- English (UK)

The AUD has opened the week on the strongest footing and is likely reflecting the fact that S&P 500 and Nasdaq 100 futures opened up 0.3%, although sellers are emerging in the futures. Asian markets should open on a strong footing, with S&P 500 futures +2.5% since Friday's close of the Nikkei and ASX 200 cash close, although this likely overstates the extent of the move.

Spot gold is down smalls, but the daily chart still looks bullish and we are watching for the upside closing break of 1738 for a future move into 1800.

Two important market debates

The two big debates that have been most prevalent through the weekend, or at least that I found most interesting, remain the disconnect between the real economy and asset values. And, where to for the USD. There has also been increased focus on the moral hazard argument, where at a simplistic level the Fed incentivised business to over-lever their balance sheet, and now the Fed is bailing them out or supporting them indirectly. We can also look at the number of countries that are opening their economies, gradually, and the market is eyeing the risk of a second wave, which is another factor that makes it hard to chase risk.

Italy has announced they will start to ease lockdown restrictions on 4 May, joining Spain who will ease movement restrictions on 2 May. France will detail a plan to the world tomorrow to end lockdown next month, while Belgium is due to open shops on 1 May. In the US, a number of states are easing restrictions, and we hope this is the start of more normal times ahead, although the post-virus world throws up many challenges and one focal-point that immediately springs to mind is the blame game and the US (and the world’s) ongoing relationship with China.

The disconnect between economics and asset values will be the focal point this week though

The data and event risk rolls in and I know investors have written off 2020 as a shocker and are looking more intently into the landscape in 2021, but this argument will be seen case in point this week. On the micro-side of considerations, this week we get to hear from some big-name corporations – Amazon, Tesla, Microsoft, Apple, Boeing, FB, Alphabet, McDonald's, and Exxon, to name but a few. Earnings expectations have come down and FY20 and FY21 consensus stand at $131 and $165, respectively, but it still means we are going into this week with investors paying 21.6x for 2020 earnings – the highest since December 2001. But they are also paying 17.1x 2021 which is still lofty given the challenges ahead.

For those that missed, here is my take on what to look for.

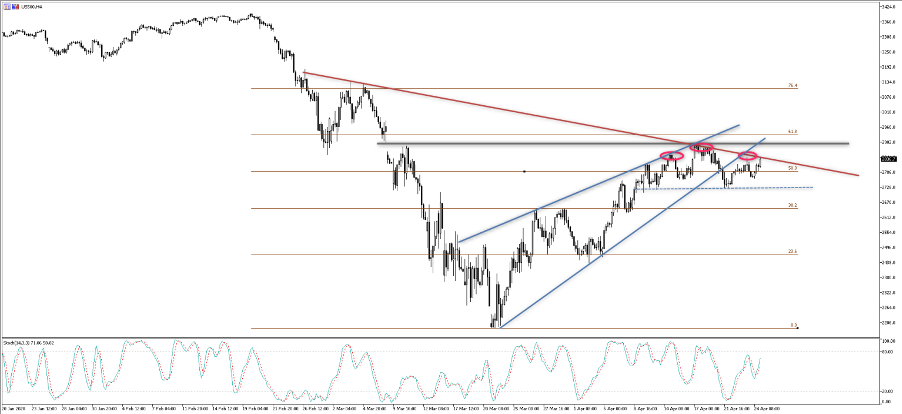

At this juncture though, in the battle of liquidity vs earnings, liquidity is winning but these are some big names dropping this week, representing a catalyst for index traders. The NAS100 is the strongest market if looking for a vehicle to express a risk-on bias this week (in index land). However, I think the set-up on the US500 needs attention. On the upside we have downtrend resistance, the 6 March gap and 61.8% fibo to clear and a break here needs to be respected, especially when we’re hearing that the systematic funds will be ramping up outright longs on a break of 3007.

However, on the downside we see price has broken the wedge and the head and shoulder neckline kicks in around 2726. A break here will see buying in the USD, JPY and US Treasuries. I am watching inflation expectations (breakevens) extremely closely, as where they go will underpin where equities and gold go.

