- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Macro viewpoint - bad real rates causing cracks to appear in risk

The question I ask is whether the bulls can really defend 1764 when US real yields are moving higher and the true cost of capital is rising? I suspect they’ll find it hard and there's a clear opportunity cost in being in a yield-less asset when real (inflation-adjusted) returns in the bond market, while still poor are becoming less so.

Another point that's been focused on in the macro community is the notion of an inflation overshoot and utilising gold as a hedge against price pressures. The debate recently raised in academic circles given the incredible levels of stimulus yet to make its way into US economics and as the vaccine is rolled out and pent-up demand is realised in services.

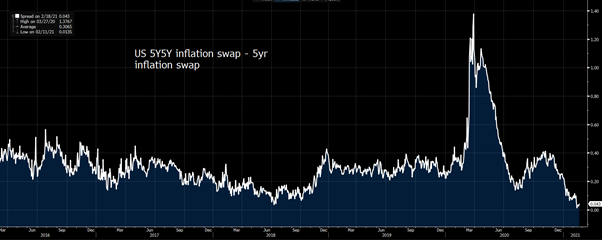

The Fed are not clearly worried and if you look at US 5y5y inflation swaps (they measure expected 5-year inflation expectations starting in five years’ time) and subtract US 5-year swaps (measure expected inflation over the coming five years) we can see this at 2bp. In effect, we can look at the premium forward inflation expectations command over near-term expectations and them at equilibrium – that being, there's no expected overshoot. The need to hedge portfolios significantly with gold, even if the low correlations allow managers to spread their variance is low and as Jeffrey Gundlach tweeted “Bitcoin may be The Stimulus Asset” and he’s a gold bull.

(Source: Bloomberg)

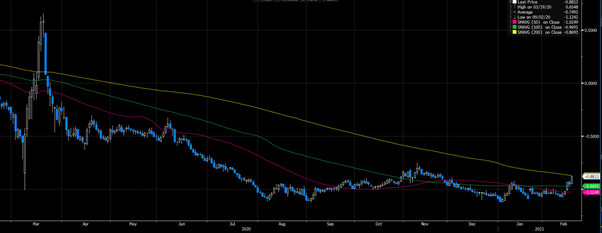

The interesting factor we’ve seen is that US 10-year real rates have gained 7bp to -88bp yet the USD is lower, with GBPUSD the flyer and eyeing 1.4000. The correlation between US real rates and the USD has been so strong of late, but today it broke down and went the opposite way. Let’s recall that real Treasury yields (or TIPS) are determined by inflation expectations (or ‘breakevens’), these can be calculated by the difference between US Treasuries and TIPS (Treasury Inflation-Protected Securities). On the day 10yr US breakeven rates have dropped by 4bp to 2.17% and breaking below the November uptrend suggesting we’ve seen a short-term peak in inflation expectations.

(Source: Bloomberg)

Real yields are higher, but they're higher because of bad forces with inflation expectations falling faster than nominal US Treasuries. No one likes this and we can coin this ‘bad rising real yields’ and I’m surprised higher beta FX like the ZAR is not finding sellers in this dynamic.

Fine, we can handle higher real rates if inflation expectations are rising but rising real rates when inflation expectations are falling represents a genuine tightening of financial conditions and it’s no surprise that equity markets have taken notice. I've been watching tech as a leading indicator for signs that the rise in bond yields was starting to impact sentiment as tech has benefited from low bond yields. Apple is starting to look a little vulnerable and the FANGS index is down for two days in a row, something it hasn’t done since mid-January. However, it’s the small caps, energy and material names that fared worst and the fact crude is 2% lower and below $60, with natgas -5% is clearly not helping the inflation call.

So again, we look at real yields and the underlying cost of capital. At this stage the move higher in ‘bad real yield’ is calling the reflation trade into question. That said, there's absolutely no panic selling. We’re only seeing a modest increase in implied volatility while industrial metals risk FX push higher – that could change if the market feels bad real yields push higher and gold will likely fall towards $1700.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.