- Français

- English

- Español

- Italiano

Why equity and FX traders simply need to watch the US bond market

That is the question that is prevalent from the FOMC meeting, and while the Fed committee have a full range of differing views, I continue to see a world where whether it’s the September or December FOMC meeting that we get a formal announcement, the most important factor is whether economics maintain their current positive trajectory and whether we see volatility pick up and the markets subsequently wearing a higher risk premium.

Despite a view from the Fed that tapering is coming, the message I heard is that a formal announcement seems likely in Q4 – which presumably means the December FOMC meeting – there is a meeting in early November, but the December meeting is where they’ll release a new set of economic and fed funds projections. I had been calling for a September taper of QE, but when in doubt the Fed will tend to err on the side of caution, which puts the probability of December in play – to me, it matters not, what counts is whether the market is anxious about the event and whether we’re about to embark on a new volatility regime.

Volatility, in my view, is the most important factor in trading – volatility is really the only true asset class – it dictates what we trade and the direction, as well as how much risk we take in each position and therefore it controls our position sizing.

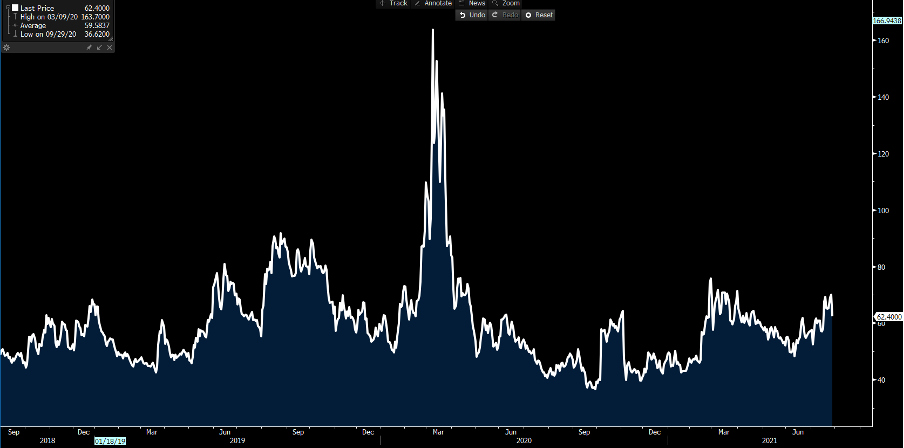

The ‘MOVE’ index – or implied volatility in US Treasuries

(Source: Bloomberg)

Of course, if we get a strong US NF payrolls (6 August) and July CPI (11 August), then the implied vol in markets may push higher and that could have big implications for us as traders. As it is, implied volatility in US Treasuries screams out a message that they don’t expect a shock anytime soon. That is interesting in itself as bond yields simply fail to find any sustained trend in the sell-off (yields higher) and there are certainly more people seeing risks that the 10-yr Treasury yields trades down towards 1% and not back into 1.77% - I am open-minded, a stance I think all traders should be, but a close below 1.17% would really increase the probability of 1% yields.

We can also look at the interest rate markets and see Eurodollar futures having caught a strong bid of late, with the September 2023 contract falling from 1.04% to 0.81% through July – so, in effect pricing out one rate hike by the end-2023. Interest rate considerations are perhaps even more important than tapering, and there is a balance (on semantics) between rates being priced in and priced out – while it seems positive that rate hikes are being priced out, we have to question why that is the case?

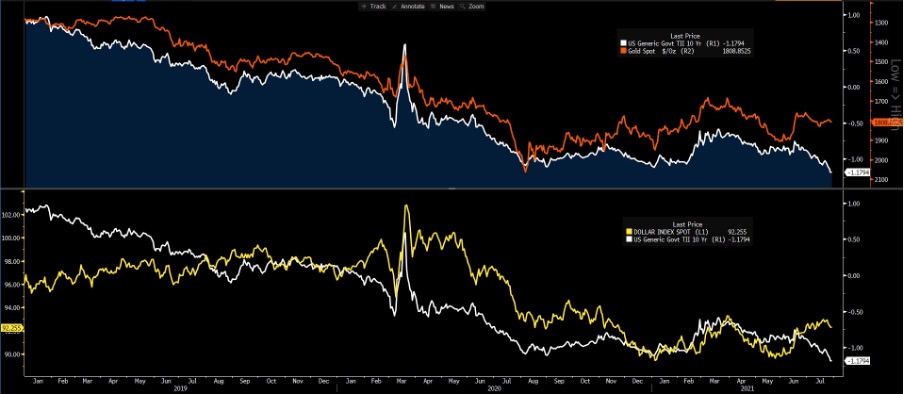

Upper pane – gold (inverted) vs US 10yr real rates

Lower – gold vs US 10 yr. real rates

(Source: Bloomberg)

This is the same when we look at inflation-adjusted Treasury yields or real rates – as it stands, we see 10yr real rates at -1.18% - the lowest levels ever. Until mid-June, this would have boosted gold and the NAS100, and weighed on the USD – but that relationship has broken down. Is it time for mean reversion and catch from the USD and gold? Again, we need to ask why the market continues to push real rates lower – I don’t think it is a positive one.

The VIX index sits at 18.31%, which prices expected daily moves (over the coming 30 days) in the S&P500 at 1.15%. S&P500 30-day volatility is realising at 11.6%, so there are still incentives for hedge funds and alike to sell volatility. The VIX futures curve is steep, which also offers incentives for funds to sell volatility, but what’s important is to understand is if the market is pricing higher volatility in the months ahead – typically future contracts are higher as they move out (on a calendar basis) but its degree of steepness we look for.

Right now the market is pricing higher vol in the future, but it's not outrageous.

Volatility regimes change all the time, but given we’ve just heard from the Fed and the next few meeting will be ‘live’ events, I thought it interesting to see how the market was implying by way of future movement.

I do think there are some very interesting dynamics shaping up in the bond market and while not overly well understood by retail traders, I ask that if yields do keep heading lower, will it simply reinforce the case of being long tech? Or will there become a tipping point where the equity market starts to express a higher level of worry at what the bond market is saying about future economic trends?

Treasuries and credit, after all, are the guiding light for equity markets and the USD.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our online application process.

Le matériel fourni ici n'a pas été préparé conformément aux exigences légales visant à promouvoir l'indépendance de la recherche en investissement et est donc considéré comme une communication marketing. Bien qu'il ne soit pas soumis à une interdiction de traiter avant la diffusion de la recherche en investissement, nous ne chercherons pas à tirer parti de cela avant de le fournir à nos clients. Pepperstone ne garantit pas que le matériel fourni ici est exact, actuel ou complet, et ne doit donc pas être utilisé comme tel. Les informations, qu'elles proviennent d'un tiers ou non, ne doivent pas être considérées comme une recommandation; ou une offre d'achat ou de vente; ou la sollicitation d'une offre d'achat ou de vente de toute sécurité, produit financier ou instrument; ou de participer à une stratégie de trading particulière. Cela ne tient pas compte de la situation financière des lecteurs ou de leurs objectifs d'investissement. Nous conseillons à tous les lecteurs de ce contenu de demander leur propre conseil. Sans l'approbation de Pepperstone, la reproduction ou la redistribution de ces informations n'est pas autorisée.