- Français

- English

- Español

- Italiano

The Daily Fix: Staying long NAS100, but will review in Jackson Hole

The GER30 being the best EU market with a 2.4% rally in cash trade, with price here now pushing into the 12 August swing high in our out-of-hours pricing. In US equities, the S&P 500 closed up 1% to new highs, where we’ve seen turnover above the 30-day average for the first time in a while in cash trade. Although, 1.2m S&P 500 futures traded is light. Breadth was far better today as well, which is something I touched on yesterday, with 82% of stocks higher on the day, led by energy (2.8%), financials (+2.3%) and industrials (1.8%). Healthcare (-0.5%) was the only sector to close lower. My NAS100 (0.6%) long is still working, but I will be strongly considering closing this into the Jackson Hole Symposium.

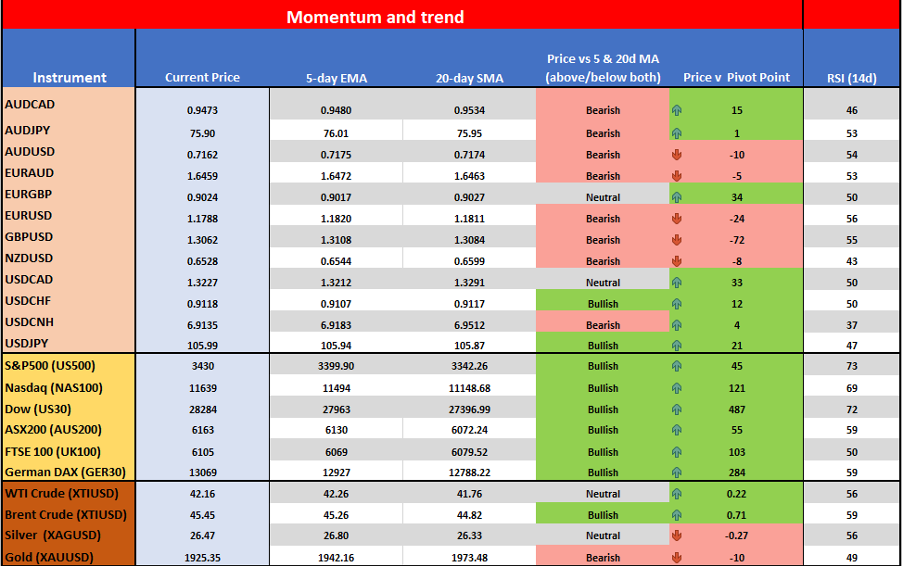

It's still no surprise that my momentum dashboard is showing some solid trends in equities, yet a messy picture elsewhere. The dashboard has conditional formatting set to detail “bearish” if price is below both the 5-day EMA and 20SMA, “bullish” if above both, and “neutral” if neither is true (i.e. its above one, but below the other). I also want to see if price is above/below the pivot point. I have used the Excel RTD Smart Trader Tool to pull prices out of MT4 and set up, so why not check it out.

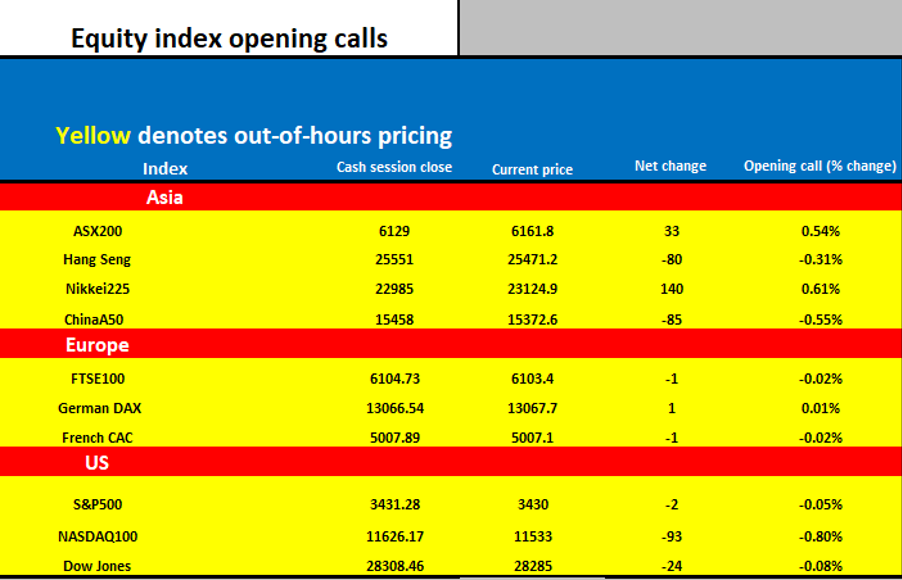

Asia should open with a mixed picture despite these leads and our calls for the ASX 200 and NKY225 look strong enough, while weakness is likely in HK and China mainland markets. Apologies, I have used bright colours.

