- English (UK)

Record GDP contraction and unemployment’s effects on currency markets and oil

This number is not only terrifying, but it is also the fastest number of lost jobs on record. The Federal Reserve pledged to continue to help the economy on Wednesday, where Jerome Powell (the Federal Reserve chair) predicted a long road ahead, with the FED saying they would push their powers to the limit to help the economy keeping rates low and funnelling credit into crucial markets.

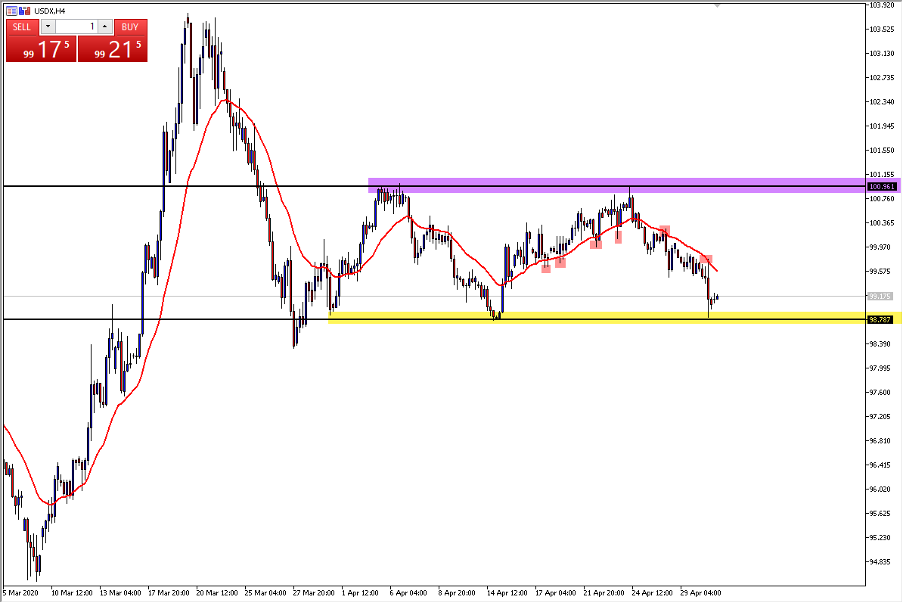

US Dollar Index (USDX) 4HR chart becomes rangebound

The US Dollar reacted to the FED news slowly this week, with a steady grind lower as dollar bulls lost steam, with a series of lower lows and lower highs on the smaller timeframes. The most interesting technical event that is happening is the respect the 4hr chart is showing the 20-exponential moving average (highlighted in red). This moving average has continued to act as dynamic support and resistance since the USDX has become rangebound, and it just shows how important the 20 moving average is from a technical perspective. Price remains rangebound on the 4hr chart with key resistance at the 101.00 area highlighted in purple and key support at the 98.80 area highlighted in yellow.

ECB says it is ready to increase coronavirus stimulus if necessary

The Euro zone posted the worst GDP result since records began yesterday with an economic contraction of 3.8% in the first quarter. In the ECB statement it was revealed that while they would continue to leave interest rates unchanged, they were prepared to increase the coronavirus stimulus programs if required. A further GDP fall of between 5% and 12% this year is a possibility, as the euro zone continues to struggle through the current pandemic crisis. Christine Lagarde (ECB President) said that the current plan was to continue purchase programs, “These purchases will continue to be conducted in a flexible manner over time, across asset classes and among jurisdictions”.

