- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

A Trader’s Week Ahead: Will Powell Deliver Amid a Deluge of Macro Risks?

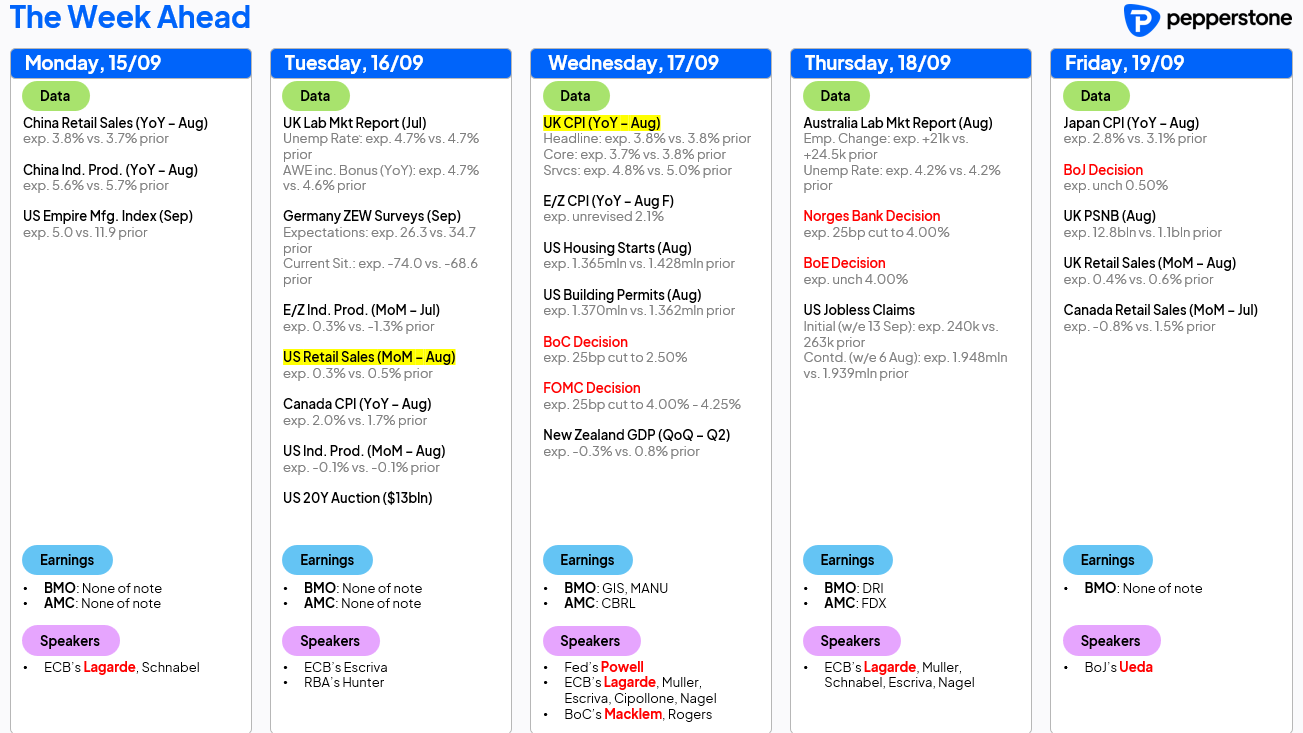

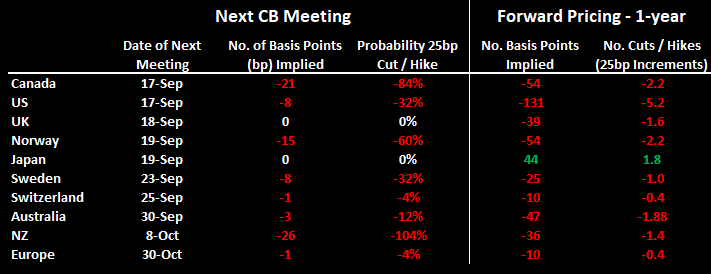

A little over four hours before the FOMC meeting, the Bank of Canada (BoC) meet and look set to get the rate-cut party started. After poor employment reports in July and August, market pricing in CAD swaps implies an 84% probability that the BoC will cut rates.

The Norges Bank (meeting 18 Sept) may also lower rates, although that is a closer call — NOK interest rate swaps imply a 60% probability of a cut, while the majority of economists also forecast a cut. I’m not one to promote trading over a central bank meeting — that is a fine art and often best left to the high frequency algos — but there is a real risk that Norges Bank holds rates at 4.25%.

