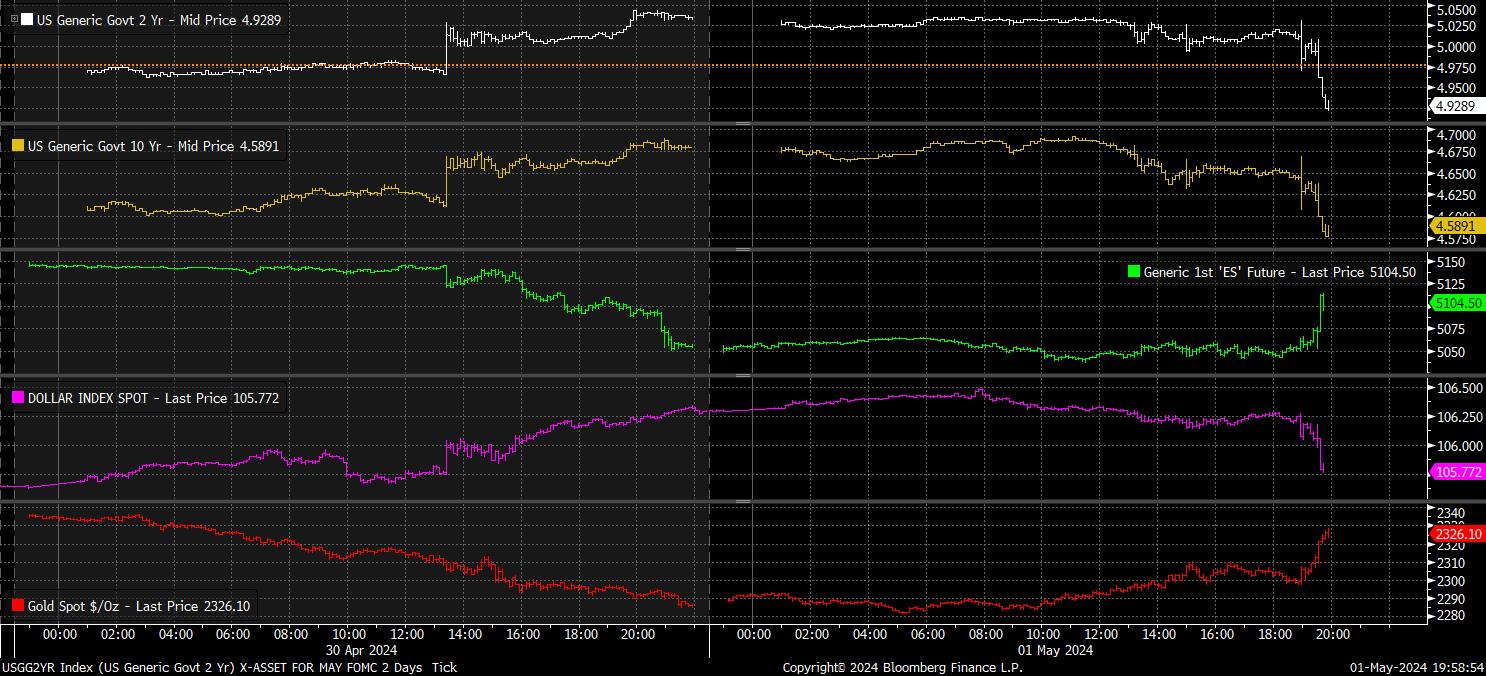

Naturally, all of this gave market participants plenty to digest. On the whole, Powell’s remarks were relatively neutral, mirroring what he, and the majority of other FOMC members, have said of late. However, given the ‘max hawk’ nature of market pricing, and positioning, heading into the March meeting, Powell’s remarks were viewed through a relatively dovish lens – seeing equities gain ground; Treasuries advance, with the 2-year rallying for the 5th straight Fex day; gold pop around 2% higher; and, the dollar roll-over against most G10 peers, with the DXY dipping back under the 106 handle.

Market pricing for future rate moves, meanwhile, also moved in a marginally more dovish direction, with around 4bp of additional cuts now priced by the end of 2024, compared to prior to Powell’s remarks. Risks here, clearly, point to a further dovish repricing over the medium-term, particularly if Friday’s jobs report, of the April CPI print, due 15th May, are cooler than expected.

Stepping back, where does this all leave us. Frankly, the May FOMC meeting will probably go down as one of the most inconsequential, and least important, in recent times. Markets had, irrationally, built up great hawkish expectations, which Powell & Co. wisely did not meet. Clearly, the Committee still have a strong desire to cut rates, with the next move in the fed funds rate all-but-certain to be lower.

This, and the faster QT taper, should continue to support risk assets over the medium-term, with the ‘Fed Put’ still well and truly alive. Furthermore, with markets now priced in an overly-hawkish manner, risks to the greenback appear more evenly-balanced, with G10s likely to trade within a range for the time being, and the broad-based USD rally probably at an end, unless the FOMC seriously put the prospect of a hike onto the table – which, they clearly have little desire to do.

Perhaps we are only talking about cuts because the Fed have told us to talk about them, despite what incoming data may be telling us. But, the FOMC are still talking about them, and that’s all that matters at the end of the day.

Related articles

此处提供的材料并未按照旨在促进投资研究独立性的法律要求进行准备,因此被视为营销沟通。虽然它并不受到在投资研究传播之前进行交易的任何禁令,但我们不会在向客户提供信息之前谋求任何优势。

Pepperstone并不保证此处提供的材料准确、及时或完整,因此不应依赖于此。无论是来自第三方还是其他来源的信息,都不应被视为建议;或者购买或出售的要约;或是购买或出售任何证券、金融产品或工具的征求;或是参与任何特定交易策略。它并未考虑读者的财务状况或投资目标。我们建议此内容的读者寻求自己的建议。未经Pepperstone批准,不得复制或重新分发此信息。

.jpg?height=420)