- Español

- English

- 简体中文

- 繁体中文

- Tiếng Việt

- ไทย

- Português

- لغة عربية

A traders’ week ahead playbook – the BoJ gets the full focus

The drivers; EU Nat gas falling to the lowest levels since late 2021, a major factor behind some positive economic upgrades to EU GDP. China’s more aggressive re-opening promoting strong trending conditions in CN50, HK50, copper, USDCNH, crude and gold. While much of the US hard data is holding up well and a belief the survey data may positively converge higher, and this comes amid a slight decline in nominal and real rates.

The easing of US financial conditions does pose a risk ahead of a raft of Fed speakers this week, some of whom may want to keep the option of a 50bp hike on the table, at a time when US hard data is still robust, and the labour market is in fine health.

Another big volatility driver would be if the BoJ disappoints market expectations and leaves policy unchanged for now – I’d argue after last week’s moves below 128.00 in USDJPY, and Japan 10yr swap rates into 1%, there is a skew in expectations/positioning towards either shifting the yield target band to 0.75% or even 1%, perhaps even abolishing altogether, but maintaining a commitment to buy bonds through QE. Some say this latter action is too soon after the changes that we saw on 20 Dec, but for me, the question is why wait?

There is increasing inflation in Japan, political pressure to end YCC and the markets are consistently testing the BoJ – most importantly, the JGB market remains highly dysfunctional and the BoJ is having to buy far more bonds than the JPY9t p/m they detailed they would buy in December. 1-week USDJPY implied vols are sky-high, so this highlights the risks to JPY positioning for traders – position sizing here will keep you in the game.

Where is the balance of risks? Given expectations, I see downside risks this week for the JPY and while the trend is for a stronger JPY, as a risk manager I would be looking to part cover JPY longs into the BoJ meeting.

For now, though, there are big moves and trends across markets – the preference is to take a systematic approach - over a tactical one – and look for continuation in the moves in the USD, gold, NAS100, CN50, XAU, crypto and crude. That is, at least until we see price close below/above the 5-day EMA or a 3- & 8-day EMA crossover, which could highlight a loss of momentum and promote a change in order book dynamics.

So, what are the known event risks for the week ahead?

US Q4 earnings – it’s a quiet week on the US Corp. reporting front, where we see just 5% of the S&P500 market cap hitting us with numbers, with the reporting calendar really heating up next week. Of the company's reporting, Netflix (report after market on Thursday / 8 am Friday AEDT) should get the lion's share of attention from clients. Consider that Netflix’s implied move on the day of earnings is 8.6% and with a creep higher in recent price action into $332, this is a one for the equity traders.

Central bank speakers – I will be looking closely at the 9 Fed speakers this week, as well as 7 ECB speakers, who will hit the wires through the week. On the Fed front, Lael Brainard (20 Jan at 05:15 AEDT) and John Williams (20 Jan 10:35 AEDT) get the most attention for possible loose guidance for a step down in future rate hikes to 25bp at the 2 Feb FOMC meeting. Given the bearish trend in the USD, there are risks the Fed speakers push back on these easing of financial conditions – so Fed speeches pose a risk in some of the price trends taking place across markets.

MONDAY

- Martin Luther King Day – no US cash equity trading, partial trading on the session in futures.

TUESDAY

- China high-frequency data dump (all data points due out at 13:00 AEDT) - Industrial production (consensus at 0.2%), retail sales (-9.5%), fixed asset investment (5%) and Q4 GDP (1.6%) – the market holds conviction in its view of a positive turn in the data around the start of Q2, on the back of the reopening measures and stimulus announced – so this data series is in the review mirror and I would not be too concerned with holding copper, SpotCrude, AUD, CNH or China equity exposures over this data point and do not expect it to move markets too intently.

- UK employment data (18:00 AEDT) – hard to see this causing too much in the way of GBP vol, but worth having on the radar if trading the GBP. As such, we see GBPUSD 1-week options implied vol at the 21st percentile of its 12-month range. Average weekly earnings are expected to push to 6.2% (from 6.1%), while the 3m U/E rate is eyed unchanged at 3.7%.

- German ZEW survey (21:00 AEDT) – With the improvement seen in some of the EU data flow of late, and EU Nat Gas trading to the lowest levels since Dec ‘21, the market expects the ZEW survey of expectations to improve at -15 (from -23.3 in the Dec read). Not expecting the data point to materially move the EUR and it should confirm the markets-held view that things are far less bad in Europe.

WEDNESDAY

- BoJ meeting (no set time) – the marquee event risk of the week. After last week’s report in Yomiuri, the market is fiercely watching to see the actions from the BoJ. There are increasing expectations the BoJ could either alter its YCC (yield curve control) program, where they contain the 10-yr JGB at a yield of -/+0.50%, potentially taking it out to 0.75%, or even abolish it altogether – possibly replacing YCC with QE and a commitment to buy JGBs. USDJPY and JPY implied volatility is at the highest levels since May 2020, so it’s a big week for the JPY and JPN225. Clearly, the BoJ have no choice but to stop the YCC program, but whether that happens this week or at some point in the next couple of meetings is up for debate – if they abolish YCC the JPY could fly. Conversely, if they don’t alter/abolish YCC and change the maturity of the yield target (to say the 5yr JGB) then we could see big JPY weakness.

