- Español

- English

- 简体中文

- 繁体中文

- Tiếng Việt

- ไทย

- Português

- لغة عربية

Analisis

Will this hike prove to be the last in the cycle?

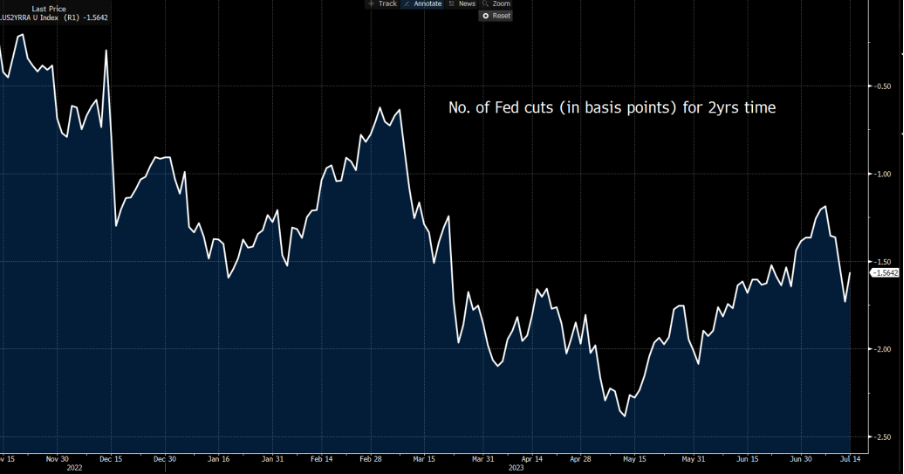

The market is certainly feeling the higher conviction that US inflation is trending in the right direction, and the moves in forward interest rates markets to revisit price cuts in 2024 were the key reasoning why the USD has been so heavily sold. We can look at the SOFR interest rate market and see on Thursday that an aggressive -160bp of cuts were priced for 2024, although this has come back on Friday, closing at -148bp. The USD and gold are moving closely to these expectations and the degree of easing from the Fed from March 2024.

The FX market is front running possible normalisation of Fed policy in 2024, and this is lifting risky assets and high beta FX (NOK and SEK especially). The question then is whether the USD sell-off has gone too far and we are at risk of mean reversion early this week – the upside in the USD will likely see equity markets finding better sellers, which all saw big gains last week.

US and Asia corporate earnings roll in this week, with SAP also getting a focus for GER40 traders, and in a quiet data week, earnings may play an influence. There is also a focus on the special rebalance of the NASDAQ, which aims to reduce concentration risks.

We start the week on a quiet tone with Japan offline for Marine Day and the potential for HK markets to close as tropical storm Talim is upgraded to a no. 8 typhoon signal.

As the week rolls on, though, one of the key topics of conversation is whether the BoJ will alter its YCC policy at the BoJ meeting on 28 July – recent press suggests moving the 10yr JGB (Japan govt bond) cap (currently set at -/+0.50%) set by its YCC program is a real possibility. Should they move it to 0.75% or even 1%, it could have big implications for the JGB market and, by extension, the JPY.

We’re coming off a big week for the US rates market, and the USD is moving very closely in alignment to this pricing – the market sees the Fed cutting before other DM central banks and by a greater degree. This is something the market is very keen to explore and could have far-reaching implications for the USD into Q3 and certainly Q423.

Rearview alpha plays - what worked best last week:

- G10 and EM FX play of last week: Short USDSEK (-5.4% WoW), short USDHUF (-4.9% WoW)

- Equity index plays - long FRA40 (+3.6% WoW), long AUS200 (+3.4% WoW), long NAS100 (+3.4% WoW)

- plays – Long Copper (+3.9% WoW), Long XAGUSD (+8% WoW)

- Equity plays for the radar – Tesla (report earnings after market Wednesday) – the implied move (on the day of earnings) is 3.5%. The stock is looking for direction with the bias defined by a break of $284.25 or $265.10. Netflix report earnings at 6 am AEST on Thursday, with the market seeing an implied move of 4%.

- Crypto plays: Long XRP (+53.4% WoW)

Marquee event risk for the week ahead:

- US 2Q earnings – in the week ahead, we receive earnings from 11% of the S&P500 market cap. Trader favourites include Bank of America, IBM, Morgan Stanley, Goldman Sachs, Netflix, Tesla, and AMEX.

- For GER40 traders, do consider that SAP SE report Q2 23 earnings on 21 July (aftermarket) – SAP holds a 9.4% weighting on the GER40, making it the biggest index weight, and therefore any outsized moves in SAP could influence the index - Can we see SAP break above E130 and to the highest levels since Oct 2020?

