- Français

- English

- Español

- Italiano

Thanks to those who attended the webinar last night, for those who did not register here is the recording.

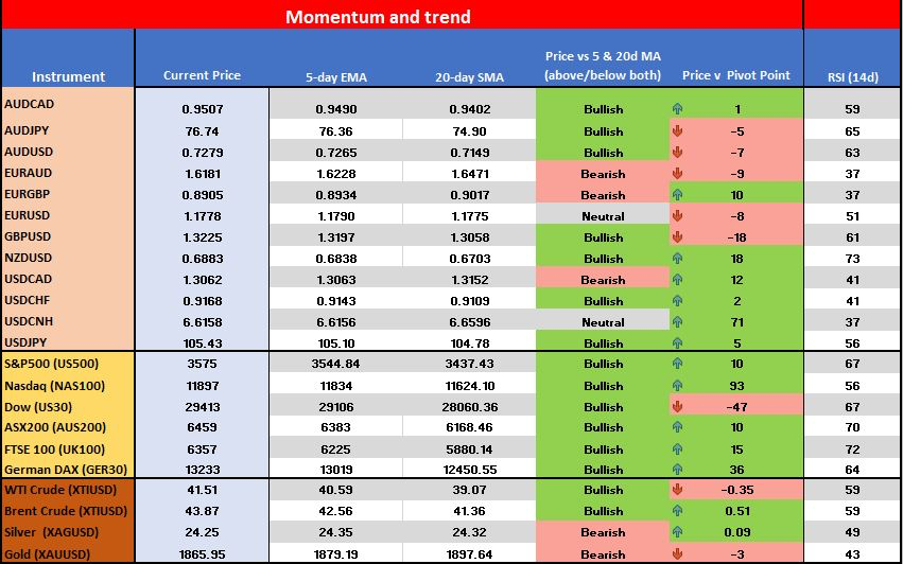

I like to give the momentum and trend monitor a quick glance before going into the charts to see the feel of the flow and for an understanding of the strength of the move. It’s using the daily timeframe which won't interest scalpers and alike, but it gives me perspective. Equities are hard to short here and as we’ve seen in the NAS100 the pullbacks are short-lived affairs and until implied volatility picks up again then the bid will remain strong in the market - as a rule, the higher the vol the greater the propensity for a ‘buyers strike’, which is where we get a better backdrop for short exposures.

There's so many interesting set-ups in the index world, but one I'm watching to see how price reacts is the GER40. With price having had a solid run and coming into key resistance at 13,460 - I would be watching price for a potential reversal here, and better supply to kick in.

I wanted to highlight a few set-ups where markets are testing key levels or are looking interesting.

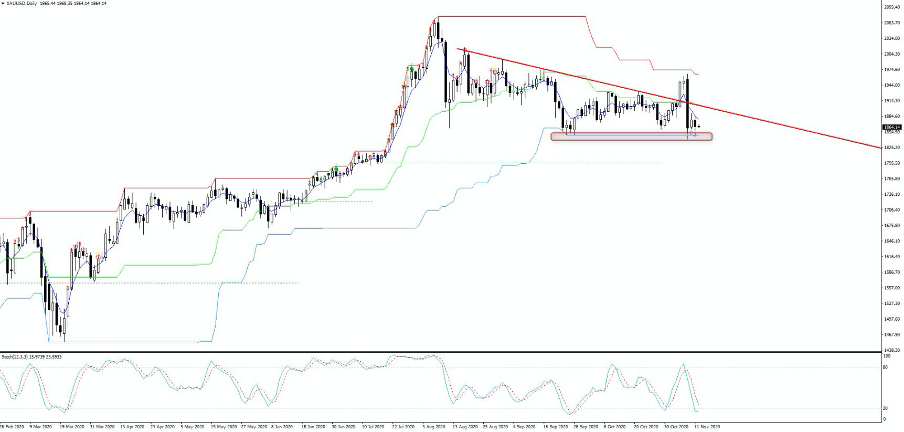

XAUUSD – We saw the failed break of the August downtrend with price reversing and finding support into the September low of 1848. The love for gold has evaporated and if I look at the options market for a guide, 1-week or 1-month call volatility trades at even levels with puts, with 1-week implied trading at a 5.4 vol discount to realised vol. Traders aren't expecting an explosive move. Given the recent move higher in ‘real’ US treasury yields and some signs of consolidation in the USD this makes sense. The downside in the near-term sits down at 1830 which is where I’d expect buyers to support, but of course a break of 1848 turns the structure more bearish.

