- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

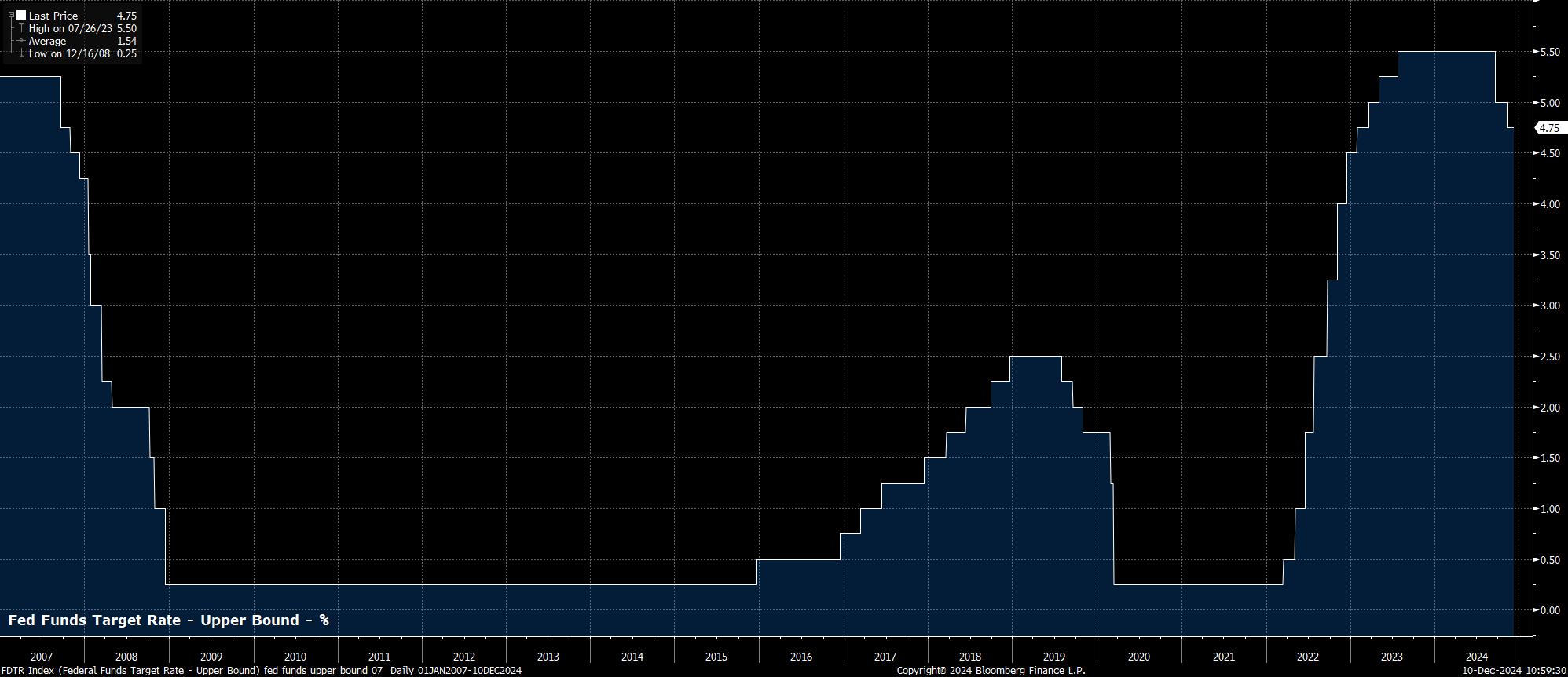

As noted, the FOMC will likely deliver a 25bp cut at the conclusion of the December meeting, lowering the target range for the fed funds rate to 4.25% - 4.50%, resulting in a total of 100bp of easing having been delivered in 2024, since the first cut in September. Money markets, per the USD OIS curve, assign around an 85% probability to said action, though pricing is subject to change depending on the outturn of November’s CPI report.

The decision to deliver a third straight rate cut is likely to be a unanimous one among voting members on the Committee, though there remains a slim possibility that Governor Bowman, again, dissents hawkishly, instead preferring to hold policy steady.

Accompanying the rate decision is likely to be a policy statement that is broadly unchanged from that issued after the November meeting. Consequently, the Committee should again stress a ‘data-dependent’ approach to future policy decisions, while stressing the risks that remain to both sides of the dual mandate. Overall, those risks are likely again to be seen as ‘roughly in balance’.

