What is CFD trading and how does it work?

CFDs offer a flexible way to speculate on financial markets or hedge an existing portfolio. Find out how they work, their advantages and risks, how they differ from traditional investing and how you can start trading them.

What is CFD trading?

A CFD, which stands for ‘contract for difference’ is an agreement between a broker and a trader to settle the difference in an asset's value from the trade's opening to its closing.

Because CFD trades are handled between two parties and outside of a formal exchange, a CFD is a type of an over-the-counter financial derivative, whose value is based on or ‘derives’ from an asset, such as currency, stock or commodity. With derivatives you can speculate on the asset’s upward and downward price movements without owning the underlying asset.

Once you decide to close and exit a CFD trade, the difference between the opening and closing price is either your profit or loss. The more the market moves in line with your prediction, the more profit you'll make. Conversely, the more the market moves against you, the more you'll lose.

How does CFD trading work?

CFDs replicate the behavior of financial markets, allowing you to buy and sell them similarly to the underlying assets they represent.

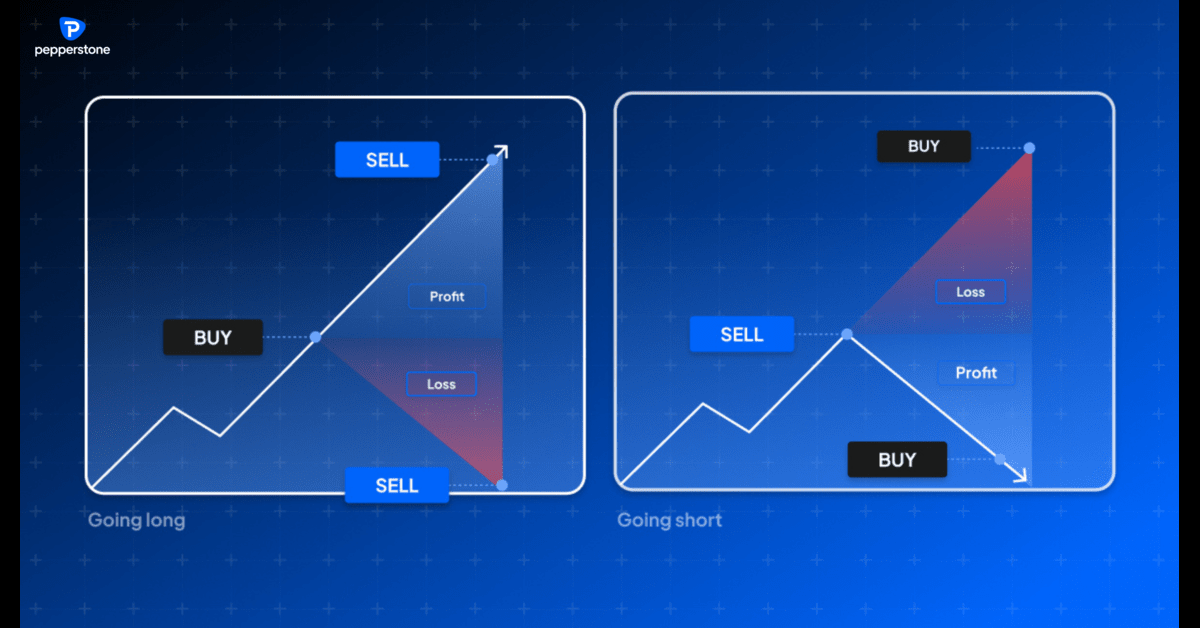

A major advantage of trading CFDs is the flexibility to speculate on an asset's price movement in either direction - going long or short. Trading both ways allows you to take advantage of upward and downward market movements in any conditions.

Going long

If you anticipate the asset’s price will go up, you can go long (buy) with the expectation of selling it at a higher price later. If the price rises, you profit by receiving the difference in value. However, If the price has dropped, you incur a loss and owe the broker the difference.

Going short

On the contrary, if you believe the value of an asset is going to decrease, you go short, by selling the asset. You will profit if the asset's price drops as anticipated and you will incur a loss if the asset's price unexpectedly rises.

Example

Imagine you think that the X stock is going to go up in value. You could gain exposure the traditional way by buying 100 shares outright, paying for them in full and taking ownership. Or you could instead trade 100 CFDs on the X stock, gaining the same exposure with a small initial deposit. Let’s put this into practice with the following scenario.