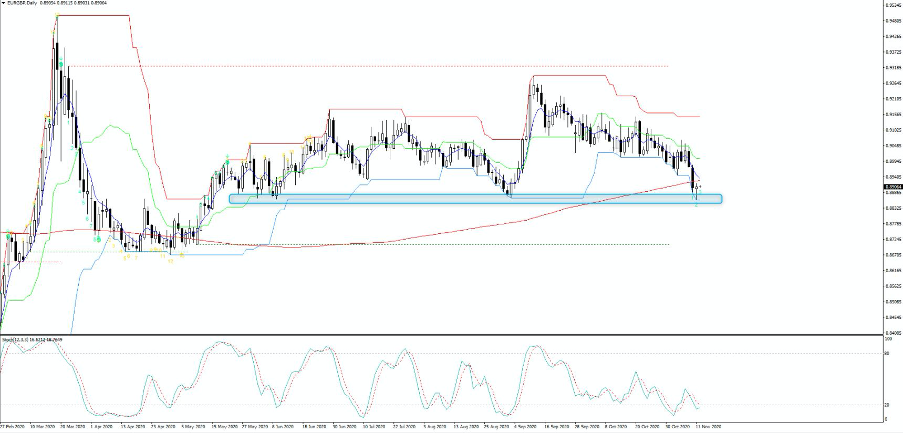

EURGBP – With a renewed focus on EU/UK trade talks and when a deal will be forged, which sounds bullish as there is a risk a deal is not found in which case GBP could find sellers easy to come by. The consensus is that it's a matter of time before a deal is found, but as always the case in the Brexit saga it's not without pushing it to the wire. Could we see something emerge this weekend (gapping risk in GBP pairs?) or early next week and ahead of the EU 27 leaders meeting on 19 November? EURGBP looks interesting, as there's clearly defined support into 0.8866, with 0.8822 the implied move from the current spot (with a 68.2% degree of confidence). My preference is to sell rallies on the day into 0.8850/60, although this is an optimistic fill.

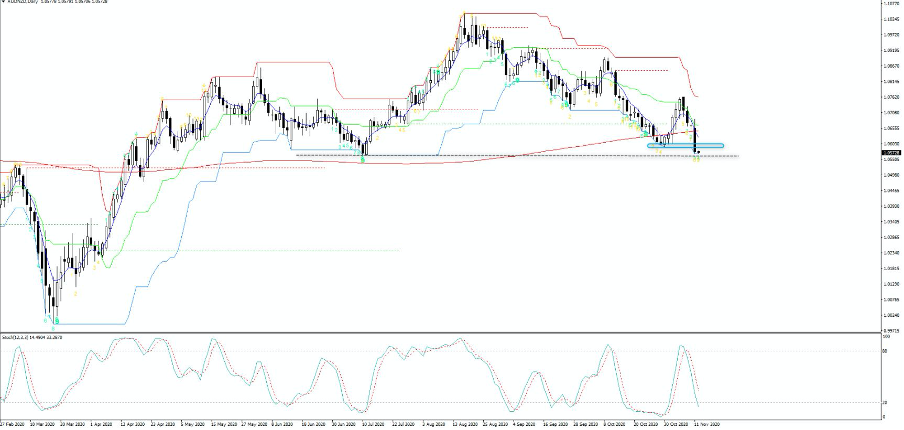

AUDNZD – The NZD has been the strongest currency on the session, with the RBNZ pushing back on expectations for a move to negative interest rates. NZDUSD traded into 0.6904, and the highest levels since March 2019. AUDNZD has broken the recent pivot low of 1.0592 and has 1.0565 (July low) in its sights. The pair looks heavy and at risk of further downside and if we look at a simplistic model using relative financial conditions, we see that it still favours the downside.

