- Français

- English

- Español

- Italiano

Big Themes For 2024 – Soft Landing On The Cards?

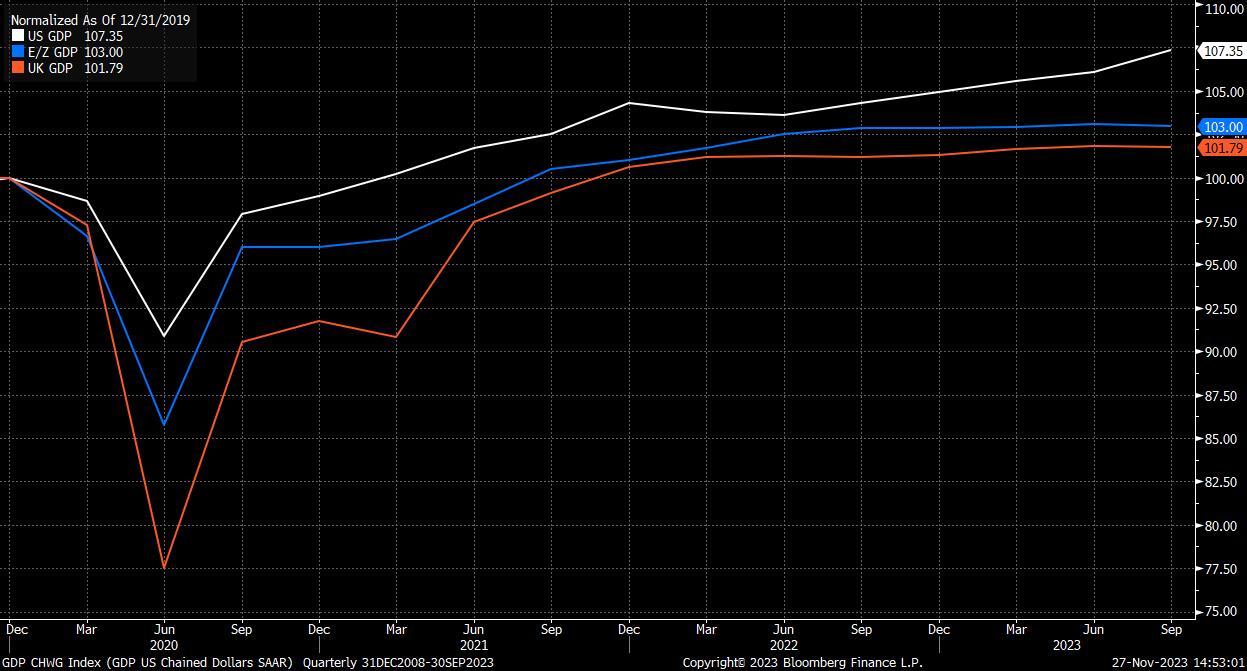

Somewhat surprisingly, 2023 has proved a year of largely resilient economic growth in most of the world, while the US economy has vastly outperformed its peers, clocking up annualised growth of almost 5% in the third quarter.

By and large, the lagged effects of policy tightening delivered over the last 18 months have yet to be fully felt, particularly in economies such as the US where long-duration fixed rate mortgages are commonplace, allowing consumer spending to remain resilient. Even in those economies where the consumer balance sheet is more fragile – such as the UK and Australia – a rundown of excess savings built up during the pandemic has largely cushioned the blow that higher rates have dealt thus far.

