- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

January 2026 US CPI: Disinflation Continues But Fed Remain In ‘Wait & See’ Mode

Headline Inflation Cooler Than Expected

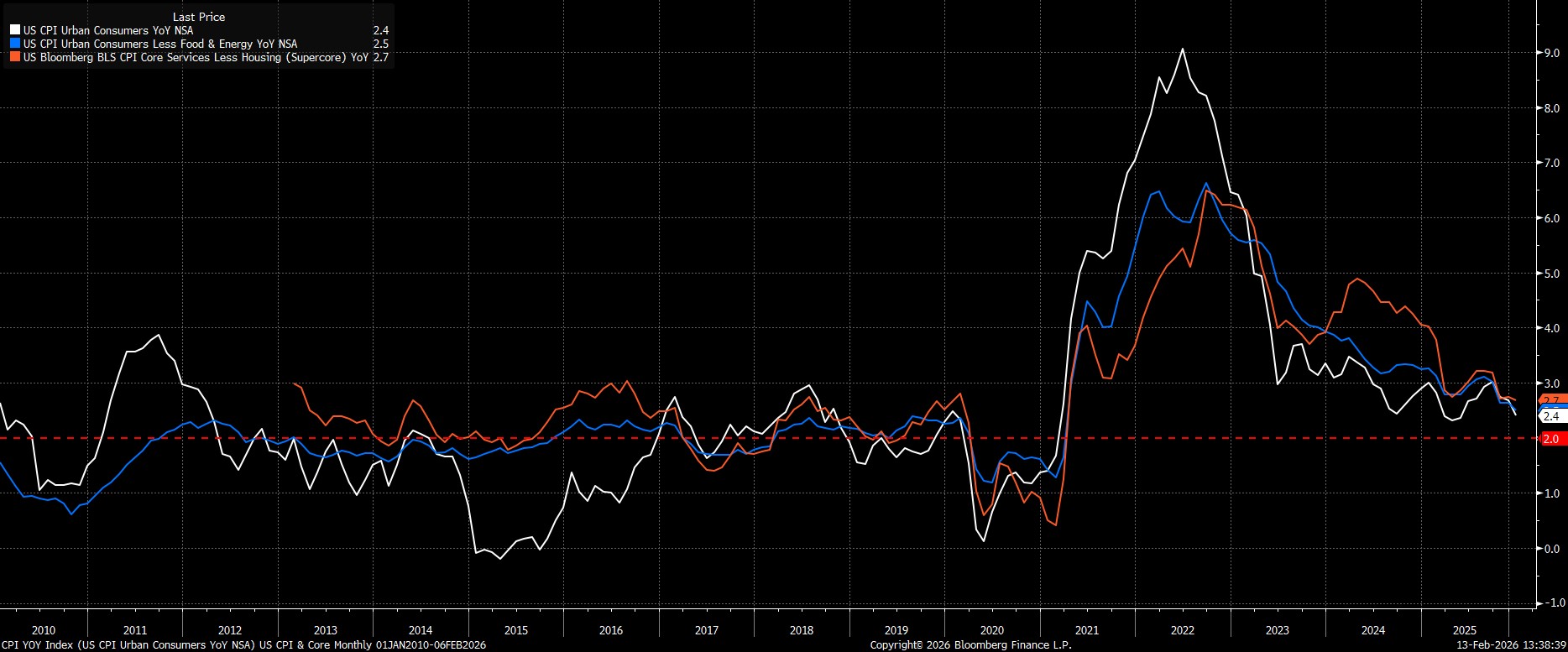

Headline CPI rose 2.4% YoY to start the new year, a touch below consensus expectations for a 2.5% YoY increase, and the slowest annual rate of inflation since last May. Meanwhile, metrics of underlying price pressures also pointed to a cooling under the surface, with core CPI rising 2.5% YoY, a cycle low, and supercore inflation (aka core services ex-housing) rising 2.7% YoY.

On a monthly basis, headline prices rose 0.2% MoM, a touch softer than the 0.3% MoM pace seen in December, while core prices rose 0.3% MoM, in line with expectations, and a touch hotter than the pace seen last time out.

As usual, annualising these monthly inflation points helps to build a clearer picture of underlying inflationary trends, especially considering the significant base effect in the YoY figures:

- 3-month annualised CPI: 2.2% (prior 2.1%)

- 6-month annualised CPI: 2.8% (prior 2.8%)

- 3-month annualised core CPI: 1.7% (prior 1.6%)

- 6-month annualised core CPI: 2.5% (prior 2.6%)

The Devil Is In The Detail

In addition, it is the details of the CPI report that are of most importance, especially as participants and policymakers continue to assess the degree to which pass-through of tariffs is exerting upward pressure on prices.

Core goods prices rose 1.1% YoY in January, the slowest pace in six months, in turn implying that the peak of tariff pass-through is likely now in the rear view mirror, pending any other levies being imposed. Concurrently, core services inflation fell below 3% YoY for the first time since the middle of 2021, likely easing any concerns over the risk of persistent price pressures.

Policy Implications Limited

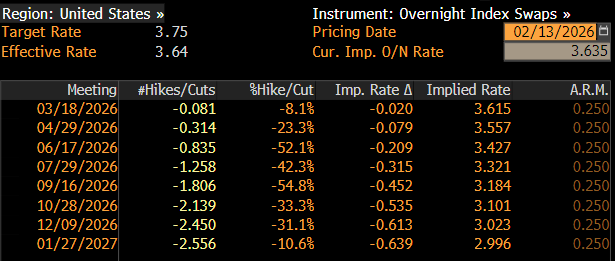

As the CPI report was digested, money markets repriced marginally in a dovish direction. Though the next 25bp cut is still not fully discounted by the USD OIS curve until July, a total of 63bp of easing is now priced by year-end, up from around 57bp pre-release.

Conclusion

Taking a step back, the January CPI report is unlikely to materially alter the near-term Fed policy outlook, not least considering that the Committee’s reaction function continues to tilt heavily towards the employment side of the dual mandate.

As a result, it remains likely that the FOMC will retain their present ‘wait and see’ stance for the time being, with the base case still that policymakers now stand pat until at least June, at which stage Kevin Warsh is due to take over as Chair, and will likely advocate for a more dovish approach. Translating such an approach into further rate cuts, however, will require incoming data to cooperate, in order for a majority of Committee members to vote in favour of further easing.

That said, risks to the base case tilt in a dovish direction, with the FOMC willing and able to respond with additional easing, were further signs of labour market softness to emerge. Note that both the February jobs and CPI prints will be in hand by the time the Committee next meet in mid-March.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.