- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

December 2025 US Employment Report: Hiring Cools, Unemployment Falls

Payrolls Growth Stays Sluggish

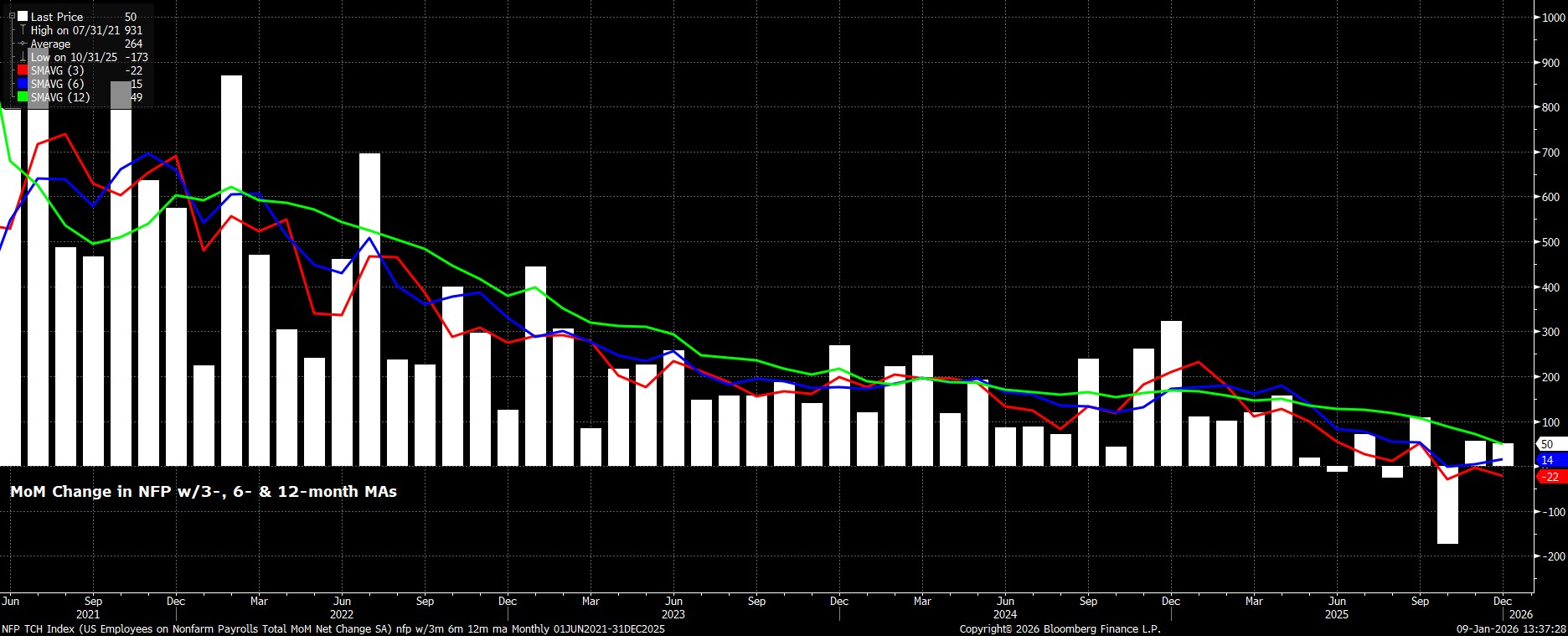

Headline nonfarm payrolls rose by +50k in December, just a touch below consensus expectations for an increase of +70k, albeit within the typically wide forecast range, of +25k to +155k. Recall, however, that there are some data quality concerns around the headline payrolls print, with Fed Chair Powell having noted that jobs growth may be overstated by as much as 60k per month, implying that the ‘real’ pace of job creation was probably somewhere around zero.

Concurrently, the prior two payrolls prints, for October and November, were revised by a net -76k, in turn taking the 3-month average of job gains to -22k, and seeing the 6-month average of job gains hover just above zero.

Under The Surface

Taking a deeper look into the jobs report, the sectoral split of employment gains pointed to both Healthcare and Leisure & Hospitality propping up the labour market at large, adding +39k and +47k jobs respectively. the majority of other sectors experienced no, or negative, MoM employment growth, with Retail Trade the major laggard.