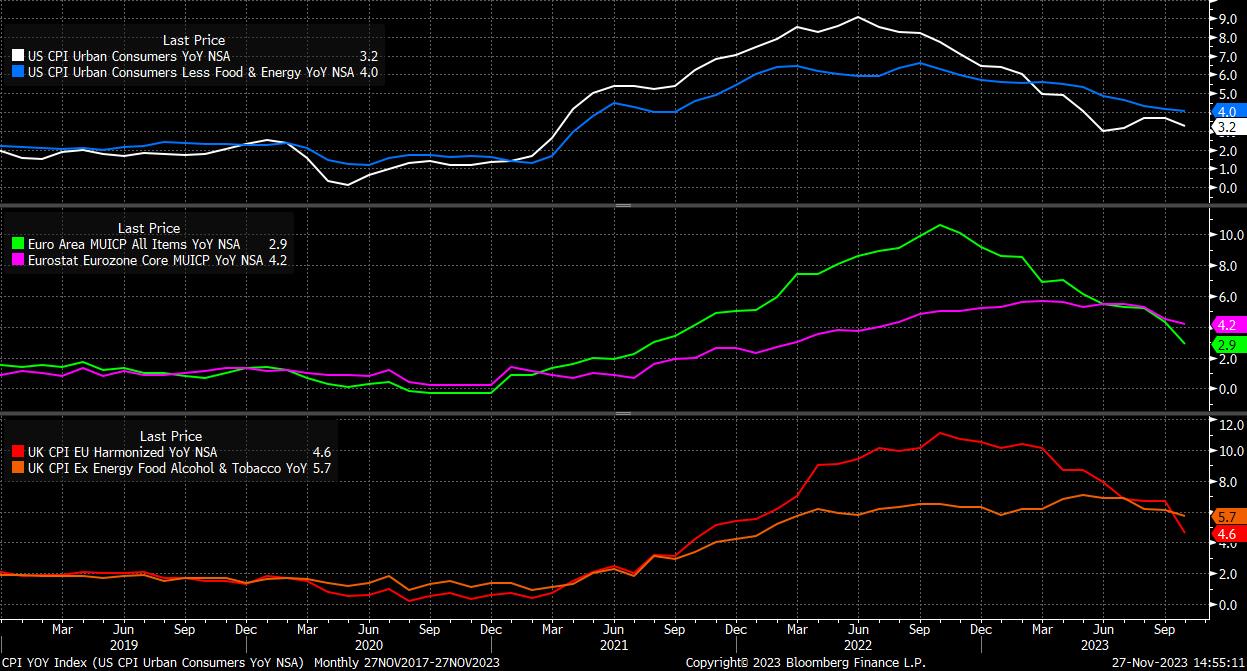

In addition to this, the disinflation process has continued across developed markets, with the exception of Japan where the BoJ’s stated aim of forcing inflation up towards 2% continues, along with accompanying earnings growth. Elsewhere, however, price pressures have continued to ebb, albeit at varying paces.

Both the US and eurozone have seen a sustained and rapid fall in both headline and core inflation rates, albeit the latter only coming of late, with prices ex-fuel and energy having remained stubbornly stuck above 5% for much of the year. The disinflation process has also continued in the UK, albeit lagging behind DM peers, largely owing to the energy price cap mechanism effectively keeping a floor under inflation measures until the fourth quarter.

It seems likely, though, that for both policymakers and financial markets, the easy part of the post-pandemic disinflationary process is now in the rear view mirror.

The expectation has long been that the ‘last mile’ of returning inflation to target will be the most difficult, and there is little on the horizon to alter this view, with policy needing now to strike a delicate balance between remaining restrictive long enough to bring inflation decisively back to 2%, while not remaining too tight for too long, running the risk of tipping economies into a recession. This balance act is likely to be made more difficult considering that the drag from tighter policy will continue, and in many cases increase, throughout the next 12 months, as real rates rise, and financial conditions become increasingly tight amid falling inflation.

This monetary drag is likely to be coupled with ongoing softness in the manufacturing sector, along with increasing signs that said softening is beginning to feed into the all-important services industry, as consumers increasingly rein in spending.

