- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

January 2026 FOMC Review: Shifting To ‘Wait & See’ Mode

Standing Pat On Rates

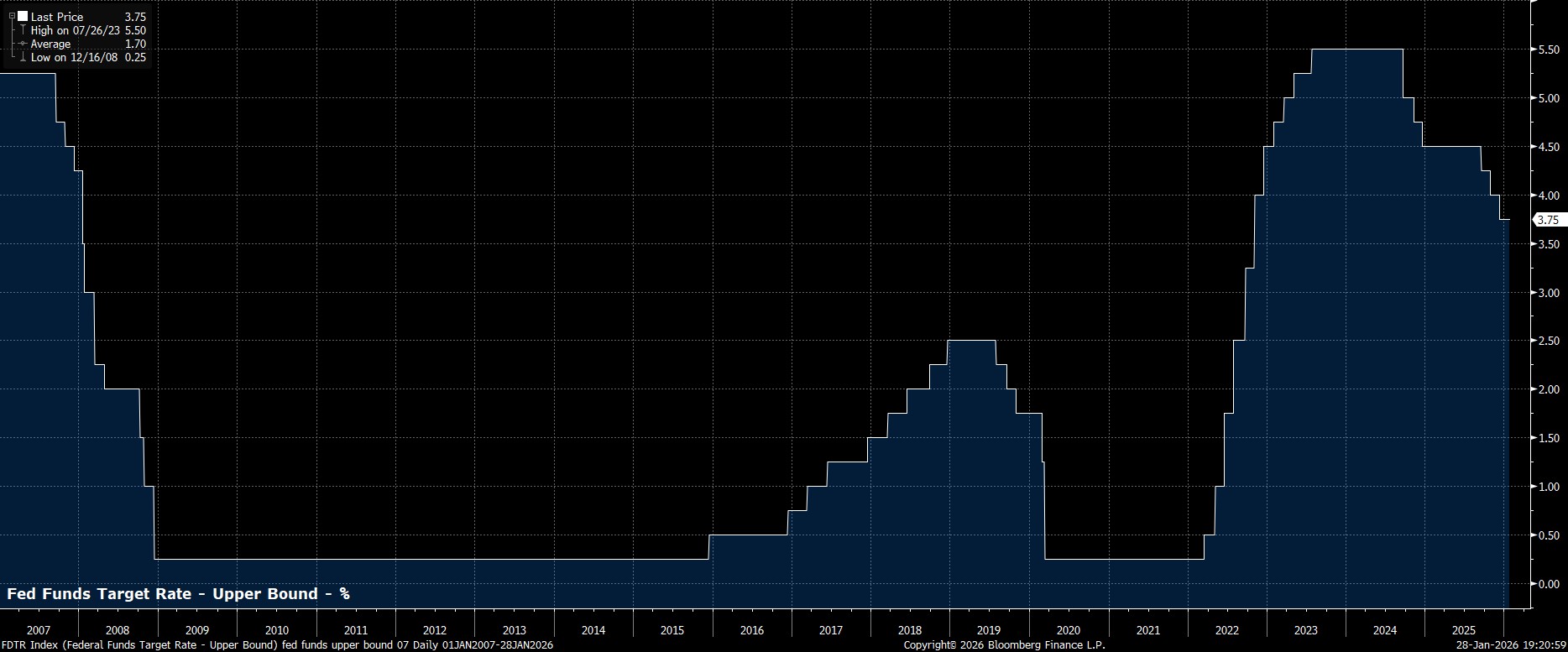

As expected, and had been fully discounted by money markets in advance of the decision, the FOMC stood pat on policy at the conclusion of the January meeting, maintaining the target range for the fed funds rate at 3.50% - 3.75%, in what should be viewed as a ‘pause’ in the easing cycle, after the Committee delivered 75bp of easing in the final four months of last year.

