- Sentiment – how ya’ll feel out there?

- Key event risk in the week ahead

- The risk to the EUR from the ECB meeting

- US nonfarm payrolls in play – watch the unemployment rate

- Swiss CPI inflation could see the CHF outperform

Sentiment

Things were looking a little dicey for US equity and risk on Friday. Still, a 1.7% rally in the S&P500 off session lows and into the close on portfolio rebalancing flows caused a rethink there. Tech was seeing red flags with over 10 companies in the sector recently lowering guidance, so the question for today is how much we can trust Friday’s reversal.

.png)

Market internals (the number of companies above 20-, 50- and 200-day moving averages, for example) look concerning, but hardly a reason to be short. At the same time, the VIX index sits below 13%, and the USD, gold, and US 2-year Treasury remain stuck in a range. Risk seems supported if the growth data holds up this week, and the market knows that the Fed will and can cut this year. Lower growth data, weaker labour markets and another challenging US CPI print next week would trigger higher market volatility.

Look for Indian markets to fire up today with a “Super Majority” seen from the BJP/NDA Alliance and Modi winning a third term in office – a fate last seen in 1962. The Nifty 50 should open 3%+ higher, with USDINR undoing much of the rally we saw last week. Policy continuation will always sit well with markets if they already like the story, and the drive to make India the world’s third largest economy by 2030.

Key event risk for the week ahead

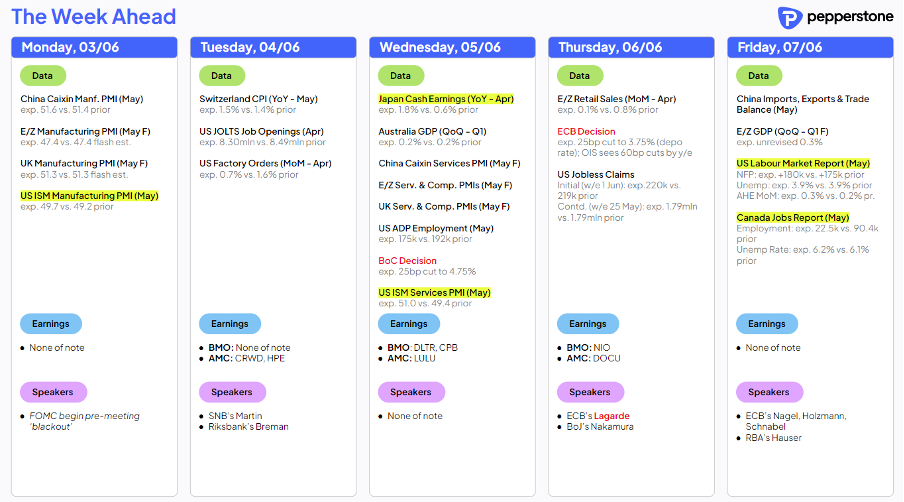

We roll into the month of June, and the event risk through which traders manage risk positions cranks up. The marquee risk for the week will be the ECB meeting and US nonfarm payrolls (NFP), but the BoC meeting, Swiss CPI, US ISM manufacturing and ISM services could also influence market sentiment and price action. China trade data, Canada employment data, US JOLTS (job openings), Aussie Q1 GDP, and Japan cash earnings may also get some focus.

At a stock level, Nvidia remains central to the moves in the NAS100 and S&P500, although Apple is supporting both indices as we head into its highly anticipated Worldwide Developers Conference (starting 10 June), where a break of $193 should get good attention. For the momentum traders, Walmart is on the radar, where the set-up suggests it could kick through $70. Bank of America also screens well from a momentum perspective, and I see the risk this can continue to rally short-term.

The ECB to cut rates but won’t commit to more

Thursday’s ECB meeting should almost certainly see the bank cut rates by 25bp, marking the first time in its history of cutting before the Fed. The EUR is not a sell on a rate cut alone, as this outcome is some 95% priced, so the bigger influence will come from guidance around future cuts – a factor Christine Lagarde will likely say is fully data-dependent - while the updated staff economic projections could also impact. Current market pricing suggests one further 25bp cut could come this year, either in the October or December ECB meeting.

The market is positioned for a relatively hawkish meeting and sees a skew towards a positive reaction in EUR. EURUSD upside has seen supply kick in around 1.0880, so price needs to clear here to see momentum build and, of course, there is a big risk from the USD side that needs to be considered this week. The upside in EURUSD should be capped at 1.0930.

NFP’s – the unemployment rate holds the keys

In the US, the big risk is the nonfarm payrolls (NFP) report on Friday, a data point which forecasting is a thankless task. The consensus is for 190k jobs created, with an unchanged read of 3.9% in average hourly earnings. The bigger reaction across markets likely comes from an unexpected change in the unemployment rate, which currently sits at 3.9% – notably, if we were to see a rise above 4%, then the USD would take a solid hit, as trader’s price a greater chance of a July rate cut (currently priced at c10%). Gold would look to test the upper limits of the $2425 to $2277 range it has held since early April.

