分析

Looking at client flow, there is a short skew, with 65% of open interest held for downside, although this is just one snapshot in time and some of these positions are super short-term (scalpers), others holding for a multi-day/week move.

With the consolidation in full view, a daily close above 7700 opens the prospect of renewed trending conditions and a move towards 7800+. Conversely, a close below 7566 would open a move towards 7475 (61.8% fibo of the 7323 to 7720 rally) - perhaps even lower if we see ASX200 VIX (ASX 30-day implied volatility) rise from 11% and towards levels of 16% we saw in October.

Momentum studies skew the probability of a break of the consolidation to the upside, but with c.40% of the index market cap reporting on Tuesday and Wednesday alone, corporate reporting and guidance will play a big role in shaping the index price action.

Sector moves coming into earnings

Going into ASX200 1H24 earnings we’ve seen tech leading the charge with the tech sector gaining 7.7% in the past month. REITs, healthcare and financial have also worked well, while the materials space has been the laggard, losing 4% during that period.

(Source: Bloomberg)

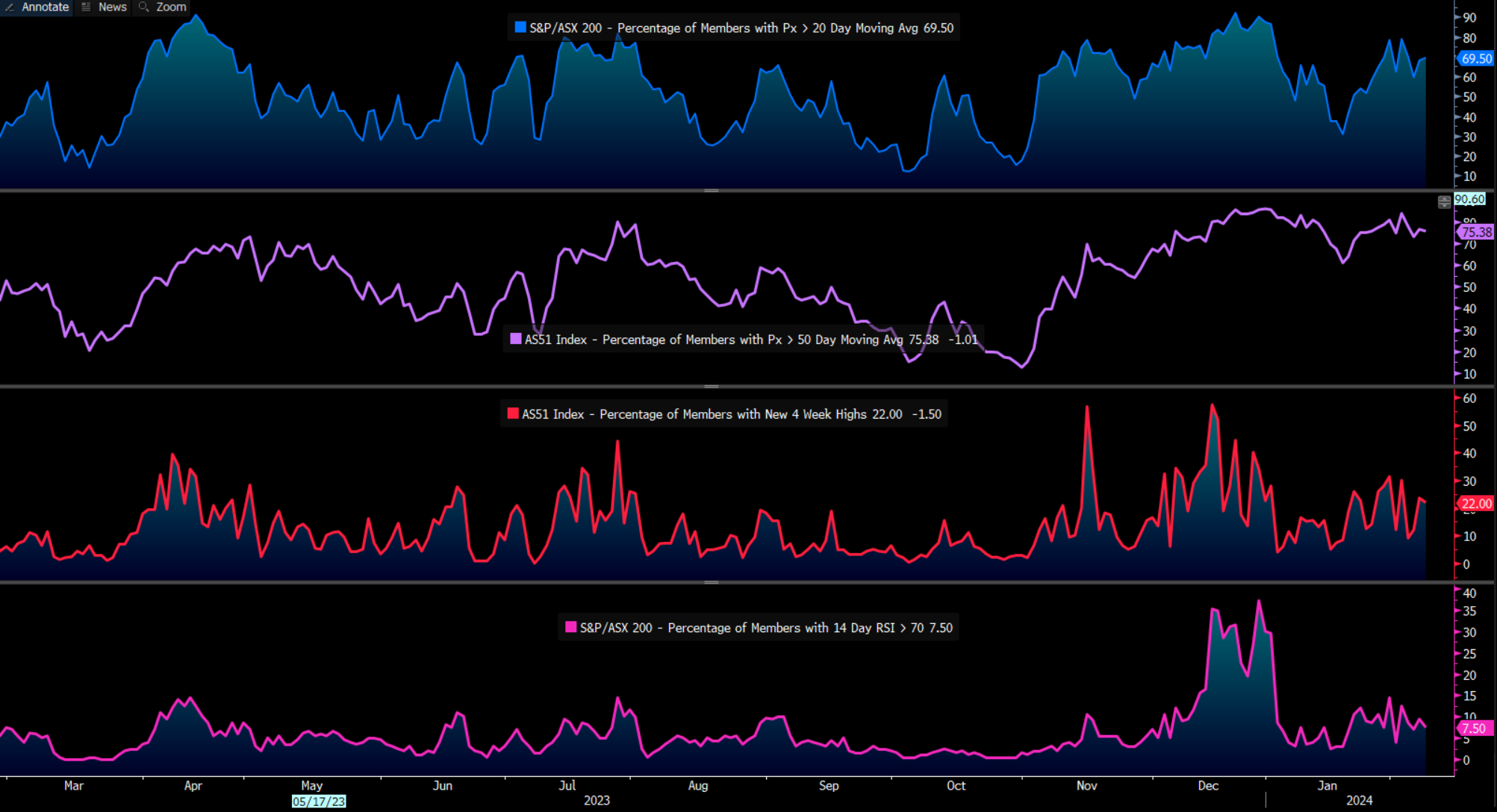

Market internals show healthy participation in the recent trend with 22% of ASX200 constituents at 4-week highs, and 70% above the 20-day MA. Bottom line - The ASX200 is a hot market but there are few signs of euphoria, which would argue for contrarian short positions.

What to watch:

Arguably the marquee names to watch this coming week are JBH (12/2), CSL (13 Feb) and CBA bank (report 14 Feb), with ANZ (12/2), WBC (19/2) and NAB (21/2) providing Q1 trading updates. Other names like WES, ORG, EVN, QBE, S32 and TLS will also get attention.

JBH is a trader favourite and will be on the radar – the stock has found good supply into $60 and has retreated into earnings – the market expects a punchy move on the day of reporting, with an implied -/+ 4.5% move expected. The market looks for $5.144b in revenue, 21.88% gross margins and $248m in NPAT. FY24 NPAT is eyed at $390m.

CSL has been a market darling since late October putting on a lazy 33% in that time, although the trend seems exhausted, and price is consolidating above $300 – the options market prices a -/+3.2% move for the CBA share price on the day of earnings, and shareholders will be focused on Behring’s gross margins, as well as a group FY24 NPAT guidance of 13-17%. Preference for buy stop orders above $306.42 and trade a momentum move.

