How does GDP affect the financial markets

Discover why GDP is one of the most significant economic releases, how to incorporate it into your trading strategy, manage the risks involved and combine it with other major economic indicators.

Gross Domestic Product (GDP) is one of the most important economic data releases for financial markets, directly impacting currencies, share CFDs, bonds, and commodity CFDs.

Understanding GDP and its importance to financial markets

Gross Domestic Product, more commonly known by its acronym GDP, is one of the most closely watched indicators on the economic calendar. It measures the total monetary value of all goods and services produced in a country over a specific period, usually a quarter or a year.

GDP readings reflect whether an economy is expanding, stagnating, or contracting, influencing financial markets across currencies, equities, bonds, and commodity CFDs. Understanding GDP can help you position trades ahead of key economic trends, manage risk effectively, and seize market-moving opportunities across multiple asset classes.

How GDP readings shape investor sentiment

GDP has a direct influence on market sentiment, asset prices, and central bank policies. A rising GDP signals economic growth, increased business profits and consumer spending. It can also cause increased demand for shares and hence, push their prices higher. Strong GDP data can also lead to expectations of higher interest rates, making a country's currency more attractive. Conversely, slowing or contracting GDP can signal economic weakness, triggering market volatility, risk-off sentiment, and potential rate cuts. This can weaken equities and the domestic currency while boosting demand for safe-haven assets like bonds or gold.

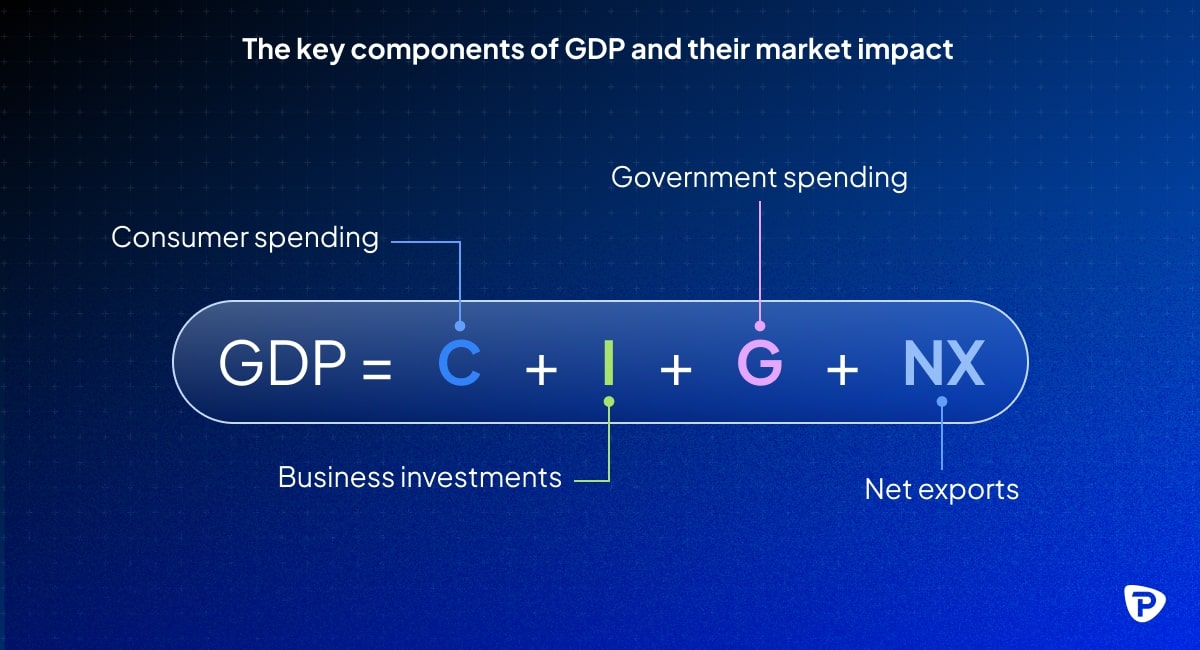

The key components of GDP and their market impact

GDP is made up of four key components, each influencing different market sectors:

1. Consumption (consumer spending) -- The engine of an economy

Household spending on goods and services makes up most of the GDP calculation. When consumers spend more, consumer goods, retail and technology shares typically perform well. A decline in spending can signal the onset of economic weakness, leading to lower corporate earnings and share prices.