A trader buys 100 CFDs on the X stock, valued at $2.00 per share. Their total cost is $200 (100 units × $2.00), though he doesn't put down the full amount. CFDs are leveraged products, so he only puts down a small portion of the total value of the trade. This is known as margin, which we’ll discuss later.

Later, let’s say the price of the stock increases to $2.50 per share. The trader decides to sell these 100 CFDs at the higher price, gaining $0.50 per CFD. His total profit will be $50 (100 × $0.50 = $50).

In the opposite outcome, the stock’s price drops to $1.50 per share. The trader decides to sell the CFDs at this lower price. He will end up losing $0.50 per CFD and in total $50 (100 × $0.50 = $50).

In both cases, the extent of profit or loss depends on how much the asset's price moves in relation to the trader’s prediction.

How are CFDs priced?

CFDs are priced based on the value of the underlying asset they represent, with adjustments to reflect transaction costs like spread, commission, and overnight charges. Let’s further unpack these terms:

What is a spread?

The spread is the difference between the buy price (ask) and the sell price (bid). This is the broker’s fee for facilitating the trade. For instance, if a company’s stock is trading at $175.25 (bid price) and $175.75 (ask price), the CFD price will be similar, with a slight adjustment to account for the broker’s spread. If the CFD price is $175.00 (bid) and $176.00 (ask), for example, the spread is $1.00.

Tighter spreads are generally more advantageous to traders because they reduce the cost of trade entry and exit. The spread size varies depending on factors such as the volatility and liquidity of the financial instrument.

What is commission?

In CFD trading, commission is a fee that a broker charges you for opening and closing a trade. It is usually a small percentage of the trade size. For example, if a broker charges 0.1% commission and you buy $10,000 worth of share CFDs, your commission fee would be $10.

Depending on your account type, some brokers may charge commission on trades or offer a wider spread instead of a commission. Make sure to check your account details to understand any fees applied.

What are overnight funding charges?

Holding a cash/spot CFD position overnight incurs a charge, called a swap fee or overnight funding fee. This happens because the broker funds the leveraged portion of your trade - essentially lending you money to control a larger position - and charges this fee for carrying that ‘loan’ past the market’s closing time. If you trade forward CFDs instead, you don’t have to pay any swap fees as they’re already covered within a wider spread.

Understanding how CFDs are priced helps you evaluate trading costs and make informed trading decisions. For a full view of the fees associated with CFD trading, visit our costs and charges page.

Leverage in CFD trading

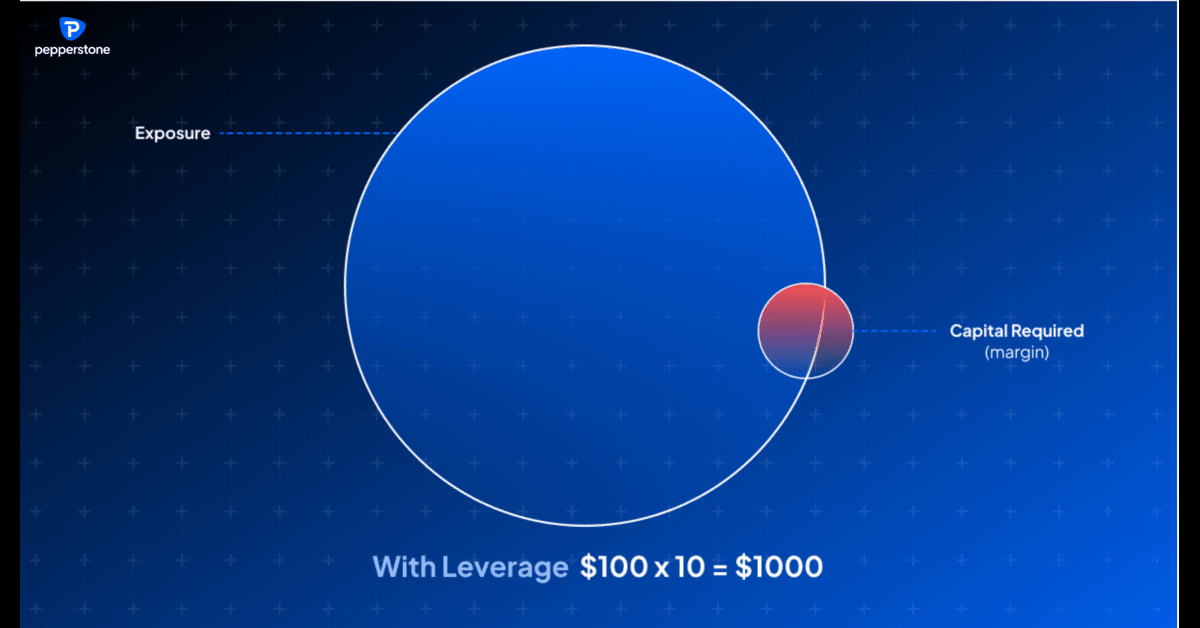

One of the standout features of CFDs is the use of leverage.