Committee Divisions Persist

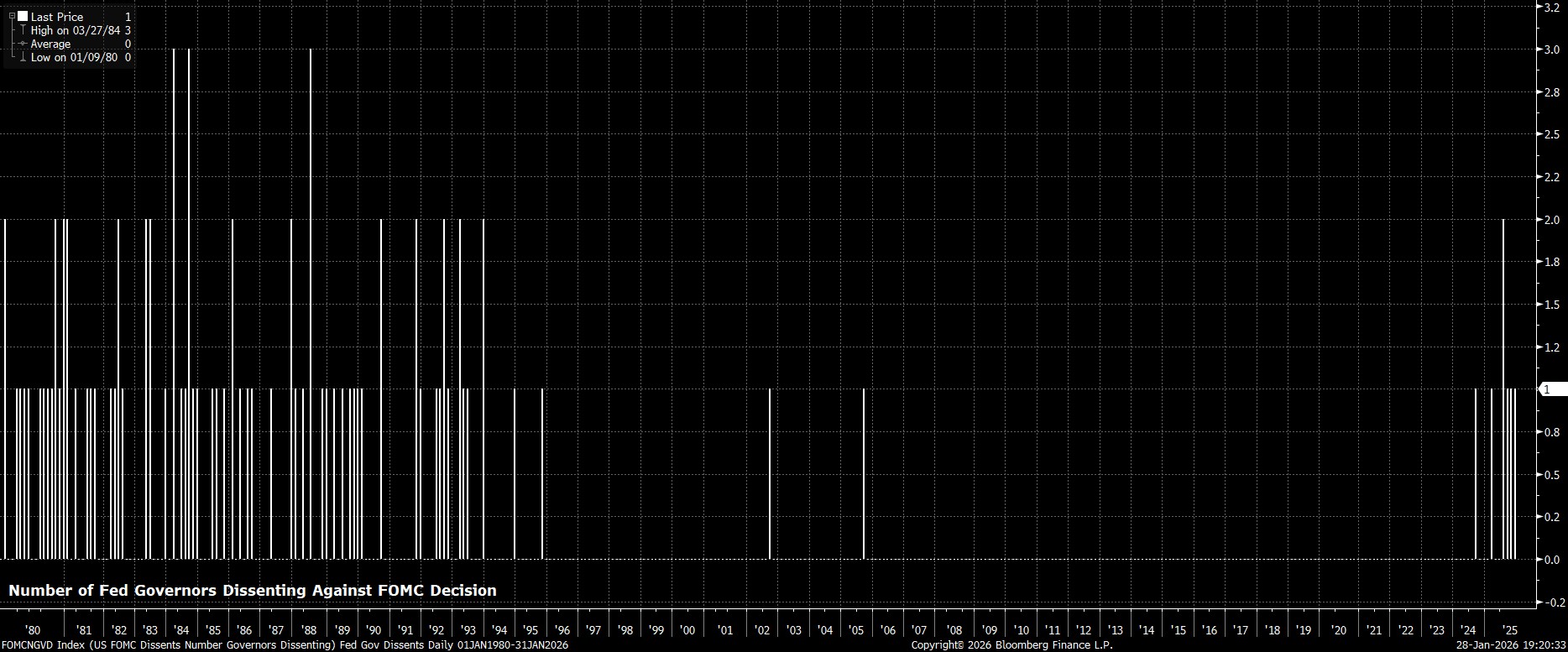

That decision, however, was not a unanimous one among policymakers, though once more this division was largely anticipated.

In what may well mark his final FOMC meeting, Governor Miran dissented in favour of a 25bp cut, and was joined in such a dissent by Governor Waller, in what could well be seen as an attempt to keep his rather slim chances of succeeding Fed Chair Powell alive.

Policy Statement Little Changed

Despite those divisions, the accompanying policy statement was little changed from that issued at the conclusion of the December confab.

As such, policymakers again referred to ‘additional adjustments’ to the fed funds rate, implying that further cuts remain on the cards, while repeating that inflation remains ‘somewhat elevated’. That said, the economic assessment was upgraded to flag a ‘solid’ pace of growth, while the statement also noted that the unemployment rate has ‘shown some signs of stabilisation’, suggesting a belief that downside risks to the labour backdrop have receded.

Powell Plays With A Straight Bat At The Presser

Reflecting on the above, at the post-meeting press conference, Chair Powell repeated his view that policy is ‘well-positioned’, while stressing that the future path for rates is not on a ‘pre-set course’, with decisions to be taken on a ‘meeting-by-meeting’ basis. Powell also reiterated that the fed funds rate is within a range of plausible estimates of the neutral rate.

In terms of other matters, Powell made no comment on his future post-May, or on the DoJ subpoenas that were served on the Fed, or on anything related to recent FX developments. Powell did, however, note that his attendance at the Supreme Court for arguments in Governor Cook’s case was due to it being ‘perhaps the most important legal case’ in the history of the Fed.

Cuts Remain In The Curve

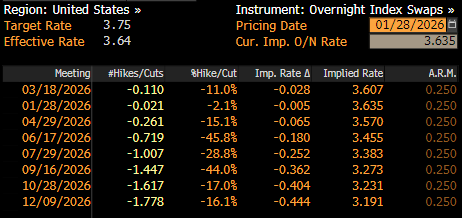

As markets digested all of the above, the USD OIS curve continues to discount further steps back towards a neutral fed funds rate over the remainder of the year. The next of those cuts, though, is still not fully discounted until July, after Powell’s replacement takes the helm.

Conclusion

All in all, the January confab will largely go down as a placeholder one, with the FOMC seemingly content – for the time being – to bide their time, taking some degree of comfort in tentative signs of labour market stability, while assessing the impact of the easing delivered at the tail end of last year.

That said, the direction of travel for the fed funds rate remains lower. Delivery of another cut in the short-term, at either the March or April meetings, would likely require indications of renewed labour weakness to emerge, to which the FOMC clearly stand willing to respond to, with the employment side of the dual mandate continuing to take precedence in terms of the reaction function.

Were said signs not to emerge, though, the current ‘wait and see’ stance is likely to persist through to the end of Chair Powell’s term at the helm. Clearly, Powell’s replacement is likely to adopt a considerably more dovish stance, though substantial disinflationary progress is likely needed in order to bring the remainder of the Committee onboard with that view.

For the time being, the balance of risks tilts towards the latter scenario being a more plausible base case, with policymakers seemingly comfortable, for the time being, with the degree of insurance that they have taken out against further employment weakness.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.