分析

By now, almost everyone is familiar in some way, shape, or form, with AI technology; be that by having a play with ChatGPT at some point since its release 18 months ago, through to more complex or commercial applications for the technology. Whatever the use case, none would be possible without the semiconductors and microelectronics upon which the aforementioned AI systems must run.

It is this that is of particular interest to market participants. While most, if not all, major tech firms are now working on some form or another of their own AI platform, it is near-impossible to gauge, particularly with the space still in its infancy, which of these will prove most successful, and which may flop. However, no matter which of these takes off, consensus expects the technology more broadly to do so, supporting the semiconductor industry at large, as markets have been discounting over the last year or so.

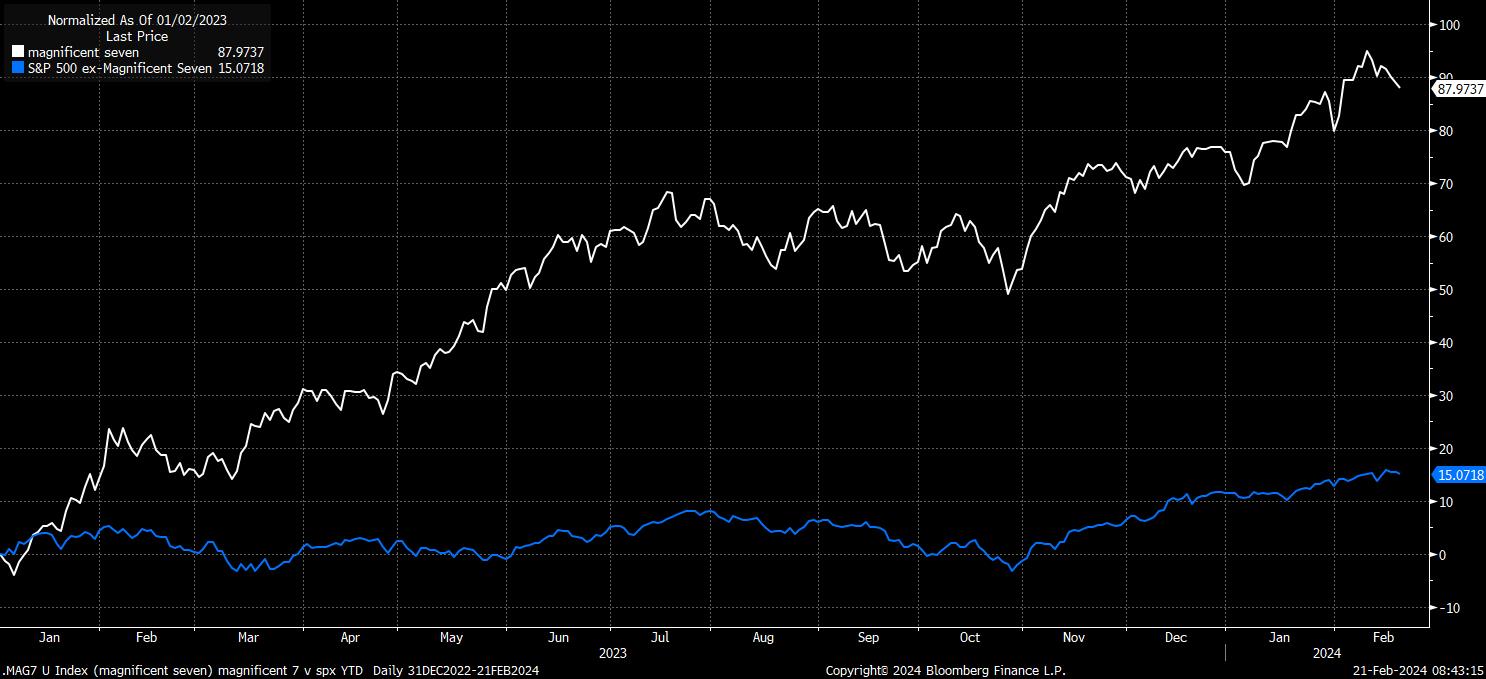

Of course, the impact of all this at an index level has been well documented by this stage. The emergence, last year, of the ‘magnificent seven’, all of which – to some extent – have an exposure to AI, and which have vastly outperformed since the start of 2023, underpinning the broader market’s returns during said period, albeit with signs of better breadth now beginning to emerge.