The fixed income world is gearing up for a chunky $148b in US Treasury auctions to play out over the next few days, which could impact yields and subsequently influence yield sensitive parts of the market. Like the USD, gold and NAS100. A risk to consider, but at this stage we’re seeing US Treasury yields rising into this supply, with 10s +3bp to 65bp, yet inflation expectations are rising faster (10yr Breakevens are +5bp) and thus real yields have fallen. It’s surprising then that gold is not having any of it, with price down 0.6%, with the USD up smalls against the basket (USDX). Copper has rallied 0.3%, yet lumber is -2.9% (after rallying for 16 straight days, however), while WTI and Brent crude are up 0.1% and 1.6% respectively. It’s all a tad messy.

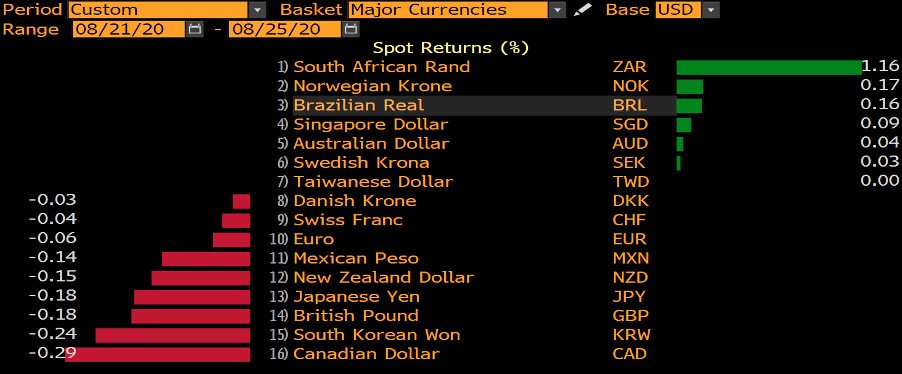

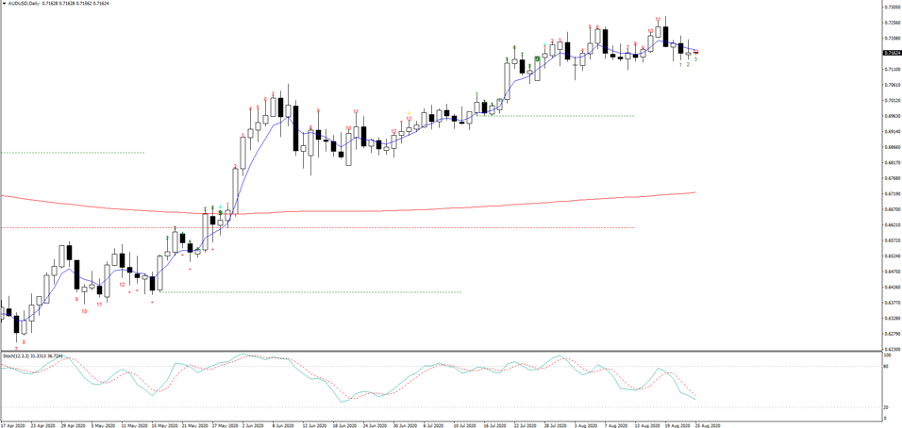

Moves in FX markets have been quite sanguine, with the ZAR having a solid move, yet that was really the only mover vs the USD. The CAD is the weakest link on the day and we see USDCAD moving into the middle esculents of the bear channel it has held since late June. GBPUSD has also been offered, with GBPUSD finding sellers into the 5-day EMA and forming a hammer candle. If this kicks lower the 1.3000/1.2980 area looks like key support, where a break sees the pair into 1.2850. Although, given the volatility one would assume that won’t happen overnight. AUDUSD has traded a 0.7204 to 0.7153 range and a look at the daily show the consolidation playing out after the run from March. One for the range traders for now.

By way of event risks, as detailed in yesterdays week ahead, we get the German IFO survey at 18:00 AEST, which is out just after German Q2 GDP and could be worth focusing on for those with GER30 and EUR exposures. The GDP numbers won’t move the dial as its Q2 data and it’s a revision of data that that has already been announced. There is little to trouble in Asia, but I would be looking at US consumer confidence (due 00:00 AEST), as this poses small risk to exposures, with the market expecting a small improvement to 93.0 (from 92.6).

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our online application process.

Le matériel fourni ici n'a pas été préparé conformément aux exigences légales visant à promouvoir l'indépendance de la recherche en investissement et est donc considéré comme une communication marketing. Bien qu'il ne soit pas soumis à une interdiction de traiter avant la diffusion de la recherche en investissement, nous ne chercherons pas à tirer parti de cela avant de le fournir à nos clients. Pepperstone ne garantit pas que le matériel fourni ici est exact, actuel ou complet, et ne doit donc pas être utilisé comme tel. Les informations, qu'elles proviennent d'un tiers ou non, ne doivent pas être considérées comme une recommandation; ou une offre d'achat ou de vente; ou la sollicitation d'une offre d'achat ou de vente de toute sécurité, produit financier ou instrument; ou de participer à une stratégie de trading particulière. Cela ne tient pas compte de la situation financière des lecteurs ou de leurs objectifs d'investissement. Nous conseillons à tous les lecteurs de ce contenu de demander leur propre conseil. Sans l'approbation de Pepperstone, la reproduction ou la redistribution de ces informations n'est pas autorisée.