- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

I'm not sure there's been a trigger, nor need there be these days, and I'm just not buying that it has been driven by gold and specifically on Warren Buffets bet on Barrick Gold Mining. Although, I see financials as by far the worst performing S&P 500 sector. Either way, this one circular trade is working, although real Treasury yields are down just 1 basis point on 5-year real Treasury and 3bp on 10s. I guess, as we saw last week, it doesn’t take much to convince the market these days.

While many watch out for a new ATH in the US500, which has been given some additional life with Goldman’s upping its year-end forecast to 3600 (from 3000), I stay long NAS100 and may even look to add. Pullbacks are pretty manageable and it is a Teflon market, whereby you can throw enough grease at it and nothing really sticks. Look at the daily of Nvidia (+6.7%) and Tesla (+11.2%) these two names are in beast mode right now and if you like trends and momentum, then these two names (and also Union Pacific – UNP) are the sort of plays you use as case studies for those starting to cut their craft as traders. The only thing that can really derail the bulls is higher Treasury yields and as I have been suggesting if these move higher in the weeks ahead then long Russell2000 and short NAS100 will be a trade I'll be on.

The data flow and event risk has been on the light side, with NY manufacturing coming in at 3.7 and well below expectations and a NAHB housing market index which beat but will not have impacted sentiment in any form. The bigger events that could rock the dial remain the DNC, starts tomorrow. Read about it here if you missed it and Wednesday’s (Thursday at 4:00 AEST) FOMC minutes.

Aussie banks to drive the AUS200

Watch the open of the ASX200 and while SPI futures have closed higher and our opening calls look positive. But news that Westpac have shelved its dividend is unlikely going to be taken well by shareholders. The banks will be the driver of the AUS200 for those involved here.

Are we about to see a new leg lower in the USD?

In FX markets the USDX is down 0.3%, with EURUSD a decent contributor to that and we see price eyeing a re-test of the June highs of 1.1910. A close above here and things get very interesting this week and it will not surprise to see EU equity markets really start to underperform US markets if the EUR takes a leg higher. It would also be interesting to see how USDCNH fares here, because the European authorities will not like the EUR appreciation against the USD but will even more concerned if EURCNH moves higher as this would start becoming ever more deflationary. The trade-weighted EUR, for reference, now sits at the highest levels since September 2018.

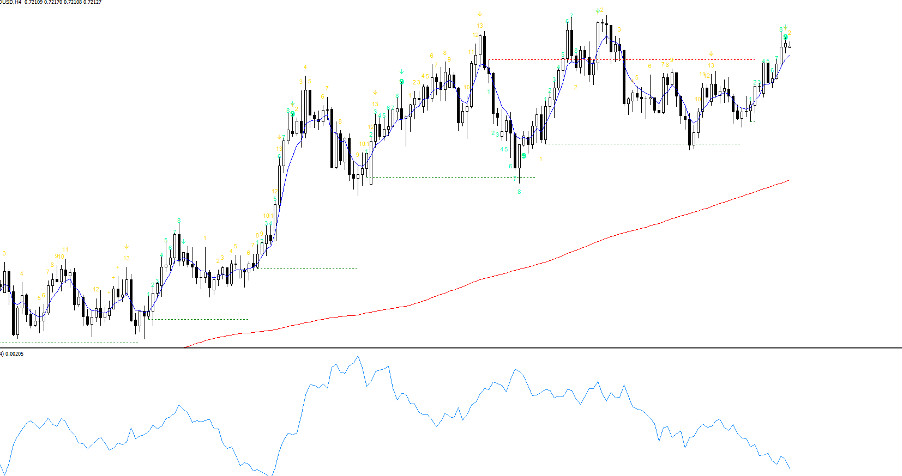

The AUD has been the star of the session, with AUDUSD following US equities as it often does so well. We watch for a break of the June highs as confirmation of that the bullish trend is set to continue. However, price is above the 5- and 20-day EMA and pivot point, so unless Asia can convince me otherwise, I will hold a trading bullish bias, potentially looking at longs into 0.7195. AUDNZD has been another pair I have focused on last week, and that hit the target of 1.1000, where the move has been one-way traffic. Until price can at least close below the 5-day EMA and we see consolidation, then I am happy to hold longs.

AUDUSD 4-hour

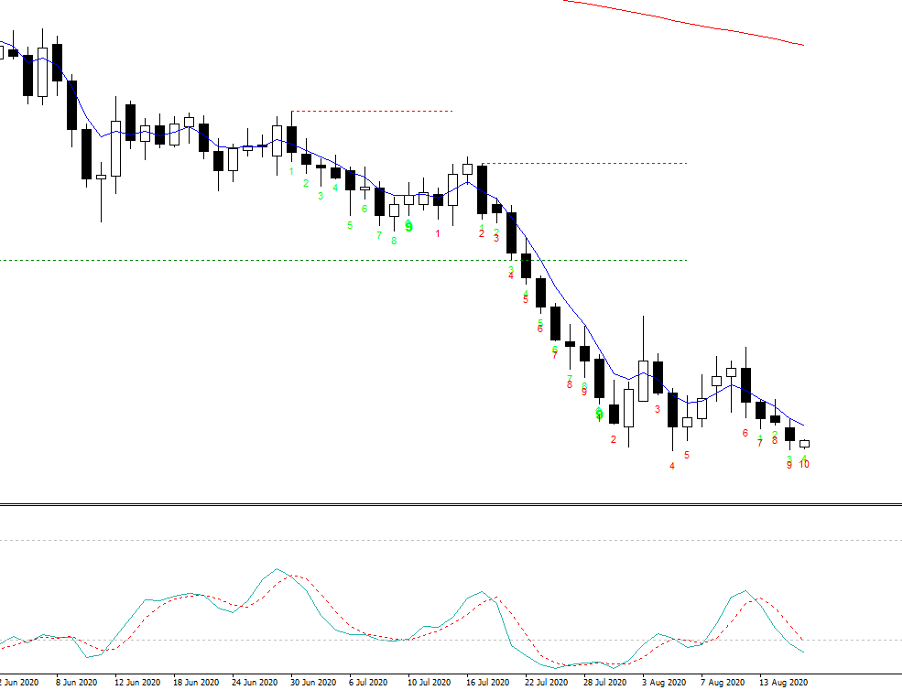

USDCHF has been well traded and the flow has certainly picked up, with price toying with the idea of breaking lower and through the 0.9050 double bottom. Is this pair about to resume its bear trend or is it putting in a bottom?

USDJPY has also caught the interest, with price having a reasonable move to the downside, with price testing the 106-handle.

The bulk of the flow remains in precious metals, with gold and silver getting a solid working out and Bitcoin also getting increased interest. We’re back talking about $2k again on gold and seemingly in a cleaner structure after the dump the bulls needed to see.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.