- English (UK)

July 2024 FOMC Review: Come Back Next Time For A Cut

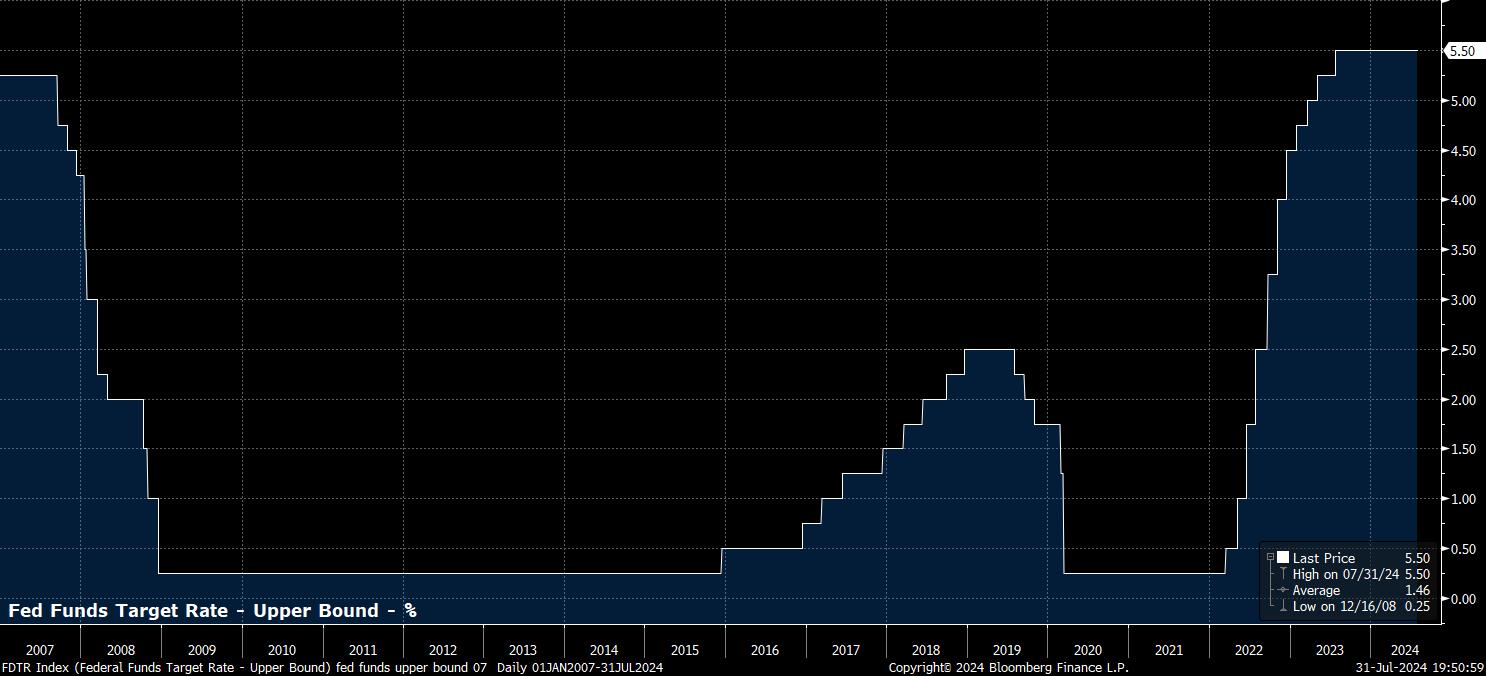

As expected, and fully discounted by financial markets, the FOMC voted unanimously to maintain the target range for the fed funds rate at 5.25% - 5.50% at the conclusion of the July policy meeting. In turn, this marks the 9th consecutive meeting at which rates have been held steady, with the fed funds rate having now been at its terminal level for precisely a year; considerably longer than the median 8 month gap between the final hike, and the first cut, seen over the last 4 decades.

Given that such a decision had been so widely expected in advance of its announcement, market participants’ focus was naturally drawn to the accompanying policy statement, and the Committee’s forward guidance.

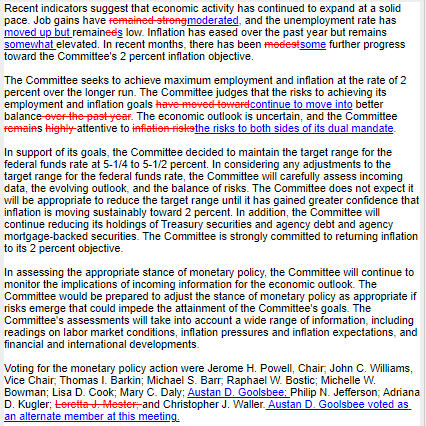

Compared to that issued after the June decision, the July policy statement featured some notable changes, which nodded towards the first cut of the cycle being delivered at the next meeting, in September.

The most notable of these changes was an acknowledgement that the Committee are now “highly attentive to the risks of both sides of its dual mandate”, a formal recognition that the laser-like focus on inflation risks, which has been the dominant theme of this cycle so far. This is, perhaps, one of the most dovish lines to feature in a post-meeting statement in the last couple of years, at least.

Furthermore, the statement saw the Committee tone down language around strength in the labour market, flagging how job gains have “moderated” of late, while also noting that the unemployment rate has “moved up”, despite remaining low. More dovish language.

On inflation, wording was strengthened, with policymakers noting that “some” further progress towards the 2% target had been made, an upgrade on the prior assessment that “modest” progress towards said goal was being achieved.

While these changes are, clearly, not an explicit pre-commitment to deliver a rate cut, they are clearly explicitly dovish revisions to the Committee’s language, compared to last time around, and represent Powell & Co. laying the foundations to begin removing policy restriction from the September meeting onwards, even while continuing to await additional “confidence” that a return towards the 2% target is indeed on the cards. Incoming data, before that meeting, should provide said confidence easily, with 2 jobs reports, and 2 CPI prints, due by then.