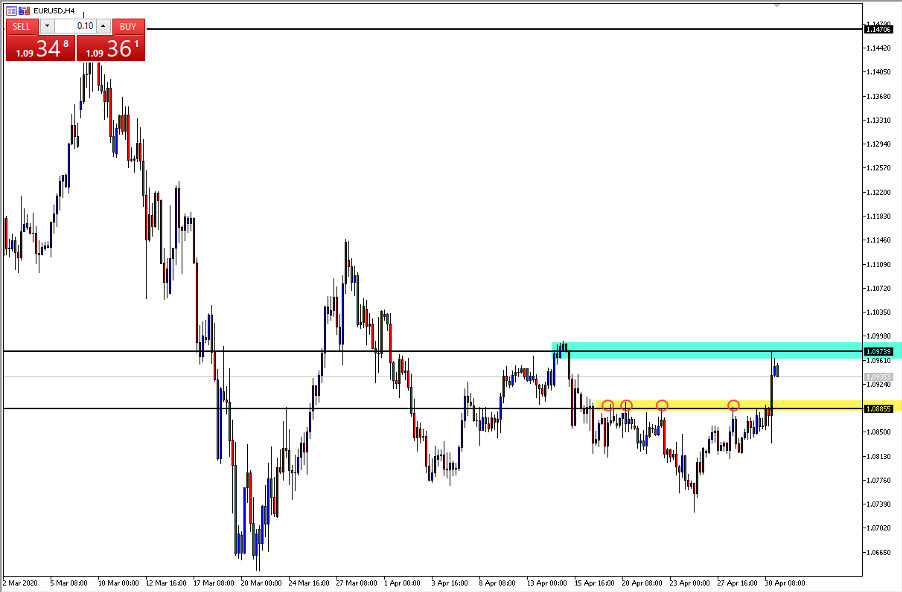

4HR EURUSD hits resistance after a breakout

The chart above shows two key support and resistance zones on the EURUSD. The first zone highlighted in yellow was technically significant because the resistance was so strong at the price of 1.08850. Price respected this level several times with over 4 touches (red circles) as the bulls took profits on the smaller timeframes and the bears started selling. The significance of this level is that when price eventually did move higher through the 1.08850 resistance level, it did so with explosive pace, quickly filling the area all the way up to the 1.0970 level (highlighted in green). Technical analysis Price Action trading tells us that when a price is well respected, if the market decides to gravitate back to this level, it can act as further support or resistance. The yellow zone could be a point of support if it is reached again, in turn providing an area of role reversal.

Oil continues to be volatile but begins a trend on the 4HR

Brent Crude (XBRUSD) has had a wild month. From the lows of $19.60, the technicals have started to move higher as the bulls enter looking for potential value. The series of higher highs and higher lows (highlighted in purple) was completed yesterday, with a breakout above the $25.20 zone (highlighted in yellow). Price quickly retested the 20-exponential moving average before continuing to track higher.

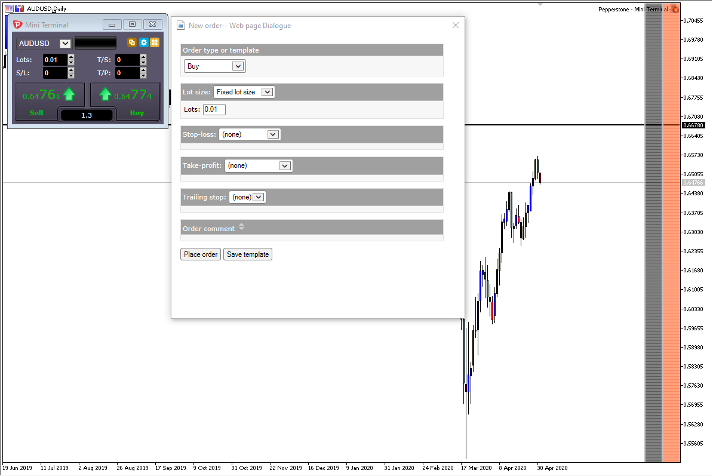

The importance of risk mitigation during times of volatility

During the Learn It Live webinar event this week, it was explained that having a great risk management plan was paramount to being able to navigate highly volatile markets. The picture above shows the Metatrader 5 Pepperstone Smarter Trading Tools mini terminal which is available to Pepperstone’s live funded account clients. It is a great tool to be able to manage risk with percentage-based lot sizes, take profits and stop loss levels.

Volatility might be back

The VIX (volatility index) spiked higher last night with the S&P 500 recording over a 2% fall. The VIX now sits above 35 points which is still much lower than the 80 level that was seen in March. With the EURUSD and USDX poised to break through key zones, the importance of risk management will be paramount as although volatility may continue to provide opportunity, it can also be a danger.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our online application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.