2. Investment (business spending & capital expenditure) -- Seeds for future growth

Businesses invest in machinery, infrastructure, and innovation to expand operations and grow. Higher investment supports industrial, construction, and manufacturing shares. A slowdown in this component may indicate weaker corporate confidence and lead to a potential economic downturn.

3. Government spending -- The stabiliser

Public expenditure on infrastructure, defence, healthcare, and public services plays a stabilising role in the economy. Increased government spending can boost construction and defence sectors, while spending cuts could slow economic growth.

4. Net exports (Exports - Imports) -- Global trade impact

This measures the difference between what a country sells abroad (exports) and what it buys (imports). A trade surplus strengthens the domestic economy and benefits export-driven industries. A trade deficit can both weaken a currency and reduce domestic production.

What is the difference between preliminary, revised, and final GDP figures, and why do they matter?

GDP figures are released in three stages:

- Preliminary (Advance): The first estimate is based on partial data, often having the biggest market impact. The advance reading is released approximately four weeks after the quarter ends.

- Revised (Second estimate): Incorporates more complete data, refining the initial figure but typically has less of an impact than the advanced reading. The second estimate follows around eight weeks after the quarter ends.

- Final GDP: The most accurate assessment, but with a typically muted market impact. Market reactions, though, can still be volatile if there are significant revisions between releases. The final reading is published around twelve weeks after the quarter ends. Even after the final release, revisions may still occur in subsequent reports as more detailed economic data becomes available.

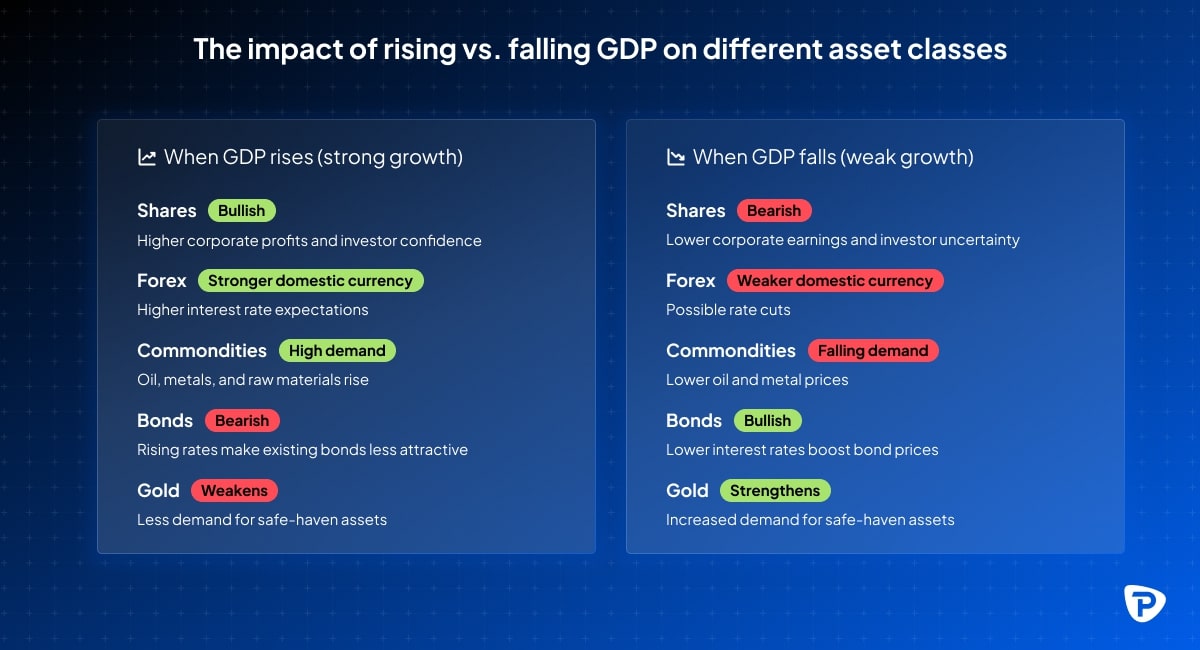

How GDP growth affects different asset classes

Currency markets

Margin FX traders closely monitor GDP as it can often provide insights into potential interest rate changes. Strong GDP growth can lead to higher inflation, prompting central banks to raise interest rates, which in turn strengthens the currency. Conversely, weak GDP growth with low inflation may result in lower interest rates or stimulus measures, weakening the currency. By tracking GDP trends, you can anticipate central bank moves and adjust currency positions accordingly.