Earnings Pressures Not Worrisome

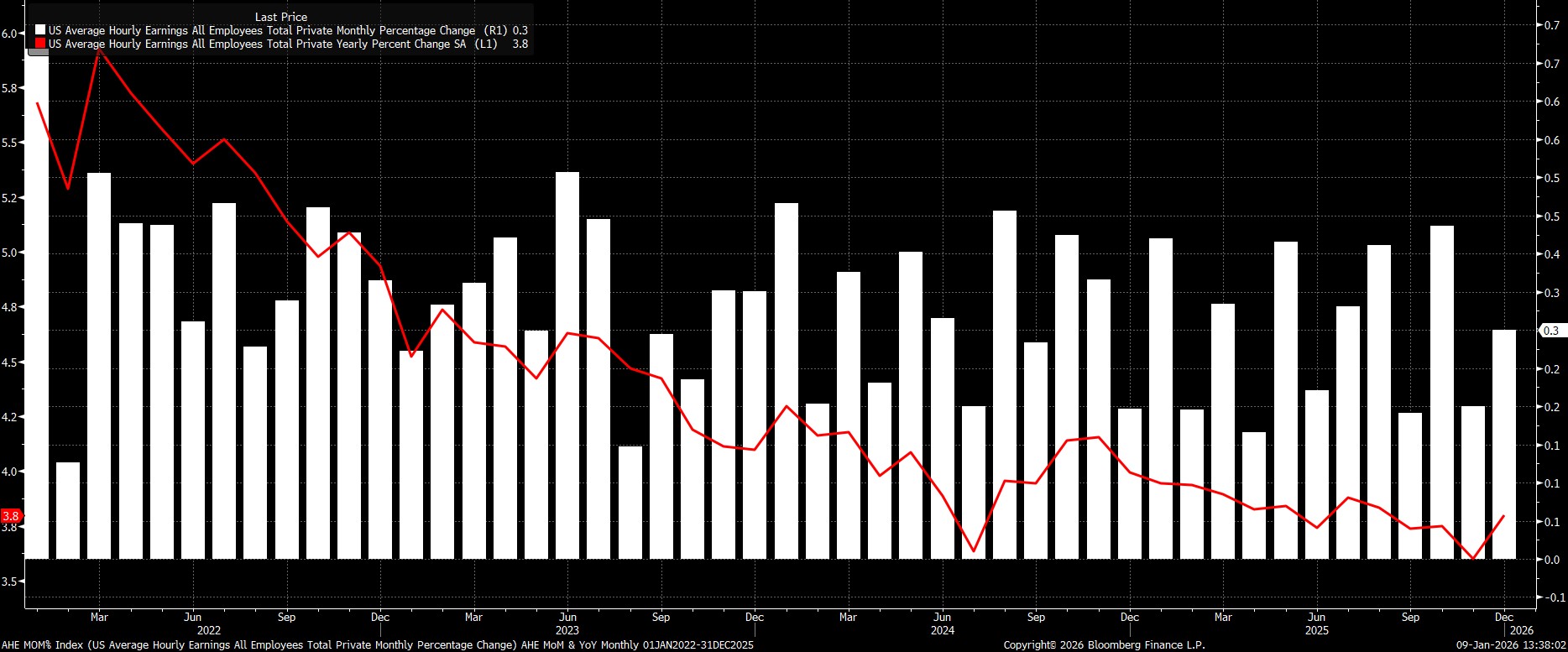

Remaining with the establishment survey, data pointed to earnings pressures having remained relatively contained as 2025 drew to a close, again serving to strengthen the long-running consensus view of FOMC members that the labour market is not a significant source of upside inflation risk at the current juncture.

Average hourly earnings rose by 0.3% MoM in December, bang in line with expectations, with that figure in turn taking the annual rate of earnings growth to 3.8% YoY.

