Robinhood, the online US-based retail stock-broker, is set to list on the NASDAQ under the ticker HOOD this week.

What does IPO stand for?

IPO stands for Initial Public Offering. It’s the first time a company lists on an exchange for its shares to be publicly traded. That means everyone can own a piece (well, nearly everyone) and not just the institutional investors or high net worth players!

What is an IPO?

An IPO is the process of raising capital in the stock market for the first time through the issuance of shares on an exchange. A private company will list a certain amount of shares for sale at a particular price (or price range) for the public to invest in. The number of shares issued combined with the share price not only equates to the capital amount raised, but it sets a valuation for the company in the public sphere.

It’s a major milestone for any company. You wouldn’t engage in this type of capital raising if you thought the market wouldn’t take well to it.

When do companies typically do an IPO?

The IPOs that we hear most about are those where the company has hit the $1billion+ valuation mark. These are called “unicorn” companies. This typically occurs when the company is around 7-10+ years old, has experienced significant growth and needs a sizable capital injection for future expansion. It also has founders and investors eager to cash in and state their presence as a major player in the industry.

But a company doesn’t need to be this special to IPO. Any company can issue shares through an IPO, from companies that are very early in their start-up phase to more mature companies that just need a hit of capital and want to allow current shareholders to lock in a return on their investment.

The vast majority of capital raised in IPOs is not from unicorn IPO activity.

