- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Todays ‘The Trade Off’ is out!!! Blake and I talk about the CZ/FTX take down, moves in crypto, the US CPI preview and set-ups we like in the market – it’s all going on, get in on the mix: https://youtu.be/ORHPhuZ4mMg

While developments in the crypto space get the lion's share of attention on social media, it's US CPI Day and this is a big risk to broad markets – the CPI data comes out at 00:30 AEDT / 13:30 GMT.

The first question I ask about a major risk event like this, where the market receives new intel which will potentially alter the thinking of the Federal Reserve, is where the balance of risk sits – and what outcome in the data would offer a more pronounced move in a market.

The options market teaches us to think in the distribution of outcomes and that is how we can think in playing data – it is good for risk management, and whether we choose to hold exposures over an event, reduce, and in some cases add.

To help us with our assessment, we can consider broad market positioning, flow and price action into the event, consensus expectations from economists and market rates pricing.

Initially, we can see the median consensus estimate from economists is for US core CPI to rise 0.5% MoM, which equates to a 6.5% YoY (from 6.6%) pace – the range of estimates sits between 6.6% and 6.4%, so this can shape expectations of what would constitute a market ‘surprise’. Headline CPI is expected to print 7.9% (from 8.2%), but it is the core measure the Fed are more focused on.

While the market is desperate to see evidence of peak inflation/peak rates I would argue a core inflation print at 6.7% would cause a greater reaction to markets than a 6.3% print.

On one hand, the market is so used to US inflation prints coming in above expectations, where we have seen 10 of the last 12 CPI prints come in above expectations – however, with so many strategists putting out charts of various forward-leading indicators showing inflation is set to gravitate slowly lower, I’d argue a higher than expected CPI print is where we really see confusion in markets and participants have to do a re-think.

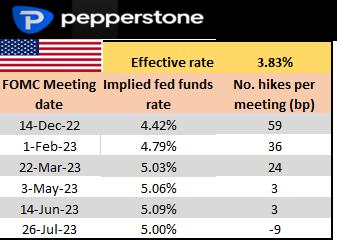

Rates Review – what’s priced by markets for the next central bank meeting – and the step up (in basis points) per meeting.

On the rates side, we see the market is pricing 59bp of hikes for the December FOMC meeting – this equates to a 36% chance of a 75bp hike at that meeting – we see the terminal pricing of the future fed funds currently at 5.08%. Again, it feeds into the idea that a core CPI print above 6.6% would likely see expectations of a 75bp hike move to, and even above, a 50/50 proposition and the USD would rally 1% or so, and we could see the NAS100 -2% and gold down 1%. In G10 FX, I would expect the AUD and NZD to underperform.

A print below 6.4% would see the market price out the 9bp of additional hikes and price a firm 50bp hike for the Dec FOMC meeting. Clearly, we look at the components of the inflation basket to see the various trends, but the initial move would be lower in 2yr bond yields, and the USD would fall, the NAS100 would rally, as would gold.

We can assess the tail risk outcomes, but the high probability is we see a number that is fairly in line with expectations – that is obviously harder to call, and we may need to wait for the guidance from Fed speakers in the session ahead to see how they interpret it.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.