- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Nvidia Q3 2026 Earnings Preview: Earnings Expectations, Market Impact & Trading Insights

Key Inputs for Traders

• Nvidia reports in the post-market session on 19 November (around 08:20 AEDT on 20 November).

• CEO Jensen Huang will deliver his post-earnings update shortly after.

• The options-implied move for the event is ±6.2%.

• A ±6% share-price move could equate to roughly a ±0.5% shift in the S&P 500 and ±0.6% in the Nasdaq 100.

• The average absolute move over the past eight quarterly reports is 6%.

• Despite frequent beats on revenue and EPS, Nvidia shares have closed higher in only four of the past eight reports.

• Year-to-date, shares are up 39.2%, and 115% from the April low of $86.42.

• After peaking at $212.19 on 29 October, the share price has corrected 13.3%, though expectations for results and guidance remain high.

• Nvidia remains a core portfolio holding, viewed as the leading AI platform for training and inference. Of 80 analysts, 73 rate the stock a Buy with a median 12-month price target of $233.97.

• Traders can react to earnings, guidance, and Jensen Huang’s remarks with Pepperstone's Nvidia 24-hour US shares.

Technical Setup Ahead of Q3 2026 Earnings

The daily chart shows sellers driving the price from $212 to $185, with support emerging near the 50-day MA.

Price remains below short-term EMAs, with the 3-EMA diverging below the 8-EMA, reflecting weaker momentum as traders trim long exposure pre-earnings.

In the past month, Nvidia has traded mostly between $181.91–$182.89, an area where buyers appear active. The 22 October low ($176.76) is key support — a break could expose the 200-day MA.

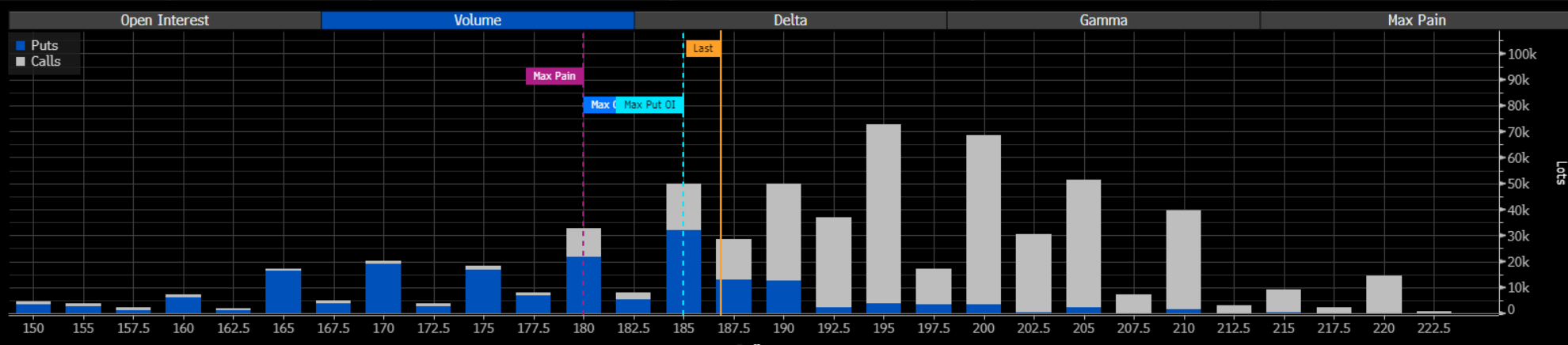

A bullish trigger would be a move above the 11 November high ($201.55). With high call-volume open interest between the $190–$200 strikes (21 Nov expiry), a positive surprise could spark dealer hedging (buying the underlying), accelerating the upside momentum.

Earnings Expectations — The Numbers That Matter

The market will focus on revenue, gross margin (GM), and forward guidance for Q4 2026.

Bloomberg consensus estimates:

• Q3 2026 Revenue: $54.99 billion (vs guidance $54 b ± 2%). The market likely wants a beat — $55–56 b would please investors. • Q3 Data-Centre Revenue: $49.11 billion. • Q4 2026 Revenue Guidance: $61.57 billion expected; anything higher would boost sentiment.

• Q3 Gross Margin: 73.64% expected — investors may look for closer to 74%.

• Q4 Gross-Margin Guidance: 74.62%.

Investor Focus - What could drive the longer-term projections

• Following his recent GTC Conference remarks, Huang is expected to expand on Nvidia’s outlook for the Data-Centre TAM (Total Addressable Market) and long-term revenue opportunity.

• Rising concerns about power consumption in the data-centre build-out — and talk of a “power wall” by 2028 — may feature heavily. Power pricing and energy-policy debates could dominate 2026–27.

• Progress toward 14 million GPU sales through CY 2025–26 and whether the $207 billion revenue target for 2026 remains realistic.

• Updates on Nvidia’s $100 billion investment in OpenAI and broader AI ecosystem strategy.

Summary

Nvidia enters its Q3 2026 earnings with high expectations, strong YTD performance, and intense focus on AI-driven data-centre growth. Traders should monitor revenue beats above $55 billion, margins near 74%, and any forward-guidance upgrades — all potential catalysts for renewed upside.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.