Leverage allows you to control a larger position with a smaller amount of capital (margin), so you can trade positions far greater than your initial investment. For instance, if a broker offers a leverage ratio of 10:1, you can control a $10,000 position with just $1,000 of your own money.

To illustrate this, consider a scenario where a trader wants to invest $1,000 in Brent crude oil, and their broker requires a 10% margin. In this case, the trader would only need to deposit $100 to initiate the trade.

While leverage amplifies your profit potential if the markets move favourably, it also amplifies your risk exposure and potential losses.

Leverage is both a powerful and potentially hazardous tool in trading that should always be carefully considered.

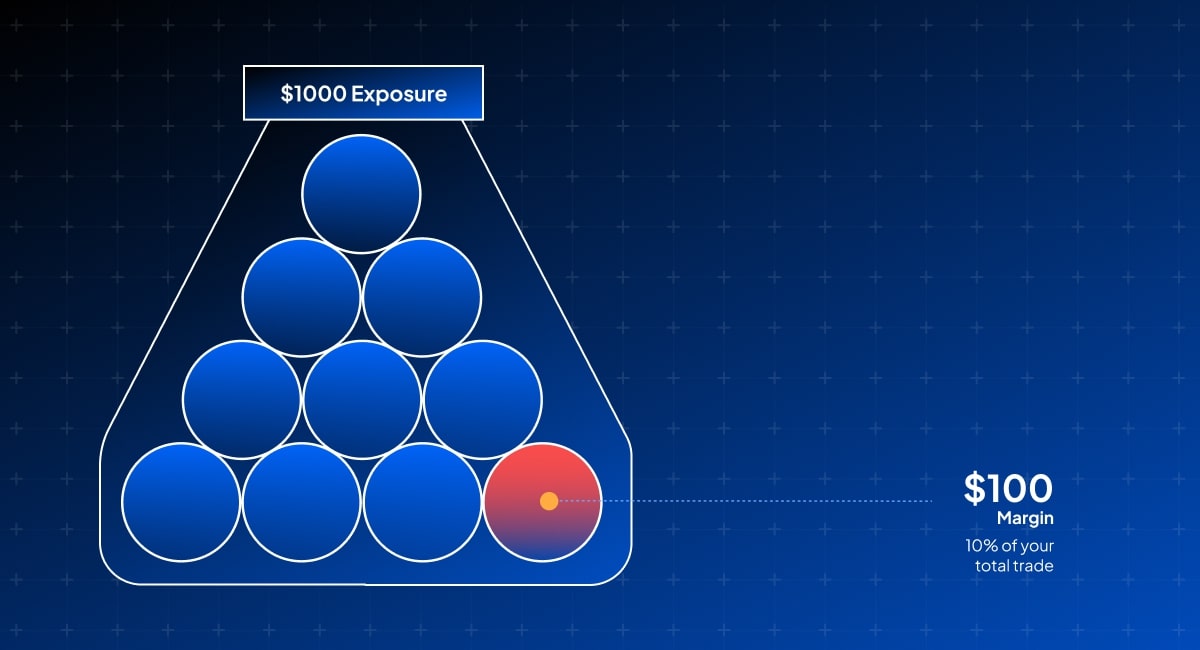

Margin

Margin is defined as the amount of funds you need in your account to initiate and sustain a leveraged position. It is usually expressed as a percentage of the total trade size and varies across different markets.

There are two primary types of margin. Both depend on your account equity – the difference between what you’ve deposited and any losses or gains from your open trades:

- Initial margin: To open a new position, the available equity in your account must be greater than the initial margin requirement.

- Maintenance margin: To keep a position open, the available equity must always be above the maintenance margin requirement. If it falls below this threshold, a margin call will be triggered, requesting that you add more funds to your account or close positions to reduce your overall exposure and therefore your margin requirement. If you ignore the requests or the equity in your account continues to fall, your positions could be closed automatically.

It's vital to note that your profit or loss is based on the full value of your position, not just on the margin you’ve put down.

Asset types available to trade as CFDs

- Forex pairs such as EUR/USD, GBP/JPY and AUD/USD.

