- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

September 2025 US Employment Report: Stale But Solid-ish

Payrolls Surprise To The Upside

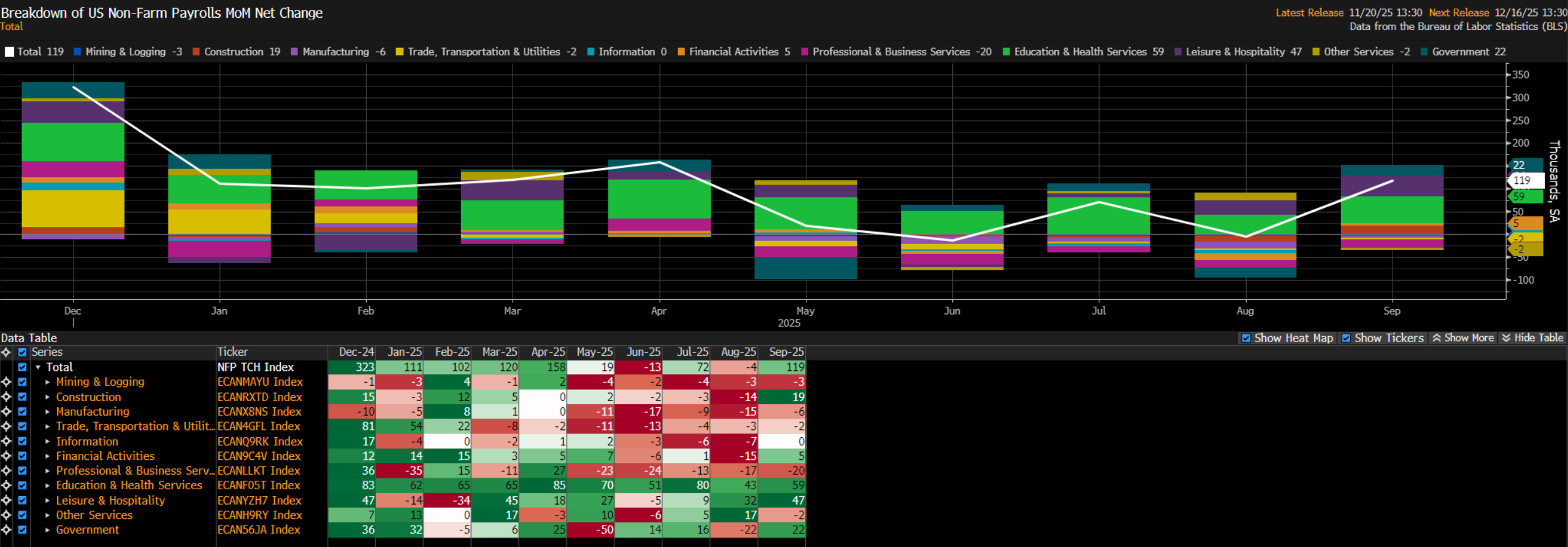

Headline nonfarm payrolls rose +119k in September, above consensus expectations for a +50k increase, and topping the wide forecast range of -20k to +105k. Simultaneously, the prior two payrolls prints, referencing August and July, were revised by a net -33k, in turn taking the 3-month average of job gains to +62k, marginally above the breakeven pace, which likely lies at around +50k at this stage.

Under The Surface

Digging further into the jobs report, almost all of the job gains seen in the month came in the Education & Health sector, where a net 59k jobs were added, and in Leisure & Hospitality, which added a net 47k jobs. Employment growth elsewhere was flat to slightly negative, in a further sign of the labour market stalling out.

