What are trading platforms and why trade on them?

Let’s start with the most basic question – what is a trading platform?

A trading platform is a software application that give you access to the financial market where you can speculate on the price movement of financial securities online. They are available for a range of asset classes, including stocks, forex, CFDs, indices, cryptocurrency, and more.

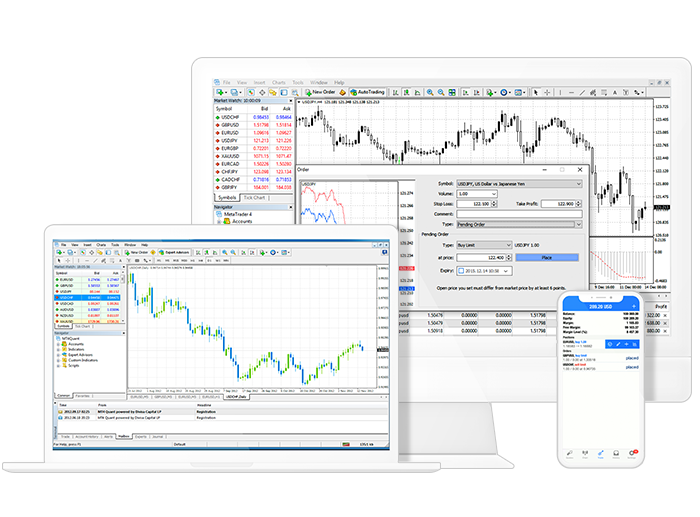

A platform like MetaQuotes’ MetaTrader 4 or cTrader, provides traders with access to market data, charting tools, and trading execution on CFDs. They can be web-based, mobile-based, or desktop-based.

‘So, which platform is the ideal one?’ is a question many beginner traders ask themselves when they first start out. Finding the ideal one that suits your needs is a subjective matter with no definitive answer. The choice between different platforms depends on various factors such as chart customisation, advanced order entry functionality, one click trading and much more.

By delving into a comprehensive analysis of the available options later on in this article, you’ll be better equipped to make an informed decision tailored to your specific requirements.

Types of trading platforms

There are three types of trading platforms: desktop-based, web-based, and mobile-based. For example, a popular third-party trading platform like MetaTrader (MT4) has different versions in mobile and desktop format, which is widely used in the forex and CFD trading industry and comes with a range of automated trading tools and add-ons.

Desktop-based platforms: offer advanced features and customisation options but are less accessible than web-based or mobile-based platforms.

Web-based platforms are easy to access from any device,all you need is a browser and your account credentials.

Mobile-based platforms offer the convenience of trading on the go from iOS and Android devices.

Download MetaTrader 4 now

Key features of a trading platform

A good trading platform should offer a user-friendly interface, advanced charting tools, a wide range of order types, robust security features, and integration with other trading tools. Let’s explore some of the key-features you should consider when deciding on which trading platform to use:

Demo Accounts: a reputable trading platform should provide the option for a demo account. Demo accounts allow users to practice trading with virtual funds in a simulated market environment, before you graduate on to the real thing and trade with your own money. They are invaluable for beginners who want to gain experience and test strategies without risking real money. Look for a trading platform that offers a fully functional demo account.

User interface: an easy to navigate interface is crucial for seamless navigation and efficient trading. A well-designed trading platform should have an intuitive layout, clear and organised menus, and customisable options. It should be easy to access various features, place orders, monitor positions, and analyse market data. Look for platforms that prioritise simplicity without sacrificing functionality, as it can greatly enhance your trading experience.

Charting tools: these are essential for technical analysis and making informed trading decisions. A trading platform should provide a wide range of charting options, including various timeframes (such as 4 hour, 1 hour, 30 minute, 15 minute), chart types (such as line charts, candlestick charts, or bar charts), and drawing tools (such as trendlines channels, Fibonacci etc). Additionally, the platform should offer indicators such as trend lines, and other technical analysis tools to help traders identify patterns and trends in the market.

Order types: a diverse selection of order types allows traders to execute their strategies effectively. Look for a trading platform that offers standard order types like market orders, limit orders, and stop orders.

Security features: when it comes to online trading, security is of utmost importance. Ensure that the trading platform you choose employs robust security measures to protect your personal information and funds. Look for platforms that utilise encryption technology and two-factor authentication.

Integration with other tools: can enhance your trading capabilities. Look for platforms that offer seamless integration with third-party applications, such as trading algorithms, automated trading systems, or financial news aggregators. This allows you to utilise additional resources and expand your trading strategies by accessing a broader range of analysis tools and market insights.

How to choose your trading platform

When comparing the best trading platforms offered by Pepperstone, it's important to consider several factors such as features, fees and ease of use.

For example, MetaTrader 4 is well-regarded for its robust charting tools and algorithmic trading capabilities, making it suitable for traders who heavily rely on technical analysis or use automated trading strategies.

While MetaTrader 5 is suitable for traders who seek a wider range of tradable instruments beyond Forex, as well as those who require advanced back-testing capabilities for strategy development.

Then there is the trading platform cTrader well-liked by more experienced traders who value advanced customisation options, direct market access, and the ability to utilise third-party trading algorithms.

TradingView, on the other hand, offers a powerful web-based charting and analysis platform with a user-friendly interface and a wide range of technical analysis tools. It’s an excellent choice for traders who prioritise in-depth charting capabilities and wish to engage with a large trading community.