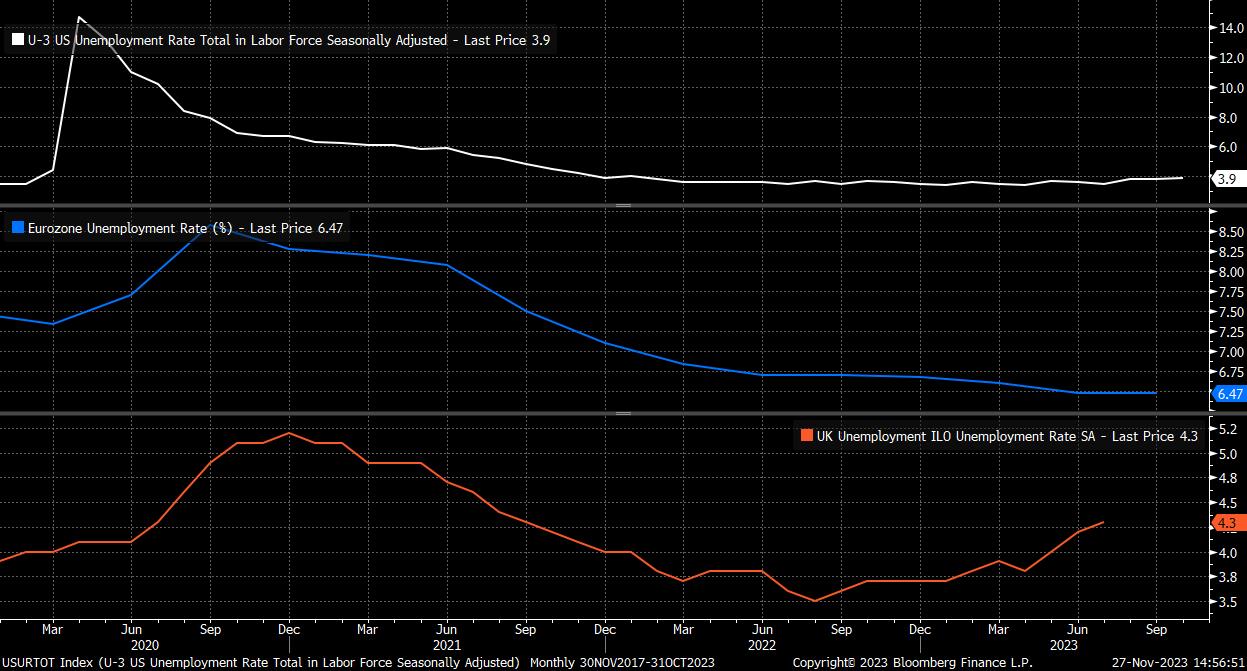

In turn, this is likely to lead to a broad based softening of the labour market across DM, as job growth slows, and unemployment continues to rise (as recent data has already pointed towards), though this will likely provide the positive side effect – for policymakers at least – of a continued cooling in earnings growth.

In such an environment of gradually slowing growth, continued disinflation, and a steadily softening labour market, G10 central banks are likely to remain on hold for some time, with terminal having been reached, and the question now being one of when, and how many, cuts are subsequently delivered? Once more, the BoJ remain an outlier to the remainder of G10, with a hike likely being announced in the first six months of the year. These topics will be examined further in a future article.

For financial markets, the return to a more ‘normal’ global economy – with steady growth, stable prices, and a more balanced labour market – requires treading a very narrow path. Risk remains plentiful as the new year looms, with geopolitical flashpoints numerous across the globe (Ukraine, Middle East, Taiwan, etc.), increasing bond supply remaining a concern for many, and China still experiencing an incredibly lacklustre pace of expansion, running a significant risk of falling into an outright deflationary spiral.

Furthermore, markets appear ‘priced to perfection’ in reflection of a soft landing taking place in 2024; equity valuations remain relatively lofty, while Treasuries – having shaken off mid-year jitters – appear also to be anticipating a relatively straightforward return to economic normality. The FX market sends a similar message, with G7 implied vol remaining just a rounding error away from an 18-month low.

Combining these two factors – a narrow soft landing path, and a priced to perfection market – leaves little room for error. Risks to economic growth clearly remain tilted to the downside in most DMs, while an earnings recession continues, and emerging markets continue to face headwinds. Along with this, the likelihood of central banks delivering so-called ‘insurance’ cuts in the face of slowing growth seems low, prior to a return of price stability; market pricing of cuts in H1 seems premature.

Though more heavily tilted to the downside, some right tail risks do present themselves. The ‘soft landing’ scenario around which consensus has formed could very well turn into a ‘no landing’ one, where inflation is returned to target without any notable slowing in growth or softness in the jobs market. Geopolitical risk may also be resolved, though sadly resolutions to conflict appear some way off at present.

Consequently, while the 2024 base case of an equity and bond market rally, coupled with a modestly softer USD, is built on solid foundations, risks clearly remain aplenty.

Le matériel fourni ici n'a pas été préparé conformément aux exigences légales visant à promouvoir l'indépendance de la recherche en investissement et est donc considéré comme une communication marketing. Bien qu'il ne soit pas soumis à une interdiction de traiter avant la diffusion de la recherche en investissement, nous ne chercherons pas à tirer parti de cela avant de le fournir à nos clients. Pepperstone ne garantit pas que le matériel fourni ici est exact, actuel ou complet, et ne doit donc pas être utilisé comme tel. Les informations, qu'elles proviennent d'un tiers ou non, ne doivent pas être considérées comme une recommandation; ou une offre d'achat ou de vente; ou la sollicitation d'une offre d'achat ou de vente de toute sécurité, produit financier ou instrument; ou de participer à une stratégie de trading particulière. Cela ne tient pas compte de la situation financière des lecteurs ou de leurs objectifs d'investissement. Nous conseillons à tous les lecteurs de ce contenu de demander leur propre conseil. Sans l'approbation de Pepperstone, la reproduction ou la redistribution de ces informations n'est pas autorisée.