- Italiano

- English

- Español

- Français

Australia Q2 CPI preview - Make or break time for an August RBA hike

The RBA has recently guided that the bank remains vigilant to upside risks to inflation, and that “uncertainty at present meant it was difficult either to rule in or rule out future changes in the cash rate”.

While not everything is rosy in Australian economics, outside of a frustratingly slow grind in inflation towards the RBA’s inflation target, and with services inflation still far higher than where the RBA would like, there are other reasons for the RBA to consider a 25bp hike.

Notably, the June employment report recorded 50k net jobs created, May retail sales gained +0.6%, household spending rose 4.3%, and national house prices have risen for 16 straight months. Some would therefore argue that the Australian economy can readily absorb real cash rates at 1.92% - the highest level since 2011.

Should we therefore see a higher Q2 CPI print, it may tip the scales and force the RBA’s hand.

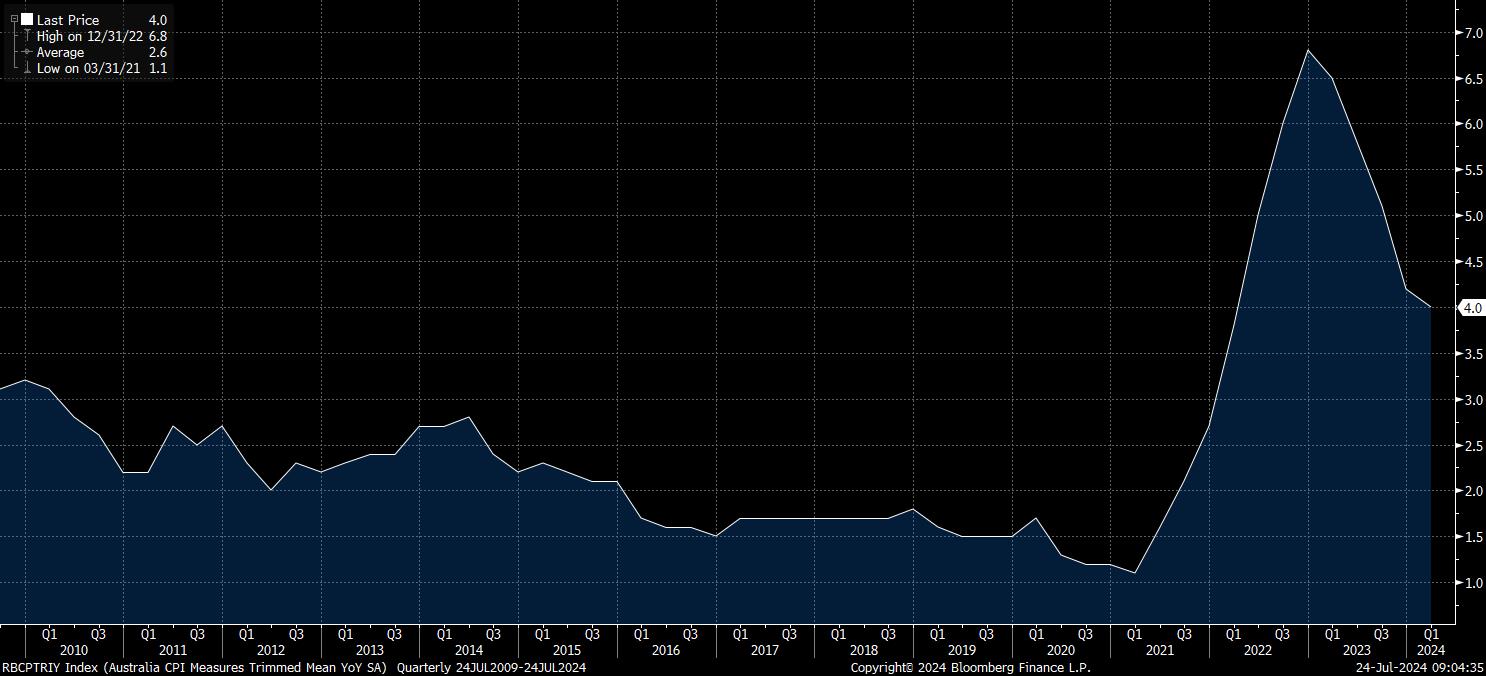

Aus trimmed mean CPI inflation – currently 4% y/y

The Aus CPI playbook:

I’ve used the trimmed-mean CPI measure, which is essentially core CPI, excluding 15% of the highest and lowest price changes within the CPI calculation. Importantly, the RBA look at the trimmed mean measure more closely than headline CPI.

