- Italiano

- English

- Español

- Français

A traders’ week ahead playbook – risky assets on fire but is it sustainable?

(https://pepperstone.com/en-au/market-analysis/trader-thoughts-consolidation-for-now-but-the-event-risk-is-building/), consider we also get the Canadian central bank meeting (Thursday 02:00 AEDT), where the BoC should hike by 25bp, with 20bp priced by the market - one for those with CAD exposures. Minutes from the last week's highly anticipated BoJ meeting will be released – in the US we get US core PCE inflation (28/1 02:00 AEDT – consensus of 5.0 YoY), various US regional manufacturing reports, S&P manufacturing PMIs, and personal income/spending (28/1 00:30 AEDT). On Friday, we get the latest update from the University of Michigan sentiment and inflation expectation survey.

In Europe, Christine Lagarde and six other ECB speakers hit us with their views on economics and policy ahead of next week’s key ECB meeting – on the data side, we get new manufacturing and services PMIs in Europe, as we do in the UK – European PMI’s may get increased focus, as the pace of contraction is expected to slow and could even expand – essentially, the wind is currently to the back of EU assets and we’re seeing some solid outperformance notably vs US equity markets.

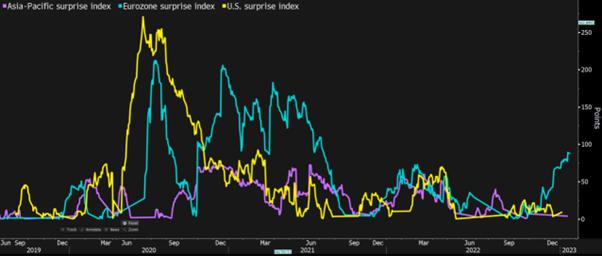

One consideration has been the better feel of EU economics, largely driven by the warmer climate and sharp declines in EU NG prices. One chart that gets good airtime is the Citigroup EU, US, and Asia economic surprise index – as we can see, the data in Europe is consistently coming in hotter than forecast – positive economic surprises are causing inflows into EU equity funds after a year of sizeable outflows.

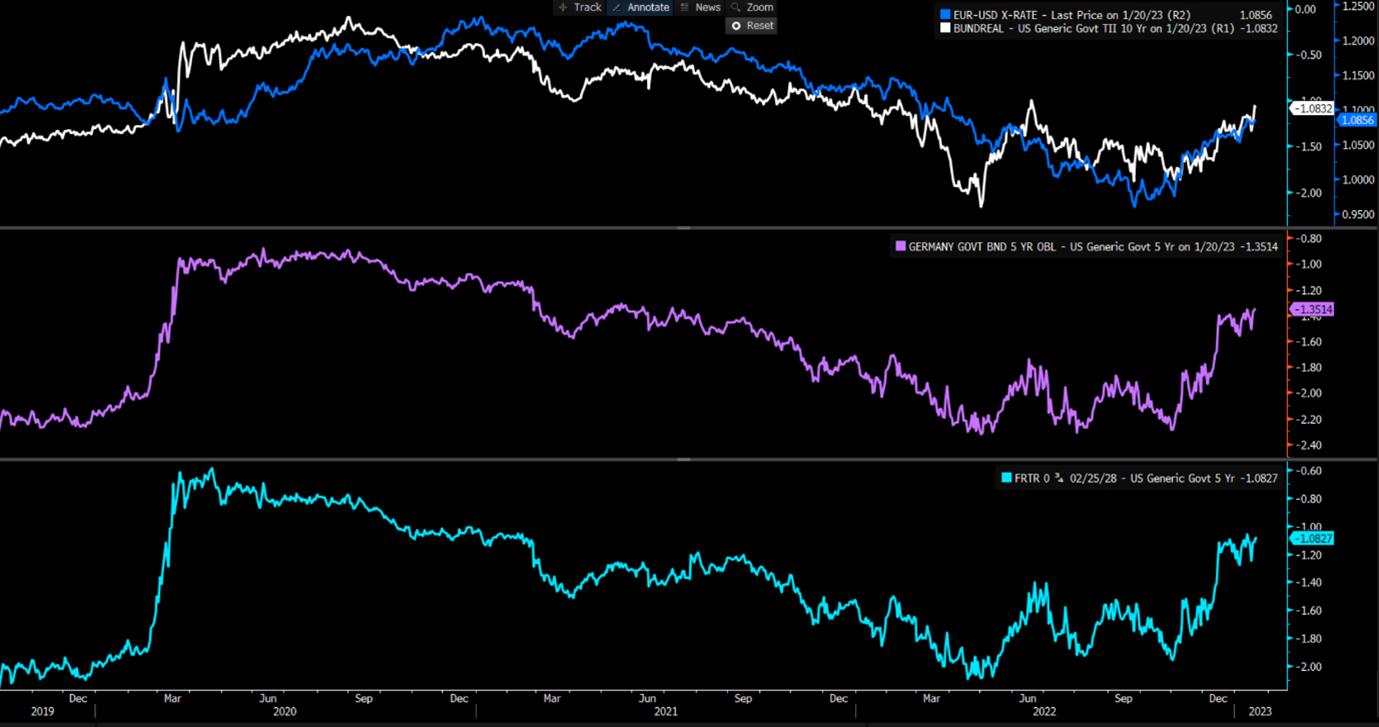

We can see this is our old friend the bond market – here I have looked at:

