Having been bullish on the USD for some time now, it feels as if the time has come to take a step back, and re-assess my long-standing view on the G10 FX space.

It’s, perhaps, best to start this re-assessment with a recap, of why I was so bullish on the buck in the first place. A view which has proved fruitful, with the greenback – per the dollar index (DXY) – trading around 5% higher YTD.

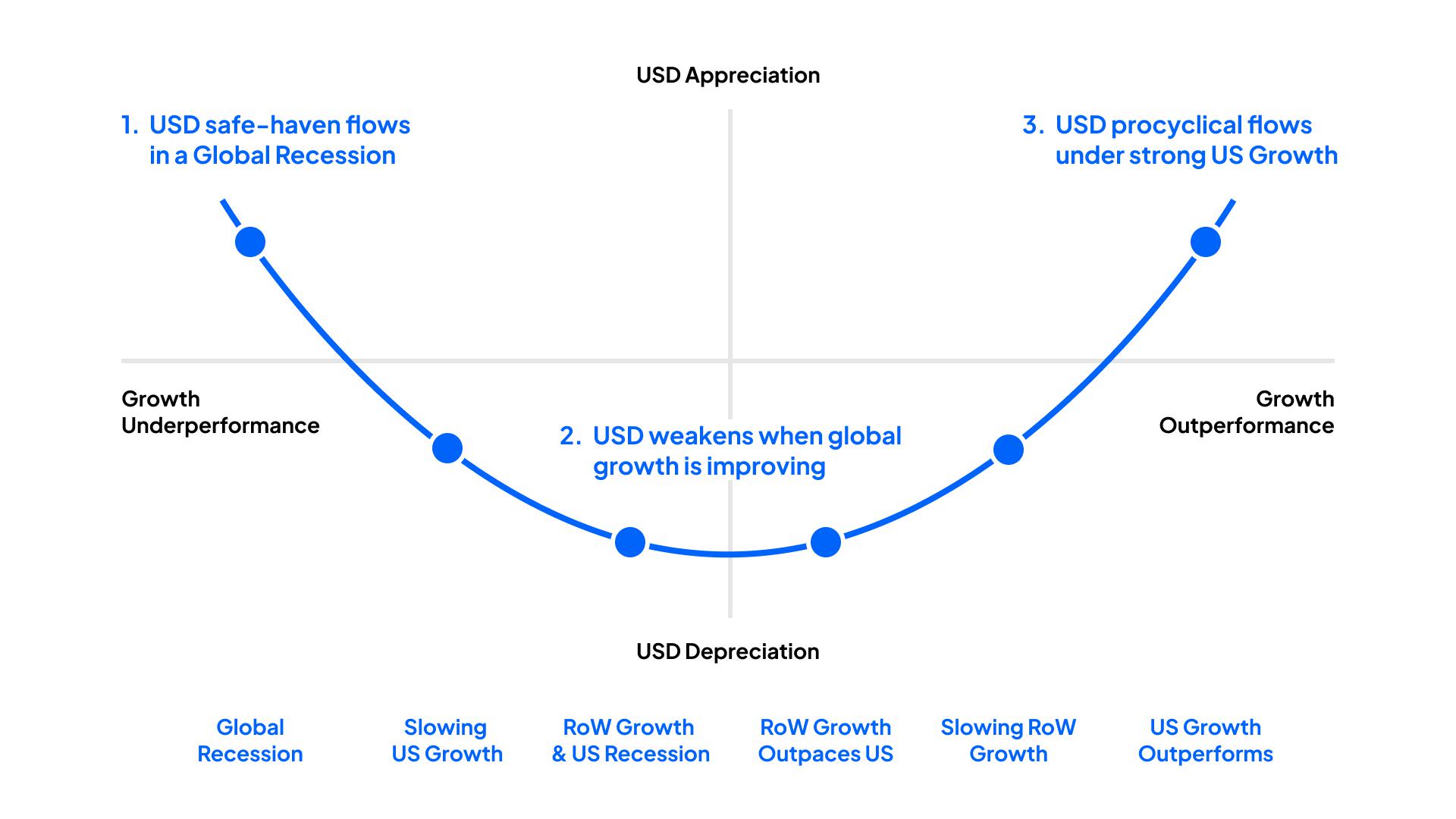

Put simply, that bullish USD view was based upon both sides of the so-called ‘dollar smile’ working in the buck’s favour.

On the one side, we have economic outperformance, or the ‘US exceptionalism’ narrative, that has dominated markets for much of the last six months. The premise here is that US growth vastly outpacing that of DM peers, coupled with stubbornly high inflation, results in a more hawkish policy stance from the FOMC, and subsequently provides the USD with a yield advantage over other G10s.

On the other side, haven demand as a result of the numerous geopolitical hotspots across the world – ranging from Ukraine, to the Middle East, to Taiwan – has also helped to underpin demand for the USD, particularly with each of the aforementioned situations remaining incredibly fluid, and unpredictable.

