Earnings Season Looms As European Stocks Continue To Outperform

To set the scene, it’s worth noting that European equities have been on an impressive run since the turn of the year – France’s CAC 40 trades at record highs, Germany’s DAX 40 sits close to its best levels since last January, while the pan-continental Stoxx 50 recently notched its highest close since December 2007.

_Daily_2023-04-20_10-12-24.jpg)

It’s also notable that we see European equities substantially outperforming their US counterparts on a relative basis. Normalised to the start of the year, in USD, the Stoxx 600 has outperformed the benchmark S&P 500 by around 4.5%, with similar outperformance in evidence if we price both in the common currency.

Against this backdrop, and after four straight weeks of gains, we head into earnings season on the continent. As we have seen in the US, investors will pay close attention to the impact of rising rates, and tighter financial conditions, on corporate profits, in addition to taking heed of guidance issued by company boards as expectations of an economic slowdown later this year continue to mount. Inflation will, of course, also be a hot topic, especially with remarks from the ECB remaining as hawkish as we have heard in some time, indicating rate hikes to continue through Q2, as well as core inflation being yet to show any signs of reaching a peak.

There are a handful of specific stocks and sectors that traders should have on their radars. Nestlé, reporting on 25th April, represent the largest individual weighting in the Stoxx 600, while Siemens stand as the largest single constituent of the blue-chip Stoxx 50 index.

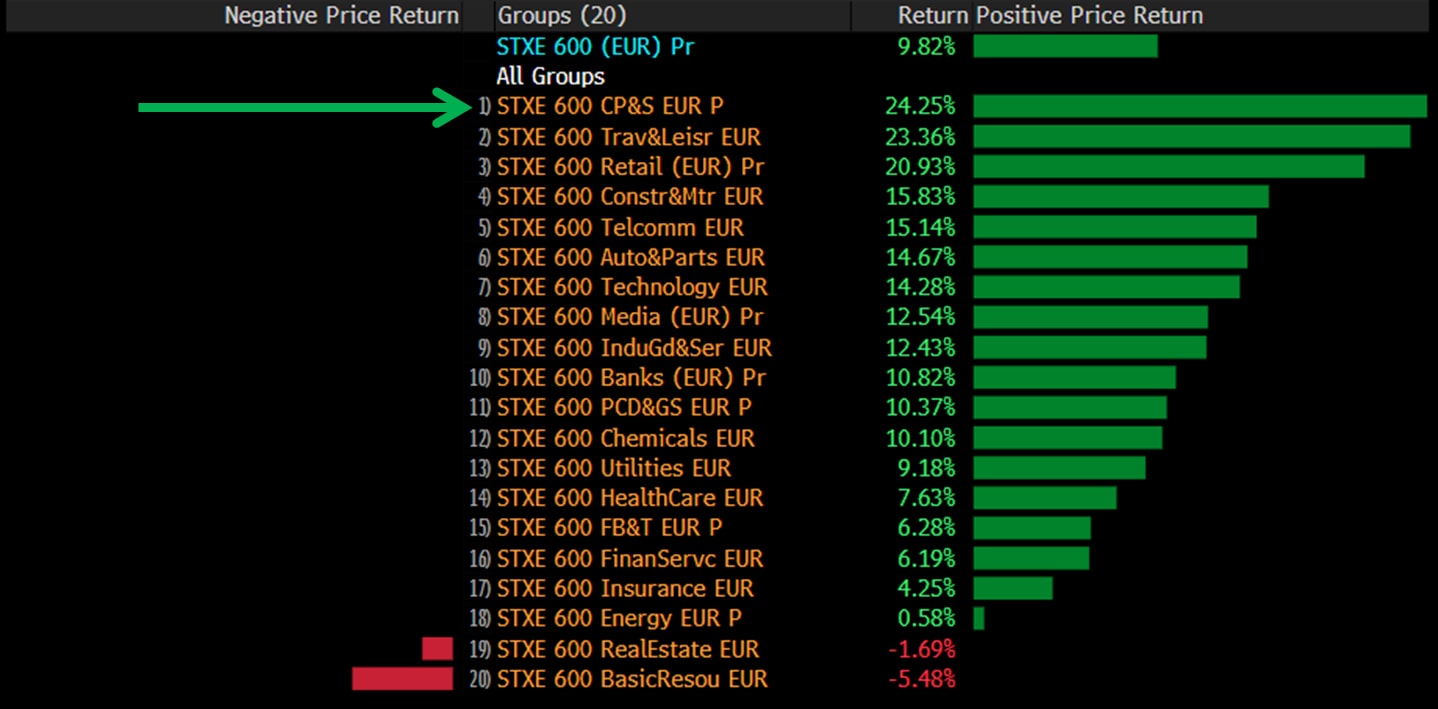

In terms of sectors, it is luxury goods that are likely to attract the most attention, particularly with the sector being the best performing in the Stoxx 600 this year.

All signs seem to point towards continued strength in the sector, particularly as China continues to re-open, and the economic recovery gathers pace. This week’s Chinese activity data helps to provide further support to this idea, with GDP and retail sales both printing substantially above expectations. With European equities being largely a proxy on Chinese economic performance, continued upside surprises here are likely to provide a further tailwind for EU indices – something that is especially true for the DAX.

Speaking of the German benchmark, we sit in an interesting position on a technical basis, with the ascent to the January 2022 high having stalled out a little, with profits being taken off the table at the 16,000 mark. The most obvious medium-run support sits below at 15,700, with a bullish bias likely to be retained so long as we remain above that level on a closing basis. To the upside, were the recent 16,045 high to give way, the bulls are likely to target a run back to last January’s 16,275 highs.

Related articles

此处提供的材料并未按照旨在促进投资研究独立性的法律要求进行准备,因此被视为营销沟通。虽然它并不受到在投资研究传播之前进行交易的任何禁令,但我们不会在向客户提供信息之前谋求任何优势。

Pepperstone并不保证此处提供的材料准确、及时或完整,因此不应依赖于此。无论是来自第三方还是其他来源的信息,都不应被视为建议;或者购买或出售的要约;或是购买或出售任何证券、金融产品或工具的征求;或是参与任何特定交易策略。它并未考虑读者的财务状况或投资目标。我们建议此内容的读者寻求自己的建议。未经Pepperstone批准,不得复制或重新分发此信息。