- Français

- English

- Español

- Italiano

A wild day on markets - flow, liquidations and high volatility

This can be achieved by taking timeframes down and above all respect the flows we’re seeing and the price action. Case in point - the VIX has pushed to 30%, having been as high as 39%, while the NAS100 VIX pushed into 44%, although again we’ve seen some volatility (vol) sellers and now sits at 35% - it’s this backdrop in which we work in and so often we can see significant reversals on limited news flow.

I had expected more of a bounce in risk assets into EU trade, as so much was looking grossly oversold, but as is the way with trading it’s about timing that flow. It was certainly looking promising through Asia with futures up, but then the market focused on another leg lower in the RUB (Russian ruble) and this resulted in Europe getting whacked, with EU Stoxx closing -4.1%. US futures fell hard, with our US500 index cracking the October lows around 4270 – at its low point, the S&P 500 was having the worst percentage move since June 2020, with various flow desks reporting further liquidations from trend- and momentum-funds – so more of the same, macro forces, flow, and liquidations in play.

Volumes have been massive and some 67% above the 30-day average in the S&P 500 cash market, while we’ve seen 3.6m S&P 500 futures traded, which again is huge. It speaks to a solid liquidation of systematic and leveraged positioning.

Crude, AUDJPY, and crypto followed closely, and correlations went towards 1.

Into the meat of US cash trade, we saw a flow change and the buyers stepped in – what we’ve seen is a simply remarkable defence of the October lows in the US500 and US equity markets more broadly and despite it looking bleak we’ve seen the S&P 500, NAS100 and Russell 2000 close higher on the day – the Russell 2k by far the standout +2.3%. Crypto has moved up sharply off the lows, and risk FX has gone along for the ride.

One questions if the algos sensed the liquidation was over and, in a market, grossly oversold covered shorts and aggressively entered trading longs.

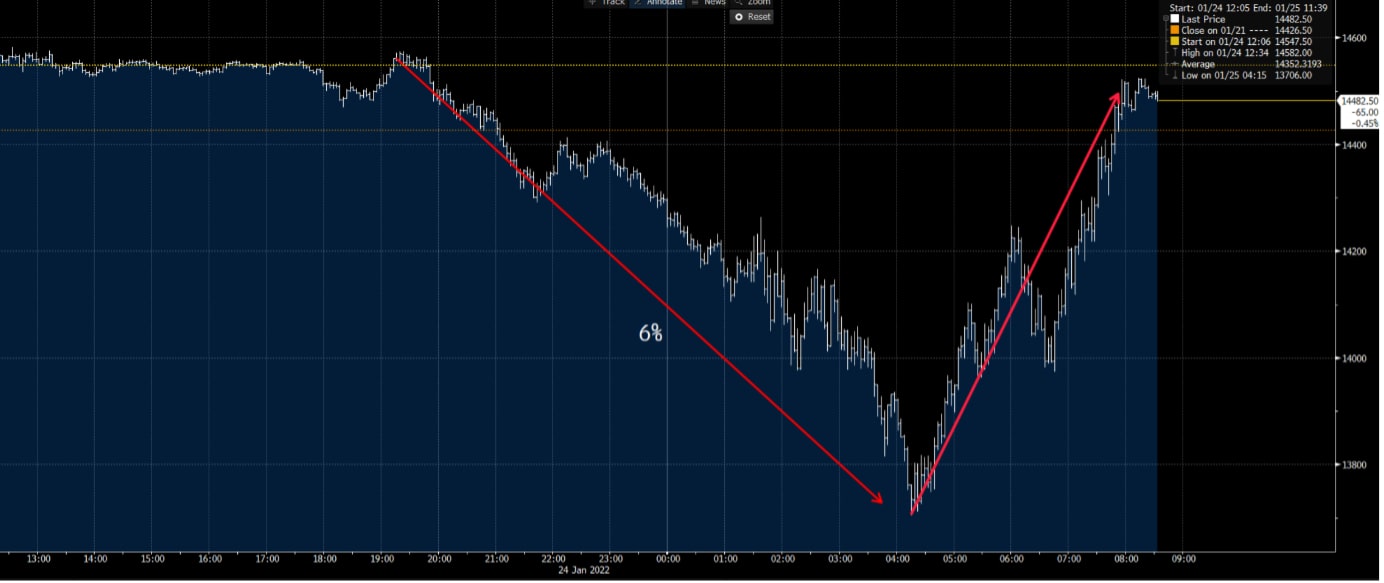

That intra-day tape in NAS100 is quite a sight – they call that a V-shaped bottom!

NAS futures intra-day

(Source: Bloomberg - Past performance is not indicative of future performance.)

Our calls for the EU and UK equity indices are flying and let’s see how Asia trades this, but at this stage, we’re calling the DAX up 1.8%.

The question now is will this move continue into the raft of mega-cap earnings and FOMC meeting this week, or is it a dead-cat bounce? With the VIX at 29%, it's clear we can expect still big moves and wild reversals.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our online application process.

Le matériel fourni ici n'a pas été préparé conformément aux exigences légales visant à promouvoir l'indépendance de la recherche en investissement et est donc considéré comme une communication marketing. Bien qu'il ne soit pas soumis à une interdiction de traiter avant la diffusion de la recherche en investissement, nous ne chercherons pas à tirer parti de cela avant de le fournir à nos clients. Pepperstone ne garantit pas que le matériel fourni ici est exact, actuel ou complet, et ne doit donc pas être utilisé comme tel. Les informations, qu'elles proviennent d'un tiers ou non, ne doivent pas être considérées comme une recommandation; ou une offre d'achat ou de vente; ou la sollicitation d'une offre d'achat ou de vente de toute sécurité, produit financier ou instrument; ou de participer à une stratégie de trading particulière. Cela ne tient pas compte de la situation financière des lecteurs ou de leurs objectifs d'investissement. Nous conseillons à tous les lecteurs de ce contenu de demander leur propre conseil. Sans l'approbation de Pepperstone, la reproduction ou la redistribution de ces informations n'est pas autorisée.