On the data docket this week we have

BoJ meeting – the meeting is today, although as per usual there is no set time. Media reports are that they will remove its Y80t bond-buying target, although when the news broke last week there was no reaction in the JPY. I continue to like the JPN225 on a break of 19,886 and will wait for price to compel and the structure to suggest the index is ready to trend.

USDJPY is interesting because it is just so dull – there is literally no range and it feels like it will break hard soon. At this juncture, the market feels this is fair value, but I am watching for a change here.

US – Q1 GDP (consensus at -3.9%), jobless claims (3.5m), FOMC meeting, ISM manufacturing (36.1). I would expect no reaction to Q1 GDP, as Q1 is but a relic in time and we are looking at Q2 and beyond. The FOMC meeting is the main game in town this week and after two emergency meetings, we look at the first scheduled meeting that could move markets. We should see the Fed tweak the interest it pays banks on excess reserves by 5bp, although, the market is going some way to discounting that and it shouldn’t cause much of a move in the USD. We should also hear more about the targeted level of US Treasury and mortgage buying, with the monthly run-rate closer to $150b, but they will retain an element of flexibility towards this.

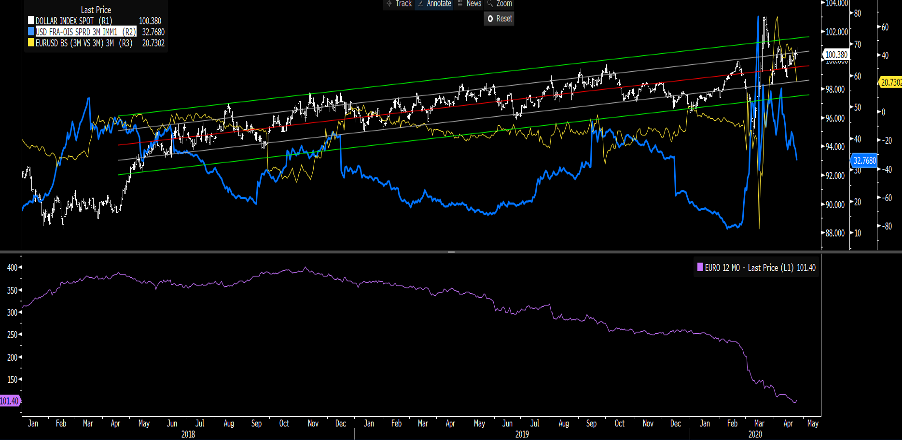

As mentioned, the debate as to where the USD is headed is key, and I will put out a note tomorrow on this as it is important. For now, the DXY (or USDX) tracks the regression channel and is not going lower despite USD funding costs (blue – 3m FRA-OIS, yellow - EUR cross-currency basis swaps) falling heavily as a result of the Fed’s swap lines, massive balance sheet expansion and excess liquidity.

Next week we get NFPs and consensus currently sits at 20m jobs lost, with the unemployment rate at 15.1%.

Eurozone – The ECB meeting is the highlight, especially given the recent widening of interbank credit metrics, notably the Euribor-OIS spread (see below), which has pushed into 30bp. The ECB will need to do more and granted the PEPP program (Pandemic Emergency Purchase Program) has been seen as a solid step forward from the bank, this program is going to need to be increased from its current E750B size – although, whether it plays out at this meeting is unlikely. We should see some tweaks to what can be offered as collateral to access PEPP funds, and similar to the Fed the ECB may accept bonds that were downgraded to junk since the start of COVID-19 the so-called ‘fallen angels’.

Whether this Thursday's ECB meeting (21:45 AEST) proves to be a vol event is yet to be seen, and we see EURUSD 1-week implied volatility at 9.17%, which implies a move (higher or lower) on the week of 116p.

I am looking at the EURAUD short idea and watching price action very closely. I do not see the ECB meeting being a huge vol event, but I am loath to hold EUR exposures over this meeting.

China – Manufacturing PMI (30 April 11:00am) – consensus at 51.0 (from 52.0). I am sceptical this will be a vol event but may get some headlines.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our online application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.