Equity markets

Share markets generally perform well when GDP growth is strong, as corporate earnings increase, and investor confidence improves. Economic contractions, however, can lead to lower profits, weaker consumer spending, and equity market downturns.

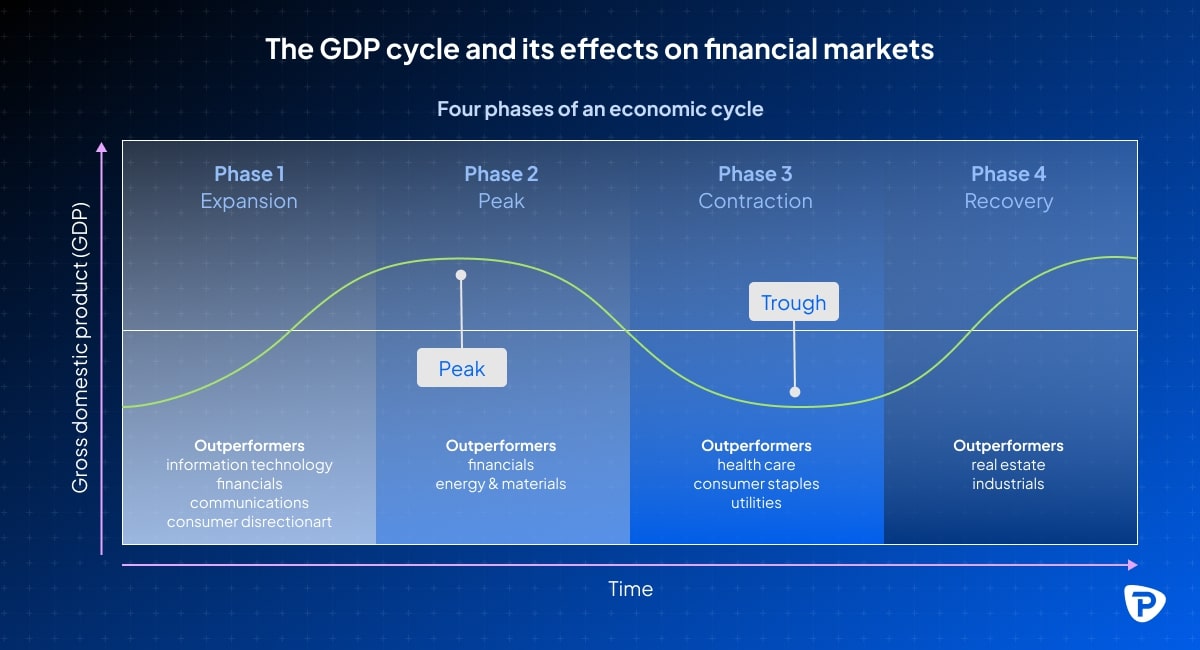

GDP growth doesn't remain constant; it fluctuates within economic cycles. Understanding these cycles can help you anticipate market moves. There are four main stages:

- Expansion: A period of strong economic growth, rising corporate profits, and increased investor confidence.

- Peak: The point at which economic growth starts to slow down before contracting.

- Contraction: Economic decline, which can lead to lower earnings and rising unemployment.

- Trough: The lowest point of the cycle, after which the economy begins to recover.

Fixed income markets

Bond traders use GDP data to predict inflation trends and monetary policy shifts. A strong economy with rising inflation often results in higher interest rates, reducing bond prices. Weak GDP growth, however, can lead to a looser monetary policy stance, making bonds more appealing as a defensive asset.

Commodity CFDs

GDP growth has a direct impact on commodity CFD demand, particularly for industrial materials like oil, metals, and raw materials. A booming economy drives higher energy consumption, manufacturing activity, and infrastructure investment, boosting commodity CFD prices. In contrast, slowing GDP growth leads to lower demand and falling prices.

Changes in GDP growth in major economies like the US and China significantly impact global commodity CFD markets. As China is a leading consumer of metals, strong growth in the country tends to increase demand for copper and steel, while weaker growth can weigh on prices. Similarly, strong US growth raises oil demand, while economic slowdowns reduce consumption. Because these economies play a central role in global trade, their GDP trends have widespread effects on commodity CFD supply and demand worldwide.

How to incorporate GDP forecasts into your trading strategies?

