US Earnings Season - Q1 2020

Why is this earnings season so important?

1. Equity markets collapsed on 19 February 2020.

Since then, we've seen some central banks cut interest rates aggressively and offer emergency lending programs while others have announced measures to radically boost liquidity in markets, such as Quantitative Easing (QE). Governments have thrown the fiscal discipline rule book out and offered huge support for business and subsidised companies from laying-off employees while they are losing revenue through the shutdown.

2. There's a lot for traders to think about.

Traders have seen the two-pronged fiscal and monetary stimulus and had to marry it with a rapid deterioration in global growth and employment while keeping a vigil on the virus case count for signs the containment measures are working. All the while, traders have had to consider a stronger USD and incredible volatility in oil and commodity prices.

3. This is what makes this US Q1 earnings season so important.

It gives investors the scope to really listen to outlooks from CEOs and CFOs: the people on the ground, dealing with consumers and the real economy, many of whom are the net beneficiaries of this stimulus.

Why trade US earnings season with us?

- Trade a wide range of forex pairs with us on ultra-tight spreads.

- Trade the US30, US500 and NAS100 with fast execution speeds.

- Go long or short on US stocks after hours with our US Share CFDs.

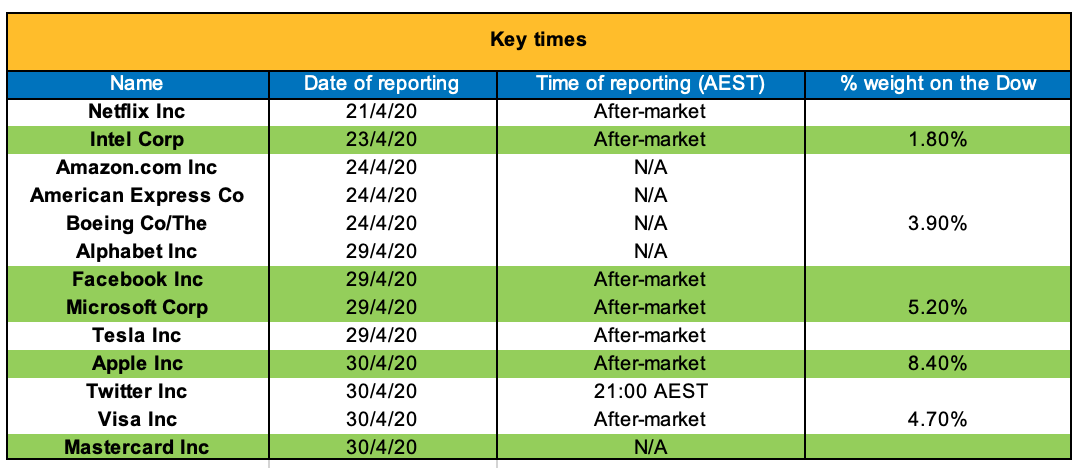

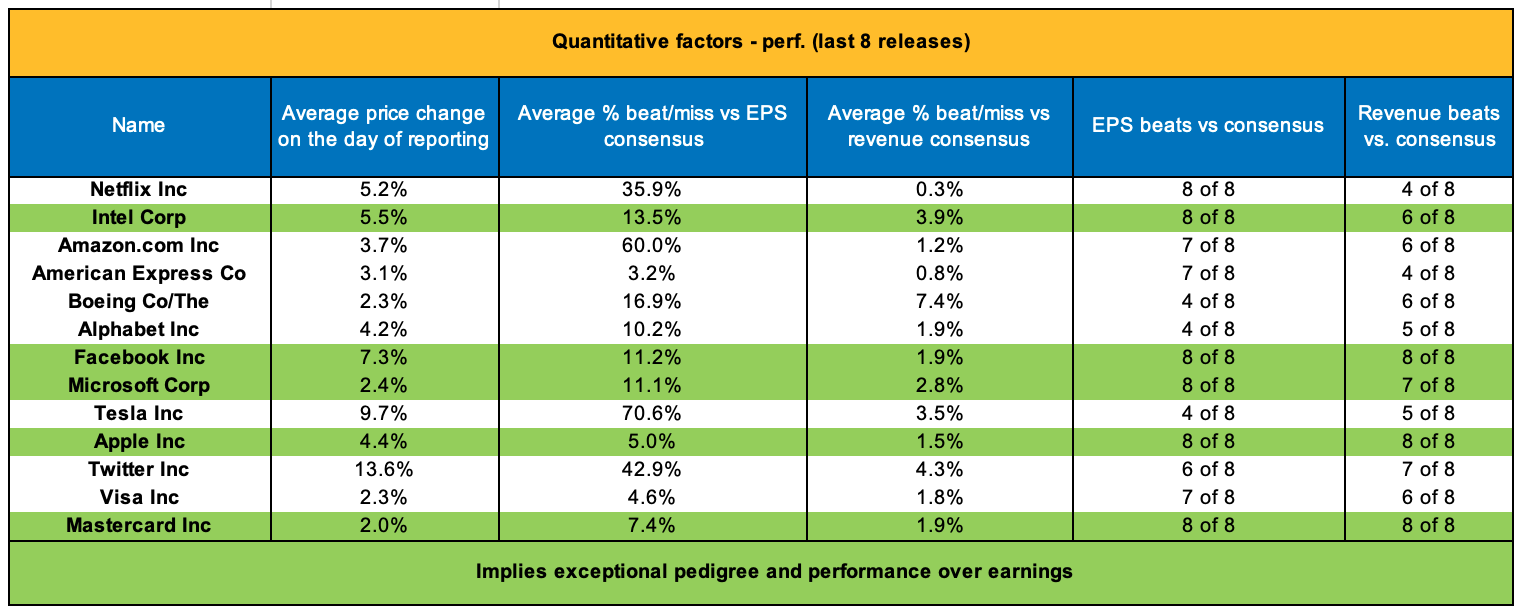

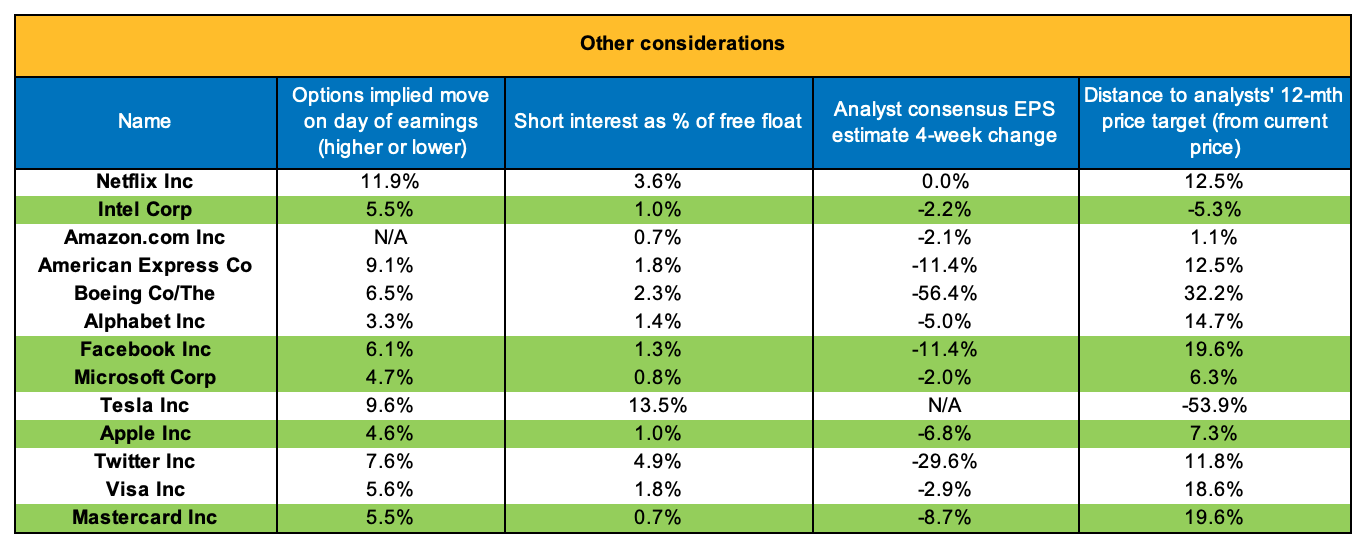

Calendar: what to expect from top US companies

Dates of earnings release, weight % on the Dow and implied moves.

\

Five-part video series

Head of Research Chris Weston explores whether the market will get the clarity they crave and what traders can look for this US earnings season.

Introduction to US Earnings season

Five reasons why US earnings are important for all traders

How to master US earnings season with us

Learn how to find your trading edge this earnings season

5 key focal points to look for

Learn about the five key macro factors for traders this earnings period

What to expect from US earnings season

Find out what analysts are expecting from earnings

The road to earnings

What implied vol is telling us and how to get a feel for the markets

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.