- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Equities have been mixed in Europe with some underperformance from the FTSE100 (-0.9%), with the DAX still holding the consolidation highs – a market I’ve been watching as to whether we see a breakout of the top of the range or this could be a level traders start to build short interests.

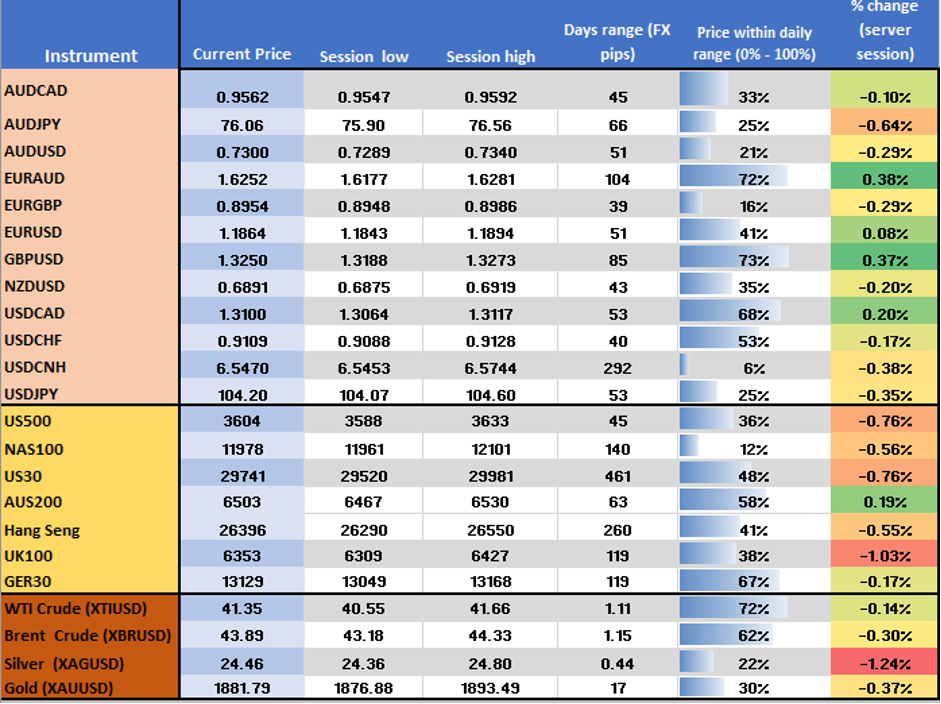

(Price dynamics – changes are from server time)

The US500 is -0.5% and selling off into the close and it’s a messy picture when drilling into the internals. Energy continues to outperform, although we see small selling in crude futures. Financials and industrials are also a touch lower with utilities fairing the worst. Small caps continue to outperform, with the US2000 +0.2%, while the NAS100 is turning lower into the close. Turnover is in line with the 30-day average.

Staying in the commodity scene and copper futures are down smalls, as is the case in gold and silver, which speaks to the limited reaction in markets to the event risk. Here we see US October retail sales printing 0.3% (vs 0.5% eyed), while Industrial production came in at 1.1% (vs 1% consensus). Fed chair Jay Powell spoke at 5:00am AEDT and while his speech was a touch more dovish from last week, there's been no reaction in either the USD or US bond market.

In fact, US treasuries were finding buyers well in advance of these event risks and we see 10 and 30-year part of the curve -4bp a piece. We also see the USD -0.2% and our USDX price eyes last week’s low of 92.07. In XAUUSD the focus remains on 1848, which we see as the 40-day low where we’ve seen some solid support of late – should this give way then I’d be looking for 1795 to come into play. I still see the market unenthused by the prospects of gold short-term with 1-month call volatility trades at a small premium to puts.