More broadly, the FOMC’s view of overall economic conditions should also be largely unchanged from that outlined last time out. While headline unemployment rose to 4.2% in November, just shy of the cycle highs seen in July, joblessness could still be categorised as ‘remaining low’, particularly when the U-3 rate is considerably below the FOMC’s 4.4% 2024 forecast. Meanwhile, on inflation, progress continues to be made towards 2%, though “remains somewhat elevated”, particularly when looking at gauges of underlying price pressures.

Meanwhile, as usual for the December meeting, the FOMC will also release an updated Summary of Economic Projections (SEP).

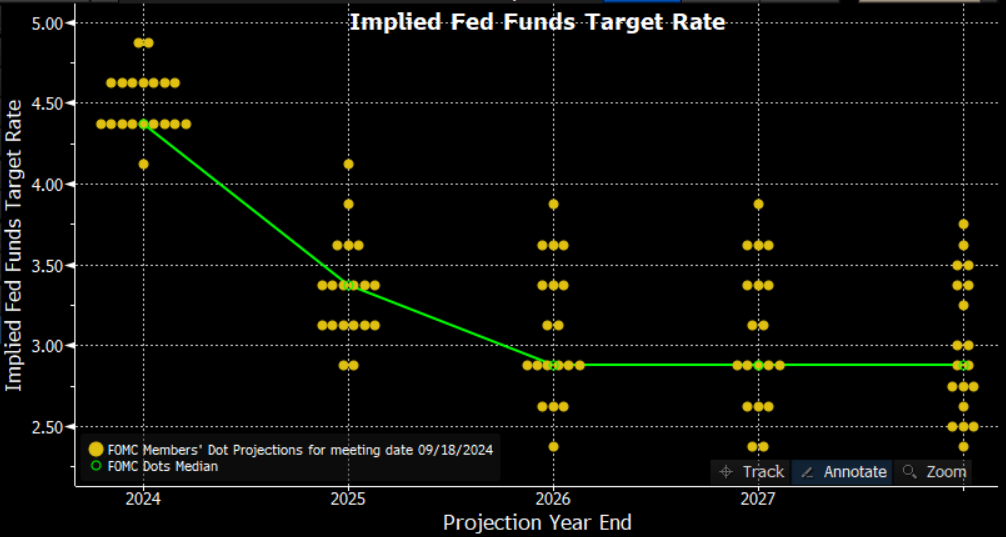

Here, the Committee’s ‘dot plot’ will likely be of most interest to market participants, with the prior dots, issued in September, indicating a median expectation for the midpoint of the fed funds rate’s target range to end this year at 4.375%, and to end 2025 at 3.375%. Said projections imply a 25bp cut at the December meeting, and four further 25bp cuts next year.

Said pace is somewhat more hawkish than that which money markets currently price, with participants envisaging just 87bp of easing by next December, compared to the 125bp which the current dots imply.

The December dot plot is likely to see a hawkish revision compared to that issued previously, with upside inflation risks having increased of late, owing not only to the somewhat lacklustre disinflationary progress seen in underlying price metrics in recent months, but also due to President Trump’s election victory.

Trump’s victory has led to expectations that significant trade tariffs will be implemented early in 2025, bringing with them a chunk of upside inflation risk. Meanwhile, Trump’s fiscal policies, likely including renewed tax cuts, and greater government spending, could spark even stronger economic momentum, introducing additional inflationary risks.

Hence, the dispersion of dots is likely to be considerably tighter this time around, with those Committee members who had previously seen rates falling to, or below, 3% next year, likely revising their estimates higher; some of the more hawkish estimates could even become more hawkish, though a Committee member projecting no cuts next year would be a bold step.

In any case, it will be difficult for the all-important median 2025 expectation to move higher. Such a move would require five members at the current median to revise their ‘dot’ to the upside by at least 25bp which, while plausible, could be considered unlikely given that policymakers are as yet unable to model the precise impacts of the aforementioned government policies likely to be introduced in early-2025.

These modelling challenges will likely also result in the FOMC’s updated economic projections being broadly unchanged from those issued a quarter ago. Policymakers must work on a ‘status quo’ basis, being unable to make assumptions on any fiscal, or other governmental policies, until they are actually implemented. That said, this does mean that the forecasts are likely to have an even shorter shelf-life than usual this time around.

Consequently, the FOMC will likely again see both headline and core PCE prices returning to 2.0% by 2026, and likely remaining there in 2027, with a bumpy path back to target likely to be followed over the next year or so.

Meanwhile, the Committee will again likely see unemployment hovering around 4.4% over the forecast horizon, as labour market conditions continue to gradually normalise. The 2024 forecast, though, of 4.4%, might be revised marginally lower, with joblessness having printed just 4.2% in November.