- Top pane – German 10yr real (i.e. adjusted for inflation expectations) bond yields – US 10yr real rates

- Middle pane – German 5yr (nominal) yields – US 5yr Treasury

- Lower pane – France 5yr yields – US 5yr Treasury

We see bond yields in the EU are becoming sharply less negative than its US counterpart and EURUSD has taken note of the relative rise. EU equities have had a blistering start to 2023 – as we see in the GER40/US500 ratio - this relative outperformance won’t last forever, of course, not when you’re seeing US tech catching a bid and the NAS100 starting to crank up. Naturally, one questions how much foreign capital is buying EU assets on an FX-hedged basis – for now, EURUSD eyes a breakout of its recent range at 1.0875 and as long as price declines are supported into the 5-day EMA - which is trending higher - then EURUSD should be traded from the long side.

Would a pullback in risk assets – a decline in equity, rise in the VIX index and wider credit spreads – punish EURUSD longs? Perhaps, but while there is no doubt global financial conditions are becoming a tad too easy for central banks liking and could really impact their inflation fight, the easier trade if equity does roll over, is long EURAUD positions - as we’ve seen in the outrageous and explosive bull trends in crypto and global equity - HK50, CHINAH, ASX200 and Friday’s moves in NAS100, that time is not now.

With China offline this week expressions of China re-opening may take a breather – for those solely concentrating their efforts on FX and indices will be missing some incredible bullish flows in single stock/ETF plays - BHP, RIO, NST, WOR and LIT ETF (Lithium ETF) to name a few – of course, leverage changes in these plays and we are subject to exchange hours (which means gapping risk), but the propensity to trend, means for those that like buying strong very compelling plays.

The market feels confident of the next moves from central banks

So looking at the data for this week I’d argue there are fewer landmines to derail sentiment – US Q4 earnings do play a greater role, with IBM, Microsoft, and Tesla out and likely to get a solid run, but the data points are mostly tier 2 considerations.

For me, it’s about getting set for the following week when we get the Fed, ECB, and BoE all out with rate hikes and guidance – the market is confident in its call for a 25bp hike next week from the Fed, as they are with 50bp hikes from the ECB and BoE – with regards to Fed action, confidence in its potential policy actions is sky high after the Fed member Waller’s comments on Friday and the WSJ article from Nick Timiraos (out Sunday).

I’d even argue the market is buying risky assets because they feel the Fed are actually in control here and may not have to put the US economy in recession.

We’ll be updating views on the ECB and BoE meetings through the week but for now, we expect a 50bp hike from both – ECB member Knot has caused a small stir with calls (on Sunday) that he wants to see a 50bp hike in both Feb and March – sounds shocking to some, but the rates market is already pricing this outcome, so should jolt the markets too intently – EU CPI estimates next week (1 Feb) could impact pricing.

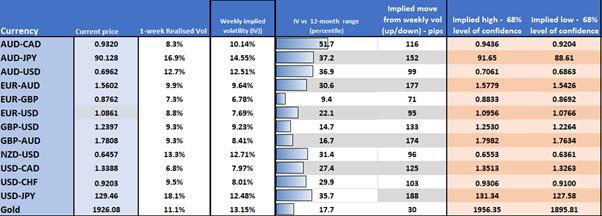

Implied volatility matrix – we see the 1-week (options) implied vol and project the implied range (with a 68% level of confidence)

Looking at the 1-week FX implied volatility matrix we see the market pricing lower degrees of movement, where most sit below the 30th percentile of the 12-month range – this is in-fitting with the lower event risk at hand and China offline for Lunar New Year. I suspect vols will rise as we head into the latter stages of the week – the prospect of consolidation seems elevated, and in some ways given the reduced event risk this week could be coined the calm before the storm.

Related articles

Pepperstone non dichiara che il materiale qui fornito sia accurato, attuale o completo e pertanto non dovrebbe essere considerato tale. Le informazioni, sia da terze parti o meno, non devono essere considerate come una raccomandazione, un'offerta di acquisto o vendita, la sollecitazione di un'offerta di acquisto o vendita di qualsiasi titolo, prodotto finanziario o strumento, o per partecipare a una particolare strategia di trading. Non tiene conto della situazione finanziaria o degli obiettivi di investimento dei lettori. Consigliamo a tutti i lettori di questo contenuto di cercare il proprio parere. Senza l'approvazione di Pepperstone, la riproduzione o la ridistribuzione di queste informazioni non è consentita.