Let's explore an in-depth analysis of the top trading platforms, including their pros and cons, as well as their suitability for different types of traders:

Trading Platform | MetaTrader 4(MT4)

| MetaTrader5 (MT5)

| cTrader

| TradingView |

Type of Trader | Beginners: | Advanced Traders: offers advanced features, a larger selection of tradable instruments, and improved back-testing capabilities for strategy development and optimisation. | Day Traders: has a customisable interface, and integration with algorithmic trading make it an ideal choice for day traders who require quick execution and access to market depth. Favoured by more experienced traders who value advanced customisation options, direct market access, and the ability to utilise third-party trading algorithms.

| Social Traders**: highly regarded among traders for its comprehensive charting capabilities and social trading community. Suitable for traders who prioritise advanced technical analysis and wish to engage with a vibrant community of traders. Both beginners and experienced traders can navigate the interface. |

Markets to trade | Primarily designed for trading Forex (currency) pairs. Also supports CFDs on commodities, indices, and precious metals. | In addition to Forex, it allows trading of CFDs on commodities, indices, stocks, and crypto. | Supports the trading of various derivatives, including Forex, CFDs on commodities, indices, stocks, and crypto. | The availability of specific derivatives on TradingView depends on the broker or exchange you connect with. This may include Forex, stocks, futures, options, and cryptocurrencies, among others. |

Device accessibility

| Availability of mobile and web-based versions, providing flexibility to trade on multiple devices. Requires downloading and installing the software for desktop use.

| Web-based version available for trading on the go without software installation.

| Limited to Web-based version available, as well as phone application. | Seamless integration with Pepperstone ctrader accounts: TradingView allows traders to connect their Pepperstone trading accounts, providing real-time data and enabling direct trading execution within the platform. |

Interface | User-friendly interface suitable for both beginners and experienced traders. Outdated interface design compared to newer platforms,

| Transition from MT4 to MT5 may require traders to adapt to a new interface and potentially update their trading strategies. Some custom indicators and Expert Advisors (EAs) may not be compatible with MT5, leading to a need for reprogramming or finding alternative solutions.

| Highly customisable user interface with detachable and rearrangeable windows, allowing traders to personalise their trading experience.

| Interactive, clean, intuitive and user-friendly interface.

|

Features | Extensive charting capabilities with a wide range of technical indicators and drawing tools. Algorithmic trading support through the MetaQuotes Language (MQL) and access to a large marketplace of trading robots and indicators.

| Enhanced features compared to MT4, including additional order types, improved charting tools, and more advanced timeframes. Improved back-testing functionality for strategy development and optimisation. Some custom indicators and Expert Advisors (EAs) may not be compatibl, leading to a need for reprogramming or finding alternative solutions.

| Advanced charting features with an extensive library of technical indicators and drawing tools. Steeper learning curve for beginners due to its advanced features and customisation options. Seamless integration with third-party trading algorithms through cTrader Automate.

| Free access to basic features, more advanced features, data, and real-time market information may require a paid subscription. Extensive charting capabilities: Traders can access a vast library of technical indicators, drawing tools, and chart types to conduct in-depth technical analysis. Social trading and community features: Users can interact with a large community of traders, share ideas, and access a wide range of user-generated content, including published trading strategies and educational resources. Customisable alerts and notifications: Traders can set up personalised alerts based on price levels, technical indicators, or specific market conditions to stay informed about potential trading opportunities. |

** Copy trading varies according to the jurisdiction. Not allowed in CySEC regions.

Smart Trader Tools for MT4 Trading with MT5 Start trading on cTrader Explore TradingView

Step by step guidelines to choosing the right trading platform

- Consider your personal preferences, trading style, and financial goals

- Compare the various platforms by looking at key features fees and commissions by the Broker

- Listen to other expert opinions to help you decide

- Open a Demo account and test the platform

- Once you feel comfortable with your decision, open a live account and start trading

Expert tips for using trading platforms

Using a trading platform effectively requires a solid understanding of the platform's features and tools, such as charting capabilities, technical analysis indicators, and risk management options, to make informed trading decisions.

You can also enhance your trading knowledge and skills by taking advantage of educational resources offered by Pepperstone, such as tutorials, webinars, and educational articles. Continuous learning can significantly improve your trading performance over time.

Expert advice on how to trade on various platforms

Discover educational content with expert market analyst and trade specialist, Chris Weston, Pepperstone’s Head of Research.

Aside from this pro advice, here are a few other general tips:

- Stay up to date on market news – most financial markets experience a lot of volatility and you’ll need to keep up to date on the news that is affecting the markets.

- Have a risk management plan in place, looking at tools to help you like stop loss and take profit levels on every single position.

- Decide on a trading strategy, to prevent costly errors resulting from emotional decision-making or excessive trading, it is crucial to have a meticulously tested and carefully crafted trading plan in place.

Related articles

此处提供的材料并未按照旨在促进投资研究独立性的法律要求进行准备,因此被视为营销沟通。虽然它并不受到在投资研究传播之前进行交易的任何禁令,但我们不会在向客户提供信息之前谋求任何优势。

Pepperstone并不保证此处提供的材料准确、及时或完整,因此不应依赖于此。无论是来自第三方还是其他来源的信息,都不应被视为建议;或者购买或出售的要约;或是购买或出售任何证券、金融产品或工具的征求;或是参与任何特定交易策略。它并未考虑读者的财务状况或投资目标。我们建议此内容的读者寻求自己的建议。未经Pepperstone批准,不得复制或重新分发此信息。

.jpg)