Commodities - All About Energy Products

Brent Crude

Brent is one of the two major global oil price benchmarks, referencing a blend of prices from four major North Sea oilfields – Brent, Forties, Oseberg and Ekofisk (BFOE). As a sweet and light crude, Brent is easily refined into diesel and gasoline, while also being simple to transport via a vast network of undersea pipelines.

As with the other crude benchmark, WTI, Brent is highly influenced by global economic performance, with oil demand unsurprisingly being incredibly cyclical in nature, and economic data from sizeable oil consumers such as China often wielding significant influence over prices. Furthermore, crude can be significantly influenced by geopolitical events, particularly in major oil producing nations, as well as the actions of the OPEC+ cartel – typically, output cuts support prices, while output increases apply pressure.

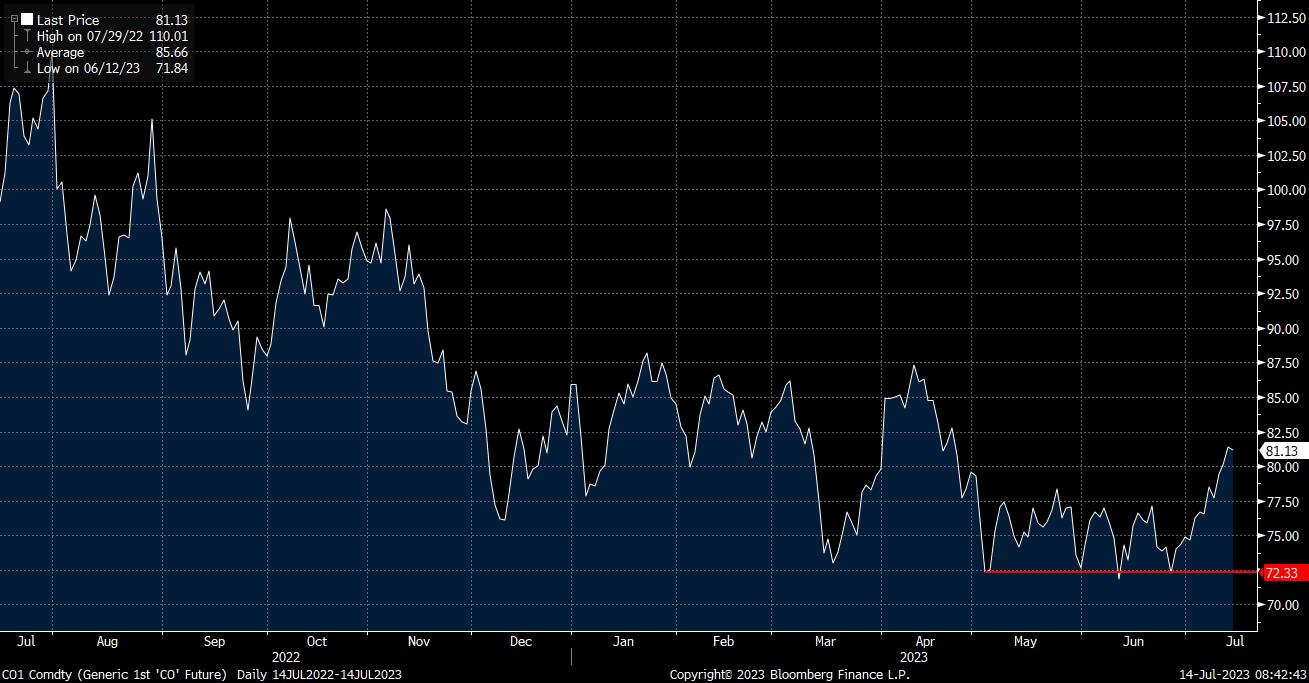

OPEC+ cuts have been a significant theme YTD, with two ‘surprise’ output cuts having been announced in an attempt to put a floor under prices. While this has had the desired effect, with $67.50bbl having established itself as solid support, we are yet to see a sustained rally, besides the recent lurch higher as a function of the softening greenback. More prolonged gains, if they were to occur, are likely to require a concrete rise in demand, something that may be unlikely if the current manufacturing slowdown were to deepen.

WTI Crude

While the drivers of WTI crude, and future outlook, are almost identical to those of Brent, there are some important differences in the underlying product behind the contract.

Geography is one, with WTI referencing a light, sweet crude both traded and delivered at Cushing, Oklahoma. In contrast to Brent, there are no geographical restrictions on the fields from which WTI must be produced, so long as the crude produced meets the requirements of the contract. Despite this, in a similar way to Brent, WTI is a high quality crude which is also easy to refine into various distillate products.

Nevertheless, WTI typically trades at a discount to Brent, at least since the shale boom in the early years of the last decade, largely due to a surplus in supply of the former. This surplus, coupled with the drying up of demand due to global lockdowns, and full storage at Cushing, contributed to the May 2020 WTI closing in negative territory, for the first time on record.

Natural Gas

Despite the ongoing global focus on climate change, natural gas remains a highly used commodity and one which is integral to the economy, with a variety of uses ranging from industrial manufacturing processes, through to electricity generation.