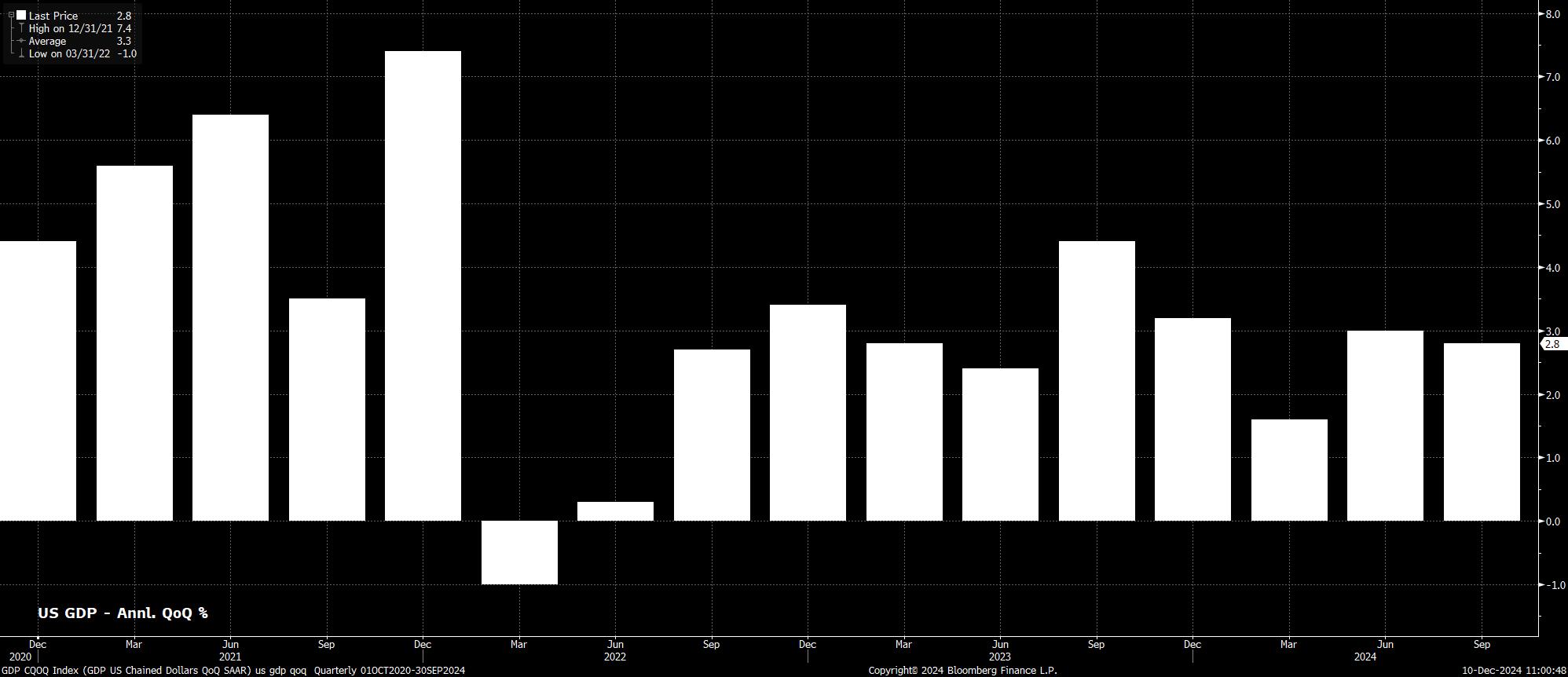

The pace of real GDP growth is also likely to remain largely unchanged, at 2.0% in each year of the forecast horizon. Economic momentum remains strong, with growth having been north of 2% in eight of the last nine quarters, and with the Atlanta Fed’s GDPNow model pointing to annualised growth of 3.3% in the final three months of the year.

This all presents a delicate balancing act for Chair Powell, at the post-meeting press conference. Broadly speaking, Powell is likely to ‘stick to the script’, noting that policy is in a good place, that rates are on a path back to neutral “over time”, and that the Committee can afford to be “cautious” in finding neutral, owing to the “good shape” that the economy remains in.

Looking ahead, however, risks around the monetary outlook are set to become increasingly two-sided in 2025. While the FOMC will remain prepared to normalise policy more rapidly were labour conditions to unexpectedly soften, the Committee will likely also be prepared to slow the pace of policy easing – ‘skipping’ a meeting if necessary – were upside inflation risks to come to fruition. With another jobs report, CPI print, PCE figure, and the first eleven days of a Trump presidency to come by the time of the January meeting, a ‘skip’ to start 2025 could well be the most likely scenario.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.