- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

The Daily Fix: Understanding the economic impact of the coronavirus

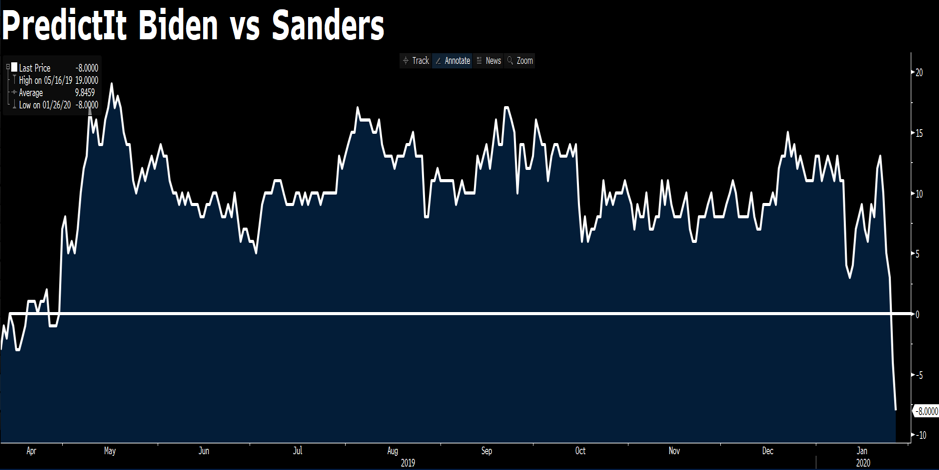

Not just to convincingly take out the Iowa caucus (on 3 February), but is now 8 ppt ahead of Biden to take the full Democrat nominee to go toe-to-toe with Trump in the three live Presidential TV debates (through September-October), and the Presidential election on 3 November. It feels like this is the time to start applying US election hedges.

In the near-term though, it’s about hedging economic risk, and there is no doubt that there will be an impact on the Chinese economy, although, it may not show up in the official statistics until late March. The question is how dramatic the impact will be and what will be the ramifications on the global economy and demand in general.

Contrasts between the annual number of deaths between Coronavirus relative to say cardiovascular diseases, road incidents and other factors have been made, and while there is a perspective here, to me when I’m looking at the economic argument, this is somewhat irrelevant. What we’re trying to understand is the economic impact shutting transport links and imposing strict travel controls in Beijing and Shanghai, as well as effectively quarantining 14 cities and millions of people will have.

With so few in markets holding any formal training in virology, trying to connect the dots is incredibly complicated, and, as with any thematic that is gripping markets and causing risk aversion, we need to understand the circuit breaker. Obviously, that comes from a cure or a plateau in the number of cases of people around the world getting the virus. But the fact is that the incubation period is up to 14 days, where the virus can be contagious during this period, even if the host has no symptoms and this makes this situation very hard to comprehend just how bad it is, or how much worse it can get.

How do we fully price risk, if we have such limited visibility on how bad this could get, not just in terms of contagion, but the impact this will have on economics and we may have to wait for weeks until this is portrayed in the formal data releases?

It’s no surprise to see rates markets moving up a gear as traders start to anticipate a future central bank response. In the US, for example, we see a full 25bp cut priced by November (from December), with two and five-year Treasury yields lower by 5 and 6bp points respectively. In fact, we are back talking Treasury yield curve inversion again, with 2s v 5s at a slight inversion, while 2s vs 10s curve sits at 15bp and below the 200-day MA.

If it weren’t for tomorrow's Q4 Aussie inflation print being so important, and Aussie rates market taking its variance more from domestic factors over global factors, then I’d expect the 24% implied probability of a cut (at the March meeting) to be higher. Perhaps most pertinently, while China’s bond market is closed, we can see USDCNH trading at 6.9858, with a punchy rally of 0.8% on the session - the market is thoroughly expecting a response from the PBoC.

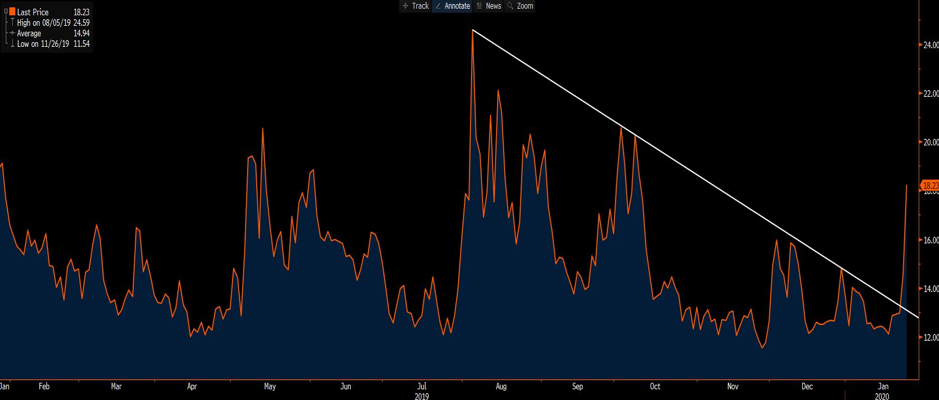

Staying in the FX theme, and we see its all buyers of JPY and CHF, which makes sense given implied vol has moved higher, with the VIX index into 18.2% and AUDJPY 1-week implied, if we want to use this pair as a proxy of risk, testing 10% and a level vol traders have been very happy to sell into. It’s all sellers of EM FX, where ZARJPY has lost a lazy 1.8%, with good selling also seen in the RUB and CLP.

In the equity world, a buyer’s strike is in store for Asia today, although Japan has already part reacted with a fall of 2% yesterday. At this juncture, Nikkei 225 futures indicate the Japanese index should open 0.8% weaker. Chinese equity markets remain closed for Lunar New Year and should remain so until 3 February, although, we can focus on the A50 index futures, which to be fair have been sold fairly aggressively since the 14 January turn and actually reside 5.5% lower from Fridays ASX 200 close.

The S&P500 closed -1.6%, with volumes some 17% above the 30-day average, with all sectors lower on the day, and it won’t surprise to see energy and materials getting a decent wack, with WTI crude trading into $52.13, although price sits a touch higher at $52.75 now. All eyes fall on crude, as a test of $50.70 – the series of low points seen between July and October – suggests this is a make or break level and we expect verbal support from OPEC to ramp up into here. We also saw Aussie SPI futures reopening overnight and sit 1.6% lower from the ASX 200 cash close, hence this marks our opening call. We watch for volume, and the general feel around price, but it feels that there will be limited panic, just a massaging of positioning of non-core longs and better signs of hedging.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.