Trading GDP announcements requires a clear and structured strategy to navigate market volatility. GDP data can significantly influence currency values, bond yields, and share prices, but reacting impulsively to the release can lead to poor decision-making.

This five-stage process provides a strategic framework to enhance trading decision-making:

Stage 1: Pre-GDP announcement

Monitor consensus estimates: Prior to any GDP announcement, make a note of consensus forecasts. Economists post expectations well in advance of the release, and the market often prices in these expectations ahead of the release. By tracking these forecasts, the potential market reaction can be anticipated.

Market Sentiment: Gauge market sentiment leading up to the release. If the consensus is strong and expectations are high, there may be limited room for a positive surprise. On the other hand, if the market has low expectations, a positive surprise could lead to a more pronounced market reaction. Follow Pepperstone's daily market analysis to help gauge sentiment.

Stage 2: Post-GDP announcement

Immediate market reaction: After the GDP announcement, markets tend to react immediately. If the data exceeds expectations, the currency of the reporting country typically appreciates as traders anticipate stronger economic growth. Conversely, weaker-than-expected data may lead to depreciation of the currency.

Wait for confirmation: The initial market reaction isn't always followed through or sustained. You should wait for confirmation of the trend before entering positions. For example, if the currency strengthens immediately after a positive GDP report, but the market retraces shortly thereafter, it could indicate that the initial reaction was driven by speculation as opposed to a sustained turn in market sentiment.

Stage 3: Use of technical indicators

Combine GDP data with technical analysis tools to refine strategies. For example, a surprise GDP beat might signal the start of a bullish trend, you could use moving averages or RSI to time trade entry and exit. By integrating fundamental analysis with technical indicators, you can also gain a deeper understanding of market movements.

Stage 4: Risk management

Given the volatility surrounding GDP announcements, it is essential to have strong risk management strategies in place. Using stop-loss orders and adjusting position sizes appropriately can help limit potential losses. Consider setting stop-loss levels above or below key support and resistance levels that could be brought into play by the data.

Stage 5: Consider the broader economic context

While GDP data is important, it should not be looked at in isolation. Consider other economic factors like inflation, employment data, and central bank statements. If GDP growth is strong but inflation remains low, central banks may be less likely to raise rates, which could dampen the bullish reaction.

Risks of trading based on GDP data and how to mitigate them

It is important to understand the risks associated with trading high-impact events like GDP releases and to implement the following effective mitigation strategies:

- Increased market volatility: GDP releases can cause sharp price swings, leading to slippage, whipsaw price action and unexpected stop-outs. Use tight stop-loss orders, trade with reduced leverage, and wait for confirmation before entering trades.

- Revisions and data adjustments: Initial GDP figures are often revised, potentially reversing market sentiment. To mitigate the risks, you should monitor subsequent GDP revisions and adjust positions accordingly. Avoid overcommitting to the first release.

- Market overreaction: Traders may overreact to GDP data without considering broader economic conditions. You need to always cross-check GDP results with inflation, employment, and central bank policies for a more comprehensive view.

- Liquidity issues: High-impact releases can sometimes reduce liquidity, leading to wider spreads, slippage and potential order execution delays. To avoid this, you could trade major currency pairs or indices CFD with higher liquidity and avoid entering large positions during low-liquidity hours.

How do GDP releases from major economies affect global markets?

Comparing GDP growth rates between the US, China, and the Eurozone can help you understand international market dynamics. When one of these major economies reports stronger-than-expected growth, it can have a significant impact on global markets:

- US GDP releases can significantly impact global markets, as the US is the world's largest economy. A strong US report may signal global growth, influencing risk assets and currency markets. Conversely, weak US GDP could dampen global market sentiment.

- China's GDP is vital for global trade. As the world's second-largest economy, China's performance is critical for emerging markets and commodity CFD prices. A slowdown in China can signal a broader global economic downturn, leading traders and investors to adjust portfolios accordingly.

- Other key economies like the Eurozone and Japan also release GDP data regularly, and any surprises can shake up global markets, influencing investor confidence and risk appetite.

How market expectations vs. actual GDP figures drive volatility

Market expectations play a crucial role in determining how different assets react to GDP releases. You should anticipate GDP figures based on analyst forecasts, economic indicators, and central bank guidance. When the actual GDP data aligns with expectations, market reactions are typically muted, as the information is already priced in.