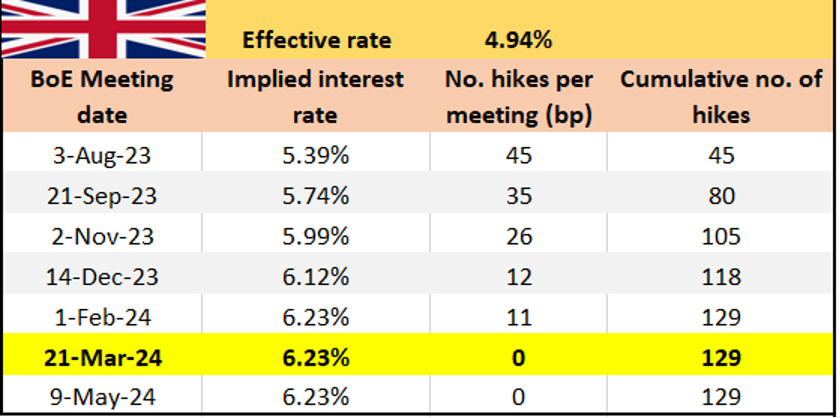

- UK CPI inflation (Wed 16:00 AEST) – The market expects UK core CPI to remain at 7.1%, while headline inflation is expected to fall to 8.2% (from 8.7%). The last 4 UK core CPI prints have come in well above expectations. With the market pricing 45bp of hikes from the BoE at the 3 Aug meeting, we’d need to see a huge downside surprise (in core CPI) to lower expectations that the BoE will hike by a further 50bp.

UK rates pricing – 45bp of hikes is priced for the 3 Aug BoE meeting. 129bp of hikes priced by March.

- Australia (June) employment report - (Thurs 11:30 AEST) – the median expectation is that 15k net jobs were created in June, with the unemployment rate remaining at 3.6%. While we look ahead at next week’s Aus Q2 CPI, the jobs report could influence expectations of RBA action on 1 August, which is priced at a 36% chance of a 25bp hike.

- Japan CPI inflation – the market sees JP headline inflation rising to 3.3% (from 3.2%), while core is eyed at 4.2% (4.3%) – with the market debating whether the BoJ alters its Yield Curve Control (YCC) program at the 28 July BoJ meeting, this data could influence that debate and potentially result in further pronounced moves in the JPY.

- China Q2 GDP (Mon 12:00 AEST) – expectations are for a rebound in GDP to 7.1% YoY (from 4.5% YoY). At the same time, we also get China’s industrial production (consensus at 2.5%), retail sales (3.3%) and fixed asset investment (3.4% YoY). Watch price action in CHINAH, copper, USDCNH and the AUD over this data.

- US retail sales (Tue 22:30 AEST) – it’s a quiet week for US economic data with US retail sales and various housing data points among the highlights – the market eyes 0.5% MoM retail sales growth.

- EU CPI (Wed 19:00 AEST) – the central case is for core inflation to remain at 5.4%, while headline CPI is expected to fall to 5.5% (from 6.1%). A 25bp hike at the next ECB meeting is a near certainty, but a lower inflation print may see longer-term expectations fall.

- Canada CPI inflation (Tues 22:30 AEST) – the market sees headline CPI at 3% (from 3.4%), and the core median at 3.7% (3.9%). The next BoC meeting isn’t until 6 September, so this CPI print may fail to move the CAD too intently.

- NZ CPI inflation (Wed 08:45 AEST) – The market sees NZ inflation running at 5.9% YoY (from 6.7%), and 0.9% QoQ – One for the NZD traders, but unless we get a blowout number, the RBNZ should hold rates steady at the next meeting on 16 Aug.

- South Africa central bank (SARB) meeting (Thurs - no set time) – One for those running USDZAR exposures, but the prospect of a 25bp hike to 8.5% seems likely.

- Turkey central bank (CBT) meeting (Thurs 21:30 AEST) – the market expects the CBT to hike the one-week repo rate to 18.25% (from 15%) – eyes on your USDTRY exposures.

Fed speakers – With the Fed entering its blackout period, we see no Fed speakers until the FOMC next week.

ECB speakers – Lagarde, Lane, Vasle, Elderson, Vujcic, Villeroy

BoE speakers – Ramsden

RBA speakers – No individual speakers – RBA July meeting minutes (Tues 11:30 AEST)

Related articles

Pepperstone no representa que el material proporcionado aquí sea exacto, actual o completo y por lo tanto no debe ser considerado como tal. La información aquí proporcionada, ya sea por un tercero o no, no debe interpretarse como una recomendación, una oferta de compra o venta, la solicitud de una oferta de compra o venta de cualquier valor, producto o instrumento financiero o la recomendación de participar en una estrategia de trading en particular. Recomendamos que todos los lectores de este contenido se informen de forma independiente. La reproducción o redistribución de esta información no está permitida sin la aprobación de Pepperstone.