- Shares of major companies from the US, UK, EU, Hong Kong, and Australia.

- Indices including the S&P 500, NASDAQ and FTSE 100.

- Commodities like gold, silver, oil, and natural gas.

- Cryptocurrencies like Bitcoin, Ethereum, Ripple.

- ETFs across different sectors and countries, such as the SPDR S&P 500 ETF Trust (SPY).

Pepperstone offers over 1350 CFD instruments to trade with razor-sharp pricing.

Contract sizes in CFD trading

All CFDs are traded in standardised contracts, called lots. The contract sizes depend on the asset, reflecting how those assets are traded in the underlying markets.

- Forex CFDs are traded in standard lots (100,000 units), mini lots (10,000 units), or micro lots (1,000 units). In a Forex trade, 1 standard lot represents 100,000 units of the base currency. For instance, when trading 1 lot of the EUR/USD pair, you're speculating on the price movement of €100,000 worth of the currency pair.

- Share CFDs are generally traded on a 1:1 basis, meaning 1 CFD represents 1 share. If you trade 100 CFDs on Apple shares, you're speculating on the price movement of 100 Apple shares.

- Commodity CFDs represent specific quantities of the underlying commodity, such as 1,000 barrels for crude oil or 100 troy ounces for gold. When you trade 1 lot of crude oil CFDs, you're controlling 1,000 barrels of oil. Providers will often offer mini lots (0.10 lot) and micro lots (0.01 lot) on commodities too, giving you more control over your exposure.

- Index CFDs are priced based on a specific value per point, which varies by contract. For example, when trading the S&P 500 index, each CFD contract might be valued at $10 per point movement, but this can differ by broker.

CFD trading example: Gold

Imagine a trader thinks that geopolitical instability is likely to encourage people to invest in gold. The broker quotes the gold spread at $3,000.00 - $3,000.10, and the trader believes that there is potential for the price to climb higher.

He decides to buy 5 mini lots (0.10 of a lot, or 10 troy ounces) of the broker’s spot Gold CFD at the offer price of $3,000.10. The total value of the position is $150,005 (10 troy ounces × $3,000.10 x 5).

Over the next few days, the trader observes an upward trend in the gold price, and the broker's quote updates to $3,025.10 - $3,025.20. The trader decides to close the position by selling at the bid price of $3,025.10.

Outcome

To calculate the profit, we need to consider the price movement and the contract size. The price moved favourably for the trader from $3,000.10 to $3,025.10, representing a movement of $25.

Since the trader’s exposure is 5 micro lots, the total profit is (10 troy ounces x 5 x 25) $1,250.00.

If the market had moved 25 points in the other direction, the trader’s loss would have been $1,250.00.

Advantages of CFD trading

- Short selling: CFDs provide the flexibility to go short, allowing you to sell an asset and potentially profit from falling prices.

- Low entry costs: Trading CFDs requires a relatively small initial deposit with which you can gain access to various markets, including stocks, forex, and commodities, among others.

- No delivery or storage required: Since you're only speculating on price direction, you never have to take physical delivery of assets such as gold or oil.

- Ease of hedging: CFDs can be used to hedge risks in both leveraged and non-leveraged portfolios. This involves opening new positions in the opposite direction to protect existing trades against temporary downturns.

- Leveraged capital: As mentioned above, CFDs enable traders to use leverage, meaning only a fraction of the trade's full value is needed as a deposit. This can increase both profits and losses.

Risks of CFD trading

CFDs are inherently high-risk, and there are several aspects that you should take into consideration before trading:

- Leverage: Trading CFDs with leverage requires a careful approach as it can amplify your profits when the market moves in your favour, but it can just as easily magnify your losses if the market moves against you.

- Overtrading: CFDs can encourage overtrading and excessive risk exposure, due to the ease of entering positions with just a small deposit. This could also lead to high transaction costs over time.

- Emotional trading: Leverage can compound the highs and lows of trading. The sudden market shifts may cause stress and anxiety leading to impulsive decisions.

- Overnight funding costs (swap rates): When trading spot or cash CFDs, holding a position overnight incurs a financing fee to cover the cost of your broker maintaining it. This rate is visible on the Pepperstone platform and should be factored in before you start trading.

Managing risk in CFD trading

When trading CFDs, it is crucial to employ various risk management strategies and tools to safeguard your trades:

- Take profit/limit order: Automatically closes a position if it reaches a predetermined level you specify, to lock in profits.