In summary – economic outperformance + haven demand = a perfect mix for USD strength.

However, some signs are now beginning to emerge that the above equation is no longer one that accurately describes the current macro, and market, environment.

Firstly, on growth, last week’s sharply below-expectations GDP print, pointing to an initial estimate of the US economy having expanded by just 1.6% on an annualised QoQ basis in the first quarter, compared to the +2.4% consensus, has cast some doubt on the ‘exceptionalism’ theme. While it should be noted that a decline in inventories contributed significantly to this downside surprise, and that consumer spending remained relatively resilient over the quarter, the report nonetheless snapped what had been an impressive run of six consecutive quarters with >2% real GDP growth.

Furthermore, recent PMI surveys have also shown how the US economy’s performance continues to converge with that of DM peers with other such economies, particularly in Europe, having seen a notable turnaround in momentum over recent months, as economic momentum stateside wanes. Again, there is a caveat, namely that signals from ‘soft’ data have been rather unreliable this cycle, though PMI figures remain important leading indicators to which markets continue to pay significant attention.

The policy picture is also appearing somewhat less supportive for the greenback. While there remains a significant divergence between the FOMC, who due to recent elevated inflation readings are sticking with their longstanding data-dependent, ‘higher for longer’ stance, and other G10 central banks who are likely to kick-off their easing cycles within the next six weeks or, in the case of the SNB, have already done so, this is a divergence that markets are now discounting, and arguably price too aggressively.

For instance, the USD OIS curve now prices just 31bp of easing from the FOMC this year, while the first 25bp cut is not fully priced until the December meeting; this compares to around 75bp of easing, and the first cut in July, that was priced at the time of the last FOMC decision in March. Furthermore, digging into the SOFR options space, one sees markets actually pricing around a 15% chance that the Fed are forced into a rate hike before the year is out.

Judging by recent Fedspeak, the dot plot, incoming data, and the extreme nature of recent swings in OIS rates, it feels just to say that the hawkish repricing has now run too far, and that the risk-reward tilts towards positioning for a dovish retreat, with the Fed’s next move still likely to be a cut later this year.

The geopolitical backdrop also appears somewhat calmer than it did some weeks ago. After a handful of tit-for-tat retaliatory missile strikes, tensions between Israel and Iran appear to have simmered down once more, while the market also continues to seem relatively unperturbed by the war in Ukraine, no in its third year.

We can use market-based proxies as a gauge of this geopolitical risk. Gold, for example, now trades well over $100 off the all-time highs seen during the peak of the aforementioned tensions, while Brent crude has also backed away from the highs, trading around 5% lower over the last three weeks, and back below $90bbl. Both of these would suggest that, in the mind of ‘Mr Market’ at least, that geopolitical risk is no longer as significant a concern as it was, and thus should no longer underpin demand for the USD to the extent that was seen of late.

Naturally, this all begs the important question of what comes next.

For the dollar to roll-over, and for the recent uptrend to become a sustained move in the opposite direction, will necessitate market participants being happy to be long of something else within the G10 FX world.

Realistically, there are few attractive G10 longs at present, with policy expectations looking overly-hawkish for both the AUD and the NZD, dovish policy risks remaining prevalent for European FX (CHF, EUR, GBP, SEK), and the relatively soft crude backdrop likely posing some headwinds for both the CAD and the NOK. While some may point to the JPY, particularly after the MoF’s recent intervention to prop up the currency, sustained appreciation here seems unlikely unless the BoJ dramatically shift stance, and shift gears to a more aggressive pace of rate hikes, which – to say the least – is a long shot.

As a result, it seems likely that we settle into a more rangebound FX environment. Broad-based USD strength appears over for the time being, with a further significant leg higher in the buck likely requiring the FOMC’s conversation to shift towards seriously considering further rate hikes, or at least the market moving to price such a move.

Neither of these prospects appear especially likely for now. So long as the market remains happy pricing 0-2 cuts this year, and the FOMC remain in their present patient stance, range trading is likely to be the order of the day.

This prior dollar bull isn’t ready to become a bear yet, but has now turned neutral on the USD over the medium-term.

Related articles

此处提供的材料并未按照旨在促进投资研究独立性的法律要求进行准备,因此被视为营销沟通。虽然它并不受到在投资研究传播之前进行交易的任何禁令,但我们不会在向客户提供信息之前谋求任何优势。

Pepperstone并不保证此处提供的材料准确、及时或完整,因此不应依赖于此。无论是来自第三方还是其他来源的信息,都不应被视为建议;或者购买或出售的要约;或是购买或出售任何证券、金融产品或工具的征求;或是参与任何特定交易策略。它并未考虑读者的财务状况或投资目标。我们建议此内容的读者寻求自己的建议。未经Pepperstone批准,不得复制或重新分发此信息。

.jpg?height=420)