- Italiano

- English

- Español

- Français

In equity land we see these momentum moves in several key indices – the Dow has closed higher for 7 straight days, and a test of March highs of 39,900 looks increasingly likely, with the index closing at session highs and the bulls in full control. Runs like this are not uncommon though, and since 2020 the Dow has seen 14 occurrences of such form and 8 of them saw the index close higher the following day - so there is no real edge in fading this strength.

We see the FTSE100 maintaining its stellar ascent with our call for that index (if it were to open now) sitting above 8400, while it was the DAX (closing +1%) that outperformed, joining the FTSE100 in breaking to a new all-time high, with strong participation in the rally, albeit on light volumes taking the index higher (volumes were 28% below the 30-day average).

One suspects it won’t be long before the CAC40, and Euro Stoxx 50 joins the all-time high party.

The S&P500 cash closed +0.5%, with the index closing above 5200, with 82% of stocks higher on the day - REITS, utilities, energy, and materials outperforming, while tech failed to participate. Looking at the intraday tape of S&P500 futures, there was a strong bid that kicked in through early European trade and the bulls never looked back, cementing what was a decent trend day and we see futures at session highs. 1.051m S&P500 futures contracts traded on the day is lightweight though (the 15-day average stands at 1.48m contracts).

(Source: Bloomberg)

The set-up and price action in the key US equity benchmark suggests the risk remains skewed to higher levels and new all-time highs remain the base case – not a huge call given we’re 1% away (in the S&P500 cash) from this milestone. Corporate buybacks are adding real tailwinds to the move, but when S&P500 20-day realized volatility is falling towards 13% and the VIX index at new lows of 12.7%, one can assume volatility-targeting strategies (mostly pension and insurance funds) would be dripping more cash into equities as vol retreats, with CTAs (systematic trend following funds) adding to longs in S&P500 futures as price moves higher – the flow show is in full effect, and its times like this that strength just begets strength.

Away from equity land, there have been further buyers in US Treasuries with yields lower by 3 to 4bp across the curve – largely a result of US jobless claims rising to 231k (from 209k), and average demand seen in the 30-year Treasury auction. The move in Treasuries has weighed on the USD with the AUD, CLP, MXN, NOK, and ZAR firing up.

AUDUSD (currently 0.6620) looks to retest big resistance into 0.6640, where a closing break would get attention from momentum accounts and could argue for a push towards 0.6800. while AUDCHF looks like it wants to break to new cycle highs. Supporting the AUD and offering tailwinds has been a 1.3% gain in copper, while HK equity markets are firing up and we should see a further bullish push higher, with breakouts likely seen in the HK50 and CHINAH index through Asia today.

GBPUSD has been where we’ve seen clients focus their attention, with the BoE meeting offering some reasonable intraday movement, with cable hitting a low of 1.2446 before broad USD weakness kicked in and we see the pair now at 1.2524. GBPAUD is breaking down through the recent lows and feels like it will test 1.8900 near-term. EURGBP holds above .8600 – happy to remain biased long on this cross, although it is a slow-moving beast.

Commodity markets have been well traded, where notably gold has gained $37 and at $2346 eyes a test of the recent range highs of $2352. Gold miners have done nicely, with the GDX +3.5%. Silver looks even more impressive adding 3.6% and eyes a push into $29. Crude has built on yesterday's bullish reversal and sits at $79.50, although in energy it is Nat Gas that is where my attention sits given after the period of price compression, the subsequent bullish breakout and now trending conditions, which all suggest this could kick – as many who trade NG will attest to, these moves can be highly frustrating and we do get many false starts – but for now, happy to be long.

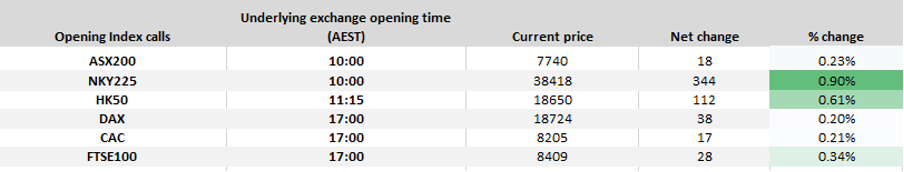

Asia should feel the love on open, where our calls suggest the JPN225 opens +0.9%, with the HK50 cash opening +0.6%. The ASX200 looks to unwind around 7740 +0.2%, with BHPs ADR suggesting an open of $43.15 +0.2%. The Aussie miners do have some tailwinds given the strong showing in FTSE and S&P500 materials, but to get the Aussie index firing we’ll need the banks to come to the party - I suspect we’ll see the big names opening around 0.2%-0.5% firmer.

The risk event calendar is hardly going to send traders covering risk through Asia and into the weekend, with several non-markets moving data points in Japan, Norway CPI, UK industrial production, Canadian employment data and the University of Michigan survey.

Related articles

Pepperstone non dichiara che il materiale qui fornito sia accurato, attuale o completo e pertanto non dovrebbe essere considerato tale. Le informazioni, sia da terze parti o meno, non devono essere considerate come una raccomandazione, un'offerta di acquisto o vendita, la sollecitazione di un'offerta di acquisto o vendita di qualsiasi titolo, prodotto finanziario o strumento, o per partecipare a una particolare strategia di trading. Non tiene conto della situazione finanziaria o degli obiettivi di investimento dei lettori. Consigliamo a tutti i lettori di questo contenuto di cercare il proprio parere. Senza l'approvazione di Pepperstone, la riproduzione o la ridistribuzione di queste informazioni non è consentita.