Typically, the single biggest factor impacting Nat Gas prices is the temperature, with demand tightly correlated with falling temperatures in winter as heating usage increases, and with rising temperatures in summer due to its use in powering air conditioning systems. Of course, hedging flows will also impact price as institutional players seek to reduce the impact of the aforementioned volatility, while geopolitical events – as with most commodities – also play a significant role, particularly in the context of Russia’s ongoing war in Ukraine.

As for markets currently, despite typically being one of the most volatile tradeable commodities, prices have settled into a $2.00 - $2.50 range for much of this year, with a significant degree of geopolitical risk premium having been priced out as war in Ukraine continues, and since alternative supplies (e.g., LNG from the Middle East) were sourced, allaying concerns about a global gas shortage.

Gasoline

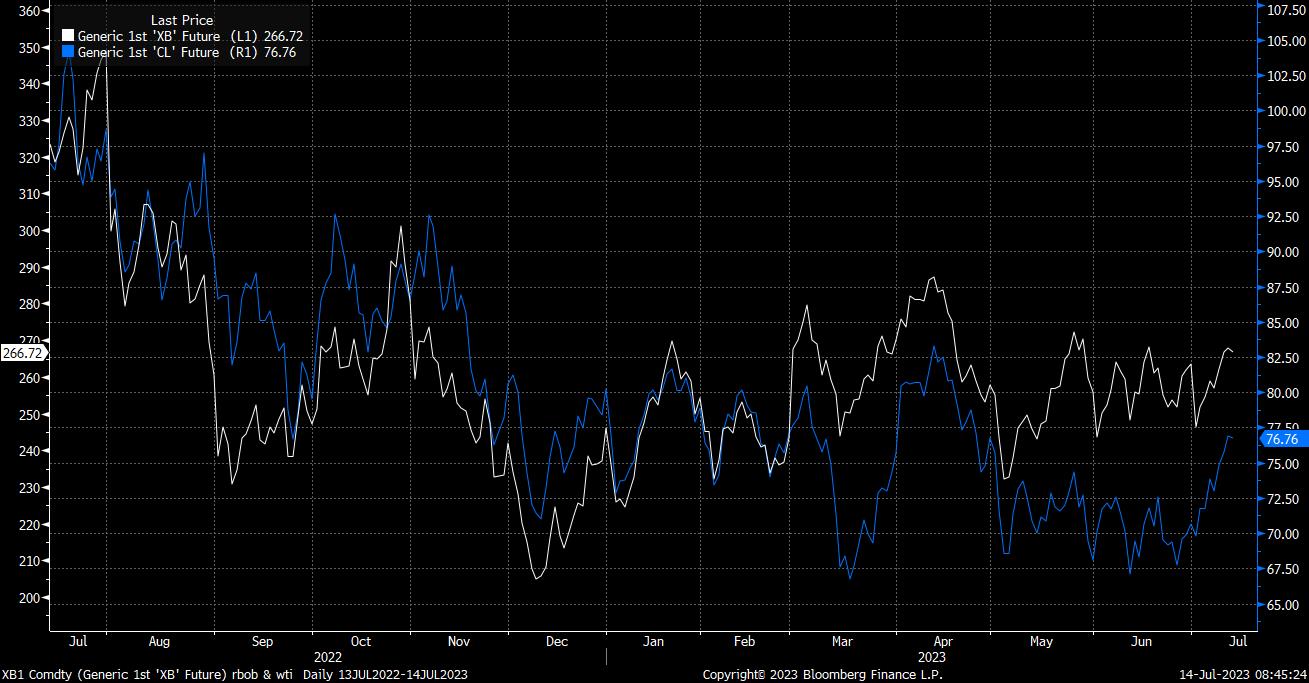

RBOB Gasoline (Reformulated Blendstock for Oxygenate Blending) is one of the most important distillates of crude oil, being used in millions of vehicles worldwide, though the ongoing transition away from internal combustion engines may reduce RBOB demand as time goes on.

Nevertheless, RBOB remains a key global commodity, and one which is primarily influenced by the same factors as both blends of crude mentioned above. That said, there are some idiosyncratic influences on the contract, namely weather in the Gulf of Mexico – an area home to many US oil refineries which produce gasoline – in addition to seasonality, with ‘driving season’, the period between Memorial Day and Labor Day, often providing support to prices.

此处提供的材料并未按照旨在促进投资研究独立性的法律要求进行准备,因此被视为营销沟通。虽然它并不受到在投资研究传播之前进行交易的任何禁令,但我们不会在向客户提供信息之前谋求任何优势。

Pepperstone并不保证此处提供的材料准确、及时或完整,因此不应依赖于此。无论是来自第三方还是其他来源的信息,都不应被视为建议;或者购买或出售的要约;或是购买或出售任何证券、金融产品或工具的征求;或是参与任何特定交易策略。它并未考虑读者的财务状况或投资目标。我们建议此内容的读者寻求自己的建议。未经Pepperstone批准,不得复制或重新分发此信息。