- Español

- English

- 简体中文

- 繁体中文

- Tiếng Việt

- ไทย

- Português

- لغة عربية

US Q3 earnings – Citi, JPM, BAC, WFC, UnitedHealth, WFC.

When we look at the companies included in the US30, there are only two banks (of the 30 constituents) - Goldman Sachs and JP Morgan. However, the US30 holds an incredibly high relationship with the XLF ETF (S&P financial sector ETF), with a 10-day correlation of 93%. So, with so many of the major financial institutions reporting, and assuming this incredibly tight relationship holds up, the US30 should take its inspiration from the movement in the US banks.

Another important risk for US30 traders this week is how the market reacts to earnings from United Health (UNH - report on 13 October). UNH commands a massive 10% weight on the US30, making it arguably the biggest weight on the index.

.png)

UNH is not a stock that CFD traders look at as closely as say a more volatile Tesla or Nvidia, given its more defensive price action. It’s one for the range traders, where buying into $460 and shorting into $520 has worked well over the past 12 months. However, given the weighting, US30 traders should be aware of the influence the stock can offer.

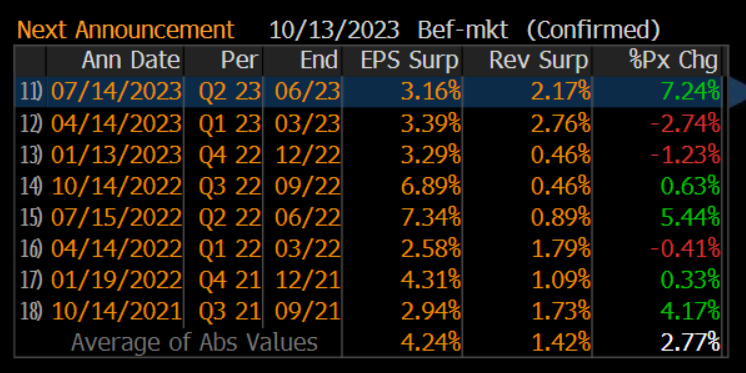

The market prices an implied move of 2.6% move on the day of UNHs reporting, which is in fitting with the average price change over the past 8 quarterly reporting periods. UNH has seen some large percentage moves over earnings and recall in the last earnings report the stock rallied 7.2% - so a sizeable rally/decline would influence the US30 given the weight.

While macro factors such as moves in bond yields, the USD and oil prices will influence the US30, one can see that earnings this week could also play a major role – time to buy the dip, or are we about to see a leg lower in the index?

Related articles

Pepperstone no representa que el material proporcionado aquí sea exacto, actual o completo y por lo tanto no debe ser considerado como tal. La información aquí proporcionada, ya sea por un tercero o no, no debe interpretarse como una recomendación, una oferta de compra o venta, la solicitud de una oferta de compra o venta de cualquier valor, producto o instrumento financiero o la recomendación de participar en una estrategia de trading en particular. Recomendamos que todos los lectores de este contenido se informen de forma independiente. La reproducción o redistribución de esta información no está permitida sin la aprobación de Pepperstone.

.jpg?height=420)