- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

The Daily Fix: Can positioning take US equities to new highs?

That may change with the wind to the backs of currencies such as the AUD, NZD and MXN. Certainly, the MXN has worked well of late, and it feels like in the absence of a pullback in stocks and a further reduction in implied vol that USDMXN heads for 23. EURMXN could push through the 50-day MA (25.64) amid the favourable environment for carry positions, although, much still depends on price action in crude which, as I say is giving back some of last week’s 25.1% rally.

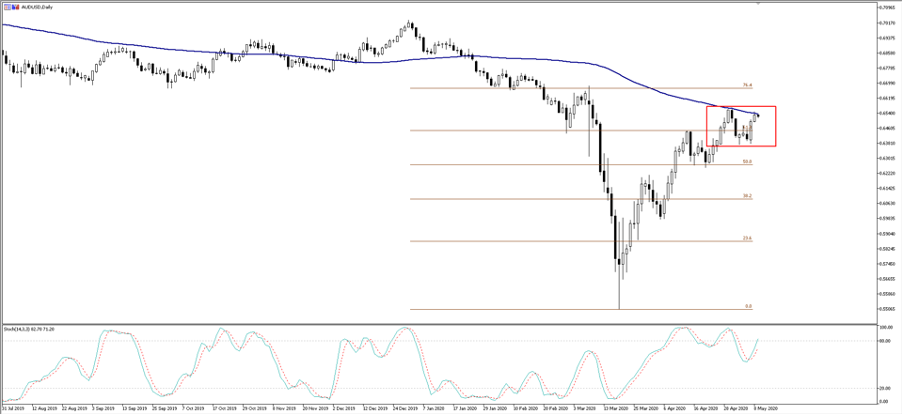

AUDUSD continues to have lock-on on the S&P 500 futures, with the US equity benchmark putting on 3.5% last week, dwarfed only by a 6% and 5.5% rally in the NASDAQ and Russell 2000, respectively.

(AUDUSD daily – pushing the 50-day MA)

On the daily, the S&P 500 will be eyeing a break of the 29 April high of 2954 and from we make an assault at 3000, which is obviously the round number, but the 100- and 200-day MA also sit here too. We are also told this is the line, where the CTAs (trend-following funds) flip to increase long positions in S&P500 futures, a development that could take us materially higher. Looking at 5-day realised volatility in the S&P500, we see it has come down to 16.4%, from a high of 176% (17 March) and we’re back to pre-crisis levels and one suspects if vol sellers push the VIX closer to 20% (currently 27.98%), vol-targeting funds then enter the fray too.

(White – S&P500 5-day realised volatility/RV, orange – 30-day RV)

This, again, would be positive for risk FX such as the NOK, AUD, NZD, MXN and ZAR.

I have been guilty of not wanting to chase this rally in equity indices, but the lack of any follow-through in the selling (pick up in vol) has certainly lowered the impulse to short risk. I do see us moving past peek stimulus inspiration, with the Fed’s balance sheet growing at an ever-slower pace, as they do for other central banks, although the commitment to do more should we see a second wave in the corona virus is key.

On the fiscal side, the US House is due to vote on a Phase 4 bill on Thursday, rumoured to be close to $750b, and it’s uncertain that will pass, with Trump making it clear he wants to tie this in with a payrolls tax cut.

It is also clear that this is not a time for thinking too intently about valuation, with the S&P 500 commanding an incredible 23.06x 2020 earnings, while 2021 FY earnings sit at 18x - economics have not played into considerations either. These are markets boosted by actions from the Fed to support credit and liquidity more broadly.

Re-positioning from hedge funds, specifically the systematic and rules-based crowd has been key and will be the reason, if it happens for new highs in US equity markets.