- UK CPI (18:00 AEDT) – the market sees headline inflation coming in at 10.5% (from 10.7%) and core inflation at 6.2% (6.3%). A 50bp hike from the BoE at the Feb meeting looks likely at this stage, so we’d need a really weak print to bring rates pricing below 40bp. Fundamentally, the GBP screens relatively unattractive vs other G10 currencies, with long EURGBP a big consensus trade in play. Eyeing the price action in this pair I have no major conviction but see an elevated risk of a move lower into 0.8800, where I’d be looking for better buyers.

- EU Dec CPI (21:00 AEDT) – this is a revision from the recently announced 9.2% YoY print on headline and 5.2% on core. Unless there is a big change then this shouldn’t move the EUR too intently. We see a 50bp hike priced for the 2 Dec ECB meeting and terminal rats pricing around 3.3% later this year.

THURSDAY

- US PPI (00:30 AEDT) – the market expects US Dec PPI inflation to fall from 7.4% to 6.8% - typically PPI is far less impactful than CPI, but the correlation with corporate earnings is higher. In a market hellbent on watching inflation metrics, the PPI print holds modest risks for USD and US equity positioning.

- US Dec retail sales (also 00:30 AEDT) – with US Q4 GDP tracking above 3% and traders positioning away from a hard landing growth scenario, retail sales could influence this growth debate – the market sees a 90bp decline (MoM), with the ‘control group’ element eyed at -0.4%. Bad numbers, relative to expectations, will weigh on the USD here, although I am not expecting this to be a big volatility event.

- Australia Dec employment report (11:30 AEDT) – the market expects 22.5k jobs to be created, with the U/E rate unchanged at 3.4%, on a participation rate of 66.8%. Rates markets are yet to be fully convinced of a 25bp hike from the RBA on 2 Feb, so a hot jobs number and it could push pricing closely to the full 25bp. The current terminal rates pricing sits close to 3.7%. Happy to hold AUD exposures over the jobs report event, as the AUD holds a close relationship with copper, China equity and broad risk sentiment than domestic factors. AUDCAD is on the radar and the momentum suggests risks for a further push higher to 0.9400.

FRIDAY

- Japan national CPI (10:30 AEDT) – the national print comes after the more forward-looking Tokyo CPI print, subsequently, the market expects Japan CPI to come in at 4% (from 3.8%). The CPI also print comes after the BoJ meeting, so depending if the BoJ acts decisively on Wednesday, the influence may be muted.

- China 1 & 5-year Prime Rate decision (12:30 AEDT) – while the broad consensus is that the PBoC will leave policy unchanged, it would not surprise to see we could see a slight cut of 10bp in the prime rate. The market also is on edge for a further easing of the RRR (reserve ratio requirement), an outcome that would increase the level of liquidity into the economy and be a further positive for Chinese equity markets and the AUD

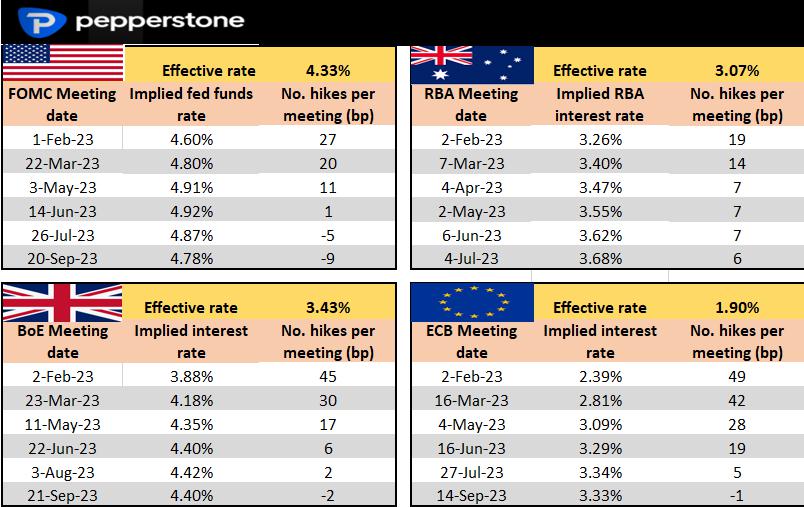

Rates Review – we look at market pricing for the next central bank meeting and the step up in the following meetings (in basis points). For example we see 27bp (or 0.27%) of hikes priced for the 1 Feb FOMC meeting, and 45bp for the Feb BoE meeting.

Pepperstone no representa que el material proporcionado aquí sea exacto, actual o completo y por lo tanto no debe ser considerado como tal. La información aquí proporcionada, ya sea por un tercero o no, no debe interpretarse como una recomendación, una oferta de compra o venta, la solicitud de una oferta de compra o venta de cualquier valor, producto o instrumento financiero o la recomendación de participar en una estrategia de trading en particular. Recomendamos que todos los lectores de este contenido se informen de forma independiente. La reproducción o redistribución de esta información no está permitida sin la aprobación de Pepperstone.