In any case, to return to our gold analogy, those are the miners, and not those selling the pickaxes. Those involved with the latter have performed even better than their ‘magnificent seven’ counterparts since the start of last year, at least using the performance of the Philadelphia Semiconductor Index (SOX) as a proxy.

There are a handful of individual names that standout among this bunch.

Nvidia is the most obvious, being the standard bearer for the AI-induced frenzy, with the stock trading almost 400% higher in the last 14 months, having already gained over 40% YTD and standing as the best performer in the S&P 500, as investors continue to bet on the chipmaker being able to maintain it’s impressive pace of sales and revenue growth into the future, having been the dominant force in this space since the frenzy over AI began.

In some respects, therefore, the success – or not – of NVDA going forward may hinge more on whether or not the competition is able to catch up, and nibble away at market share, rather than any initiatives that NVDA themselves may bring forward.

_Da_2024-02-21_08-39-02.jpg)

These competitors are numerous. One that has been particularly headline-grabbing of late has been Super Micro Computer (SMCI), a long-standing player in the computing space, though one which has only recently been thrust into the limelight, due to the production of highly customisable computing equipment and efficient servers, which are well-suited to AI-related applications.

The stock has taken off since preliminary Q2 earnings were released in mid-January, with EPS printing $1 above analyst estimates of $4.55, while net sales were also around $800mln above expectations. Clearly, with this interim set of results being substantially above the guidance delivered at the end of 2023, market participants have interpreted this as a sign that demand is continuing to accelerate, and is doing so in an incredibly rapid fashion. Though price has pulled back from the highs just north of $1,000 – hardly surprising after a >200% rally – a slew of price target upgrades have continued to feed through, with many viewing the recent pullback as a pause in the upward trend, rather than the start of a more prolonged decline.

Another name that has caught the eye of late is ARM Holdings, again after earnings pointed to a continued increase in demand, while also delivering a chunky 25% upgrade to FY EPS expectations.

The interesting point to note here is that, unlike NVDA, SMCI, and others, ARM specialise in a slightly different area of the semiconductor industry. The chipmaker, in contrast to others, specialises in low-energy mobile processors, rather than the energy-intensive graphics units that others do, and which are pivotal for AI use cases. Perhaps, this speaks to how we are now at a stage where anything and everything to do with computer manufacturing is being branded as ‘AI’, even if that is not the core business of the corporation in question.

In any case, the move in ARM shares – which have risen by two-thirds since the aforementioned earnings report – is rather bittersweet for advocates of the City of London, such as myself. Before its IPO, ARM went through a prolonged process of weighing up whether to list on the London Stock Exchange (LSE), or on the tech-heavy New York based Nasdaq. In the end, the Softbank-owned firm plumped for a Nasdaq listing, choosing a venue perceived as much more ‘tech friendly’ than that on this side of the pond.

This produces a classic case of ‘what might’ve been’ for the UK market. The FTSE 100 currently trades around 2% higher since the IPO back in mid-September 2023. However if, hypothetically, on that date, ARM was added to the London benchmark, replacing the smallest weighted name of Endeavour Mining, the index would be almost 5% higher over that same time period.

Related articles

此处提供的材料并未按照旨在促进投资研究独立性的法律要求进行准备,因此被视为营销沟通。虽然它并不受到在投资研究传播之前进行交易的任何禁令,但我们不会在向客户提供信息之前谋求任何优势。

Pepperstone并不保证此处提供的材料准确、及时或完整,因此不应依赖于此。无论是来自第三方还是其他来源的信息,都不应被视为建议;或者购买或出售的要约;或是购买或出售任何证券、金融产品或工具的征求;或是参与任何特定交易策略。它并未考虑读者的财务状况或投资目标。我们建议此内容的读者寻求自己的建议。未经Pepperstone批准,不得复制或重新分发此信息。