However, when GDP figures deviate significantly from expectations, volatility spikes:

- Stronger-than-expected GDP → Currency appreciation, rising bond yields, and bullish equity sentiment.

- Weaker-than-expected GDP → Currency depreciation, falling yields, and risk-off market moves.

Larger deviations create sharper price swings, as traders adjust positions to reflect the new economic outlook.

How should you interpret GDP growth in the context of other economic indicators?

While GDP growth is a key economic measure, it should be analysed in context with other indicators to get a broader picture of economic health and market direction. Here's how GDP interacts with other key metrics:

- Unemployment: Strong GDP growth with falling unemployment signals a robust economy, potentially leading to higher interest rates and a stronger currency. However, if GDP grows while unemployment remains high, it may indicate an uneven recovery or weak wage growth, which can limit market optimism.

- Inflation: Rapid GDP growth can lead to inflationary pressures, prompting central banks to raise interest rates. You should monitor whether GDP growth is accompanied by rising inflation, as this could strengthen a currency but weigh on equities and bonds. Conversely, low inflation alongside strong GDP suggests room for continued growth without immediate rate hikes.

- Retail sales & consumer spending: Since consumer spending is a major part of GDP, strong retail sales alongside GDP growth confirm economic strength. Weak consumer spending despite GDP growth might indicate business-driven expansion rather than broad economic participation.

- Manufacturing & services data (eg ISM, PMI): GDP reflects past performance, whereas PMI (Purchasing Managers' Index) and ISM (Institute for Supply Management Manufacturing Index) reports give real-time insights into business activity. If GDP is strong but PMI data weakens, traders may anticipate slower future growth.

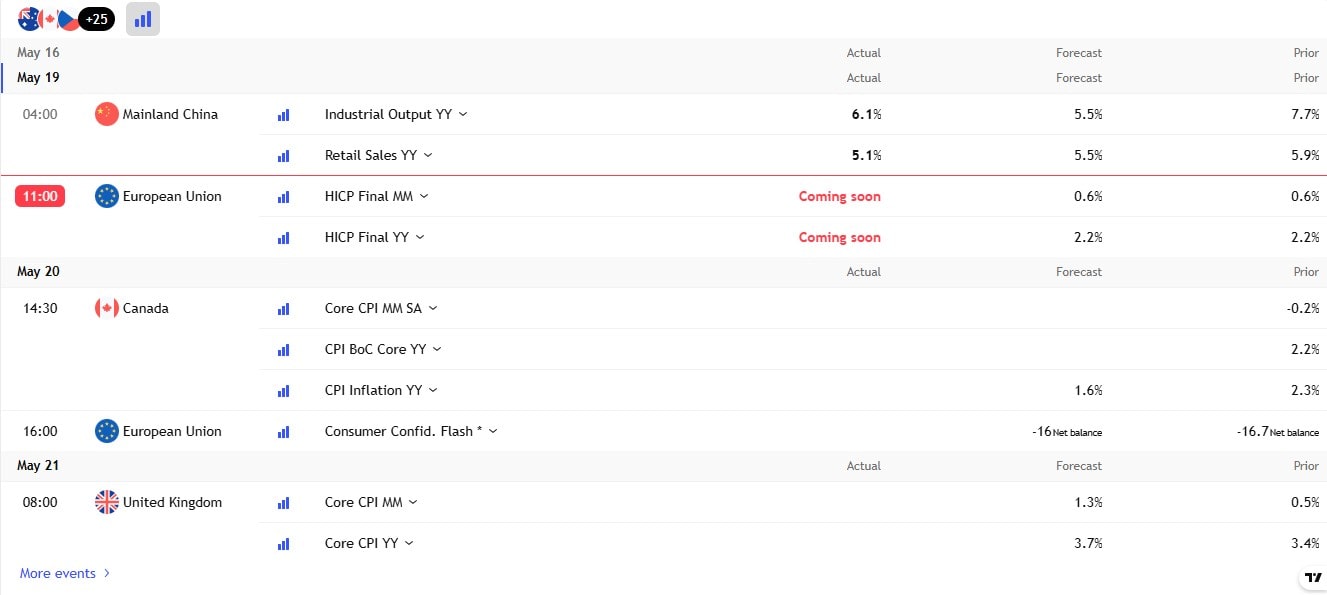

GDP data releases and other key economic indicators can be tracked using Pepperstone's Economic Calendar.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.