CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

A Traders’ Weekly Playbook: Risk fires up with shorts crushed

The question for this week is whether to chase, to buy weakness within the ST trend or to counter.

The fact we saw US 10-year Treasuries drop 26bp on the week to 4.57%, with 10-year real rates -23bp to 2.17%, catching a market positioned heavily short. As buyers covered and even reversed in US Treasury exposures, the pressure valve was released on the equity market, where the result was the biggest weekly gain in the US500 (+5.9%) of the year, reclaiming the 50-day MA. High short interest stocks went on a blistering run.

The NAS100 had its best weekly gain since January and price eyes trend resistance at 15,181. The VIX index was crushed 6.4 vols to 14.9%, while High Yield credit spreads tightened 39bp.

The market has certainly questioned the US exceptionalism story, which had resulted in so much capital flowing into USDs. While the US Treasury Department’s preference to skew upcoming bond issuance to shorter tenors helped flatten the US 2s v 10s yield curve, we also saw a clear cooling in the US nonfarm payrolls report, marrying with a weaker ISM manufacturing and services, and consumer confidence report.

A weaker USD has helped risk

FX implied volatility trades to the lowest levels since 2022, and we saw the USD universally shunned, losing 1.4% w/w, with high beta FX (CLP, COP, MXN, NZD, AUD) all putting on a show and seeing some huge gains. GBPUSD stopped short of 1.2400, with EURUSD eyeing 1.0750.

Positioning has played a big part in the moves, with both bond and equity shorts covering hard, and risk hedges being unwound, amid a dusting of aggressive organic longs being put on. With a decent amount of the re-positioning out of the way, while a cooling of data is acceptable, if the economics darkens there will be a tipping point where it negatively impact sentiment and we’ll likely see equity and bond rally concurrently.

The fact that SOFR rates futures priced an additional 20bp of cuts for 2024 (to price 106bp of cuts) highlights the markets vision of slowing economic trends. Debating when the first rate cut comes from the Fed is all the rage again – where the market prices this action at the May FOMC meeting. Look for US mega-cap tech to work well if this theme gets traction.

The week ahead

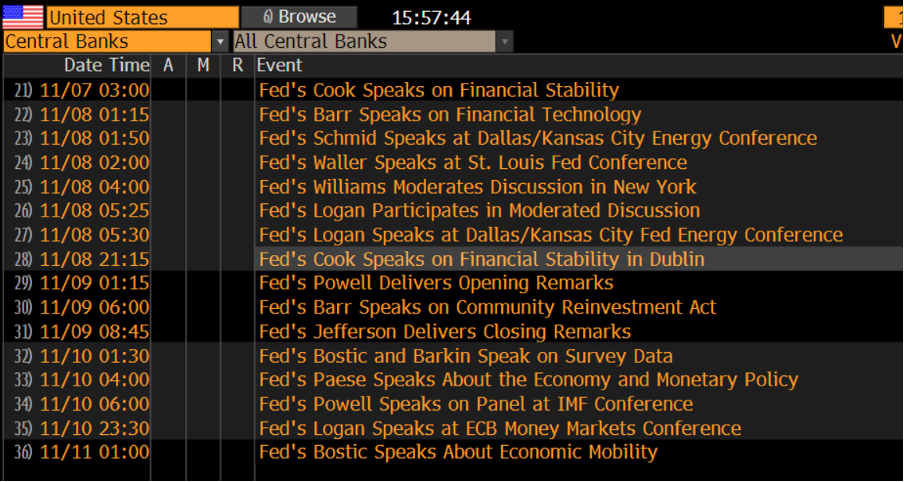

As we look ahead at the new week, we see the event risk is on the light side, so we may see the market pause for breath. With 17 different Fed speakers, including Chair Powell, due to speak this week we may see some modest push-back on easier financial conditions and that may unsettle risk. My preference is to buy weakness in equity and risk FX, as it feels like the rally in long-end US Treasuries has been a tad too powerful. An open mind is always essential.

Out of the US data and central bank chatter, the RBA meeting, China data and data flow from the LATAM region will garner interest.

Trades I like - short NOKSEK, USDCLP, EURAUD, EURCHF (into 0.9670) and US crude. On the long side AUDCAD, coffee and GBPCAD.

Key event risk for traders to navigate:

RBA meeting (Tuesday 14:30 AEDT) – the meeting offers a clear risk for both AUD and AUS200 exposures. While economists are largely on the same page with a 25bp hike, the rates market prices a hike at 60%, with a total of 43bp of hikes priced to peak rate in June 2024. The base case is for a 25bp hike, but it certainly wouldn’t be a complete shock to see them on hold. AUDUSD looks constructive for 0.6600, however, I also like short EURAUD trades for a swing move to 1.6250.

RBA Statement on Monetary Policy (Friday 11:30 AEDT) – the RBA will release its new economic projections, with core CPI likely to be revised up 40bp for Dec 23 to 4.4%, and headline CPI to 4.5%. We should still see the RBA getting back to the 2-3% inflation target range by Dec 2025. Unemployment should be revised lower, while GDP assumptions revised modestly higher in the years out.

China trade balance (Tuesday – no set time) – The market consensus is for a further improvement in the pace of decline with imports to come in -4.5% and exports at -2.9%.

China CPI/PPI (Wed 12:30 AEDT) – the market looks for CPI to print -0.2% and PPI -2.8% (-2.5%). Unlikely to be a major event risk, with USDCNH driven by the USD.

UK Q3 GDP (Friday 18:00 AEDT) – the consensus is for -0.1% qoq / 0.5% yoy, which are hardly inspiring growth numbers. While GDP is old news, the data could still influence the GBP given how sensitive traders are to growth metrics. Positioning shows a market heavily short of GBP, notably real money accounts who hold an extensive net short exposure. Leverage funds (mostly hedge funds) hold a decent short exposure too and have built on it over the week.

Mexico CPI (Wed 23:00 AEDT) – The consensus estimate is for headline CPI to come in at 4.28% yoy and core CPI at 5.5% yoy (from 5.76%). With the market pricing the first rate cut in the March to May period it would take a very weak CPI print to rush that pricing forward. Still, with Banxico wanting to see greater disinflation before easing, this is a risk for MXN traders’ exposures.

Banxico (Mexico) meeting (Friday 06:00 AEDT) – we should almost certainly see interest rates on hold at 11.25%. The bank’s outlook and guidance are where we could see the volatility in MXN.

Chile CPI (Wed 22:00 AEDT) – the consensus is that we see CPI inflation at 0.6% mom and 5.1% yoy (unchanged). After cutting by a smaller-than-expected 50bp in the October meeting, and halting its USD purchases we’ve seen a breathtaking rally in the CLP (Chilean peso). While the market expects another 50bp cut in the Dec BCCh meeting, the CLP will take its direction from broad risk sentiment in markets and the CPI print may have a short-lived impact. I like USDCLP further lower.

US University of Michigan survey & 1 & 5-10 yr inflation expectations (Sat 02:00 AEDT)

Key corporate earnings – FY earnings from WBC (6 Nov) & NAB (9 Nov)

Central bank speakers

BoE - Huw Pill (7 Nov at 04:00 AEDT & 9 Nov 19:30 AEDT), Gov Bailey (8 Nov 20:30 AEDT)

ECB – Lane (8 Nov 19:45 AEDT & 9 Nov 19:10 AEDT), President Lagarde (10 Nov 04:30 AEDT)

Fed – Chair Powell (10 Nov 06:00 AEDT)

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.