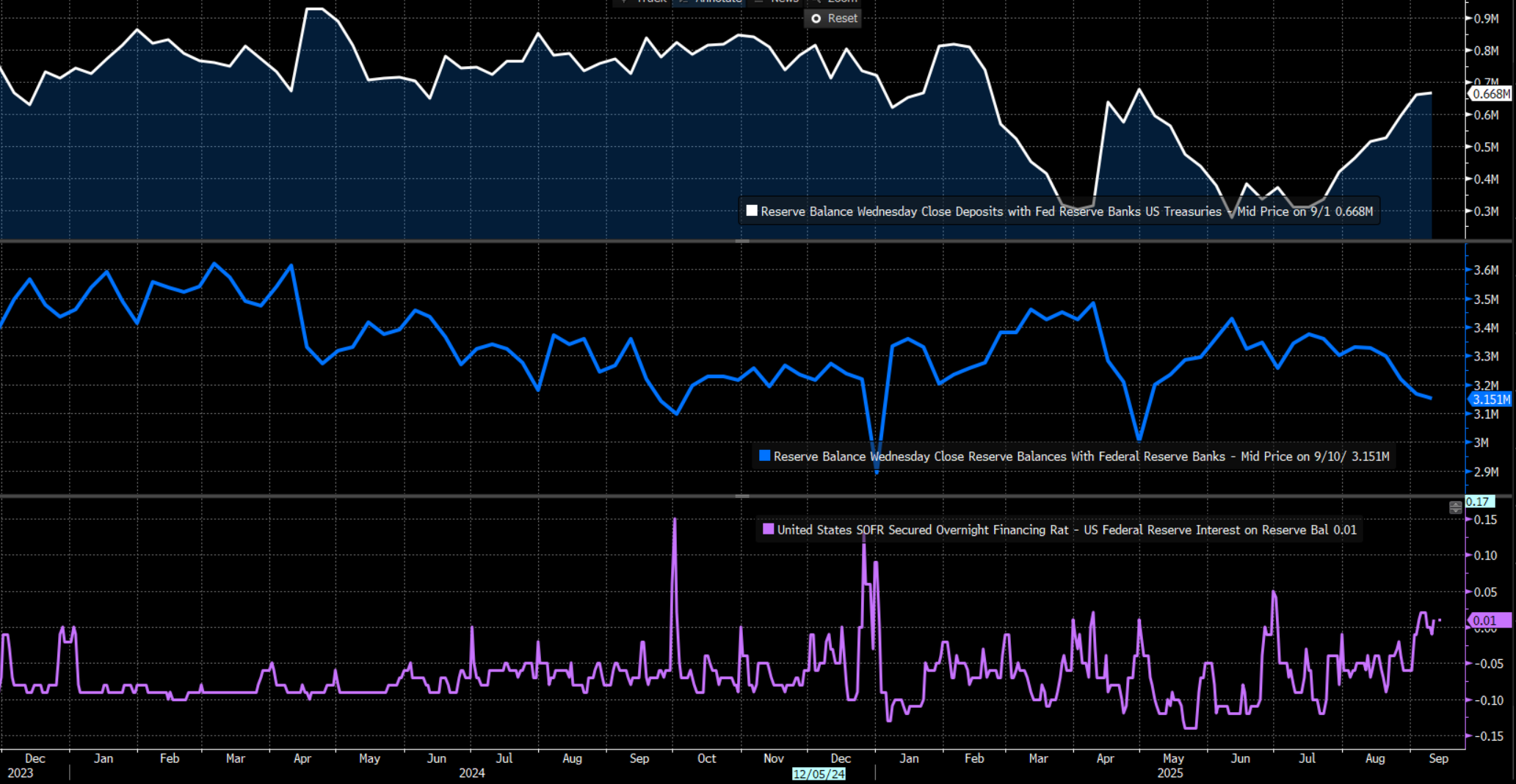

In the session ahead, U.S. corporations will make their estimated quarterly tax payments to the IRS. These payments are debited from companies’ deposits at commercial banks (e.g., JPMorgan, Bank of America, Citi). The Fed then reduces the banks’ reserve balances (which currently earn 4.40% risk-free) by the same amount and credits the Treasury General Account (TGA).