Earnings Pressures Remain Contained

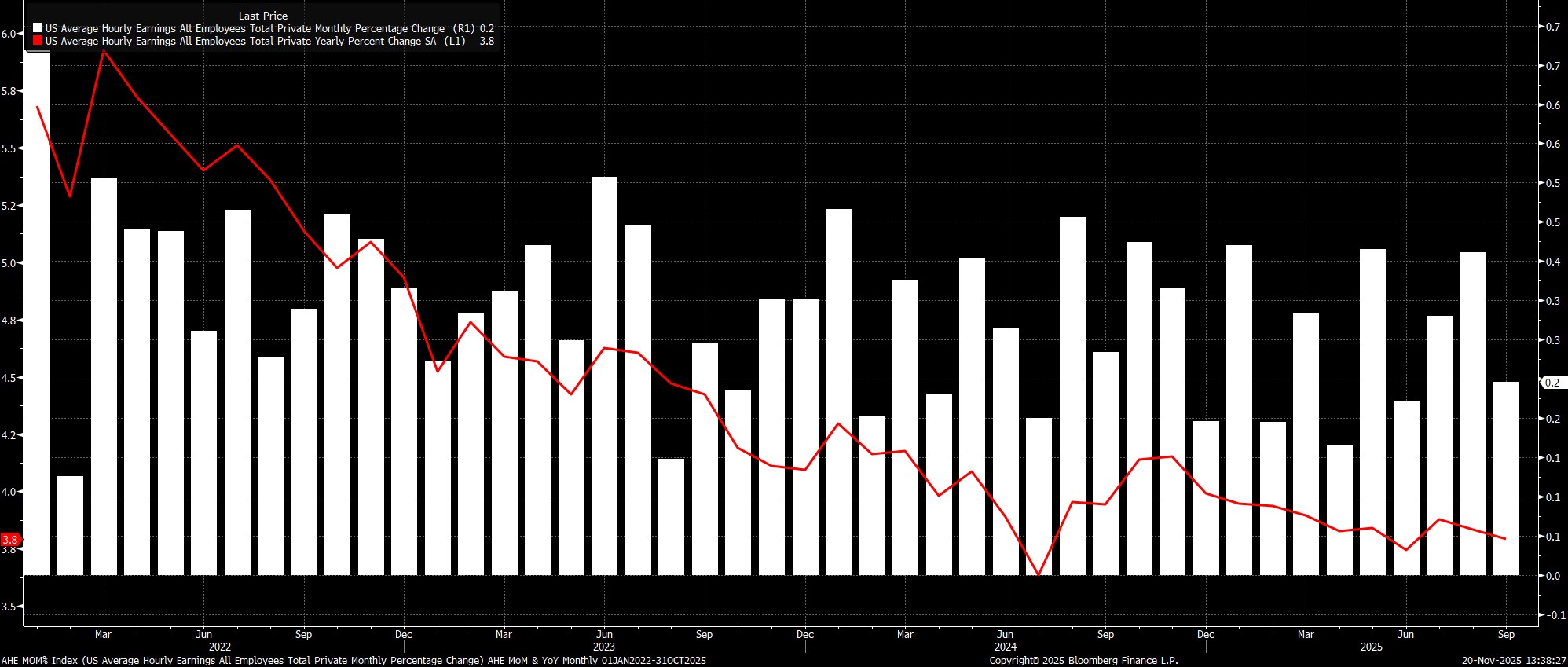

Sticking with the establishment survey, the labour market report pointed to pay pressures remaining relatively well-contained, in turn reinforcing the FOMC’s longstanding view that, for the time being, the labour market does not present a source of significant upside inflation risk.

Average hourly earnings rose 0.2% MoM, a touch cooler than expectations, which in turn saw the annual rate tick higher to 3.8% YoY.

Household Survey Paints A Mixed Picture

Meanwhile, turning to the household survey, unemployment unexpectedly ticked higher to 4.4%, printing fresh cycle highs, though this was largely driven by a further rise in labour force participation, to 62.4%, hence could be construed as a ‘positive’ considering that it was driven by an increase in job seekers, as opposed to a rise in layoffs.

This data, though, must continue to be accompanied with something of a ‘health warning’, as the BLS continue to grapple with the rapidly changing composition of the US labour force, and falling survey response rates, which remain close to their lowest level on record.

Money Markets Reprice Dovishly

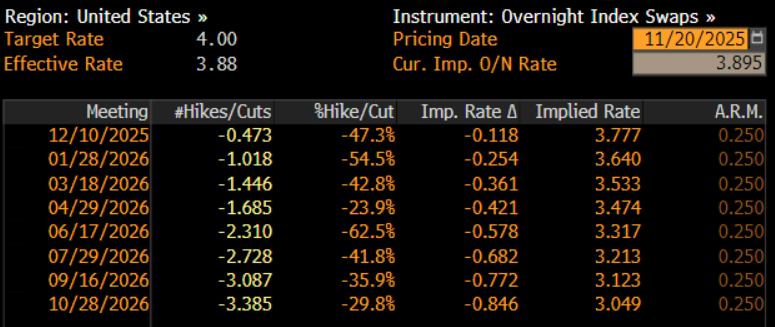

In reaction to the somewhat stale data, money markets repriced marginally in a dovish direction, now discounting around a 40% chance of a 25bp cut in December, up from about 33% pre-release, while still fully discounting the next 25bp cut at the March 2026 meeting.

Conclusion

Taking a step back, the much-delayed September jobs report largely tells what is now a familiar story, namely that the US labour market remains sluggish, operating close to its stall speed, with both the pace of hiring, and firing, subdued.

That said, another 25bp Fed cut at the December FOMC meeting is far from a foregone conclusion, particularly with neither the October nor the November jobs reports due to be published until after that final confab of the year. When coupled with hawkish minutes from the October meeting, flagging how ‘many’ believed a December cut would likely not be appropriate, it is clear that the bar to another rate reduction by year-end is now a relatively high one. Though a further 25bp cut in December remains my base case for now, risks clearly now tilt towards the FOMC standing pat.

Were they to do so, however, it seems more likely that such a move would resemble a ‘pause’ in the easing cycle, as opposed to simply skipping a meeting. Put simply, with easing currently being framed as ‘risk management’, holding steady in December would imply a consensus view among policymakers that the risks in question have been adequately managed.

It would, hence, be unusual to then follow that up with a rate cut at the very next meeting, likely meaning that the next ‘live’ meeting would not come until next March, and that the FOMC would become much more reactive in nature, as opposed to proactively removing policy restriction in order to support the labour market. That, in turn, runs the risk that policymakers fall considerably behind the curve, only cutting again when it’s far too late.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.