2024 UK General Election: Quick Thoughts To Set The Scene

There are many ways in which political careers can come to an end, but ‘death by electoral suicide’ (as one Tory MP termed it) isn’t one that you typically come across particularly often. It seems, though, to be the route that PM Sunak has chosen. Starmer to Downing Street, Rishi to Janus, seems the most likely outcome come the morning of 5th July.

Certainly, this is the outcome that opinion polls currently point to, with the opposition Labour party around 20 points ahead. Naturally, polls can be expected to narrow as the campaign goes on, however even in a long campaign, common wisdom suggests that a gap any larger than 7-9 points is too vast a gulf to make up.

The handy chart below, aggregating a range of polls, comes courtesy of Politico:

With that in mind, the election result appears something of a foregone conclusion. A Labour majority is clearly the base case in the minds of almost all investors, though risks are that this majority is substantially narrower than the ‘landslide’ some predict, given both unfavourable boundary changes, and the huge uniform national swing required to produce such a majority. Across the UK, a swing of around 12.5 percentage points, from Conservative to Labour, would likely be required to obtain such an outcome, far bigger than the 8.8% swing seen when Tony Blair came to power back in 1997.

Despite all this, little seems to be moving the needle in terms of polling at this stage. Two tax-cutting budgets, the emergence of the economy from recession, and the return of inflation to – as near as makes no difference – the BoE’s 2% target, have done almost nothing to narrow the polling gap thus far. Perhaps, this is a reason why PM Sunak has surprisingly plumped for the first July election since the 1940s – if the polls haven’t improved thus far, despite positive catalysts, ‘when will they?’ may be the question being posed in the corridors of power.

Speaking of previous elections, I’d argue that this is the first ‘normal’ election that we will have had in the UK for around a decade and a half; i.e., one that hasn’t been fought around a single issue. The 2015 election was one which paved the way to the EU referendum, while the 2017 and 2019 elections were fought almost entirely on Brexit. While the UK-EU relationship remains far from settled, it is at least no longer a political hot topic.

_2024-05-24_18-59-13.jpg)

It appears that the ‘hot topic’ this time around is most likely to be the economy, particularly with the majority of voters continuing to feel the squeeze of the rising cost of living.

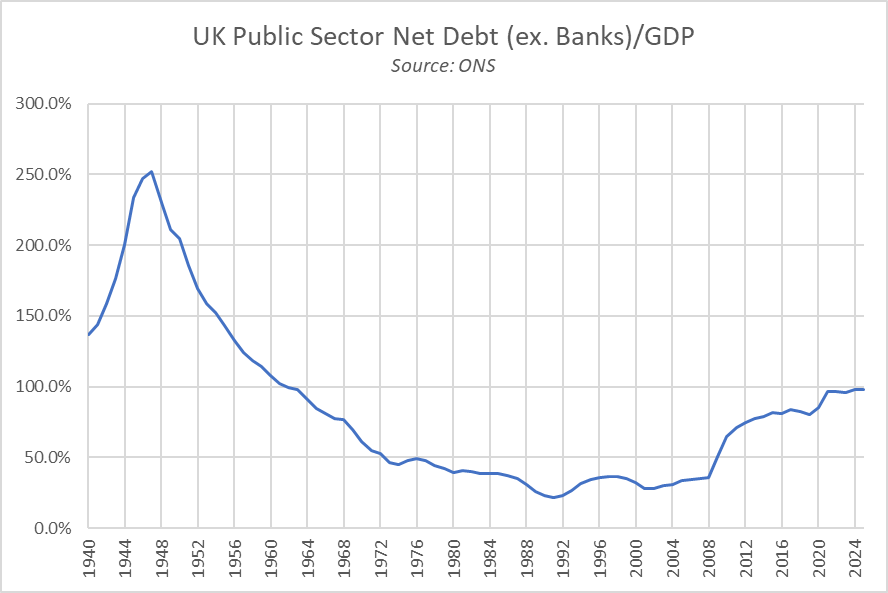

However, on this note, it’s important to recognise that neither party is likely to have significant fiscal ‘wriggle room’ upon claiming, or reclaiming, power. While taxes have been cut in back-to-back major fiscal events, the tougher choices on spending cuts have been continually pushed towards the tail end of the OBR’s 5-year forecast horizon, by which fiscal rules state debt must be falling as a percentage of GDP.

As has been discussed at considerable length, HM Treasury is operating with incredibly little ‘headroom’ – i.e., the gap between planned borrowing, and the fiscal rule limit. Back in March, at the Budget, Chancellor Hunt met the aforementioned rules with around £9bln of headroom, while the move into the new tax year may double said headroom, owing to the forecast horizon now stretching to 2029-30, this still gives incredibly little room for manoeuvre, no matter the colour of the rosette that the Chancellor may be wearing once the polls close.

Taking the above into account, from a macro perspective at least, the 2024 general election appears relatively unlikely to be a ‘game-changer’.

This, in addition to the likely result having been discounted months ago, helps to explain the almost entire lack of reaction in UK assets (the GBP, gilts, or the FTSE) to Sunak’s surprise announcement. Some may also argue that, by this stage, some degree of political chaos has become habitual for UK investors, hence this is simply being dismissed as the latest episode of the ‘Westminster Bubble’ soap opera.

