- Français

- English

- Español

- Italiano

Key focal points this week:

- US non-farm payrolls (Saturday 00:30 AEDT) – consensus +150k jobs, U/E rate 3.9%, earnings +5.2%

- Senate hearings (on Thursday) for Fed nominees Raskin, Cook and Jefferson – views on policy expectations are key

- OPEC meeting (Wednesday) – it’s an easy decision to increase output by 400k barrels p/d

- Eyes on developments in the Ukraine and Russia/NATO relations.

- RBA (Tuesday 14:30 AEDT), Gov Lowe speech (Wednesday 12:30 AEDT) and Statement on Monetary policy (Friday 11:30 AEDT) – the market prices 110bp of hikes (or 4.4 hikes) in 2022.

- BoE meeting (Thursday 23:00 AEDT) – The market places an 80% chance of a hike here

- In Europe, we get initial CPI (Wed 21:00 AEDT – consensus 4.4% from 5%), with the ECB meeting the day after.

- Chinese markets are closed for Lunar New Year

- US Q4 earnings from: MicroStrategy (the implied move on the day of earnings - 9.8%), Exxon (2.9%), Alphabet (3.4%), Alibaba (3.5%), Meta Platforms (5.6%), QUALCOMM (7.1%), Amazon (4.4%)

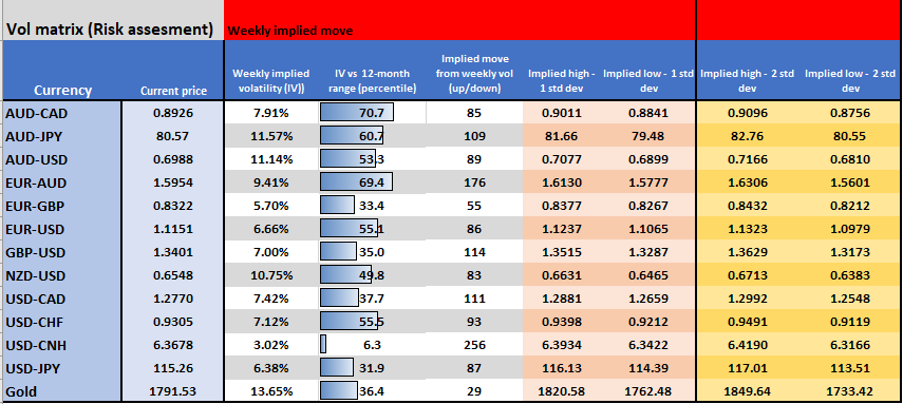

Implied volatility matrix

With these event risks in play, I’ve looked at the 1-week implied volatility levels (priced in the options) market. I've derived the implied move (higher or lower) and adapted to get the indicated range where price should be contained with a 68.2% and 95% levels of confidence. Traders can use to understand if the market sees these events holding the potential to cause fireworks and can be good for mean reversion and risk management.

(Source: Tradingview - Past performance is not indicative of future performance.)

Another dramatic week in financial markets with the US500 closing +0.8% on the week, while over the same period the USDX added 1.7%, crude +2.9% (closing higher for the sixth straight week), Gold -2.4%, Bitcoin +6.9%, while the number of implied hikes for 2022 priced into US rates lifted from 3.9 hikes to close at 4.75.

After hitting 32.48%, our US volatility index, which is priced off the VIX futures, has seen good interest to sell volatility and we see this back at 26.99% and it would not surprise to see this move closer to the 23-24% range by the end of the week. Obviously, this will be driven by the S&P 500 but the S&P 500 needs a close back above the 200-day MA (now 4435) and 4450/54 (last week’s high and 38.2% fibo of the recent pullback) to get a feel of better bullish momentum – the massive hammer candle on the weekly suggests the bulls have regained some composer and it would not surprise if we saw follow-through here.

While I take a view that the risks are skewed to a positive week, I tend to feel risk will be sold into a more extended rally, as the Fed no longer have the markets back and have injected much uncertainty to see momentum really take hold.