- Stop loss: Allows you to specify a price at which your position will automatically close, to limit losses if the market turns against you. Note that stop-loss and take-profit levels are not guaranteed, so you might not be closed out at the exact level you specify if the market moves quickly or gaps.

- Trailing stop: Automatically adjusts as the market moves in your favour, staying a set distance behind the current price. If the market rises, it moves up to lock in profits. If it reverses, it holds and closes your position to protect gains.

- Price alerts: Some providers, such as Pepperstone, enable you to set alerts for specific price levels, so you can decide how to act if your chosen market hits a price you’re waiting for.

- Position monitoring: Regularly review your trades to ensure they align with your risk tolerance and trading strategy. Monitoring helps you stay alert to market changes and react promptly.

- Education: Enrich your trading knowledge with guides to technical analysis, fundamental analysis, risk management, and market psychology. Pepperstone offers various educational resources for traders of all levels.

Platforms for trading CFDs

Pepperstone provides a suite of five innovative platforms, tailored to fit different trading styles. These platforms are accessible at no cost and available across various devices, including mobile, tablet and desktop.

TradingView

You can link your Pepperstone trading account directly to TradingView. This platform offers advanced charting capabilities and news features to help you keep up with significant market developments.

MetaTrader 5

The enhanced successor of MetaTrader 4 offers superior performance and precision. MetaTrader 5 boasts faster processing speeds, supports position hedging, and provides advanced pending order options. It also offers a range of tools and indicators designed to elevate your trading strategies.

MetaTrader 4

The world's favourite FX platform delivers live quotes, real-time charts, comprehensive news updates, and in-depth analytics. MetaTrader 4 offers a variety of order management tools, technical indicators, and expert advisors, making it suitable for traders of any level.

cTrader

cTrader offers an intuitive interface and features customisable presets and detachable charts, ensuring a user-friendly experience. It supports advanced order execution features and it allows you to code using the C# programming language.

Pepperstone platform

Our flagship platform and app provide a secure and streamlined trading experience anywhere you are. Pepperstone’s trading app gives you access to global markets on the go, allowing you to execute real-time CFD trades across FX, shares, indices, ETFs, commodities and cryptos.

How to get started with CFD trading

- Open a CFD trading account

You can normally open a Pepperstone account within minutes, by following our four-step application process. - Choose your market

Pepperstone offers you the opportunity to trade thousands of instruments across FX, indices, commodities, shares and more. - Open your position

On the Pepperstone deal ticket, you can set your contract size, apply stop and limit orders and view your fees before you hit buy or sell. - Monitor your CFD trades

Monitor all your open trades in real time or use automation to do this on your behalf with our suite of world-class tech. Close your trades whenever you like.

Interested in trading CFDs with Pepperstone? Open an account today.

CFD Trading FAQs

How do I use CFDs for hedging?

CFDs could be an effective hedging method as they allow you to take both long and short positions, helping to counterbalance adverse movements in one trade with desirable outcomes in another.

If a trader owns $5,000 worth of Tesla shares but expects the stock price to drop, they can use CFDs to protect against potential losses. By selling an equivalent amount of Tesla shares through a CFD (going short), the trader can profit if Tesla’s price falls. The CFD profit can help offset the loss in their physical Tesla shares, reducing the overall financial impact and without having to sell their actual shares.

What is the difference between CFD trading and traditional stock investing?

When comparing CFD trading to traditional stock investing, ownership and leverage are the fundamental differences.

In CFD trading, traders do not acquire actual ownership of the underlying shares. Instead, they predict how their prices will change. If the market moves in their favour, they make a profit, but if it moves against them, they incur a loss. Conversely, traditional stock investing involves purchasing shares outright, entitling the buyer to legal ownership and any associated benefits, such as dividends and voting rights.

CFDs operate on leverage, requiring only a fraction of the total trade value as a deposit to initiate a position. This amplifies both potential gains and losses. In contrast, traditional share purchases require full payment upfront.

While CFD trading offers flexibility and speculative opportunities, traditional stock investing provides tangible ownership and direct participation in a company's equity.

How do CFD providers make money?

CFD providers make money primarily through:

Spreads: The difference between the buy (ask) and sell (bid) prices of a CFD. Traders pay the spread when entering and exiting a position.

Commission: For some assets, a small commission may be charged per trade. This depends on the CFD provider and trading account types available.

Overnight charges: A fee charged for holding leveraged positions overnight.

What markets can I trade on?

Pepperstone offers you the opportunity to trade 1350+ CFD instruments across FX, indices, shares, commodities , ETFs and cryptocurrencies.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.