Les CFD sont des instruments complexes et présentent un risque élevé de perte rapide en capital en raison de l’effet de levier. 72.2% des comptes d’investisseurs particuliers perdent de l’argent lorsqu’ils investissent sur les CFD. Vous devez vous assurer que vous comprenez le fonctionnement des CFD et que vous pouvez vous permettre de prendre le risque élevé de perdre votre argent.

- Français

- English

- Español

- Italiano

With the economists’ forecasts at +1.8m to -100k, once again the distribution of estimates is huge. It’s all finger in the air stuff when it comes to forecasting, but what’s most important for traders is whether this is a volatility event and whether this has any political implications.

The market will also consider the unemployment rate (consensus 8.2% from 8.4%) and hourly earnings, but overall, it’s the headline number that will drive price – if it does invoke a reaction.

Let's see the number, but we’ve seen a decent ADP payrolls report and a fall in continued employment claims. Although, many have picked up on the fact jobless claims seen in California were effectively removed from the survey as they rework their system to eliminate fraud. Seasonal factors point to a solid NFP number, and the market is positioned for a number just over 1m, but does it matter to markets? It’s the trend that I think is most important here and unless we get a blowout number, then the pace of job creation is falling and will continue to do so into October.

If I look at USDJPY, overnight implied vol it sits at 4.4% which is incredibly low and offers a 34-pip move – so the implied range is 105.25 to 105.92. Does this feel too low given the headline risk? Perhaps, but it gives you a sense that markets are not seeing great movement at this stage and thus NFP’s are not expected to be a vol event.

The debate on US fiscal stimulus rages on and the latest is that we’ve just seen the House pass the $2.2t aid bill and naturally the Senate has rejected it without delay. The Republicans having earlier raised their offer to $1.6t earlier and rejecting the DEM proposal. We know the dialogue with Steven Mnuchin and Nancy Pelosi is there, but this move in the House would lower the probability of a fiscal deal emerging and the US needs fiscal. Just look at the 2.7% decline in August personal income and understand that will continue to fall and even accelerate, and that will weigh on disposable capital and economics in the next couple of months.

Given Biden’s odds have come in post the first debate I question if the DEMs actually want a deal. The odds of Biden getting the White House have risen to 63% and for the first time the DEMs are favoured to get the Senate. Replacing ‘no majority’ as most likely outcome (in the eyes of the punters). Granted, the DEM campaign may not look bookies odds, but they know the wind is to their backs, so humanity aside, why make a deal? Surely a deal, while very much needed, gives Trump ammunition and favours his campaign.

We’ve also seen Trump’s top aid Hope Hicks testing positive for COVID-19 and Trump detail he’ll be headed for quarantine. Will the next presidential town hall debate on 15 October now take place? Seems this is Trump’s out if he wanted one.

Equity markets haven’t reacted too greatly at this stage. Although, we’re starting to see some selling in S&P 500 futures and the ASX200 is down 0.8%. US Bonds have hardly moved, although we’re seeing good buying in Aussie bonds, taking back some of the chunky sell-off seen yesterday (Aus 10s +11bp). What caught a lot of people’s attention was a 5% sell-off in copper though and that had a lot of people talking, while crude was down over 3%. Both are lower through Asia today. So, watch the daily chart of copper, it could be very telling from here and the idea of trading reflation. Fiscal is key for that.