A US unemployment rate below 3.8% should result in US rates markets pricing closer to 1 cut this year, and lift USDJPY into ¥158, subsequently undoing all the ¥9.8 trillion of MoF FX intervention undertaken through May. This would make trading the JPY challenging as MOF/BoJ intervention risk would ramp up again.

In the lead-up to NFPs, we get the US JOLTS job openings, ADP private payrolls, and jobless claims. On the growth side, US manufacturing and services ISM are due – two data points that the market often fails to respond to, depending on its mood. For now, the DXY (US Dollar Index) tracks a range of 105.20 to 104.20, following the trading range carved out in the US 2-year Treasury of 5% to 4.70%.

After last week US core PCE print came in line with expectations at 2.7% y/y, amid a soft personal spending print (at 0.2%), US swaps price a 25bp cut in the September FOMC meeting at a 50/50 proposition, with 35bp (or 1.5) of cuts priced by December. The US labour market data this week and ISM prints could influence that pricing, but it still feels on current data trends that a cut in July or September is a tall order and one cut this year – either in November or December - is more likely.

Swiss CPI could offer increased movement in the CHF

The currency to own last week was the CHF, where the alpha play in G10 FX has been long CHFJPY – that trade gets called into question this week with Swiss CPI due on Tuesday (16:30 AEST) with economists eyeing an unchanged read on headline CPI at1.4%, with the core CPI read expected to tick up to 1.3%. The CPI data will have implications for expectations around the 20 June SNB meeting, in which the market prices a 25bp at 45%. The other important aspect is that SNB head Jordan detailed last week a preference for selling foreign currency (buying the CHF) as inflation could rise due to the weakness in the CHF. Should we see an inflation print above 1.4% then the SNB could look to intervene more aggressively here by selling its foreign currency holdings, which could mean the downside reaction in EURCHF, USDCHF, and AUDCHF will be more pronounced.

The range of 0.9150 to 0.9000 in USDCHF can be best seen in the weekly chart – subsequently, a downside break of 0.9000 would attention from momentum accounts.

The BoC is expected to cut but it could be close

While the ECB meeting is almost a done deal, the BoC meeting has greater two-way risk for the CAD and while the market prices a 25bp cut at 75%, and 61bp of cumulative cuts priced by December, it wouldn’t surprise as much to see the BoC keep rates unchanged. CADCHF could be a tactical play this week to put on the radar, with the pair holding a range of 0.6700 to 0.6600 where a breakout could be the start of better-trending conditions. We also get Canadian payrolls on Friday, with the consensus calling for 22k jobs created and the U/E rate unchanged at 6.2%.

No worries with Aus Q1 GDP

In Australia we get Q1 GDP on Wednesday, with expectations for meagre 0.2% q/q, leading to a moderation to 1.2% y/y (from 1.5%). Subdued growth and sticky inflation aren’t a great balance, but we look at the influence from a rising inventory build and falling net exports – it’s the consumption element that matters most to the market. Still, given the backwards focus of GDP, I wouldn’t be overly concerned with holding AUD or AUS200 exposures over the GDP data, although we could see a bigger downside reaction if quarterly GDP contracts.

China data and equity price action may matter as much to AUD traders, with China exports due on Friday, with economists expecting exports to grow at 5.1%, and imports at 4.7%. If USDCNH can push back towards the recent highs of 7.2750 then this will likely weigh on AUDUSD. On the week I’d be fading upside moves into 0.6715 or using dips to .6590 to buy.

In the UK, we get the BoE Decision Makers Panel (DMP) on Thursday which could explore the recent moderation in price and wage pressures – UK swaps don’t see a chance of a cut from the BoE until September, so the guidance here could influence rates and by extension the GBP. On the election front, we see the first televised leaders debate on Tuesday (9 pm UK time), but this shouldn’t swing the polls too intently and therefore shouldn’t be a volatility event for the GBP.

Good luck to all.

Related articles

此处提供的材料并未按照旨在促进投资研究独立性的法律要求进行准备,因此被视为营销沟通。虽然它并不受到在投资研究传播之前进行交易的任何禁令,但我们不会在向客户提供信息之前谋求任何优势。

Pepperstone并不保证此处提供的材料准确、及时或完整,因此不应依赖于此。无论是来自第三方还是其他来源的信息,都不应被视为建议;或者购买或出售的要约;或是购买或出售任何证券、金融产品或工具的征求;或是参与任何特定交易策略。它并未考虑读者的财务状况或投资目标。我们建议此内容的读者寻求自己的建议。未经Pepperstone批准,不得复制或重新分发此信息。