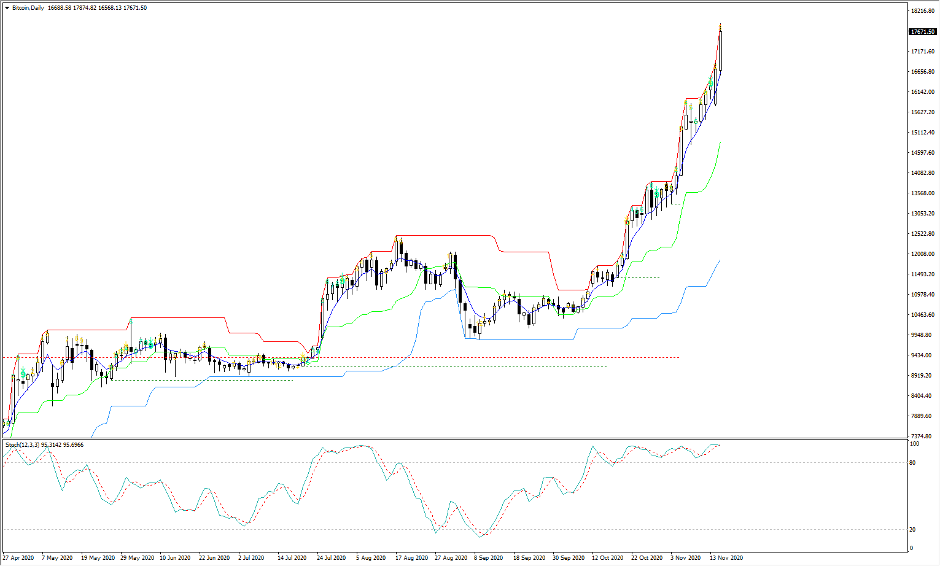

Gold may be finding few friends, but It’s hard not to like what I see in the crypto space as well and Bitcoin is on fire. FOMO is well and truly in play here and the fact that so many big hitters are publicly declaring their positions is clearly helping. At the risk of giving the rally the kiss of death, the 2017 and ATH of 19,500 are in real sight now and this parabolic move suggests buying any pullback. I don’t see this move as a mania or grossly over loved just yet.

In FX, we’ve seen net selling in AUDUSD and AUDJPY, notably (in AUDUSD) into last week’s high of 0.7339, where traders would have been influenced by moves in copper and the selling in the S&P 500. On the docket today RBA governor Lowe speaks at 10:40 AEDT and for the second time this week, so it seems unlikely we’ll hear anything new. We also get Q3 wage price index with expectations for 0.2% QoQ and 1.5% YoY. I don’t see this being a volatility event for traders to concern themselves, with tomorrows October Aussie jobs report being an event that could and one to assess AUD exposures over. Its finger in the air sort of estimates but the market expects 27,500 jobs to be lost, with the unemployment rate to lift 20bp to 7.1%.

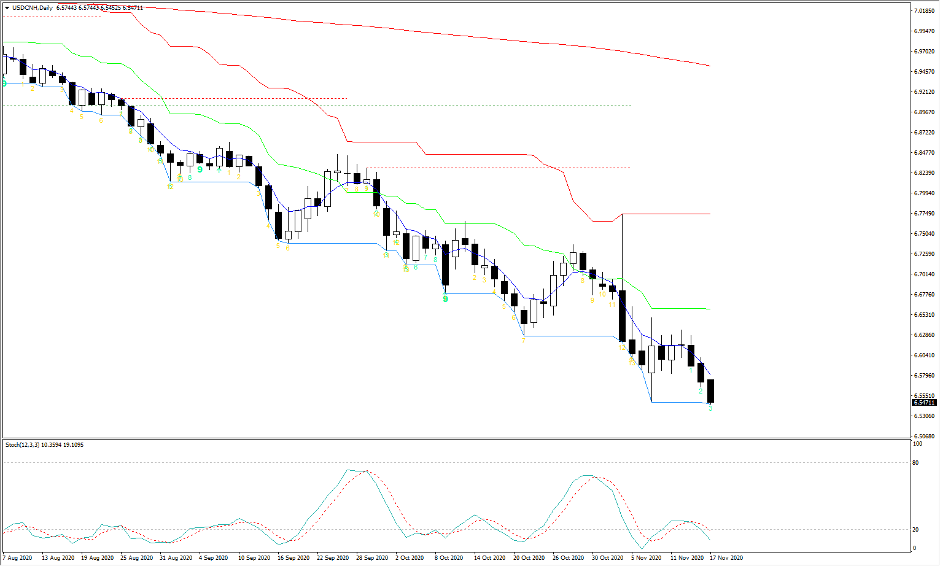

Keep an eye on USDCNH which has come off the radar a bit of late, but has quietly been going about its business and looking for a closing break of the bear trend low of 6.6489. If this takes another leg lower it could resonate in USD selling, notably supporting the AUDUSD and NZDUSD. Certainly, if we look at the differential between the yield on offer in Chinese and US bonds, it’s not hard to see why rallies in USDCNH are limited and the trend is towards continued yuan appreciation.

GBP has been the strongest G10 currency, but even then the gains on the day have been limited to 0.4%. I wrote on the current state of Brexit talks yesterday, so take a look at that if the thematic interests – EURGBP has printed both a lower low and high and again eyes the double bottom at 0.8866. For context (and as a guide to setting an expectation of movement) the options market puts a 22.4% probability of a test here in the coming week.

There's some interest in the upcoming UK October CPI and RPI (at 18:00 AEDT/7:00am GMT), although it’s the month-on-month read that could weaken and the YoY read (for both inflation metrics) should remain largely unchanged at 0.5% and 1.2% respectively. Again, it seems to unlikely really move the dial on GBP if we’re looking at the data as an event risk.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.