- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Short-Term Traders Navigate Big Swings as USD Weakens and Momentum Builds in Equities

Many have focused on the US ISM manufacturing report, which again highlighted a stagflation theme in the sub-components. Notably, only 2 of the 18 industries surveyed do not see higher input prices, with most suppliers saying they are passing the additional cost to the consumer. Inventories were a big drag on the report and the new orders component was less bad than the April read, but at 47.6 was still a poor outcome.

How much the ISM report had to do with the moves is debatable, because a simple visual of the intraday charts showed the manufacturing data had a minimal lasting impact and the market was quick to reverse any change in the intraday trend stemming from the data.

While cries of “Sell America” can be heard, we can also consider other factors such as flows deployed for the new month, prepositioning ahead of today’s US JOLTS job opening report and Friday’s nonfarm payrolls and the possibility of headlines rolling in later in the week from a call between Xi and Trump.

Sell America lite

Picking up on the ‘Sell America’ mantra – clearly, very few are giving up on US equity and they are unlikely to do so until we see real cracks emerge in the US labour market – the S&P500 and NAS100 are the best-performing major equity indices at present, and with S&P500 cash and futures closing at or near session highs the buyers dominated the tape. The NAS100 looks the hotter equity index play though, with Nvidia and Meta putting the backbone into the heavy lifting on the day and while energy has been the hot sector – courtesy of a solid 3% rally in crude – the market is clearly overweight US tech and should Nvidia break and close above $140, again, this becomes a MOMO chase. Broadcom is within striking distance of its ATH and implied to move -/+6.6% on the day earnings (report after market on Thursday) and with Meta having a solid bullish breakout, we’ll need to see a weak labour picture this week to derail the trends here.

Few may be deserting US stocks, but one could make a case that international investors have been only too keen to hedge their USD exposure and lift hedging rations. The USD remains offered and has lost ground on the day vs all major currencies, with the selling gathering pace through late Asia trade and spilling over into Europe.