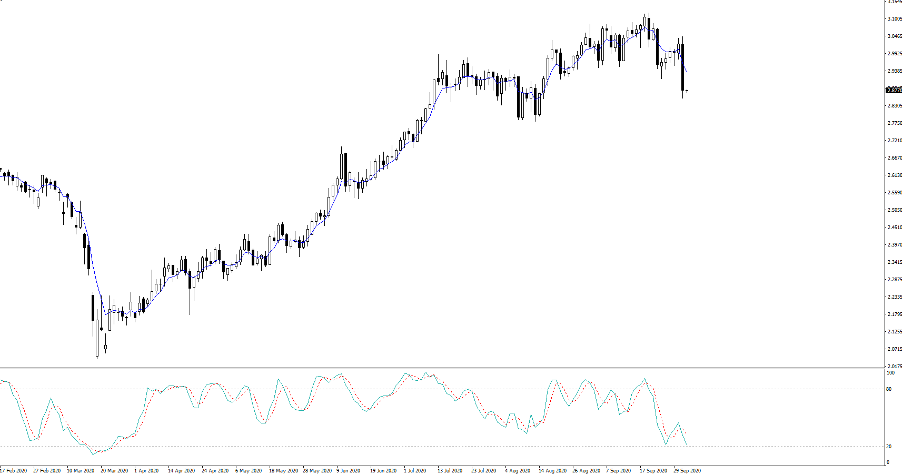

Its interesting that the AUD has not reacted too intently and if we look at the AUDUSD (white) vs the Bloomberg industrial metals index (41% weighted by copper, 23% aluminium, 19.4% zinc and 16% Nickel) we see the pair has diverged after holding a strong relationship of late. I certainly can't see risk holding up that well if the commodity index rolls over.

(Source: Bloomberg)

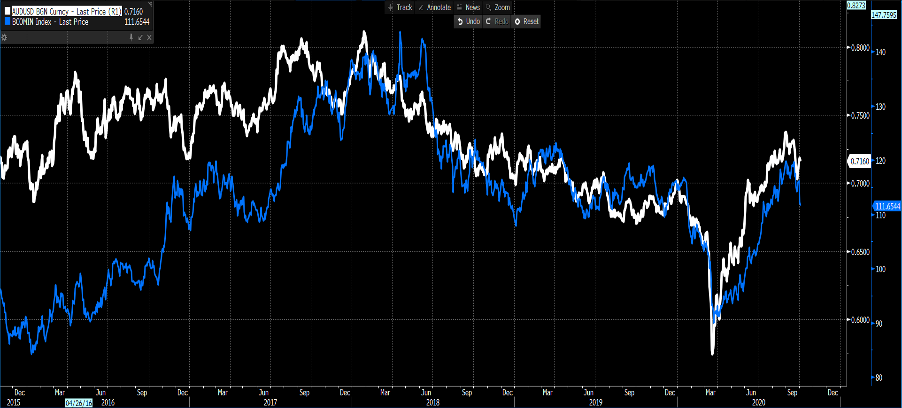

I would also be looking closely at USDCNH (white) given its strong inverse relationship with AUDUSD (blue - inverted) – As we see, the pairs are closely related so weakness in the CNH is resonating in a lower AUD. The combination of weaker copper and CNH could see a lower AUD. Fundamentally, this is where to watch.

(Source: Bloomberg)

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

Le matériel fourni ici n'a pas été préparé conformément aux exigences légales visant à promouvoir l'indépendance de la recherche en investissement et est donc considéré comme une communication marketing. Bien qu'il ne soit pas soumis à une interdiction de traiter avant la diffusion de la recherche en investissement, nous ne chercherons pas à tirer parti de cela avant de le fournir à nos clients. Pepperstone ne garantit pas que le matériel fourni ici est exact, actuel ou complet, et ne doit donc pas être utilisé comme tel. Les informations, qu'elles proviennent d'un tiers ou non, ne doivent pas être considérées comme une recommandation; ou une offre d'achat ou de vente; ou la sollicitation d'une offre d'achat ou de vente de toute sécurité, produit financier ou instrument; ou de participer à une stratégie de trading particulière. Cela ne tient pas compte de la situation financière des lecteurs ou de leurs objectifs d'investissement. Nous conseillons à tous les lecteurs de ce contenu de demander leur propre conseil. Sans l'approbation de Pepperstone, la reproduction ou la redistribution de ces informations n'est pas autorisée.