_2024-05-24_19-01-38.jpg)

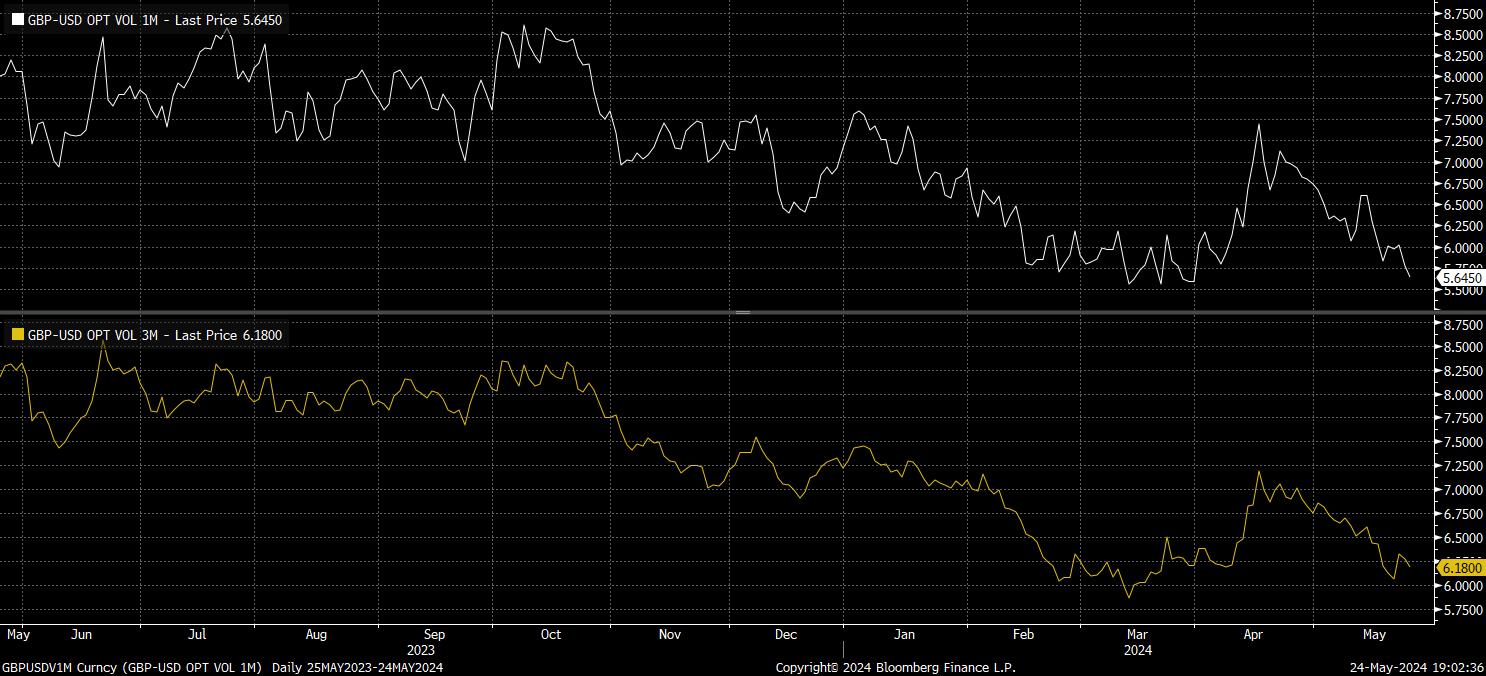

Even if spot markets have shown little sign of election-induced movement thus far, one would expect GBP vols to pick up as election day nears, and hedging activity around the poll increases.

Perhaps the most significant tail risk that participants may seek to hedge would be a hung parliament, in which no party wins an outright majority, and protracted negotiations must take place in order for a government to be formed. Naturally, one would expect this to lead to downside for the GBP. On the other hand, a Conservative majority, leaving the Tories as the largest party for the fifth election running, poses upside GBP risks. Both scenarios, however, likely require Sunak to pull one – or several – large rabbits out of his hat during the upcoming campaign.

On the whole, then, it seems that the election, and 6-week long political pantomime surrounding it, is likely to bring an awful lot of noise, but very little signal, for financial markets. Focus, instead, for UK assets should remain on the domestic economic outlook, most obviously the timing of the BoE’s first 25bp rate cut, which now seems much more likely to come in August, after the surprisingly hot 2.3% YoY headline April CPI print received this week.

Related articles

此处提供的材料并未按照旨在促进投资研究独立性的法律要求进行准备,因此被视为营销沟通。虽然它并不受到在投资研究传播之前进行交易的任何禁令,但我们不会在向客户提供信息之前谋求任何优势。

Pepperstone并不保证此处提供的材料准确、及时或完整,因此不应依赖于此。无论是来自第三方还是其他来源的信息,都不应被视为建议;或者购买或出售的要约;或是购买或出售任何证券、金融产品或工具的征求;或是参与任何特定交易策略。它并未考虑读者的财务状况或投资目标。我们建议此内容的读者寻求自己的建议。未经Pepperstone批准,不得复制或重新分发此信息。

.jpg?height=420)