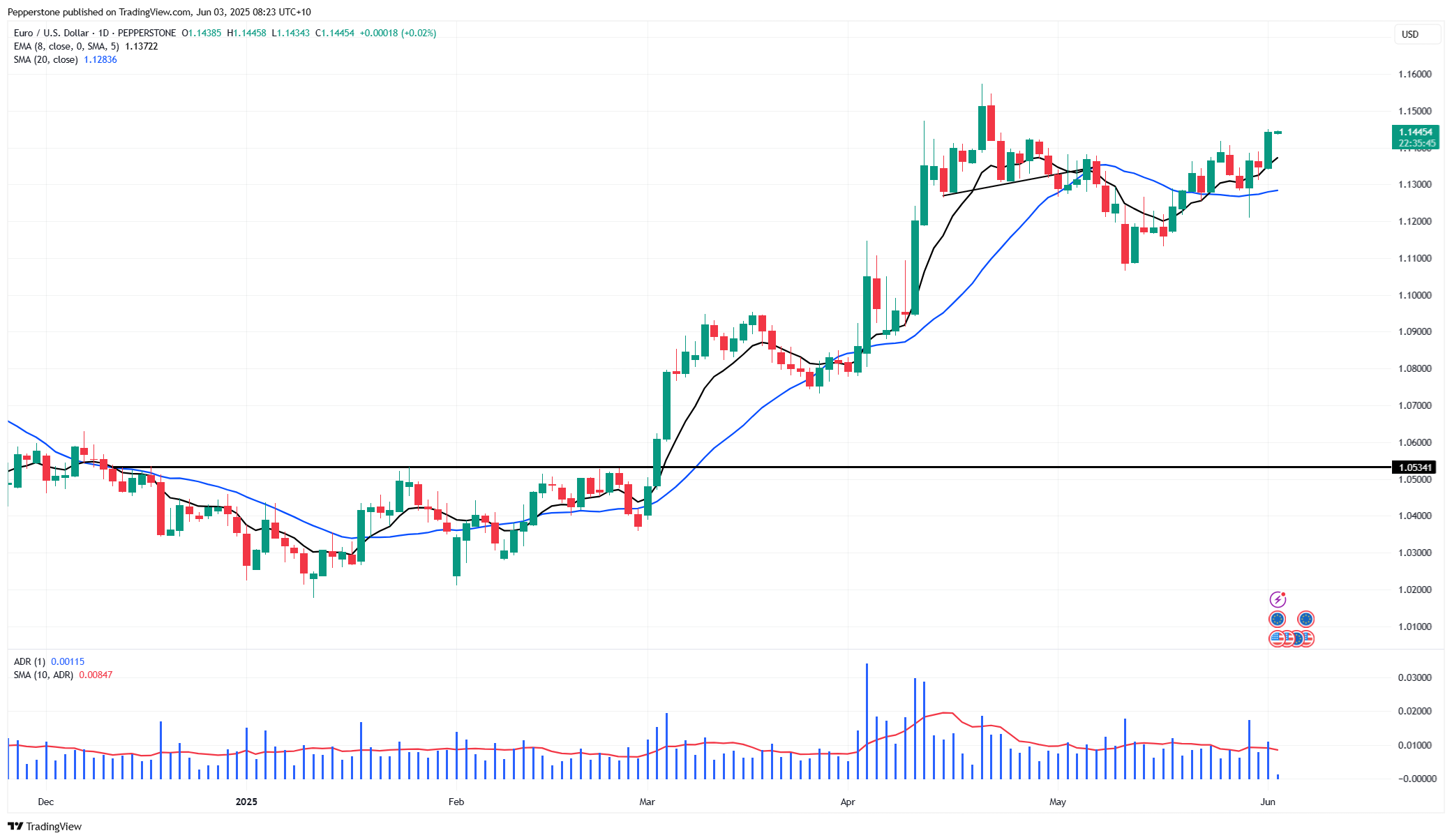

One could argue that with realised and implied volatility on a cross-asset basis at suppressed levels the macro funds are adding to carry positions in the BRL and MXN and using the USD as a funding currency - but this is isolated to LATAM FX. Outside of that tactical play, the move has really been a momentum shift, with the DXY firmly below the 99-handle, driven by EURUSD breaking the 26 May pivot high of 1.1418, USDJPY pulled below 143 and eyeing the 28 May lows of 142.10 and GBPUSD looking to retest the recent highs of 1.3593.

We see selling in US Treasuries with yields up 4bp across the curve – clearly not enough to negatively impact US equity sentiment, with some late session buying taking some of the heat of the move – however, a further push into 4.50% and more so into 4.60% in the near-term, driven by hotter inflation expectations and term premium, and US equity may take more notice. Moves in long-end USTs are a risk, but one for another day.

Gold finding strong buyers in Asia and Europe

Gold (and silver) have feasted on the USD's weakness, with the intraday chart highlighting the influence the weaker USD had in driving gold to $3381 on the day. The 50-day MA proved to offer the bulls a solid platform last week and since then both spot and front-month futures have closed above the 23 May highs and on the highs. We can talk about the various reasons to hold gold, and the countries where we are seeing the relative demand, but to me, it feels as though the gold market sniffs out a sustained move lower in the USD and a longer-term shift for the USD to revert to the long-run averages in some of the classic metrics such as PPP (Purchasing Power Parity).

The ASX200 set to open 1.5% from ATHs

Asian equity will take headwinds from the moves in US equity, crude, gold and the weaker USD and run with it, where it will be a gentle sea of rolling green across the screens. ASX200 and the NKY225 look set to outperform, with a cash open in the region of +0.9% a piece, with our opening call for the ASX200 just 1.5% away from the ATH printed on 14 February. On the docket, the RBA May meeting minutes are due at 11:30 AEST, with net exports, inventory and company operating profits also due and key inputs for tomorrow's Q1 GDP print. In Europe, we get CPI data and then the US JOLTS job openings report will garner attention, with a focus on the quits and layoffs rate.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.