With the Treasury Department well into its process of rebuilding the TGA (now at $668b), bank reserves held at the Fed have subsequently fallen from $3.38t in July to $3.15t and could feasibly pull below $3t in the next few weeks. This is increasing the discussion that reserves may be moving away from what is considered ‘ample.’ While quarter-end dynamics are also a factor, falling reserves could impact the U.S. funding markets (repo/SOFR, fed funds, commercial paper, and T-bills), and there are signs that is already taking place.

With SOFR (Secured Overnight Financing Rate - essentially, the cost of borrowing short-term cash) now at 4.41% and settling a touch above what the Fed pays select banks on reserves (the IORB rate- currently 4.4%) last week, there will be discussions about a potential formal end to the Fed’s QT program, and the reduced liquidity viewed as a function of falling bank reserves may be a dynamic put to Jay Powell in his press conference.

Whether SOFR pushes markedly higher — say to a 5–10bp premium above IORB — will attract focus from the STIR (short term interest rate) and fixed-income community, but whether that spills into higher volatility in US financial equity or the broader equity markets, and other risk assets remains to be seen. Most participants know the process of rebuilding the TGA is now well underway and has a target, and the Fed has de-stigmatized the use of its liquidity programs (Standing Repo Facility and Discount Window), so its highly unlikely we see a re-run of the Sept 2019 repo 'crisis'.

Either way, the effective functioning of U.S. funding markets is crucial to the entire financial system, so a broader range of market players may start watching the US funding markets more closely this week, while the Fed will be keen to ensure that liquidity concerns don’t escalate. With levels of cross-asset volatility still at rock-bottom levels, markets head into a ‘Triple Witching’ week pricing in little evidence of concern about drawdowns or higher volatility. That could change if market players fail to hear exactly what they want. As such, we remain diligent, nimble, and open-minded, prepared to react dynamically to any changes in sentiment, liquidity conditions, and volatility.

Overview of the Key Event Risks for the Week Ahead

- Reaction to Fitch’s France sovereign rating downgrade to AA-: EURUSD is unchanged in early interbank FX trading but could find modest sellers if the France 10yr–German bund yield spread widens further.

- The FOMC meeting (Wednesday) is the marquee event risk: a 25bp cut seems assured. Focus will be on the appetite to ease again at future meetings, the number of dissenters voting in favour for 50bp, and the new set of ‘Dots’ and economic projections.

- Policy meetings are also seen from the BoE (no change expected), BoC (25bp cut expected), BoJ (no change), and Norges Bank (25bp cut expected).

- Friday marks ‘Triple Witching’ in the U.S., with the quarterly expiration of equity index futures (e.g., S&P 500 futures), equity index options, and single-stock options.

- Watching for stress in U.S. funding markets: Monday’s corporate tax payments will build the TGA and reduce bank reserve balances held at the Fed. The result could be pressure in short-term funding markets, with SOFR trading above IORB late last week.

- U.S. Treasury Secretary Scott Bessent meets China’s VP He Lifeng — expect trade headlines through the week.

- China releases its monthly economic data dump: August home prices, retail sales, industrial production, and property investment (Monday).

- U.S. retail sales, employment data from the UK (including wages) and Australia, and inflation prints from the UK, EU, and Canada

Central Bank Policy Expectations

Interest rate swaps pricing for the next meeting, and cumulatively for the 12 months ahead:

A Dive into the FOMC Meeting — The Skew in Risk

A 25bp cut is the default position held by the large majority of market players, and it's only if enough voting members felt the need to front-load cuts could an outsized 50bp cut play out. There will be some focus on liquidity and the longevity of the Fed’s QT program, although deeper colour may not come until the minutes are released on 8 October.

The new set of ‘Dots’ will be closely watched. The median dot is likely to remain at 3.875% for this year, indicating a central case for one more cut, but there is a risk it is taken down to 3.625% - which would be in line with market pricing and expectations. We may also see one more 25bp cut added to the 2026 ‘dot,’ with the central view being that the fed funds rate is taken to 3.375%, even if estimates for core PCE inflation are pulled modestly higher to 2.5% (from 2.4%).

Given the recent rally in USTs and the pricing in U.S. interest rate swaps, it seems a tall order for the Fed to deliver a dovish surprise to markets. This tilts the risk towards a sell-off in rates and potentially USD upside. Whether that spills over into increased selling of equity is debatable, as the Fed should maintain a strong appetite to ease again in October, which could bring out intraday dip buyers and help contain any downside.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.