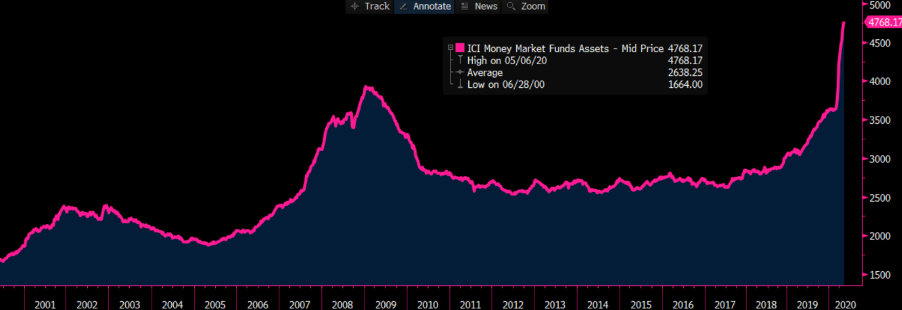

Consider that cash in money market funds, the safest of safe, has grown 30% since March, so there is still a ton of cash on the sidelines.

We can also look at the futures position in S&P 500 futures held by non-commercial players and see this held net by short 222k contracts – that’s the largest net short positions held since 2015 and over two standard deviations of the 10-year average.

(Total US$ value in money market funds)

(Source: Bloomberg)

The disconnect between economic reality and valuation is keeping a lot of discretionary players from entering the market here, and that is fair as it feels incredibly wrong to buy risk - I guess that is one of the many reasons why a systematic approach can work in one’s favour.

So, we watch the S&P 500 and NAS futures through Asia, where both markets were down smalls early doors and are coming back to the flat line as I type. There is little to trouble on the data side, although tomorrows (22:30 AEST) US CPI could be interesting with headline expected to drop 0.8% MoM and core -0.2%, amid a fierce debate on whether we get inflation or deflation as a result of COVID-19.

Retail sales (Friday 22:30 AEST) would typically get a strong look-in, and calls for an 11.7% decline won’t go unnoticed, but just as we saw with the 20m jobs lost in Fridays NFP and the failure to move markets; economic data at the moment is largely irrelevant, at least for markets - who will be looking intently on re-openings in the US and Europe, with plans to do so in the UK, Australia and others.

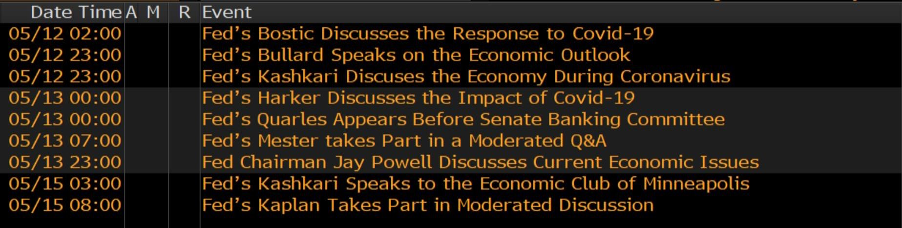

What could be important is the raft of Fed speakers this week, which you can see on the calendar below. Fed chair Powell mid-week speech will be the highlight, especially, with all the talk of negative rates that were priced into the rates market most intently on Thursday. In a crisis, you leave everything on the table, and things move so fast that what the central bankers say one day may not count the next. So, while Powell sits in the camp that negative rates are not warranted – he has been consistent on this message - it makes some sense for Powell to be vague enough to keep negative rates as a future option.

He can remove pricing from the fed funds future by lifting interest earned on excess reserve (IOER) by 5bp. However, with yields on 2- and 5-year Treasuries at record lows, in turn supporting sentiment more broadly, and reducing the appeal of the USD, it has pushed traders out the risk curve. Therefore, it makes sense for Powell to be somewhat vague on the subject.

As the week rolls on front-end yields (2 and 5-year USTs) could matter for the USD this week and presumably for gold too, which maintains the 1738 to 1675 range. USDCNH continues to be a central focal point and barometer of sentiment towards the US-China relationship, while inflation expectations and implied vol continues to be central too.

Good luck to anyone trading the Bitcoin Halving today, with price trading lower into the event. It seems we are seeing a buy the rumour, sell the fact scenario play out before the fact it seems. For anyone interested in this event , I interviewed Grant Colthup, CEO of Mine Digital on the matter and he gives a balanced and considered view on the event and the prospects going forward

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.