- Italiano

- English

- Español

- Français

Bitcoin trader – is a sleepy market about to get lively

These levels also marry up well with the upper and lower Bollinger band, if we use the 200-day moving average as the mean of the bands. These levels are significant and until we see tangible news that truly alters sentiment, then traders will likely look to fade rallies into $31k and flip to long positions into the lower bounds of the range.

Bitcoin daily chart

That strategy will be dictated by the news flow at the time and the rate of change in price as we approach these levels – could it be that this time is different, and we see better-trending conditions on the higher timeframes?

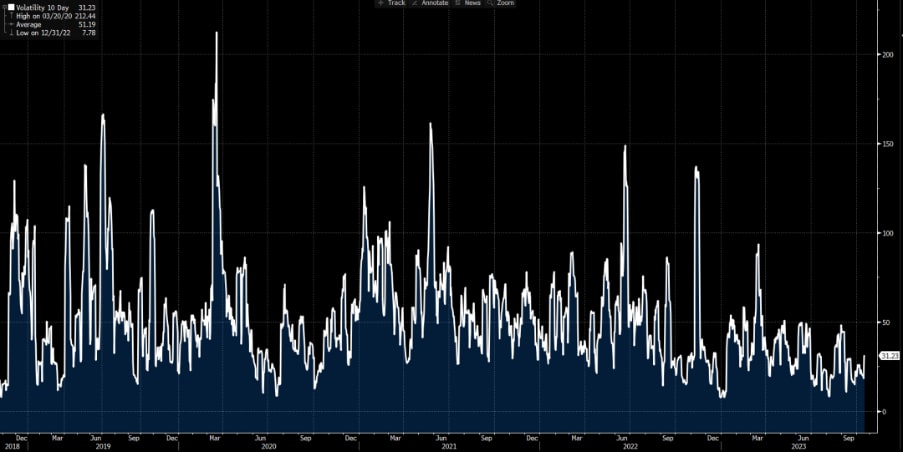

With range trading conditions we often get lower volatility and that’s exactly what we’ve seen. Where since April Bitcoin’s 20-day realised volatility has failed to break 50% - a level that between 2019 to 2021 was the average level of volatility over that period. In fact, in mid-September, 20-day volatility fell to a lowly 10%, with the 10-day average high-low trading range falling to just 430 points – hardly the conditions that will compel CFD traders, especially when other markets have been moving more aggressively.

Bitcoin 20-day historical volatility

Importantly, conditions have since evolved, and we currently see the Bitcoin price making higher highs within that defined range, and volatility has risen to a more palatable 30%. It certainly feels like volatility is about to crank up a gear and this suggests putting Bitcoin back on the trader radar.

On a micro level, the market is on watch for a formal decision from the SEC to allow a spot Bitcoin ETF. We were given a false start yesterday with a newswire putting out a post that the Greyscale spot ETF application had been approved by the SEC, sending Bitcoin $2k higher to $30k. However, the move quickly reverted after it was confirmed the headlines were incorrect.

Will the SEC give a spot ETF the green light?

What the move does offer is insights into how price could act when we do finally get a formal decision from the SEC.

Of course, we could see the SEC reject the spot ETF, and we would likely see the price under sharp pressure, potentially testing and even breaking the range lows.

A positive decision is the call

Conversely, the odds are certainly skewed now that we get a positive decision from the SEC, potentially offering the green light for the Grayscale spot ETF. This could come at any stage in the next 7-10 days, so traders are clearly staying abreast of the headlines and prepared to react.

Given the SEC’s recent call not to appeal the court ruling on Grayscale's application to convert the Trust into a spot ETF, as well as the sheer number of other ETF issuers who have filed for a spot ETF, many see a very strong possibility it passes. If the Grayscale decision gets approval, then all other applications should also get formal approval.

One suspects the first move – which will likely be driven by news recognizing Algo’s - will not be the last move, and a wall of discretionary capital will chase the ensuing rally in Bitcoin. It could also be argued that some of this scenario is partly priced in given such lofty expectations of it passing – that said, I would expect the top of the trading range at $31k to come into play and I see a low risk of a buy-the-rumour sell the fact playing out.

A spot ETF offers financial advisors and other such market participants a reputable vehicle through which to push to clients. Because the ETF issuer buys the underlying Bitcoin, rather than the futures, this will offer greater confidence from a regulatory and compliance perspective. Consider that every issuer who has filled a spot ETF application with the SEC has made deep changes to appeal to regulatory considerations, such as active surveillance.

Also, while the correlation Bitcoin holds with equities and bonds frequently changes, adding a Bitcoin spot ETF to a diversified portfolio can help lower portfolio variance through diversification; a factor all good advisors try to achieve for clients.

A spot ETF should appeal

Market participants will likely migrate cash out of existing Bitcoin futures and futures ETF given the roll charge and the negative carry that is involved in rolling the futures product upon expiry. All things being equal the spot ETF should outperform a futures ETF over a longer duration for this reason. The greater the demand, the more ETF shares are created and placed into the secondary market, which involves buying more Bitcoin in the underlying market.

Its time to put Bitcoin back on the trader radar

Naturally, as traders try and estimate how this may impact future demand and the broad adoption story, we could see an extended move in Bitcoin. We shall see, but this is why Bitcoin volatility should continue to increase and after sleepy conditions, the upcoming catalysts suggest trading conditions are looking far more compelling for CFD traders.

Related articles

Pepperstone non dichiara che il materiale qui fornito sia accurato, attuale o completo e pertanto non dovrebbe essere considerato tale. Le informazioni, sia da terze parti o meno, non devono essere considerate come una raccomandazione, un'offerta di acquisto o vendita, la sollecitazione di un'offerta di acquisto o vendita di qualsiasi titolo, prodotto finanziario o strumento, o per partecipare a una particolare strategia di trading. Non tiene conto della situazione finanziaria o degli obiettivi di investimento dei lettori. Consigliamo a tutti i lettori di questo contenuto di cercare il proprio parere. Senza l'approvazione di Pepperstone, la riproduzione o la ridistribuzione di queste informazioni non è consentita.