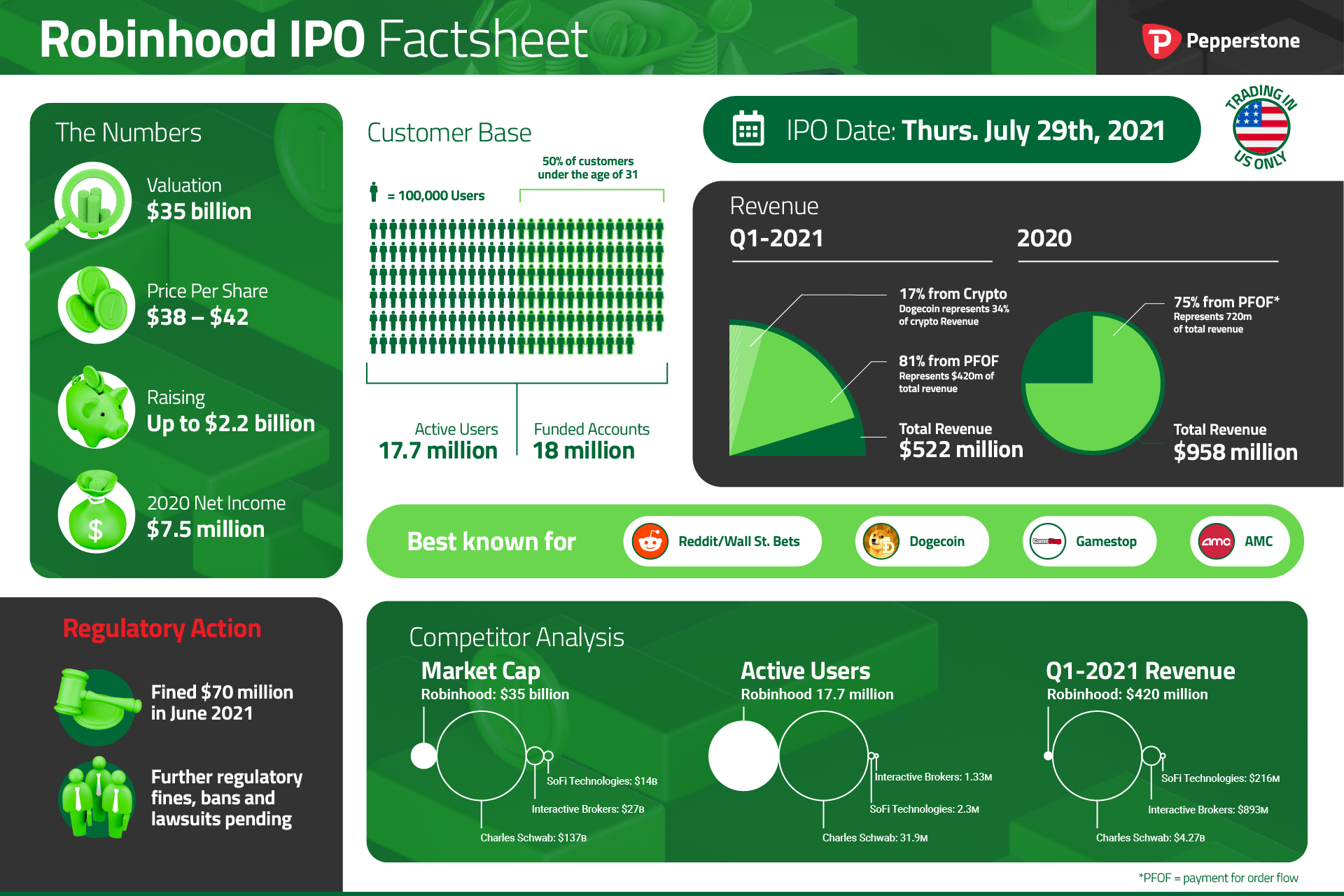

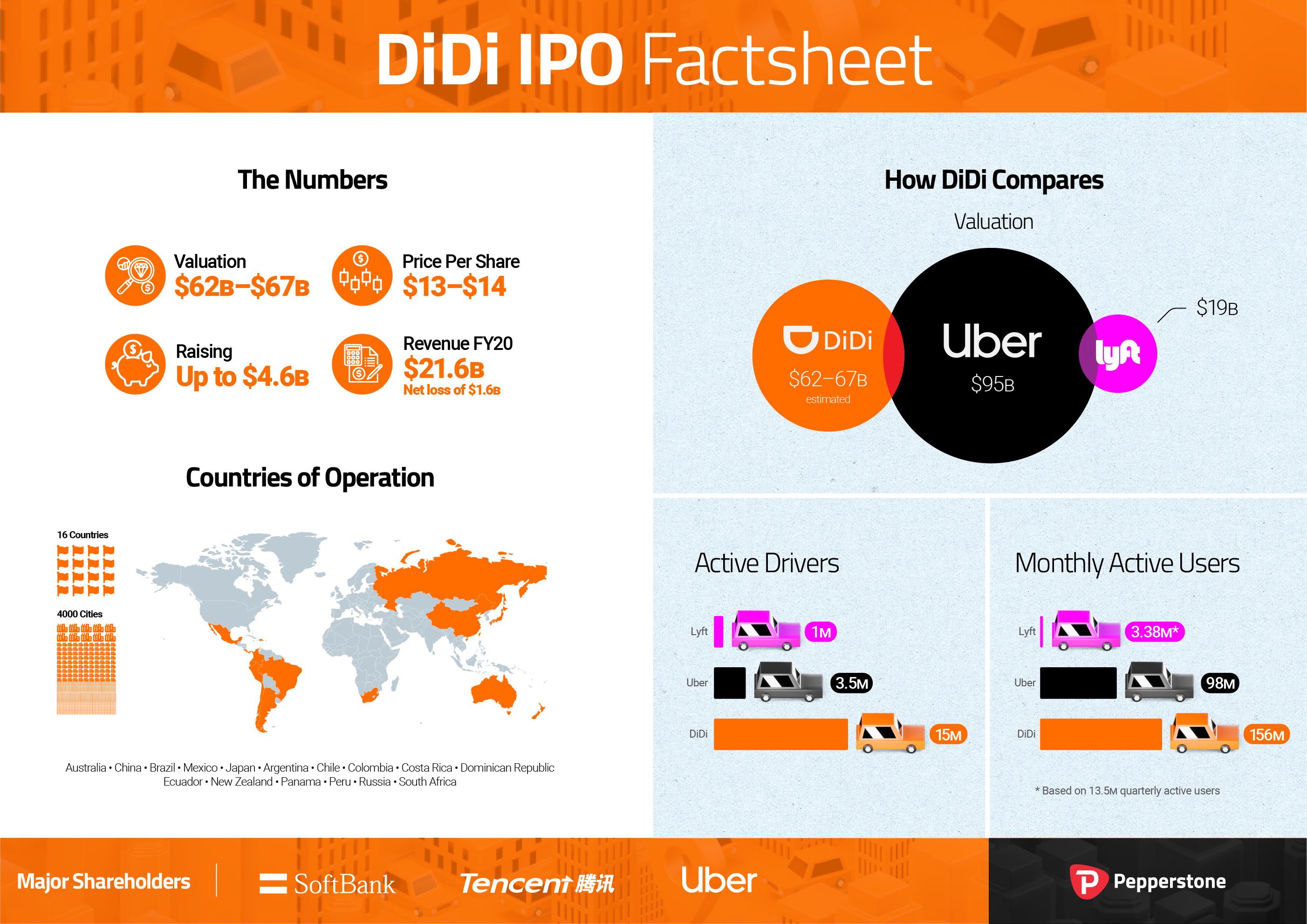

IPO factsheets

Why do companies do IPOs?

Companies use IPOs to raise capital for their ongoing operations, to fund expansions and invest in equipment and technology, and to pay down debt. They also use IPOs so that the current institutional and high net worth or angel investors can cash in on their investments.

Going public provides liquidity for the company's shares, enabling it’s shareholders to more easily buy or sell shares, and it introduces a greater pool of investors which can lead to appreciation in its overall value.

The status of the company is also a factor. Going public through an IPO generates interest in its operations and potential, and signals to the market that things are going well and it expects to continue on its current growth trajectory, or that it anticipates its potential being further unlocked by listing.

Issuing shares through an IPO can even enable the company to seek better terms on loans given its new credentials as a listed company with increased scrutiny and transparency

How do you buy shares in an IPO?

Only a small fraction of shares are generally listed for purchase by retail investors, generally around 5-10%. The majority are reserved for institutional and high net worth investors. Investing directly in the IPO, which is called the “primary market”, involves applying for a certain number of shares at a particular price range.

This is called the “book build” which the underwriter(s) - investment banks tasked with selling the issue - are in charge of. They contact institutions and high net worth individuals asking if they would be interested in purchasing shares in the company, and in some cases reserve a portion for the general public to apply for.

Given the relatively low amount of shares on offer for retail clients in the primary market, retail traders and those that are not “part of the club” can more easily access shares in the secondary market. This is where the shares first start trading on the exchange where they are listed.

How to trade IPOs?

Retail investors and traders can purchase the shares directly from other shareholders that are willing to sell, and agree to pay the market price for them. Alternatively, retail traders and investors can purchase shares in a company once they first start trading on the exchange through derivative securities such as options and contracts for difference (CFDs).

Pepperstone offers CFDs on IPOs, so you’re not purchasing shares in the primary market like the institutional investors, but rather you trade the IPO based on where its prices are in the secondary market. This reduces the hassle of share ownership and allows you to speculate on the value of the company in the days and weeks after it lists. You can even short the company if you think it's doomed to fail!

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information provided here, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

.jpg)