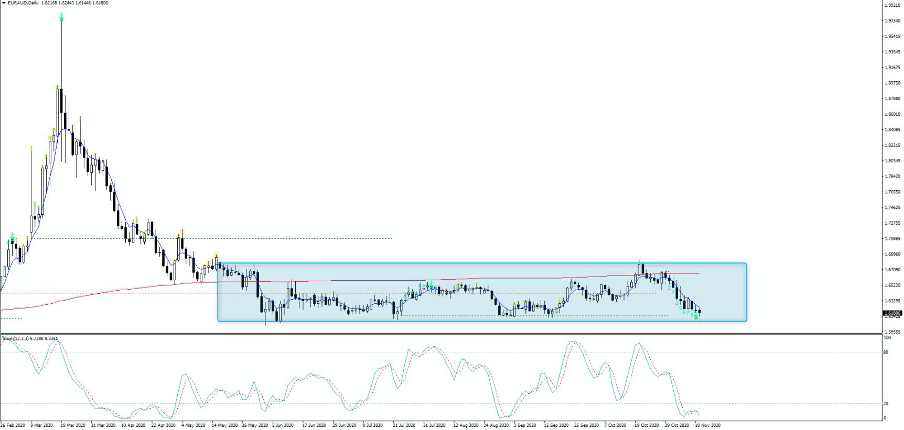

EURAUD – A pair that has just loved the 1.67 – 1.62 range. We’re at the lows now, is this a time to buy?

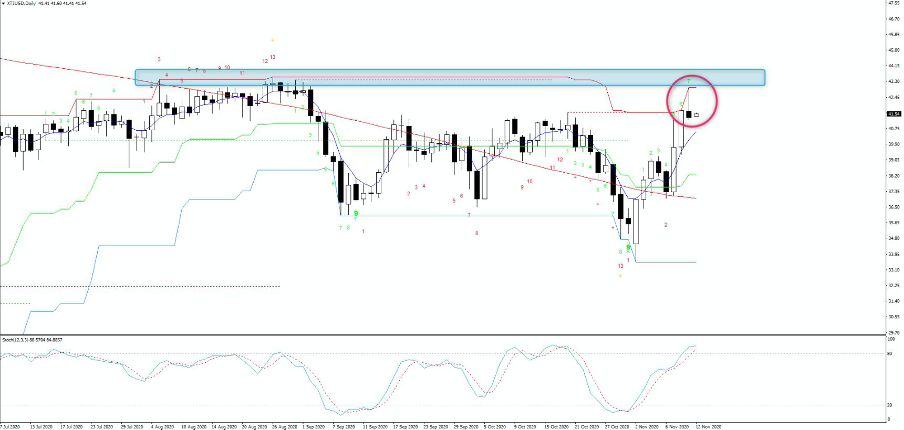

XTIUSD – We’ve seen price print a shooting star on the daily, with the move into the range high. A breakout is not off the table, which would be a powerful message on expected global growth for 2021, with OPEC looking to delay its planned output increase. However, for now the worry is near-term demand stemming from lockdowns.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

Le matériel fourni ici n'a pas été préparé conformément aux exigences légales visant à promouvoir l'indépendance de la recherche en investissement et est donc considéré comme une communication marketing. Bien qu'il ne soit pas soumis à une interdiction de traiter avant la diffusion de la recherche en investissement, nous ne chercherons pas à tirer parti de cela avant de le fournir à nos clients. Pepperstone ne garantit pas que le matériel fourni ici est exact, actuel ou complet, et ne doit donc pas être utilisé comme tel. Les informations, qu'elles proviennent d'un tiers ou non, ne doivent pas être considérées comme une recommandation; ou une offre d'achat ou de vente; ou la sollicitation d'une offre d'achat ou de vente de toute sécurité, produit financier ou instrument; ou de participer à une stratégie de trading particulière. Cela ne tient pas compte de la situation financière des lecteurs ou de leurs objectifs d'investissement. Nous conseillons à tous les lecteurs de ce contenu de demander leur propre conseil. Sans l'approbation de Pepperstone, la reproduction ou la redistribution de ces informations n'est pas autorisée.