- Italiano

- English

- Español

- Français

FTSE futures versus CFDs. What is the difference?

Both FTSE100 futures and FTSE100 CFDs allow you to get exposure to the 100 largest companies listed on the London Stock Exchange. There are some key differences between FTSE futures and a contract for difference. Let’s look deeper.

FTSE futures and how they are traded

A futures contract is an agreement between two parties to buy or sell a product or asset at a predefined price and date.

Popular futures contracts are based on Foreign Exchange, Commodities, Indices and Stocks. Futures contracts are traded on a futures exchange such as the Chicago Mercantile Exchange (CME) or, in the case on FTSE futures, the LSE and the Intercontinental Exchange (ICE).

Contracts, Codes and Expiration Dates

Although futures contracts are often offered with a monthly expiry, depending on the product, the most popular contacts are quarterly with the expiry being the third Friday of the third month. This is known as Triple Witching.

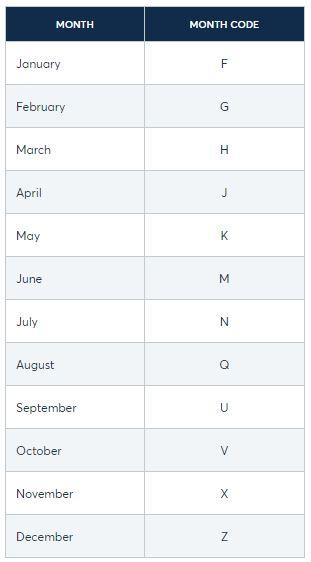

Each product and each month are defined by a unique code.

The FTSE100 December 2022 code is: XZ22.

X is the FTSE100 symbol. Z is the contract date. 22 being the year.

Figure 1 CME Group

Futures are traded in contracts. One FTSE futures contract has the value of £10 per point.

A CFD, contract for difference

Acontract for difference is a contract between a buyer and a seller that stipulates that the buyer must pay the seller the difference between the closing value of an asset and its value at the opening of the trade.

The main differences between FTSE futures and CFDs

The main differences between trading a futures contract and a CFD are:

- Futures market participants tend to be banks and large financial institutions

- Futures contracts have larger spreads but do not require overnight funding. This can make them the preferred choice for long-term speculation

- CFDs do not have expiration dates

- Trading futures can require larger margins or deposits

- Although there is the possibility of trading micro futures contracts, CFDs are generally more flexible when it comes to trade size

- CFDs are over-the- counter products (OTC). They are traded through network of brokers and not through an exchange

How to trade the FTSE with Pepperstone

You can get exposure to FTSE100 CFDs through Pepperstone. To get more information please click here.

Related articles

Pepperstone non dichiara che il materiale qui fornito sia accurato, attuale o completo e pertanto non dovrebbe essere considerato tale. Le informazioni, sia da terze parti o meno, non devono essere considerate come una raccomandazione, un'offerta di acquisto o vendita, la sollecitazione di un'offerta di acquisto o vendita di qualsiasi titolo, prodotto finanziario o strumento, o per partecipare a una particolare strategia di trading. Non tiene conto della situazione finanziaria o degli obiettivi di investimento dei lettori. Consigliamo a tutti i lettori di questo contenuto di cercare il proprio parere. Senza l'approvazione di Pepperstone, la riproduzione o la ridistribuzione di queste informazioni non è consentita.