- Aus Q2 CPI > 4% y/y - The implied probability for a 25bp hike in Aussie interest rate swaps increases from 30% to 50-60% (AUD higher, ASX200 lower)

- Aus Q2 CPI < 3.8% y/y - The implied probability of a 25bp hike decreases from 30% to 15-20% (AUD lower, ASX200 higher)

- Aus Q2 CPI comes in between 3.8% y/y to 3.9% y/y - The implied probability of a hike remains around 25-30% (AUD slightly lower, ASX200 higher)

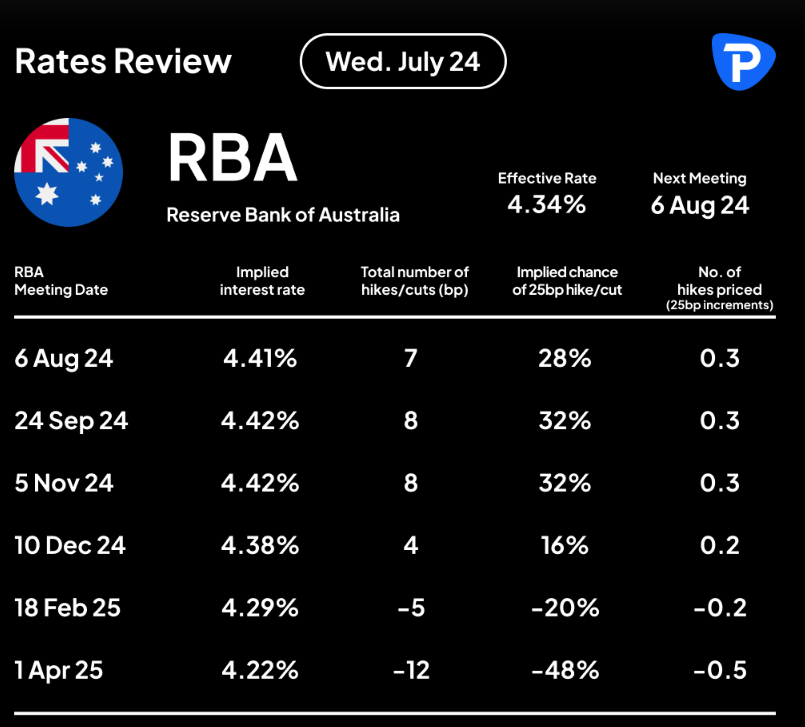

Aussie interest swap pricing – expectations for RBA policy per meeting

Recent higher frequency data suggests the Q2 CPI print could come in at 1% QoQ, and a little above the RBA’s own forecast of 3.8% y/y (for both headline and the trimmed mean measure). With AUD swaps pricing a 25bp hike in August at a 30% probability, a Q2 trimmed mean CPI print above 4% would therefore see that implied probability rise to around 50-60%. It would mean we go into the RBA meeting, with expectations delicately poised.

The RBA’s economic forecasts

Conversely, should we see Q2 trimmed-mean CPI below 3.8%, it would not only constitute a slower rate of change from the prior quarter but would be lower than the RBA’s own forecasts which they detailed in the May Statement on Monetary Policy (see above). Should we see a number at or below 3.7% and we’re likely to see the implied probability of a hike fall to 15-20%.

The most reluctant rate hike ever

Another factor, should we get a modestly hotter CPI print, is whether another 25bp hike will have any effect at all on aggregate demand, consumption patterns and ultimately inflation. Most importantly, we should consider that there is obviously a stark difference between a token 25bp hike and that of a renewed hiking cycle.

I would argue that while a one-off 25bp hike would hurt households already doing it tough, most Aussie households and consumers would adjust quickly to life under a 4.60% cash rate.

Of course, if the average household felt there were more hikes in the pipeline, then consumption could take a sizeable hit, and many would throw the word ‘recession’ around more liberally.

We can see that swaps/rates traders hold a view that interest rates should fall from April 2025. So, the strong market view is if we do get a hike, it will be the most reluctant hike in history – a one-and-done – and subsequently likely to be reversed in Q2 2025.

With that in mind, if the RBA does end up hiking by 25bp in August, what will matter far more for Aussie markets is the RBA’s choice of wording and whether they open the door for more hikes in the future. A so-called ‘hawkish hike’, where the RBA hike and open the possibility for more could really get volatility pumping. It also seems an unlikely outcome, but should this be the path the RBA take, it would likely result in the ASX200 being sold aggressively, and traders suggesting the RBA’s path of least regret will end in clear regret.

The RBA does consider developments offshore, but in a world where most G10 and EM central banks are either cutting rates or about to, the RBA hiking rates would make them a massive outlier.

How to trade CPI?

Like most traders I speak to I think the prospects of a hiking cycle are remote and I also acknowledge that I have limited edge in trading a news event like CPI – However, given the prospect that it could promote cross-market volatility, it is well worth putting this firmly on the risk radar, and considering the playbook and how each outcome could affect the markets we trade.

Short AUS200 or long AUDNZD positions would be the cleanest read on a hot CPI print (and vice versa on a weak CPI print). Many would express the CPI print through AUDUSD, but this pair currently has a closer relationship to Chinese equity indices and copper and iron ore futures than Aus-US interest rate differentials.

Related articles

Pepperstone non dichiara che il materiale qui fornito sia accurato, attuale o completo e pertanto non dovrebbe essere considerato tale. Le informazioni, sia da terze parti o meno, non devono essere considerate come una raccomandazione, un'offerta di acquisto o vendita, la sollecitazione di un'offerta di acquisto o vendita di qualsiasi titolo, prodotto finanziario o strumento, o per partecipare a una particolare strategia di trading. Non tiene conto della situazione finanziaria o degli obiettivi di investimento dei lettori. Consigliamo a tutti i lettori di questo contenuto di cercare il proprio parere. Senza l'approvazione di Pepperstone, la riproduzione o la ridistribuzione di queste informazioni non è consentita.