Household Survey Proves More Resilient

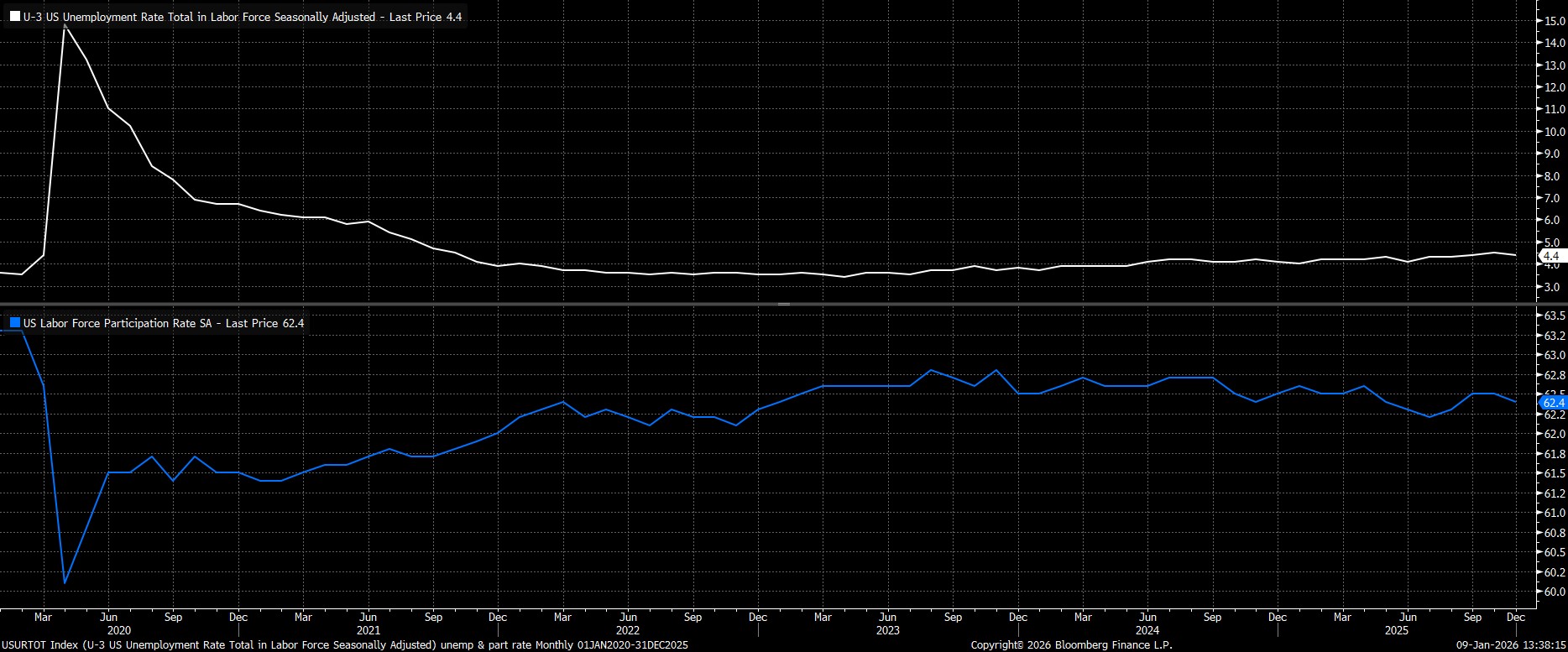

Turning to the household survey, headline unemployment unexpectedly declined to 4.4% last month, from a downwardly revised 4.5% in November. Labour force participation, meanwhile, fell to 62.4%, in line with expectations.

While the household survey must also come with a health warning of its own, given low survey response rates and the rapidly changing composition of the labour market, there is nonetheless a general belief that, for the time being, it offers a cleaner and more accurate read on the true state of the US labour market, hence likely carries greater implications from a policy perspective than the headline payrolls figure.

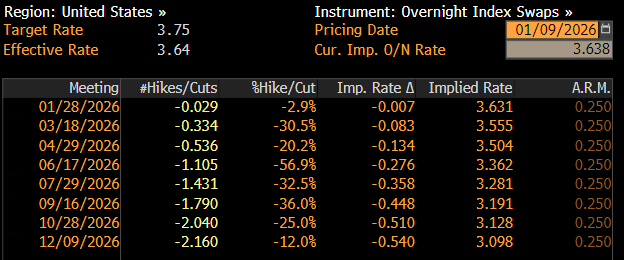

Money Markets Price Out January Cut

In reaction to the jobs report, money markets now see next-to-no chance of a Fed cut at the tail end of this month, discounting just a 2% chance of such a move. The USD OIS curve also underwent a modest hawkish repricing further out, with March now seen as a 1-in-3 chance of a 25bp cut, albeit with the curve still fully discounting the next 25bp cut for June.

Conclusion

Taking a step back, the December jobs report offers our first ‘clean’(ish) read on the state of the US labour market since the summer, with releases in the intervening period having been delayed, and skewed, by last year’s government shutdown. By and large, the figures largely paint a similar picture to that which was already known – namely, that the employment backdrop remains somewhat soft, and that while the labour market is ‘bending’ for the time being, the risk remains that it may well end up ‘breaking’.

Despite that, with unemployment having fallen below the end-25 December SEP projection, a fourth straight 25bp cut at the January FOMC meeting now seems a long shot, with policymakers instead likely to be comfortable that they have already taken out a degree of ‘insurance’ to support the labour market, and being content to adopt a more data-dependent stance, especially as the Committee’s hawks remain concerned over lingering upside inflation risks, largely from tariffs.

That said, the direction of travel for the fed funds rate remains lower, with the FOMC likely still wanting to remove policy restriction, and return the FFR to a more neutral level (which could be 3% or lower) by the end of the year, if not sooner. In any case, in light of today’s data, the can has now been kicked down the road to March, at the earliest, in terms of the next 25bp cut being delivered, though such a move will be contingent on labour data remaining uninspiring, or deteriorating further, by the time of that meeting.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.