- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

The same can be said in AUDJPY overnight vol which refuses to push above 10% despite China’s Q1 data clearly going to take a hit from the reduction in consumer activity, fallout in confidence and a refocus of supply chains – 10% being a level I feel defines sentiment in FX, where a push through here would indicate FX markets, and even asset classes like equities, bonds and credit may start to see more pronounced moves in price.

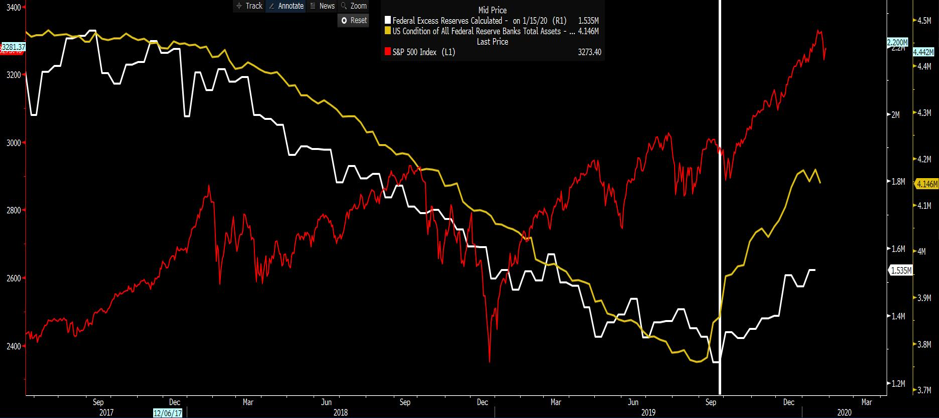

The fact is, vols has fallen a touch thanks again to the Fed, and ironically Fed chair Powell, even touched on the idea that the Fed weren’t directly trying to suppress volatility in money markets. Perhaps directly no, but the Fed’s balance sheet expansion, subsequent increases in excess reserves, along with a widely held belief that any rapid tightening of financial conditions will be met with a show of defiance - with interest rate cuts, yield caps, or increased liquidity conditions, has been a strong contributor to record low vol seen in FX markets, and subdued vol in fixed income and equities too.

Tweaks to IOER and its liquidity timetable

The Fed did lift IOER (interest earned on excess reserves) by 5bp to 1.60%. This was a point of contention for interest rate traders, who were divided on whether they would lift IOER at this meeting or in the months ahead. Outside of rates markets, this hike mattered little for price discovery, other than it would lift the Fed funds effective rate into the middle of their Fed fund target band of 1.50% to 1.75% and allow flexibility should we see excess reserves (in the banking system) grow from current levels of $1.535t into, and above $1.7t, which would have the effect of lowering the fed funds effective rate towards the 1.50% lower bounds of the FF range.

The Fed have detailed that they will remain in the market offering repo and T-bill purchases (currently running at $6ob p/m) through to Q2, which, in turn, could be the catalyst for excess reserves to lift through $1.7t. So, when they decide to phase out, or taper the program, there should be enough liquidity in the system to hold above the floor of $1.5t – a new defined level Powell has now introduced.

Introducing this floor is important, it shows Powell is clearly cognisant that the equity and credit traders have bid up risk, pushing equities to all-time highs and reducing vol in correlation with its balance sheet and increased excess reserves. So, he is concerned that any reduction here, as they phase out the program, will work against the markets, causing traders to close short vol positions (such as VIX futures) and out of equities.

(Red - S&P500, yellow - Fed's balance sheet, white - excess reserves)

Source: Bloomberg

A dovish turn on inflation

We also heard that the Fed “are not comfortable with inflation running persistently below our 2% objective”, and that read as dovish to market participants. While there are many other comments to consider, these on inflation caused the reaction with rates traders buying into January fed funds and eurodollar futures, subsequently increasing rate cut expectations for year-end by 4.5bp. We see 1.6 rate cuts now priced by December, up from 1.2 cuts.

US 2-year Treasury yields are 5bp lower on the day, and 3bp lower since the Fed meeting, with all parts of the Treasury curve lower by 5 to 8bp. Real (inflation-adjusted) yields are lower, and we see 10-year real yields turning decidedly negative at -5.5bp, with 5s -18bp and it interests me that gold is only up 0.7% given we are seeing US yield curve inversion and ever deeper negative real yields. AUD-denominated gold looks the better trade and we eye new all-time highs here.

USDJPY has lost small ground on the moves in US bonds and rates and once again looks to test the 109-handle, with solid two-way flow in USDCHF, with increased buying into 0.9730. Flip onto the daily though and see the pinbar (chart below) looking ominously in play. EM FX has seen a mixed fare and perhaps hasn’t seen the buying one would expect given we’ve seen a Fed happy to keep liquidity in check and offering a slight dovish turn on inflation. I guess we still have the 2019-nCov to work through and the economic overhang that will require the PBoC to go hard on liquidity to keep hibor and shibor in check and allow efficient access to working capital for Chinese businesses.

US equities have closed down a touch, although all the action is taking place post-market with Facebook and Tesla reporting. The market has treated these names very differently, with Tesla currently up 6% in the post-market trade, while Facebook is lower by the same amount. Not sure this helps NASDAQ futures too greatly though. We see the lead in for Asian equities as somewhat soggy, but I’d expect the ASX 200, Hang Seng and Nikkei 225 to open modestly lower.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.