With the July meeting, as usual, not seeing the release of an updated Summary of Economic Projections (SEP), or ‘dot plot’, it fell to Chair Powell at the post-meeting press conference to further tee up a move at the next meeting.

Powell noted his sense that the Committee are moving closer to the point of delivering a rate cut, albeit that we are “not quite there yet”. At the same time, Powell reiterated the data-dependency of the FOMC, remarking that no decision on a potential September has been made just yet, but that such a move “could be on the table”. Once more, policymakers continue to seek more “good data”, to gain more confidence in the disinflationary path, before pulling the trigger on a rate reduction.

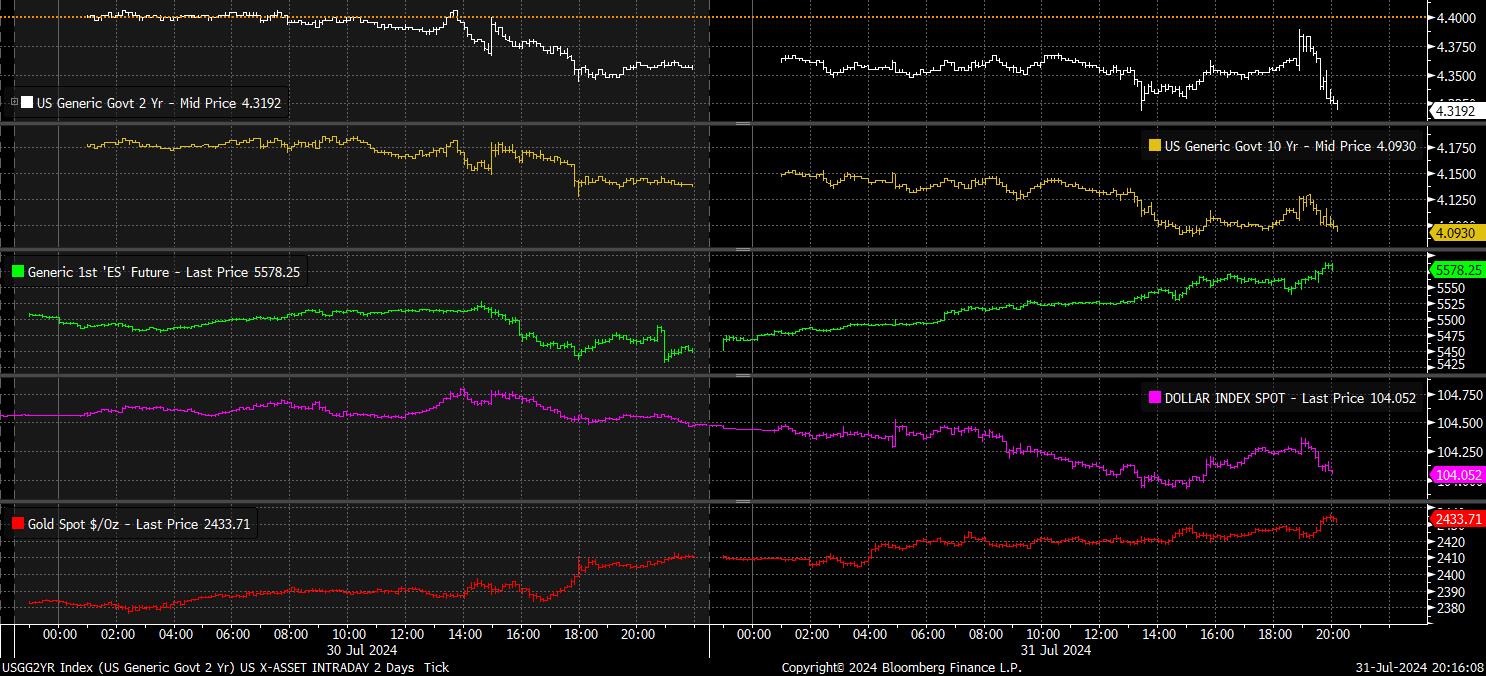

Money markets, unsurprisingly, took almost all of the July FOMC decision in their stride, with almost everything from the statement, and the press conference, bang in line with expectations. The USD OIS curve continues to fully price a 100% chance of a cut in September, while also discounting around 65bp of easing by year-end, both unchanged from pre-FOMC pricing.

The same could be said for markets more broadly, which were also rather unperturbed by the decision in its totality. Treasuries did rally modestly during the press conference, led by the front-end of the curve, while equities marginally extended earlier gains, ahead of more megacap earnings after the close. The G10 FX space, as well as gold, were also similarly unbothered.

The bottom line is this – barring a huge adverse data surprise, the FOMC will be cutting rates by 25bp at the September meeting. The end-August Jackson Hole Symposium provides policymakers with another opportunity to signal such a move, were it minded to do so.

Further out, rate reductions at a quarterly pace, in line with the publication of updated Summaries of Economic Projections, seem likely, leading to a cumulative 50bp of cuts this year, marginally more hawkish than markets currently price.

Such a pace of easing would be, roughly, in line with that set to be delivered by other G10 central banks, limiting potential USD downside, with risks to the greenback actually tilting in the opposite direction, owing to the US economy's continued strong growth, and the anaemic pace of expansion seen elsewhere.

Meanwhile, the path of least resistance, despite the recent blip, should continue to lead to the upside for equities, with the 'Fed put' still alive and well, along with both economic, and earnings, growth remaining solid. The Treasury curve, finally, should continue to steepen, as the Fed increasingly move towards targeting an inflation 'range', as opposed to an outright 2% price level.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.