CBA also rallied hard in the past 3 months but has carved a tight range of $117 to $114 since 23 Jan – a break either side here will likely impact the fortunes of the AUS200 and be a catalyst to see it break the recent consolidation range. The options market implies a -/+2.8% move on 1H24 earnings, and they do have some form in beating net income expectations in 7 of the past 8 half-yearly reports. This time around the market looks for net interest margins of 2% (-10bp from 1H23), cash earnings of $4.952b and a dividend of $2.11. The banks asset quality and lending volumes will be looked at closely, as will guidance on economic trends and expected demand for credit.

ANZ continues to work well on the long side and seems a market darling with the buyers in control with $28 in sight. Quarterly trading updates offer investors the chance to gain insights into its liquidity and capital position, as well as trends in bad and doubtful debts and lending data.

Price sits 5% above broker's consensus 12-months price targets, so longs would want to see enough in the result to promote EPS upgrades and reviewed price targets.

As always it is not just the actual earnings that matter to investors in this reporting period, but the guidance is key:

- With consumer spending falling, we look at trends in expected consumer demand, especially with stage 3 tax cuts kicking in mid-year

- Pricing power and how companies are looking to position costs through the year.

- Capital management – with balance sheets in good health, could we see increased CAPEX, dividends, and buybacks?

- Exposure to China and trends in demand

- How businesses could fare should we see the cash rate reduced later in the year.

Earnings aside the macro matters, and how it feeds into sentiment through global equity markets. Aussie rates have repriced on late, with interest rate futures pricing the first 25bp cut around the June/August RBA window, with two 25bp cuts expected this year.

The AUS 10YR govt bond yield sits at 4.11% and well off the highs of 5% seen in early November, where a lower yield/discount rate would be boosting the present value of equity and making the income on offer in the ASX200 somewhat more compelling.

A weaker AUD would boost the appeal of the Aussie equity index to international money managers who would hedge the currency risk.

So, a big week ahead for AUS200 and equity traders, let's see if earnings can promote renewed life into a consolidating index.

Trade Aussie equities with no minimum commissions on the MT5 platform, so reach out to the team for more info on getting access to that platform.

Good luck to all.

此处提供的材料并未按照旨在促进投资研究独立性的法律要求进行准备,因此被视为营销沟通。虽然它并不受到在投资研究传播之前进行交易的任何禁令,但我们不会在向客户提供信息之前谋求任何优势。

Pepperstone并不保证此处提供的材料准确、及时或完整,因此不应依赖于此。无论是来自第三方还是其他来源的信息,都不应被视为建议;或者购买或出售的要约;或是购买或出售任何证券、金融产品或工具的征求;或是参与任何特定交易策略。它并未考虑读者的财务状况或投资目标。我们建议此内容的读者寻求自己的建议。未经Pepperstone批准,不得复制或重新分发此信息。