On a micro level, earnings continue to come in thick and fast, and this week we get several crowd favourites – I like Meta (FB) as a tactical long this week, not just because the volatility offers expectations of some punchy moves in price, but it has a solid pedigree at earnings (it has beaten 7 of the past 8 quarter in sales and EPS) and it looks to be grinding out a bottom – while holding over earnings is not something I promote, it would not surprise to see this at $320 by the end of the week.

US data in focus

In the US, ISM manufacturing is expected to see a slight decline in the pace of expansion at 57.0 – however, the market will watch the ‘prices paid’ sub-component and any signs that supply chains are normalising.

US non-farm payrolls should get the lion’s share of attention though, with the USD gaining vs all G10 currencies last week, notably vs the AUD (AUDUSD fell 2.7% on the week). The consensus is we see 150k jobs created in January but hiring is going to be affected by Omicron which is why we see the spread in the forecast distribution is seen at +250k gains to 400k job losses. Job losses here won’t be accounted for in the unemployment rate as furloughed employees are considered “employed not at work) – subsequently, the unemployment rate is not expected to change from 3.9% - the USD may take its cue from with average hourly earnings where the consensus expects this to rise to 5.2% from 4.7%.

Central banks meetings in play

We have central bank meetings in Australia, Europe, the UK with the BoE likely to hike by 25bp opening the door to balance sheet reduction – GBPUSD remains in a downtrend, but I am seeing signs of exhaustion in the bearish trend, with a higher low on Friday and a 9 count on Demark set-up – hard to take longs here though and obviously if the BoE don’t hike then we could be looking for 1.3200/1.3170 as a low point. Long GBPNZD has been the momentum play, but this is overbought, and I feel mean reversion could kick in this week.

GBPNZD daily

(Source: Tradingview - Past performance is not indicative of future performance.)

he RBA meeting should close off its QE program given what we’ve seen in labour and inflation reads – more importantly is the guidance, where the RBA may look to guide to a 2023 hike (from 2024). They will continue to beat the drum that they want 3%+ wage pressures to justify a hike. With over 4 hikes priced from the bank this year, the RBA’s commentary will need to come towards market pricing, or we could see downside risks in the AUD – that said, overlap the AUDUSD and the US yield curve (the premium 10yr Treasury yields wear over the 2yr Treasury) and we can see as the yield curve flattens out so too traders sell AUDUSD – the rolling 2-week correlation (by value) is 0.92.

With China’s markets closed for the Lunar NY, the US and Aussie bond market should drive the AUDUSD – here’s more in an idea I put out on TradingView.

Finally, the OPEC meeting looks interesting with SpotBrent eyeing $90 and SpotCrude sitting at the highest levels since 2014. Given the higher prices and failure to live up to prior output agreements, OPEC won’t find it hard to lift output by another 400k barrels – this is priced so I don’t expect a lift in output to rock the crude price too intently. Crude is such an important part of the capital markets, so as goes crude, as goes risk.

If oil doesn’t fancy, Oats is a more exotic trade and feel this has further legs to the upside.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our online application process.

Le matériel fourni ici n'a pas été préparé conformément aux exigences légales visant à promouvoir l'indépendance de la recherche en investissement et est donc considéré comme une communication marketing. Bien qu'il ne soit pas soumis à une interdiction de traiter avant la diffusion de la recherche en investissement, nous ne chercherons pas à tirer parti de cela avant de le fournir à nos clients. Pepperstone ne garantit pas que le matériel fourni ici est exact, actuel ou complet, et ne doit donc pas être utilisé comme tel. Les informations, qu'elles proviennent d'un tiers ou non, ne doivent pas être considérées comme une recommandation; ou une offre d'achat ou de vente; ou la sollicitation d'une offre d'achat ou de vente de toute sécurité, produit financier ou instrument; ou de participer à une stratégie de trading particulière. Cela ne tient pas compte de la situation financière des lecteurs ou de leurs objectifs d'investissement. Nous conseillons à tous les lecteurs de ce contenu de demander leur propre conseil. Sans l'approbation de Pepperstone, la reproduction ou la redistribution de ces informations n'est pas autorisée.